Nvidia Corp. shares rallied in the extended session Wednesday after the maker of graphics processing units that is leading the AI-hardware charge reported a 141% surge in data-center sales and record results.

Nvidia

NVDA,

shares rallied 6.6% after hours, following a 3.2% rise in the regular session to close at $471.16, less than 1% below the stock’s record closing high of $474.94, set on July 18, according to FactSet data. A close at such levels on Thursday would mean a new record high for the stock.

Nvidia forecast third-quarter revenue of $15.68 billion to $16.32 billion, while analysts had estimated $12.59 billion, with $9.15 billion of that coming from data-center sales.

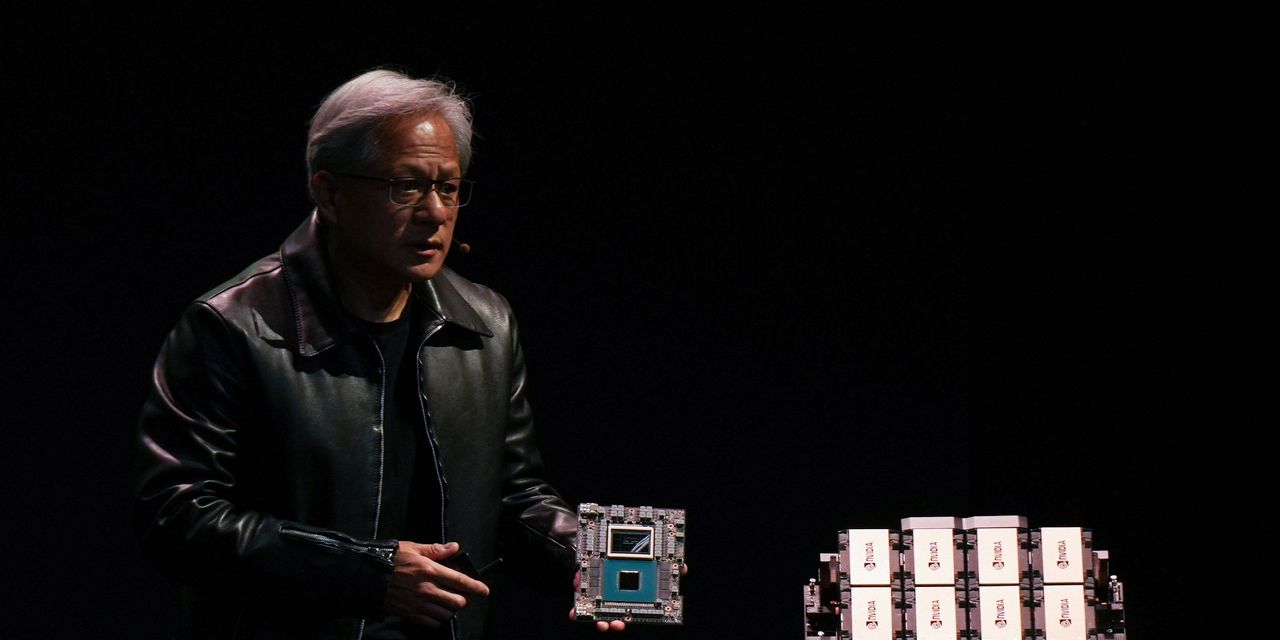

“We’re seeing two simultaneous platform shifts at the same time,” Chief Executive Jensen Huang told analysts. “One is accelerated computing,” he said, then, “generative AI enabled by accelerated computing came along. And this incredible application now gives everyone two reasons to transition to do a platform shift from general-purpose computing — the classical way of doing computing — to this new way of doing computing: accelerated computing.”

For the year, Wall Street, on average, expects earnings of $8.29 a share on $44.54 billion in revenue, a 71% increase from fiscal 2023’s $26.97 billion, with $32.41 billion of that in data-center sales.

The Santa Clara, Calif.-based company reported second-quarter net income of $6.19 billion, or $2.48 a share, compared with $656 million, or 26 cents a share, in the year-ago period. Only

Adjusted earnings, which exclude stock-based compensation expenses and other items, were $2.70 a share, compared with 51 cents a share in the year-ago period.

Revenue surged to a record $13.51 billion from $6.7 billion in the year-ago quarter, driven by a 141% leap in data-center revenue to $10.32 billion.

Analysts surveyed by FactSet had forecast earnings of $2.08 a share on revenue of $11.19 billion, and data-center sales of $8.03 billion.

Nvidia Chief Financial Officer Colette Kress said that “strong demand” for the company’s HGX platform “was primarily driven by the development of large language models and generative AI.”

The ramp-up of those products to supply strong demand was key in raising the company’s gross margin to 71.2% from 45.9% year ago, and from the first quarter’s 64.2%, Kress told MarketWatch in a post-conference-call interview. Data-center products, “because of the complexity and the software that’s included” in Nvidia’s chips, boosted margins as the company ramped up their production to satisfy growing demand, Kress told MarketWatch.

“The rise of data-center grows the company’s margins,” Kress said.

Earlier, Kress told analysts that it’s not just the company’s cutting-edge architecture that’s driving HGX sales. The system not only includes the Grace Hopper superchip, it also uses the company’s previous-generation architecture Ampere hardware.

“We are still selling both of these architectures in the market,” Kress told analysts. “Now, when you think about that, what does that mean from both the systems as a unit? Of course, it’s growing quite substantially, and that is driving in terms of the revenue increases.”

Right after the report, Lopez Research analyst Maribel Lopez told MarketWatch that Nvidia’s “numbers prove just how much money there is in the AI hardware opportunity.”

“While cloud companies are selling AI services, Nvidia is walking away with a bulk of the revenue and profits,” Lopez said. “Nvidia’s minting cash with no apparent slowdown in sight.”

Nvidia shares are up more than 222% on a year-to-date basis, compared with a 42% surge in the PHLX Semiconductor Index

SOX,

a 15.5% rise by the S&P 500

SPX

and a 31% gain by the tech-heavy Nasdaq Composite

COMP

over the same span.

Even with shares at such record highs, Nvidia said its board approved an additional $25 billion in share repurchase power to its $3.95 billion remining under a previous authorization.

Huang also stressed the importance of its growing partnership with VMware Inc.

VMW,

announced Tuesday.

“We’ve been working several years with VMware to make it possible for VMware to support not just the virtualization of CPUs, but the virtualization of GPUs,” Huang said, adding that the partnership allows the distributed computing capabilities of GPUs and AI libraries to be sold by VMware’s sales force.

Read: Will AI do to Nvidia what the dot-com boom did to Sun Microsystems? Analysts compare current hype to past ones.

Nvidia is only one of a handful of companies to report dramatic profit surges this earnings season. Nvidia’s unadjusted net income soared 844% from a year ago. Of the large tech companies this earnings season, cybersecurity company Palo Alto Networks Inc.

PANW,

reported a 6,800% surge from a year ago, according to Dow Jones data.

Nvidia, which has stood as the largest publicly traded chip maker by market cap since February, having traded that title back and forth with Taiwan Semiconductor Manufacturing Co.

TSM,

since late 2020, closed above the $1 trillion mark officially for the first time on June 14. Nvidia ended Wednesday with a valuation of $1.164 trillion, and one analyst thinks it could be the most valuable U.S. company in a few years.

Nvidia currently stands as the fifth-largest U.S. company by market cap behind Apple Inc.

AAPL,

Microsoft Corp.

MSFT,

Alphabet Inc.

GOOG,

GOOGL,

and Amazon.com Inc.

AMZN,

While all have a big stake in the future of AI, the latter three companies are scrambling to outfit their cloud-service provider data centers with new AI gear amid tight supply.

While Nvidia is considered the overwhelming leader in the AI chip market, Advanced Micro Devices Inc.

AMD,

is considered a distant second. AMD’s data-center numbers declined in the company’s recent earnings report, although the company didn’t have comparable AI chip sales in its results.

Shares of AMD and TSMC were both up more than 3% after hours Wednesday.

See also: Nvidia ‘should have at least 90%’ of AI chip market with AMD on its heels

Read the full article here