Investment Thesis

Dover Corporation’s (NYSE:DOV) revenue in the current year is expected to benefit from pricing increase as well as an improved backlog to sales conversion. The company’s longer-term outlook also looks good with secular growth trends such as the increasing demand for natural refrigerants and heat pumps due to their low carbon footprint, as well as the robust growth of single-use components for biological drug manufacturing, are expected to drive revenue growth in the coming years.

On the margin front, the benefits from positive price/cost dynamics and recent productivity investments, as well as management’s commitment to driving operational excellence through initiatives like advanced industrial automation, digital/e-commerce integration, and back-office efficiency bodes well for the company. Furthermore, the company’s focus on mergers and acquisitions with higher margin target companies should also improve its portfolio mix in the longer term.

Currently, the company’s stock is trading at a discount compared to its historical valuations. Considering the favorable long-term prospects of Dover Corporation, this presents an opportunity to buy the stock at an attractive valuation.

Revenue Analysis and Outlook

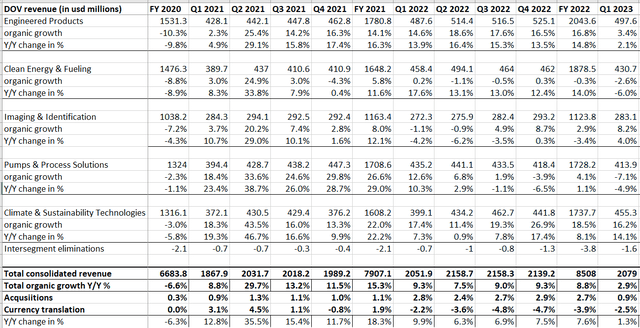

After experiencing robust organic growth in most segments throughout FY21 (15.5% Y/Y total organic growth) and FY22 (8.8% Y/Y total organic growth), Dover Corporation’s organic revenue growth slowed down to 2.9% in the first quarter of 2023. This deceleration was primarily attributed to declines in the Clean Energy & Fueling (DCEF) and Pumps & Process Solution (DPPS) segments, with negative organic growth rates of 2.6% and 7.1%, respectively.

The decline in the DCEF segment was mainly driven by reduced demand for dispensers and EVM card readers, which overshadowed the revenue growth from clean energy components, vehicle wash, and fuel transport within the segment. The demand for EVM cards is normalizing post the strength in FY21 and early 2022 and the comparisons are expected to ease in the back half of this year. Meanwhile, the DPPS segment experienced an expected decline in the biopharma sector during Q1, which offset solid organic growth in other businesses within the segment such as precision components, industrial pumps, and thermal connectors. While the long-term outlook for the Biopharma market is good, it is currently seeing normalization post a strong last couple of years.

In contrast, the Engineering Products (DEP), Imaging & Identification (DII), and Climate & Sustainability Technology (DCST) segments delivered positive year-over-year (Y/Y) organic growth in Q1 2023. The DCST segment exhibited the strongest performance, with a 16.2% Y/Y organic growth rate, driven by robust demand for heat exchange and CO2 refrigeration systems, as well as beverage can-making equipment, which continued to fulfill strong backlog orders.

The Engineering Products segment achieved 3% organic growth Y/Y, propelled by positive pricing, strong organic growth, and increased bookings in waste-handling equipment parts, as chassis availability improved compared to the previous period. On the other hand, the Imaging & Identification business experienced 8% organic growth Y/Y, primarily due to solid growth in core marking & coding and serialization software, particularly Software-as-a-Service (SAAS) offerings.

Overall, the strong organic growth in three out of the five segments, coupled with a $19 million (0.9%) contribution from an acquisition, offset the negative impact of currency translation amounting to $52 million (2.5%), resulting in a year-over-year revenue growth rate of 1.3% in the first quarter of 2023.

DOV Segment Sales (Company Data, GS Analytics Research)

Looking ahead, strong demand across most of the company’s businesses, combined with pricing increases and improved backlog conversion facilitated by an improving supply chain, is expected to support revenue growth in the upcoming quarter. However, this growth should be partially offset by the negative impact of a $90 million order de-booking by a client in the Climate and Sustainability Technologies segment. It is important to note that management considers the order de-booking of $90 million temporary, and expects to be rebooked by the end of the year.

Taking a closer look at the segment-wise outlook, the Engineered Products Segment is anticipated to benefit from increased production of refuse collection vehicles due to improved chassis availability. Additionally, the segment is expected to experience stability in the vehicle aftermarket and capitalize on automation and digitalization efforts in waste collection, further supporting its revenue growth.

In the Clean Energy & Fueling segment, solid demand is expected across all businesses except for aboveground dispensers. The continued strong demand, coupled with the increasing adoption of clean energy sources such as hydrogen (H2), liquefied natural gas (LNG), liquefied petroleum gas (LPG), and electric vehicle (EV) charging, along with the automation of car washing, and an expected recovery in the EMV business throughout the year, thanks to easing comparisons, should contribute to revenue growth in this segment in the coming years.

The Imaging and Identification segment is anticipated to benefit from sustained robust demand for renter consumables, professional services, and attractive growth in software offerings. The Pumps and Process Solution segment is expected to experience strong growth in industrial pumps, thermal connectors, and plastic & polymers, supporting its revenue growth. Moreover, while the Biopharma business within this segment has seen some pressure of late due to demand normalization post covid, it is poised to benefit from long-term tailwinds driven by the demand for single-use components in biological drug manufacturing, contributing to long-term revenue growth. The comparisons in this business are also easing in the back half of this year.

In the Climate Sustainability segment, the rapid regulatory-driven shift toward natural refrigerants, which have a lower carbon footprint compared to hydrofluorocarbon refrigerants, is expected to be advantageous. Additionally, the segment is well-positioned to benefit from the secular transition from gas boilers to heat pumps, driven by decarbonization regulations in Europe. The small carbon footprint of heat pumps further strengthens the revenue growth prospects for this segment in the coming years.

Overall, the majority of the company’s businesses are stable and expected to continue driving revenue growth this year. Management has given 3% to 5% revenue growth target for FY23 which looks achievable. In the long term, the company’s revenues are poised to benefit from secular growth trends, particularly related to heat exchangers, natural refrigerants, and the biopharma business. This makes me optimistic about the company’s growth prospects.

Margin Analysis and Outlook

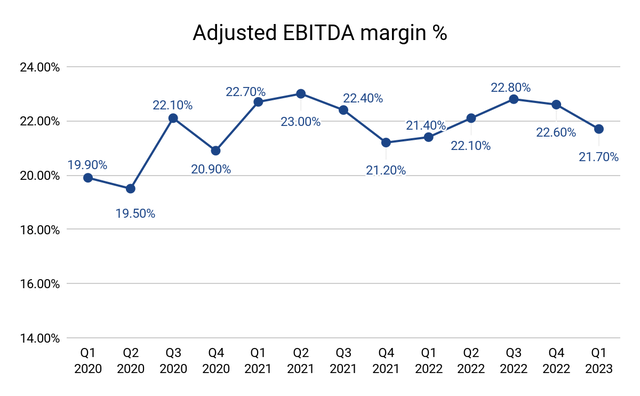

The company’s adjusted EBITDA margin demonstrated growth in the first quarter of 2023, with four out of five segments delivering year-over-year (Y/Y) margin growth. The only segment that experienced a decline in margins was the Pumps & Process Solutions segment, which decreased to 30.5% from 36% in the prior-year quarter. Nevertheless, it remained the company’s highest-margin business segment.

The Y/Y margin growth in the other segments was driven by factors such as productivity gains, positive price/cost dynamics, and investments made in previous periods to achieve cost efficiency. Additionally, an improved supply chain across most segments played a role in more than offsetting the headwind from currency translation during the quarter. Overall, these factors contributed to a 30 basis points (bps) Y/Y growth in adjusted EBITDA, which reached 21.7%.

DOV Adjusted EBITDA margin (Company Data, GS Analytics Research)

Looking ahead, the company’s margin is expected to continue benefiting from favorable price/cost dynamics, as well as volume leverage driven by the conversion of current bookings and backlog trends. Additionally, the company’s focus on digital/e-commerce initiatives and automation efforts, which have already yielded $10 million in productivity gains, along with targeted mergers and acquisitions in high-margin areas and improvements in back-office efficiency, should further contribute to the company’s margin in the long term.

Valuation and Conclusion

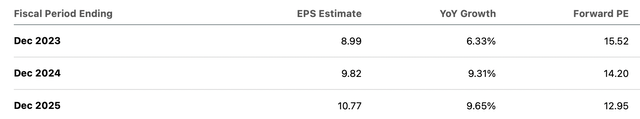

Over the last five years, Dover has traded at an average forward P/E of 18.28x. The stock is trading at a meaningful discount to those levels on forward consensus EPS estimates.

DOV Consensus EPS estimates (Company Data, GS Analytics Research)

Its EV/EBITDA (FWD) of 12.19x is also a meaningful discount to its 5-year average forward EV/EBITDA of 13.75x. I believe investors are worried about the macroeconomic uncertainty which has resulted in a contraction of the company’s valuation multiple. This gives an opportunity for longer-term investors to buy the stock at an attractive valuation. The stock can give good returns if an investor can wait for the macroeconomic cycle to turn and for valuation to re-rate to historical levels. Hence, I have a buy rating on DOV stock.

Read the full article here