Macy’s Inc. (NYSE:M) offers an attractive dividend yield and an undemanding valuation. However, the company faces a range of challenges such as declining sales and market share. Despite this, Macy’s possesses a valuable portfolio of prime real estate assets that could act as a safety net during tough economic times. In my view, its strong balance sheet and low debt levels provide stability, and the company’s current low valuation indicates that the market may have already factored in its challenges.

Sales and US Retail Market Share

Macy’s has long-faced challenges with declining sales and market share, an issue predating the pandemic. Global Data has noted that the company’s market share has declined from 3.0% in 2016 to 2.5% in 2021. These challenges have persisted in recent months as Macy’s continues to report further declines in sales. However, these recent sales declines are not unique to Macy’s with GlobalData noting that when it comes to apparel, consumers are increasingly reducing non-essential expenses and adopting a more cautious approach to spending. This shift in consumer behavior is particularly affecting the middle market segment, as more shoppers are gravitating towards value-focused apparel outlets, such as off-price stores. As a result of this trend, department stores, which mainly operate in the mid-market segment, experienced a.3% decline in sales.

Therefore, declines seem likely to persist as a core part of Macy’s customer base becomes increasingly cost conscious. In its most recent earnings call management noted that:

The decline [in sales] was most pronounced at Macy’s, which has the largest exposure to the lower and middle income consumer with roughly 50% of its identified customers and an average household income of $75,000 or under and about 85% at $150,000 or under.

Persistent inflation has seen these consumers increasingly putting off discretionary spending. As inflation remains elevated and consumers express concern over the possibility of a recession, sales in this business seems unlikely to increase substantially in the near term or to reverse the trend of sales declines. Some strategic errors by management have also contributed to the decline in sales. Management noted that:

In hindsight, we converted too early with spring fashion well set by early March, but without enough balance in weather-appropriate apparel and footwear. Store traffic was healthy but conversion was challenged. Most of the country experienced below average temperatures for an extended period of time, while we were over-indexed in spring and early summer fashion, including special occasion and did not have enough colder weather and seasonless product.

While it can be difficult to predict shopping patterns with precise accuracy in light of extreme weather events, such events are becoming increasingly common, and it is hoped that management will implement new strategies to address these challenges. In my view, Macy’s simply cannot afford to lose out on sales through strategic blunders in inventory positioning.

The balance sheet

A core part of the value that investors see in Macy’s is the underlying value of its real estate. Macy’s owns several retail store locations, with some notable examples being the 291,000 square-foot Bloomingdale’s store at South Coast Plaza and the 2.2 million square-foot Herald Square location in Manhattan. The Herald Square property alone has been estimated to be valued between $3 billion to $4 billion. However, there has been some disagreement over the precise valuation of its real estate portfolio, with analysts at Cowen providing a much lower estimate of between $5 billion to $8 billion for its entire portfolio.

Notwithstanding these disagreements over the precise value of its real estate, even the estimates at the lowest end are higher than the market capitalization of the entire company. This means that Macy’s could theoretically sell key real estate to improve its financial position during challenging times. It is this strong balance sheet together with its already depressed valuation that prevents me from considering Macy’s a sell, notwithstanding its limited sales growth prospects in the near future.

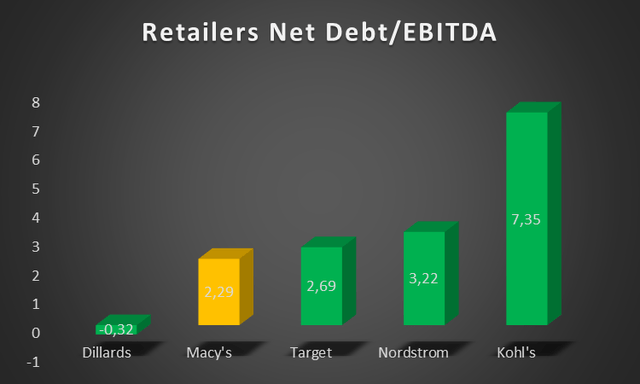

Retailers Net Debt to EBITDA (Author created based on data from EquityRT)

Macy’s net debt to earnings before interest, taxation, depreciation and amortization (EBIDTA) at 2.29 is also the second lowest of the major retailers in the peer comp charts indicated above. Macy’s debt levels accordingly appear very sustainable, both on a standalone basis and in comparison to its peers. This is further supported by Macy’s high interest coverage ratio of around 8.9.

Valuation

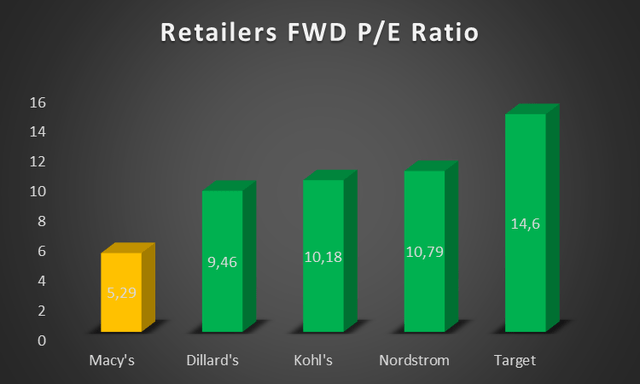

Macy’s is currently trading at a forward P/E ratio of around 5.29. This is the lowest of the retailers included in the peer comp chart below. While its lower P/E ratio can partially be justified by its decline in market share and sales declines, this lower P/E ratio also suggests that the market has already priced in these risks.

Retailers FWD P/E Ratio (Author created based on data from EquityRT)

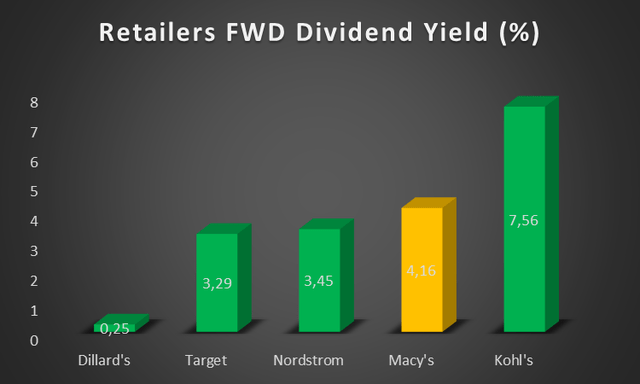

Macy’s forward dividend yield at just over 4% is also the second highest of the retailers included in the peer comp charts below. However, it is worth mentioning that Macy’s dividend might not be considered the safest dividend out there. Seeking Alpha Quant Ratings currently grades Macy’s as a D- for dividend safety and F for consistency. This is likely driven in part by some dividend cuts at Macy’s in recent history.

Retailers FWD Dividend Yields (%) (Author created based on data from EquityRT)

Unfortunately, I also don’t foresee Macy’s stock rerating in the near term given continued concerns over its declining sales and market share. A shift by its new management such as a divestment of some of its real estate might unlock shareholder value and contribute to a rerating of the stock. Nevertheless, I do not really consider this to be a possibility in the immediate future, as there are no indications of such plans at the moment.

Conclusion

In my view, Macy’s is currently a hold, given its attractive dividend yield and undemanding valuation. Despite these positive factors, the challenges of a declining market share and sales seem likely to persist in the near term. While I believe that the market might have priced these challenges in already, I also don’t foresee any near term catalysts that would result in a rerating of the stock.

Read the full article here