Investment Thesis

Investing in companies that offer an attractive Dividend Yield provides you with several benefits:

- The companies offer you an extra source of income beyond your regular salary.

- You can generate this extra income without selling stocks.

- You receive dividends regardless of whether stock prices are currently rising or falling.

- It allows you to steadily increase your wealth over time and in a relatively safe way.

In order to help you find attractive companies that can provide an additional income via dividend payments, I will present two that I consider to be attractive and which I would buy if I could only select two high dividend yield companies for this month of May.

In order to be part of a pre-selection of companies, the selected companies had to meet the following requirements:

- Dividend Yield [FWD] > 2.5%

- Average Dividend Growth Rate over the past 5 years > 1%

- P/E [FWD] Ratio < 30

- EBIT Margin [TTM] or Net Income Margin [TTM] > 5%

- Return on Equity > 5%

- Payout Ratio < 80%

These are the two high yield dividend companies that I currently consider to be particularly attractive:

- Verizon (VZ)

- U.S. Bancorp (USB)

In this analysis, I will explain in more detail why I have selected these two companies and why I consider them to be appealing at this moment in time when compared to their peer groups.

Verizon

Verizon currently has a Market Capitalization of $162.74B. At the company’s current stock price of $37.67, it pays a Dividend Yield [FWD] of 6.74%.

When considering Verizon’s currently relatively high Dividend Yield in combination with its relatively low Payout Ratio of 51.74% and its 5 Year Dividend Growth Rate [CAGR] of 2.04%, I assume that the company will be able to provide investors with a reliable and steadily increasing dividend income within the next years. These metrics played a significant role in selecting Verizon as one of my top two high dividend yield companies for this month.

The company pays a higher Dividend Yield than competitors such as AT&T (T) (Dividend Yield [FWD] of 6.34%), and a significantly higher Dividend Yield [FWD] than the likes of T-Mobile (TMUS) (does not pay a Dividend), Deutsche Telekom (OTCQX:DTEGY) (3.21%), BCE (BCE) (5.82%), Orange (ORAN) (4.84%), and Swisscom (OTCPK:SWZCF) (OTCPK:SCMWY) (3.42%). This reinforces my belief that Verizon is currently the most attractive pick out of its peer group for dividend income investors.

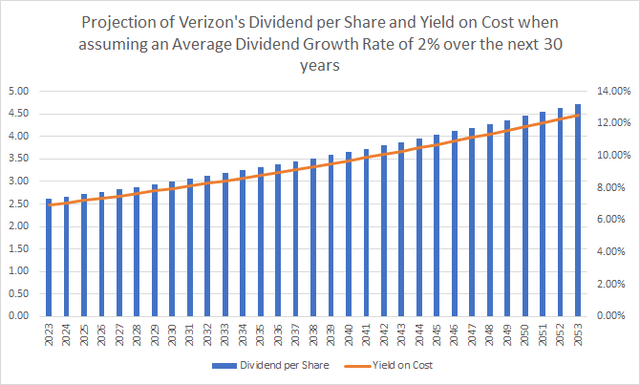

Projection of Verizon’s Dividend and Yield on Cost

As mentioned, Verizon has shown a Dividend Growth Rate [CAGR] of 2.04% over the past 5 years. In the graphic below you can find a projection of the company’s Dividend and its Yield on Cost when assuming that it will be able to raise its Dividend by 2% over the following 30 years.

Due to Verizon’s relatively low Payout Ratio of 51.74% and its Average EPS Diluted Growth Rate [FWD] of 4.09% over the past 5 years, I believe that the company should be able to raise its Dividend by 2% per year in the future.

If you were to invest in the company at its current stock price of $37.67, you would be able to achieve a Yield on Cost of 8.45% in 2033, 10.30% in 2043, and 12.55% in 2055.

Source: The Author

In addition to that, it can be highlighted that the Accumulated Yield on Cost that you could potentially achieve would be 101.71% in 2035. This would imply that you would get back your initial investment in the form of dividend payments by 2035 (no withholding taxes have been included in this calculation).

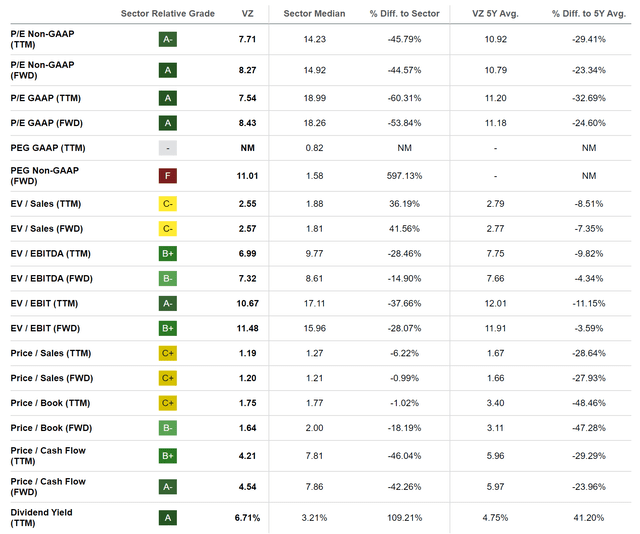

Verizon’s Current Valuation

At this moment of writing, Verizon has a P/E [FWD] Ratio of 8.43. Its current P/E [FWD] Ratio stands 53.84% below the Sector Median and 24.60% below its Average P/E [FWD] Ratio over the past 5 years. These figures provide us with evidence that Verizon is currently undervalued.

But these are not the only metrics to confirm that the company is currently undervalued.

The same is proven when having a look at Verizon’s Price / Sales [FWD] Ratio of 1.20, which stands 0.99% below the Sector Median and 27.93% below its Average Price / Sales [FWD] Ratio over the past 5 years, further indicating that the company is undervalued.

When focussing on the company’s Dividend Yield [TTM] of 6.71%, we can further see that it stands 109.21% above the Sector Median and 41.20% above its Average Dividend Yield [TTM] over the past 5 years, serving as additional evidence that Verizon is undervalued at this moment in time.

Below you can find the Seeking Alpha Valuation Grade, which further demonstrates that the company is currently undervalued.

Source: Seeking Alpha

In addition to the company being undervalued, I would like to highlight that I see Verizon as being in front of its peer group when it comes to Profitability: while Verizon’s Return on Equity is 24.59%, T-Mobile’s is 5.58%, Deutsche Telekom’s is 10.71%, AT&T’s is -5.13%, BCE’s is 12.87%, Swisscom’s is 14.58%, and Orange’s is 7.44%.

U.S. Bancorp

Within the past 12-month period, U.S. Bancorp has shown a Total Return of -37.30%, which has contributed to the fact that the bank currently pays an attractive Dividend Yield [FWD] of 6.27%.

Source: Seeking Alpha

U.S. Bancorp’s current Dividend Yield [FWD] of 6.27% stands significantly above the ones of its peer group: while Wells Fargo (WFC) provides its shareholders with a Dividend Yield [FWD] of 3.09% at its current price level, Bank of America’s (BAC) is 3.13%, Citigroup’s (C) is 4.43%, JPMorgan’s (JPM) is 2.88%, and Royal Bank of Canada’s (RY) is 4.04%

However, its high Dividend Yield [FWD] is not the only reason why I believe the company is an ideal pick for dividend income investors at this moment in time.

The bank is also characterized by a relatively high Dividend Growth Rate from which dividend income and dividend growth investors can benefit from: its Dividend Growth Rate 10Y [CAGR] lies at 9.31%, which clearly demonstrates that the bank is not only an excellent pick for investors looking for dividend income, but also for those aiming to combine an attractive Dividend Yield with Dividend Growth.

This mixture of dividend income and dividend growth has strongly contributed to me selecting the bank as one of my two top high dividend yield companies for this month of May.

Even from today, the bank can provide you with a relatively high Dividend Yield while increasing this Dividend Yield at an attractive Growth Rate. This allows you to earn a significant amount of extra income from today while the amount increases year over year.

Furthermore, the U.S. bank shows strong results in terms of Profitability. It has a Net Income Margin [TTM] of 25.50% and a Return on Equity of 12.43%, which stands 12.30% above the Sector Median (11.06%). The banks financial health is further underlined by an A3 credit rating from Moody’s (obligations with an A rating have a low credit risk).

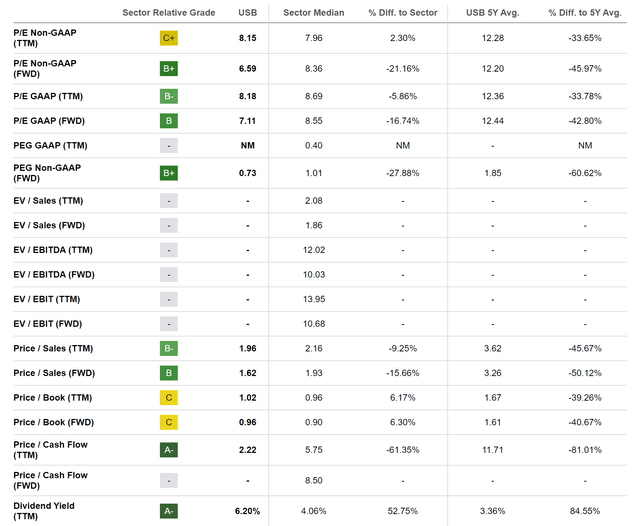

U.S. Bancorp’s Current Valuation

I consider the bank to currently have an attractive Valuation: its P/E [FWD] Ratio of 7.11 is 42.80% below its Average P/E [FWD] Ratio from over the past 5 years, which is a clear indicator that the bank is undervalued at the time of writing.

This is also confirmed when comparing its P/E [FWD] Ratio with the Sector Median (which is 8.55): its current stock price lies 16.74% below the Sector Median.

At this moment in time, the bank’s current Dividend Yield [FWD] is 50.19% higher than the Sector Median (which is 4.17%) and 80.55% above its Average Dividend Yield [FWD] from over the past 5 years (which is 3.47%). These metrics serve as additional indicators that the bank is currently undervalued.

In addition, it can be highlighted that U.S. Bancorp’s current Price / Book [FWD] Ratio of 0.96 stands 40.67% below its Average over the past 5 years, once again confirming my theory that the bank is currently undervalued.

Below you can find the Seeking Alpha Valuation Grade for U.S. Bancorp, which provides further confirmation that the bank is undervalued at this moment in time.

Source: Seeking Alpha

Conclusion

Companies that pay a relatively high Dividend Yield can be excellent investment choices in order to help you generate extra income on top of your salary.

They allow you to increase your wealth while you don’t need to sell your stocks in order to obtain capital gains. They also mean that you don’t need to worry when the stock prices of your investment portfolio decline.

Companies that offer both an attractive Dividend Yield and Dividend Growth are particularly appealing for investors, as they help you to increase your annual income.

U.S. Bancorp and Verizon are such companies: while U.S: Bancorp currently pays a Dividend Yield [FWD] of 6.27%, Verizon’s stands at 6.74%.

In addition to that, the companies have shown a Dividend Growth Rate [CAGR] of 10.00% and 2.04% respectively over the past 5 years. Their Payout Ratios of 50.53% and 51.74% respectively, further indicate that there is room for future dividend enhancements.

In addition to that, I consider both companies to be undervalued at this moment in time. While U.S. Bancorp’s P/E [FWD] Ratio of 7.11 currently lies 42.80% below its Average P/E [FWD] Ratio from over the past 5 years, Verizon’s P/E [FWD] Ratio of 8.43 is 24.60% below its Average over the same time period.

Author’s Note: I would appreciate your opinion on this article! If you could only choose two high dividend yield companies for this month of May, which would you select?

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here