Don’t forget the FOMC release is Wednesday afternoon, July 26th, and according to the CME FedWatch tool, there is a 99.5% chance the new fed funds range after Wednesday’s release will be 5.25% to 5.50%. Remember, history tells us any probability over 60% on the FedWatch tool, has never not happened.

This week, after commenting on it last week, the global custodian banks performed well, particularly Northern Trust (NTRS). Even the iShares Regional Bank ETF (KRE) rose 7.5% this past week. Charles Schwab (SCHW) too had a big week, up 13.60% after FHLB balances fell.

Expenses ran a little hotter than expected, although organic “net new asset growth” was decent at +5.3% for Q2 ’23. (As the top 10 client holdings have indicated, Chuck has been a top 10 position for years, but as of June 30 ’23, the stock was down 31% YTD. Very little SCHW has been sold YTD.)

The earnings reports of interest next week:

- Microsoft (MSFT): Tuesday, 7/25, AMC

- Alphabet (GOOGL): Tuesday, 7/25, AMC

- Coca-Cola (KO): Wednesday, 7,26, BMO

- Boeing (BA): Wednesday, 7/26, BMO

- Intel (INTC): Thursday, 7/27, AMC

- Bank of Montreal (BMO) – before market opens

- AMC Entertainment Holdings (AMC) – after market closes

Exxon (XOM) and Chevron (CVX) report Friday morning, 7/28/23, before the open, and reports such as AT&T (T) and Visa (V) and several others will be scrutinized as well, just to see what the commentary details.

AT&T doesn’t trade well at all. S&P and Moody’s rate T’s long-term debt, BBB/Baa2 and the amount of long-term debt outstanding is $138 billion, down from $180 in mid ’21 (which is a plus), but that’s a lot of debt outstanding.

Yes, the lead cable news led to a sharp decline in the stock this week, but the common stock currently sports an 8.5% dividend yield, and here’s the trend in free cash flow for T:

- 2023: $2.3 billion (one quarter, as of March ’23):

- 2022: $12.4 billion

- 2021: $26.4 billion

- 2020: $28.4 billion

- 2019: $29.2 billion

- 2018: $22.8 billion

Source: Refinitiv’s Eikon

S&P 500 data:

- The forward 4-quarter estimate (FFQE), fell a whopping $0.03 this week to $229.94 from last week’s $229.97, and early January, ’23’s $228.98.

- The P/E on the FFQE is 19.7x this week, versus 19.6x last week, and 17x to start 2023.

- The S&P 500 earnings yield ended the week at 5.07%, versus 5.10% last week, and 5.86% to start the year.

- The Q2 ’23 S&P 500 “upside surprise” or beat rate is 7.4% as of this week, actually a little bit stronger than Q1 ’23’s +6.8%. That’s good news.

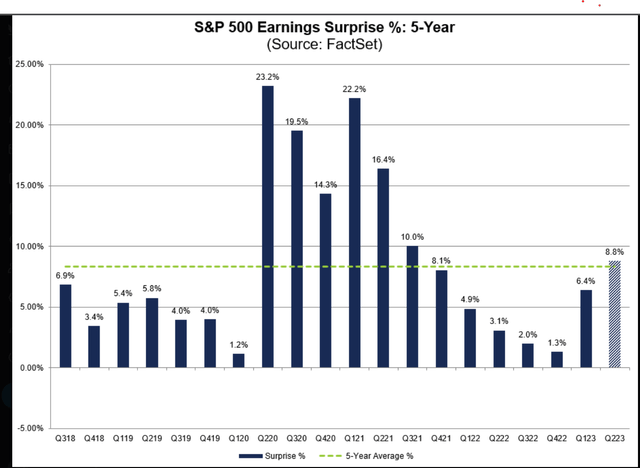

Here’s a great chart from FactSet, posted to Twitter this week, showing the “average” upside surprise or beat rate for the S&P 500 for the last 5 years, which is horribly distorted by the Covid period. The 9 quarters pre-Covid averaged just 3.4% versus the above bar chart’s average for the 20 quarters of 8.8%.

Don’t bank on 8.8% every quarter. Jeff Miller, my now-deceased friend who ran the popular “Dash of Insight” blog on Seeking Alpha, and was someone I used to commiserate with about S&P 500 earnings data many times, thought the “average” upside surprise was historically between 2% and 5%.

Ed Yardeni probably has some thoughts on this topic, but I can’t specifically recall the commentary.

The point being the average upside surprise on the S&P 500 for long periods of time is probably between 2% to 5%.

Summary/conclusion: Microsoft and Alphabet are two more “Magnificent 7” stocks (as someone coined them) to report Q2 ’23 financial results this coming week, and given how Netflix (NFLX) and Tesla (TSLA) responded to their respective earnings reports – both higher quality, large-cap growth stocks – the mega-cap names could be in for some profit-taking.

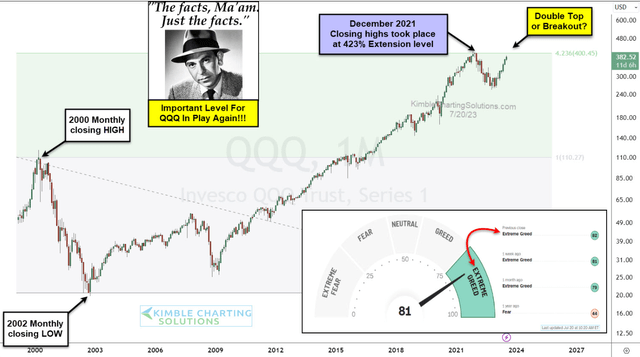

This chart from Chris Kimble speaks volumes:

Note the sentiment too.

The technician Trinity uses to provide technical analysis – Gary Morrow (Twitter: @GarySMorrow) – thinks some selling might be in store for technology stocks and the Nasdaq in the near future.

Gary thinks the SMH or the semiconductor index is hitting a wall, which is interesting given how well Intel traded this week. IBM (IBM), Cisco (CSCO) and Intel have held up as the market seems to be sniffing out value and long-out-of-favor tech stocks.

Take all this as one opinion and with a considerable grain of salt. Past performance is no guarantee of future results and none of this is advice. Writing about S&P 500 earnings data keeps me disciplined and focused and makes sure that I at least stay on top of the data week to week.

All S&P 500 EPS and revenue data is sourced from IBES data by Refinitiv, unless otherwise noted. Readers should gauge their own appetite for market volatility and adjust accordingly.

Thanks for reading.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here