One of the reasons that managing our money can be so challenging is that most of the guidance offered is in a different language. It’s a language created by financial companies selling products, financial regulators reining in the financial companies, personal finance gurus developing a schtick for sale, and the IRS with its endless string of acronyms and code.

For too long, financial planners and advisors have focused on educating clients and teaching them to speak “financialese” when they could be translating financial planning into the language of life that clients can more easily connect with.

Even the Certified Financial Planner™ Board, the foremost credentialing body of financial planners, has created the building blocks of the practice in such a way that it is couched in terms and techniques oriented toward practitioners and products rather than the people served.

Terms such as tax planning, investment planning, insurance planning, retirement planning, and estate planning can be challenging because they are really just implementation tools, more means than ends in themselves.

For example, nobody (aside from financial advisors) wakes up in the morning and thinks:

- “Today’s the day! I want to buy some insurance.”

- “I can’t wait to optimize my risk-adjusted portfolio!”

- “Finally, I get to refine the language in my testamentary trust.”

- “Cash flow statement, here we come.”

However, when we translate financial planning into the language of life, it’s easier to see how anyone—everyone—could be motivated by the following:

- Live – Ensure a predictable source of income in the present.

- Grow – Grow your assets to ensure provision for the future.

- Protect – Protect your family, lifestyle, and property.

- Give – Give to the people and causes that are important to you.

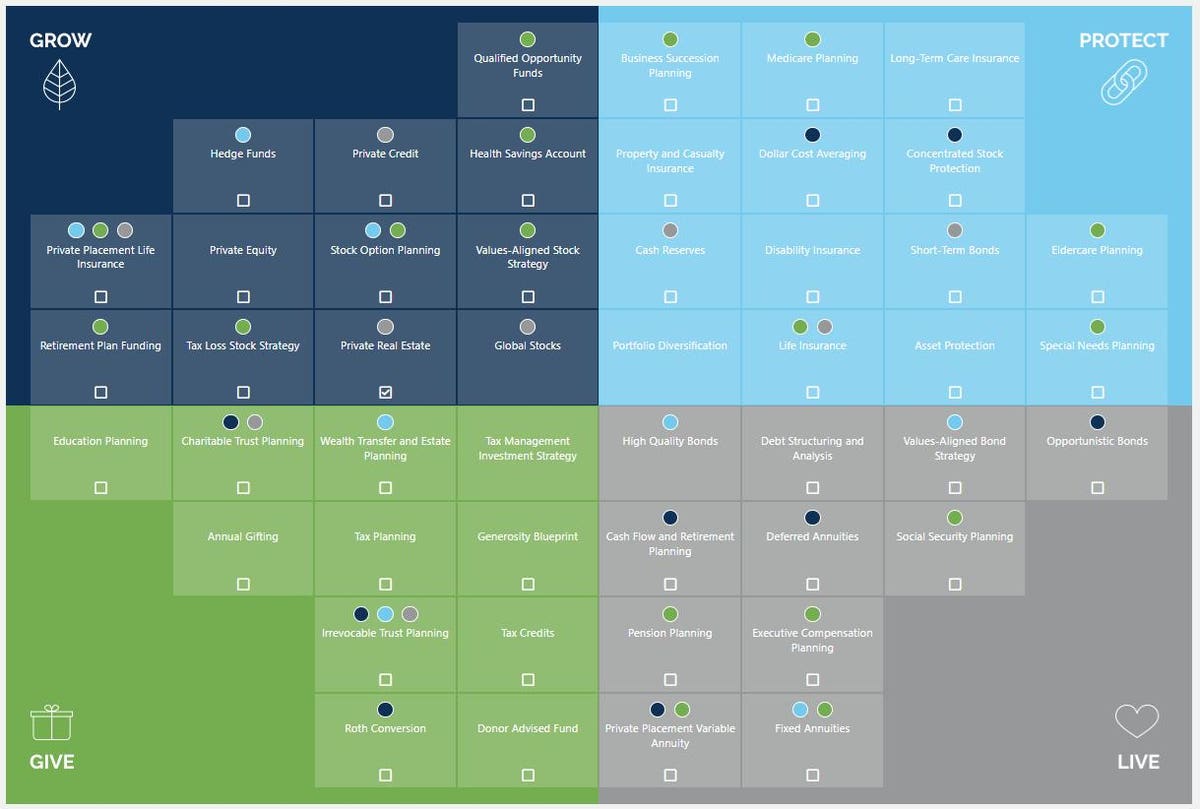

In 26 years in the financial industry, I’ve not seen or recommended a viable strategy, tool, or product that didn’t satisfy one of these four pillars of personal finance. For example, cash flow management, career planning, Social Security analysis, and retirement income planning, for example, are all Live strategies. Portfolio optimization and the myriad of equity investment possibilities are Grow strategies. The establishment of emergency savings, life insurance, and excess liability insurance are all Protect strategies. And education planning, estate planning, and charitable gift planning are all—you guessed it—Give strategies.

Here’s an example of a reordering of wealth management through this elemental lens, where the color coding denotes areas of overlap, indicating where individual strategies may offer benefits from more than one pillar of planning:

In addition to the benefits of translating and reordering financial planning into the language of life, we can immediately imbue planning with a greater sense of purpose. For example, there’s no inherent meaning or value to simply owning a term life insurance policy—but protecting your family from financial ruin if you’re no longer able to generate an income? Yup, that’s something I can get behind.

One of the reasons such a strategy also works is because of its malleability. Each individual and household is unique, and we are also perpetually changing. So, too, might our respective goals and planning priorities.

I’ve seen studies suggesting up to 80% of financial planning recommendations are not implemented. While I’m sure this failure is multi-symptomatic, I believe the primary reason is that the entire financial planning process has been orchestrated by and for those in the business rather than those being served by the business.

Therefore, it is through translating financial planning into the language of life, infusing it with greater meaning, and customizing its implementation according to the unique values and goals of each individual and household, that the positive outcomes we all hope to see can be more readily realized.

Read the full article here