A Quick Take On PROS Holdings

PROS Holdings (NYSE:PRO) provides enterprises with a variety of selling software tools and services.

The company has recently largely completed its transition to a cloud-based system and business model.

I previously wrote about PROS with a Hold outlook.

Given the expected slowing topline revenue growth in 2023 combined with continued high operating losses, I remain Neutral [Hold] on PRO until management can improve revenue growth while further reducing its operating losses.

PROS Holdings’ Overview

Houston, Texas-based PROS was founded in 1985 to provide configure-price-quote software, originally as on-premises software and more recently on a subscription basis.

The firm is headed by Chief Executive Officer Andres Reiner, who has been with the firm since 2007 and was previously a Software developer at Platinum Technology and Product Architect at ADAC Laboratories.

The company’s primary offerings include:

-

Smart Configure Price Quote

-

Smart Price Optimization

-

Airline Revenue Optimization and Management

-

Airline Real-Time Dynamic Pricing

-

Group Sales Optimizer

-

Digital Retail

-

Related Services

The firm acquires customers through its in-house sales and marketing teams as well as through partners, resellers and systems integrators.

PROS Holdings’ Market & Competition

According to a 2022 market research report by Global Industry Analysts, the market for configure-price-quote software was an estimated $1.6 billion in 2020 and is forecast to reach $3.9 billion by 2026.

This represents a forecast CAGR of 16.3% from 2021 to 2026.

The main drivers for this expected growth are a rise in demand as a result of the COVID-19 pandemic, as customers seek more efficient ways to power their sales efforts.

Also, the on-premise segment is expected to continue to dominate even as growth shifts to cloud-based CPQ environments

Major competitive or other industry participants include:

-

Apttus

-

Aspire Technologies

-

Callidus Software

-

Cincom Systems

-

ConnectWise

-

FPX

-

Infor

-

International Business Machines

-

Model N

-

Oracle Corp

-

Salesforce.com

-

SAP Ag

-

Vendavo

PROS Holdings’ Recent Financial Trends

-

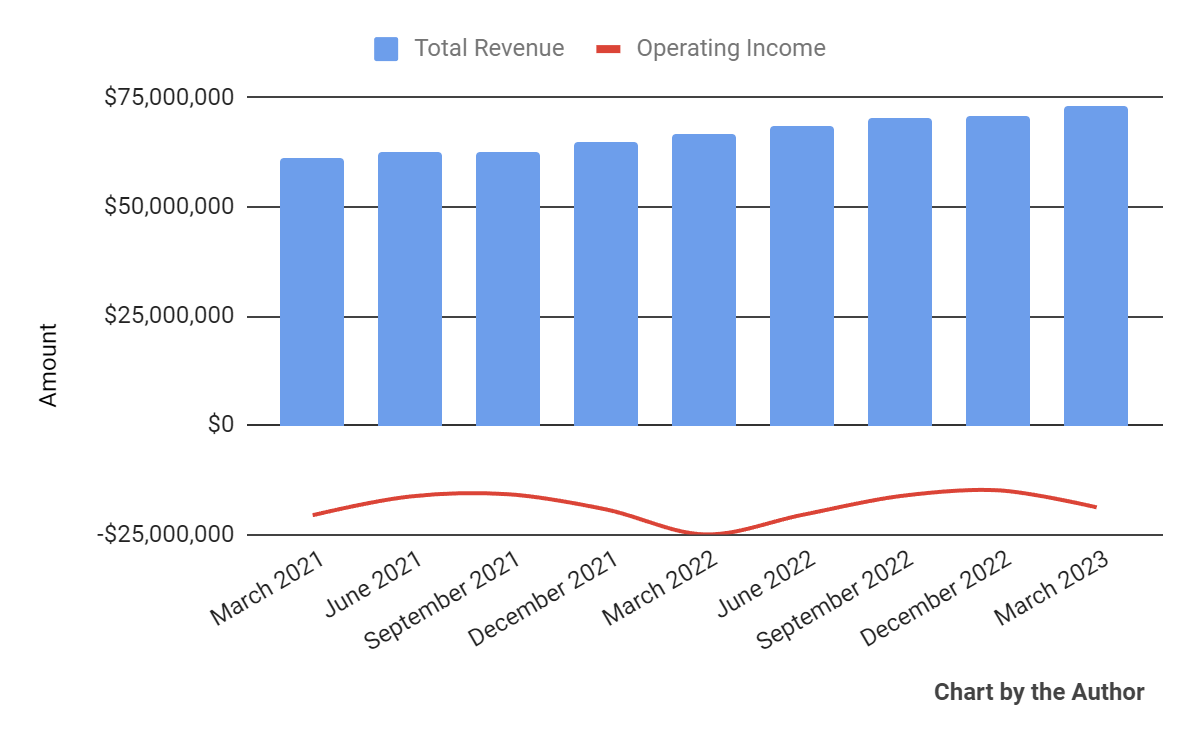

Total revenue by quarter has risen steadily; Operating income by quarter has fluctuated well into negative territory.

Total Revenue and Operating Income (Seeking Alpha)

-

Gross profit margin by quarter has trended higher in recent quarters; Selling, G&A expenses as a percentage of total revenue by quarter have moved lower more recently.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

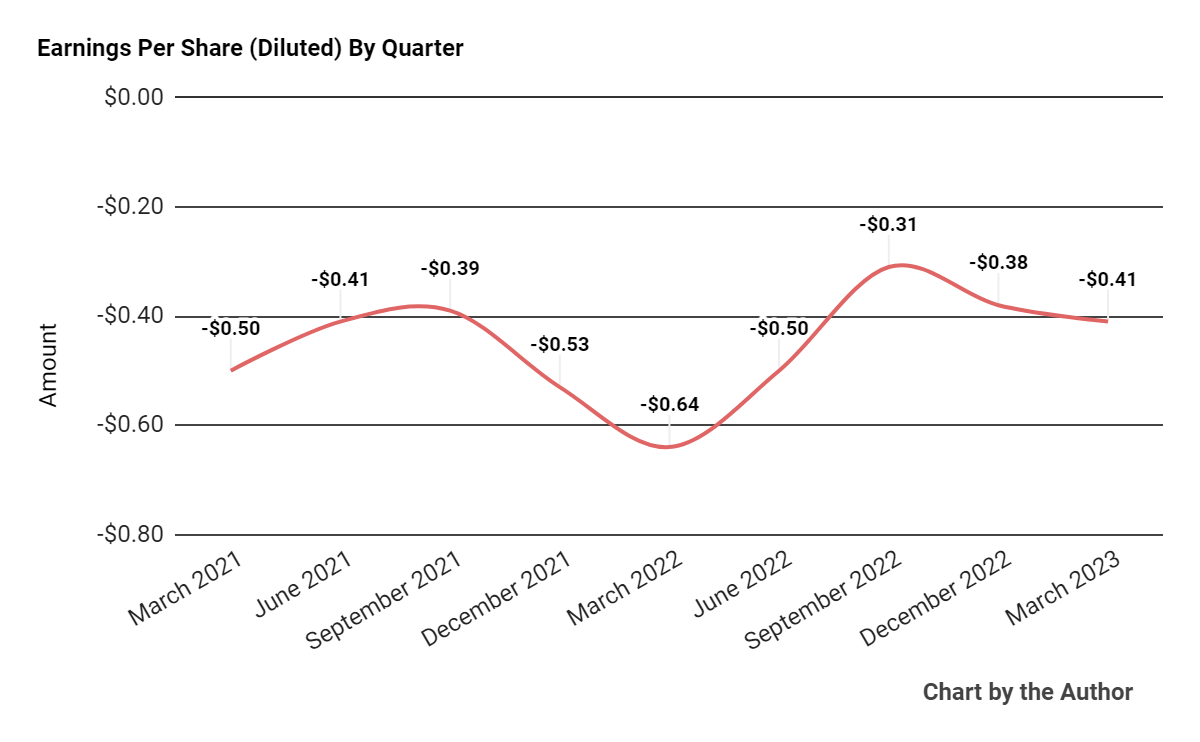

Earnings per share (Diluted) have remained substantially negative, as the chart shows below.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

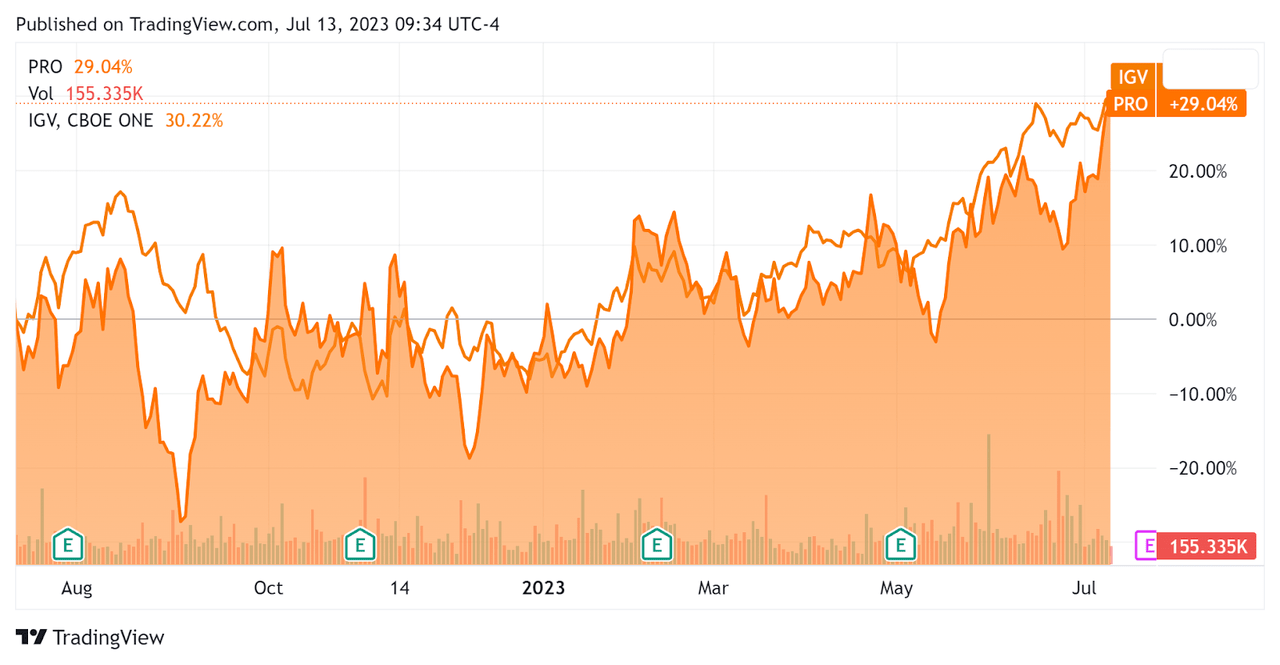

In the past 12 months, PRO’s stock price has risen 29.04% vs. that of the iShares Expanded Technology-Software ETF’s (IGV) rise of 30.22%, as the chart indicates below.

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $192.4 million in cash and equivalents and $290.2 million in total debt, none of which was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash used was $20.9 million, during which capital expenditures were only $1.9 million. The company paid $41.4 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For PROS Holdings

Below is a table of relevant capitalization and valuation figures for the company.

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

5.8 |

|

Enterprise Value / EBITDA |

NM |

|

Price / Sales |

5.2 |

|

Revenue Growth Rate |

10.3% |

|

Net Income Margin |

-25.7% |

|

EBITDA % |

-20.2% |

|

Net Debt To Annual EBITDA |

-1.3 |

|

Market Capitalization |

$1,500,000,000 |

|

Enterprise Value |

$1,630,000,000 |

|

Operating Cash Flow |

-$19,040,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.60 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

PROS’ most recent Rule of 40 calculation was negative (9.9%) as of Q1 2023’s results, so the firm still needs significant improvement in this regard, per the table below.

|

Rule of 40 Performance |

Q4 2022 |

Q1 2023 |

|

Revenue Growth % |

9.8% |

10.3% |

|

EBITDA % |

-22.3% |

-20.2% |

|

Total |

-12.5% |

-9.9% |

(Source – Seeking Alpha)

Commentary On PROS Holdings

In its last earnings call (Source – Seeking Alpha), covering Q1 2023’s results, management highlighted the ‘75% improvement in adjusted EBITDA year-over-year.’

Leadership also stressed the AI features as core to its system, with the company having ‘productized AI algorithms that predict demand, optimize supply chains, drive customer cross-selling, upsell recommendations, detect customer attrition, and predict customer willingness to pay among many others.’

Notably, the firm is processing an average of 5.9 million transactions per minute with a platform uptime of 99.97%.

The company’s trailing twelve-month gross revenue retention rate was 93%, indicating the company needs to improve its sales & marketing efficiency.

Total revenue for Q1 2023 rose by 10.1% year-over-year and gross profit margin increased 0.8%.

Selling, G&A expenses as a percentage of revenue dropped 4.8% YoY while operating losses decreased by 24.8% but still remained high.

Looking ahead, management guided to 2023 revenue of $296 million at the midpoint of the range or 7.2% growth YoY.

If achieved, this would represent a step down in growth rate from 2022’s growth of 9.78% over 2021.

PRO’s financial position is reasonably good, with significant cash and liquidity and a moderate amount of long-term debt. Free cash used in the trailing twelve-month period was a manageable amount.

The firm’s Rule of 40 performance has been poor, producing only slightly less negative sequential results in the most recent quarter.

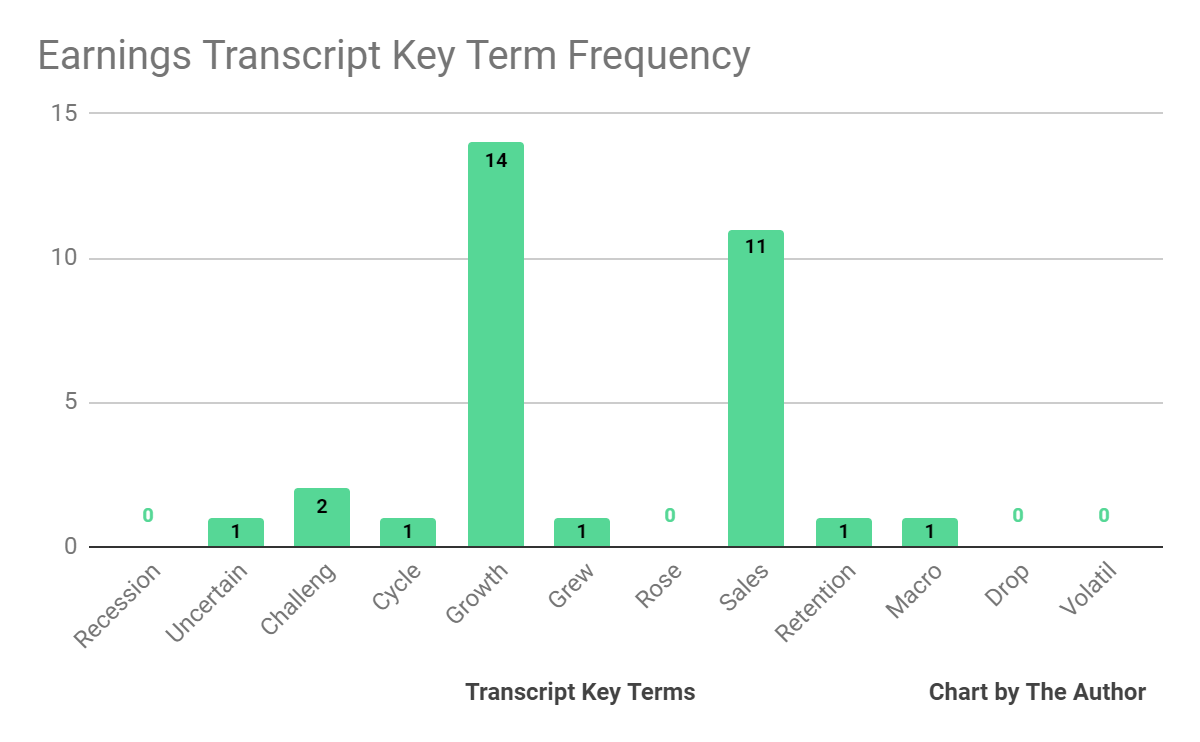

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below.

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited ‘Uncertain’ once, ‘Challeng[es][ing]’ two times, and ‘Macro’ once.

Analysts questioned company leadership about the travel portion of its activity as well as the challenging macro environment’s effects on its land-and-expand approach.

Management said they aren’t seeing any ‘major shifts from field delays, overall.’

Regarding valuation, the market is valuing PRO at an EV/Sales multiple of around 5.9x on TTM revenue growth rate of 10.3% against a median implied ARR growth rate of 21% (Source).

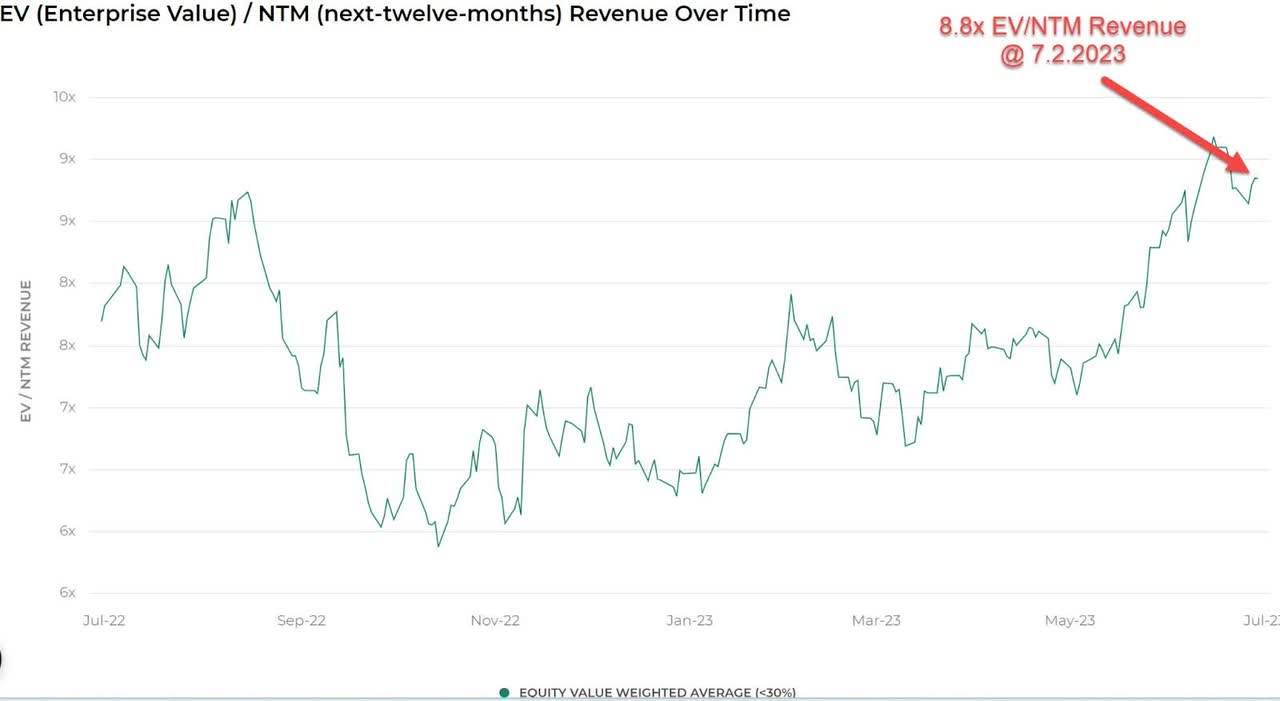

The Meritech Capital Index of publicly-held SaaS application software companies showed an average forward EV/Revenue multiple of around 8.8x on July 2, 2023, as the chart shows here:

EV/Next 12 Months Revenue Multiple Index (Meritech Capital)

So, by comparison, PRO is currently valued by the market at a discount to the broader Meritech Capital SaaS Index, at least as of July 2, 2023, likely due in part to its lower growth rate compared to the index.

Risks to the company’s outlook include an economic slowdown that appears to be underway, reduced credit availability which can affect customer/prospect spending plans and lengthening sales cycles which may reduce its revenue growth potential in the near term.

Given the expected slowing topline revenue growth in 2023 combined with continued high operating losses, I’m Neutral [Hold] on PRO until management can improve revenue growth while further reducing its operating losses.

Read the full article here