Summary

Linde plc (NYSE:LIN) is the largest industrial gas company globally. With its large scale, it is able to establish presence in multiple end markets such as electronics, manufacturing, healthcare, etc., which helps in its ability to maximize its production efficiency. The business is also led by a very strong management team that is shrewd at optimizing cost while growing topline at a steady clip, leading to margin expanding net margin from 12% in FY18 to 15% in FY22, and I anticipate this trend to continue overtime as the company continues to raise prices whenever possible (without hurting volume) and enjoying a long-term secular uptrend in volume (from new projects). Looking ahead, I am also very positive on the future growth runway as management continues to announce new projects. Importantly, given LIN scale and market presence, I expect it to be often the optimal vendor of choice to partner with when pursuing projects, as such it should continue to receive project proposals. I also expect LIN to be a frequent participant as a share buyer as well given it has a $10 billion share buyback plan, which I expect to be filled and further increased as it continues to growth cash flow. LIN could also lever up the balance sheet when debt is cheap to return excess capital. All in all, I am recommending a buy rating given the positive outlook.

1Q23 results

For 1Q23, the $8.2 billion in revenue was in line with expectations, and the $3 billion in adjusted EBITDA was higher than $2.75 billion. Also exceeding expectations was EBIT, which came in at $2.2 billion. When broken down by division, every division performed above expectations with the exception of Engineering, which fell 21% short. All regions, however, saw higher-than-expected profits.

Growth outlook is positive

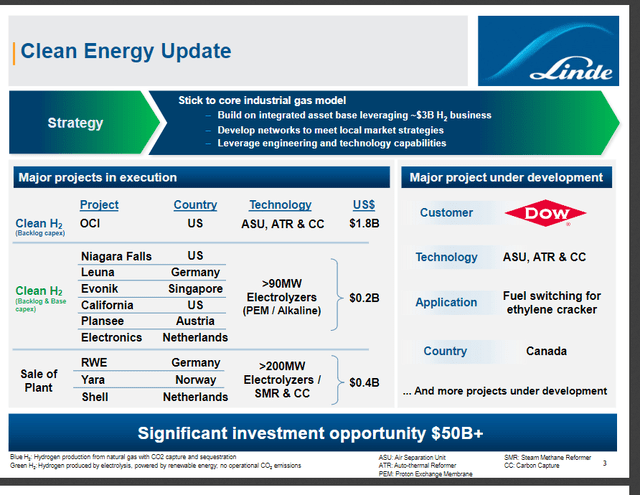

At the end of Q1, the backlog was $7.7 billion, and over the next two to three years, management anticipates $9 to $10 billion in new clean energy projects. Since the TAM is so astronomically large and, more importantly, benefits from a secular tailwind, I am optimistic about LIN’s future growth prospects. One example is green hydrogen projects, which are expected to have a TAM of $50 billion worldwide and $30 billion in the United States over the next decade. While I will admit that there will be significant lumpiness in the arrival of new decarbonization projects (remember, there are over 200 projects in development which we do not know when they will flow through the P&L), I am confident that this is simply a matter of time and revenue realization. In my opinion, LIN is a go-to partner for major projects thanks to its established market presence, extensive arsenal of engineering and logistics capabilities, and solid financial footing. Taking these measures should guarantee that LIN is able to capture the growth and underlying profits. There are many prospects outside the country as well; management anticipates that these will arise primarily in the European Union and the Middle East, with fewer possibilities in Asia and Latin America.

1Q23 earnings

Pricing power

Being the largest player comes with its perks: pricing power. Throughout the past year of inflation, LIN has been able to increase prices to fend off inflation while maintain its volume at historically high levels without experiencing any noticeable effects. I don’t expect prices to remain at their current elevated level forever, but even with energy costs moderating, I think we’ll continue to see positive results in the profit and loss statement within the next quarter or two. This is because merchant and gas have a delayed impact. Assuming management can keep costs where they need to be, we should see a positive flow through to the EBITDA line, which will further reduce the LIN leverage ratio. LIN’s net debt to EBITDA ratio is only 1.4x as of 1Q23. Today’s consensus estimates that LIN will generate $12.3 billion in EBITDA in FY24, resulting in a leverage ratio of just over 1.1x. Given LIN’s capacity to generate substantial cash flow, I believe a leverage ratio of 2-3x is entirely sustainable. In a scenario where LIN’s EBITDA multiple drops to 2.5x in FY24, the company will have access to an additional $17 billion in cash that can be put toward share repurchases, new growth initiatives, or value accretive M&A.

Conclusion

LIN is a well-managed and highly efficient industrial gas company that operates on a global scale, providing services to various end markets. The company has been successful in expanding its margins and profitability by optimizing its cost structure while steadily growing its revenue. I am positive about the company’s future growth prospects, given its large-scale operations and market presence, and the projected growth in demand for industrial gas services. LIN’s strong financial footing also enables it to pursue new projects and invest in value accretive M&A. The company’s pricing power and ability to increase prices in the face of inflationary pressures further enhance its growth outlook. Based on these factors, I recommend a buy rating for LIN.

Read the full article here