A man lives by believing something: not by debating and arguing about many things. – Thomas Carlyle

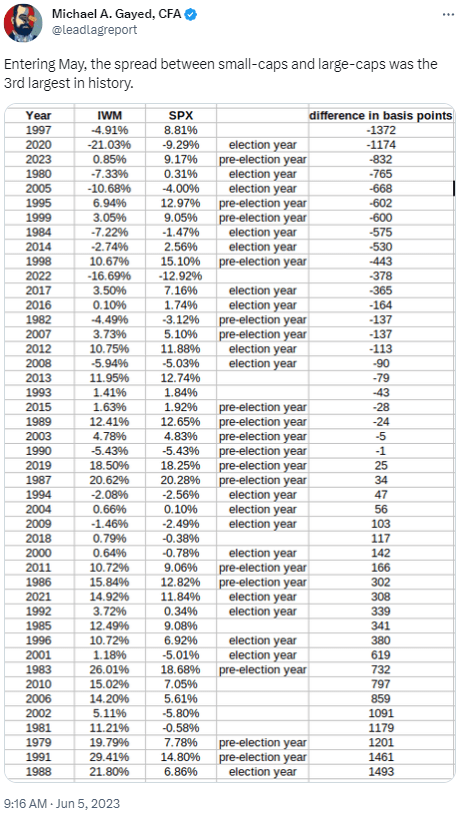

Entering May, the spread between the Russell 2000 Index (RTY, IWM) and the S&P 500 Index (SP500, SPY) was the third-largest in history. Only 1997 and 2020 had larger weaknesses in the first four months of the year than this year.

Twitter

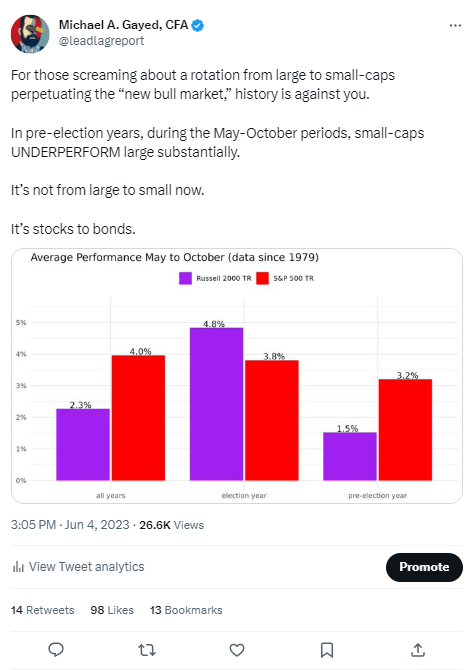

This has led many to argue that we are about to see a significant rotation out of large-cap stocks and into small-cap stocks. However, with the seasonally weak “worst six months” for stocks from May to October, history does not favor the bulls in the near to intermediate term.

Twitter

So which is more likely? Small-caps melting-up to catch-up to large-caps, or large-caps breaking down to match the message of small?

The Case for Small-Cap Stocks to Melt-Up

Proponents of the small-cap melt-up argue that the significant spread between the Russell 2000 and the S&P 500 signals an upcoming rotation. They believe that as the economy recovers from the pandemic, small-cap stocks will benefit more as they have more room to grow and are more sensitive to economic improvements.

The problem that I have with this is that there is still a looming recession and credit event out there, and consumer stocks have not fared well on a relative basis at all. A slowdown in demand-pull inflation, combined with weakness in housing (which I still very much believe is in the early innings) makes this challenging. And with interest rates on credit cards at new highs, it’s only a matter of time until you start seeing a major slowdown.

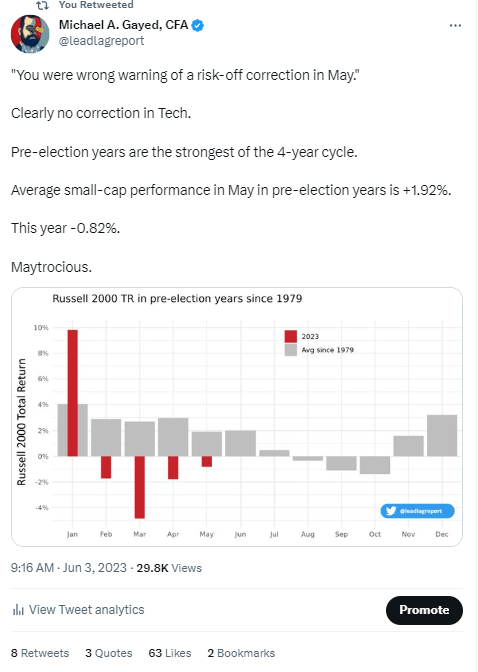

Twitter

The Case for Large-Cap Stocks to Crash

I’ve made the argument multiple times that this is a very deceptive market and that we are likely in a correction in the context of a pre-election year melt-up, but it must be considered that this year could play out like 1987 (a melt-up, a crash, and a Fed pivot all in one year). A credit event would be the catalyst for such a path.

Yes – pre-election years historically are strong. But 2023 is NOT playing out like historical pre-election periods.

Twitter

Bonds as a Better Allocation?

I do believe there will be a rotation out of large into small, but the question is when. The real rotation may end up being from stocks to Treasuries (TLT) on a risk-off flight-to-safety trade sequence. We saw this briefly as the regional bank crisis (KRE) was playing out in March. I suspect we still see this in the coming months re-assert. But anecdotally, I can tell you that I see a lot of overconfidence creeping into the way traders and investors are seeing the market now.

Bear markets make fools of bulls and bears.

What do you think? Will small-caps play catch-up or large-caps break down?

Anticiapte Crashes, Corrections, and Bear Markets

Anticiapte Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here