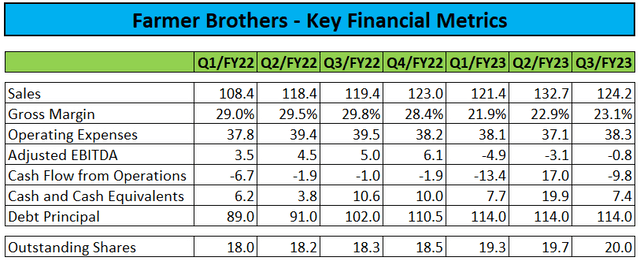

Undoubtedly, 2023 has been a tough year for Farmer Bros. Co. (NASDAQ:FARM), or “Farmer Brothers,” with shares hitting new all-time lows last week following a number of disappointing quarterly reports in recent months:

Company Press Releases and Regulatory Filings

In addition, the company has warned investors of potential near-term debt covenant violations in its shareholder letters and regulatory filings (emphasis added by author):

(…)

The Credit Facilities have a commitment of up to $90.0 million and a maturity date of April 26, 2027. (…)

The Credit Facilities contain customary affirmative and negative covenants and restrictions typical for a financing of this type. Non-compliance with one or more of the covenants and restrictions could result in the full or partial principal balance of the Credit Facilities becoming immediately due and payable and termination of the commitments. As of and through March 31, 2023, we were in compliance with all of the covenants under the Credit Facilities.

Failure to comply with these covenants would result in a default which could accelerate the repayment obligations and impact our liquidity. Accordingly, an event of default could have a material and adverse impact on us. If we are unable to cure, obtain a waiver from the lenders, or refinance the Credit Facilities, we anticipate not being able to meet the current contractual covenant beginning June 30, 2023.

We consider it probable that management’s plans, including the options described above, will be able to alleviate the potential noncompliance with the debt covenant prior to June 30, 2023.

Potentially, Farmer Brothers have managed to avoid a potential debt default by agreeing to sell its direct ship business, including its Northlake, Texas, facility, to customer TreeHouse Foods, Inc. (THS) for approximately $100 million in cash, subject to customary purchase price adjustments.

The company expects to use the proceeds from the sale to pay down outstanding debt associated with its asset-based lending (“ABL”) and retire its term loan.

The sale will increase Farmer Brothers’ balance sheet flexibility and allow it to focus on execution, improving margins and driving strategic growth in the direct store delivery (“DSD”) and key account sales channels.

(…)

Following the sale of its Northlake, Texas facilities, Farmer Brothers expects its annual revenue will be approximately $350 million with vastly improved product margins.

“Our shift to a DSD-focused organization will allow us to further increase internal efficiency, decrease our operational cost and allow us to enjoy higher margins,” said Farmer Brothers Chief Financial Officer Scott Drake. “In addition, proceeds from the sale will allow us to solidify our financial position by recapitalizing the company, which gives us flexibility to explore additional growth opportunities.”

Farmer Brothers

Keep in mind that Farmer Bros. decision to relocate from California and build its new $100 million headquarters in Texas in 2016 was based on expectations for annual cost savings of up to $20 million. With the company’s most modern facility now being sold alongside the direct ship business, one might ask about the impact on operating expenses.

As of March 31, the company had $47 million outstanding under its term loan and $67 million under its asset-backed revolving credit facility, with a weighted average interest rate of 6.15%.

With the term loan anticipated to be paid off, I would expect Farmer Brothers to amend the terms of its revolving credit facility to reflect the reduced size of the company and get much-needed covenant relief.

Assuming all of the proceeds are being used to reduce outstanding debt, annualized interest savings would be slightly above $6 million.

On the flip side, the company will keep its corporate headquarters in Northlake, Texas, which will result in the requirement to lease back the office space of the facility.

Not surprisingly, market participants celebrated the news during Wednesday’s trading session, with FARM shares ending the day up 70% on very strong volume.

Unfortunately, the massive rally only helped equity holders to recoup losses suffered over the past two months, but even after Wednesday’s outsized move, the stock is still down by almost 30% year-to-date.

With annual revenues of $350 million and expectations for “vastly increased product margins” going forward, an enterprise value of below $75 million seems dirt cheap. However, market participants are likely to require more color on the trajectory of the remaining business before committing additional funds.

To be perfectly honest, I would have expected management to publish a comprehensive presentation and hold a conference call to discuss the transaction in more detail, as well as providing expectations for the direct store delivery business going forward.

In addition, management’s stated intent to explore “additional growth opportunities” is suited to raise fears of ongoing, poor capital allocation decisions.

That said, after facing pressure from activist investors, Farmer Bros. recently agreed to appoint two of their nominees to the Board of Directors and establish a committee “tasked with reviewing strategic alternatives and capital allocation initiatives.“

Undoubtedly, Wednesday’s asset sale has been a result of this strategic review, and value investors might very well consider betting on more to come, but judging by management statement’s in the press release, Farmer Brothers might be done with asset sales for now.

Bottom Line

Farmer Brothers’ beaten-down shares staged a major rally after the ailing company apparently managed to avoid near-term debt covenant violations by selling its state-of-the-art facility in Northlake, Texas, alongside its direct ship business to customer TreeHouse Foods for approximately $100 million.

Net proceeds from the transaction are expected to be used for paying down the vast majority of Farmer Bros.’ outstanding debt.

Hopefully, the company’s activist shareholders will continue to put pressure on management to consider additional shareholder value-enhancing transactions going forward.

Even after Wednesday’s 70% rally, Farmer Bros. Co. shares remain cheap, with an EV/Revenue ratio of just 0.2x. However, without management providing additional color on the anticipated trajectory of the retained DSD business, FARM shares are likely to remain range bound for the time being.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here