~ by Snehasish Chaudhuri, MBA (Finance)

Since February 2022, economic restrictions imposed on Russia by Western countries pushed energy prices and subsequent inflation to record high levels and forced the central banks to increase the interest rates. The US Federal Reserve has been very aggressive since the past 15 months, as it increased interest rates ten times in a row and by a total 5 percent. Higher interest rates resulted in higher borrowing costs, and sent recession signals and lowered demands for mortgage loans. Also, inflation and a gloomy outlook impacted buying of new homes, and thus again demand for mortgage loans. However, there are quality stocks like Angel Oak Mortgage REIT, Inc. (NYSE:AOMR) that have been quite consistent with its pay-out and generated an extremely strong yield.

AOMR Has Offered High Quarterly pay-out, Which Resulted into a Strong Yield

Angel Oak Mortgage REIT Inc. is a real estate finance company that offers investment securities; residential mortgage loans; and commercial mortgage loans. This mREIT acquires and invests in first lien non-qualified mortgage loans and other mortgage-related assets in the US mortgage market. AOMR has a low market capitalization of $197 million, and a huge debt of almost $1.9 billion. However, for a mortgage finance company, such a high level of debt is not unusual. It was incorporated in 2018 and has been offering strong quarterly payout since then. Quarterly pay-out has ranged between $0.32 and $0.45, which is significantly high as compared to its price. AOMR is currently trading at $7.72, and has a 52-week price range between $4.43 and $15.77. No wonder that the trailing-twelve-months yield stands very high at 18.24 percent.

Future Prospect of Mortgage Market and Impact of Interest Rate Hikes on It

The US Federal Reserve had been very aggressive since the past 15 months, as it increased interest rates ten times in a row and by a total 5 percent. Policymakers estimate that Fed is set to enhance the key rate by another half percentage point to a range of 5.5 percent to 5.75 percent in 2023. By next year, however, the central bank expects to gradually cut rates to 4.6 percent in order to revive a weak economy and lower the inflation rate. Inflation has been more than halved within the past 12 months. From a peak CPI inflation of 9.1 percent during June 2022, it has now come down to 4 percent in May 2023. CPI inflation is expected to further decline to 3.2 percent by the end of 2023.

However, a core measure that strips out volatile food and energy items advanced sharply to 5.3 percent. The economy is expected to grow a modest 1 percent during 2023. And the current 3.7 percent unemployment rate is forecasted to rise to 4.1 percent by the end of 2023. The 30-year fixed mortgage rate is around 7 percent, and has come down from a 52-week peak of 8.25 percent. The 15-year fixed-rate mortgage is now 6.30 percent. While mortgage rates doubled following the first few rate hikes last year, the most recent rate hikes have had very little impact. This is because the mortgage market has already factored in those expected rate hikes. Still, anything that brings uncertainty into the economy may cause mortgage rates to fluctuate.

Risks: Unpredictable Macro Factors, Excessive Leverage, Conflicting Interest

Mortgage REITs invest in property loans, and securities. As such, they are closer to banks than real estate facility providers in that they are really lenders, not landlords. Most of these mREITs are heavily discounted and commonly offer double-digit yields, and in turn attracts income-seeking investors. However, these mREITs are much more riskier than the traditional equity REITs. mREITs doesn’t own real estate properties, rather their assets are loans, which always will have default risks. They are just a spread business – they try to earn a spread by lending at a rate higher than the rate in which they have borrowed. These interest rates and spreads can be extremely unpredictable.

Business models of most mREITs aren’t built on solid foundations. Various macro factors may result in earning high returns as well as in suffering huge losses. More importantly, most of these macro factors are out of their control. An exceptionally high leverage component makes things more complicated. Since their underlying investments (loans or securities) are generally safer, these mREITs use a lot more leverage, often 2-3 times their equity, in order to earn attractive returns. High leverage may lead to high returns when things are going right, but at the same time there lies the risk of losing it all when things go south, and that’s why many of these mREITs have such poor track records.

Various mREITs are externally managed, i.e., the management function is outsourced to an outside asset management firm like Blackstone, Vanguard Group, State Street Global Advisors or KKR. Under such circumstances, the asset management firm typically earns fees based on the volume of AUM managed, and some incentive fees based on performance of the assets it is managing. The downfall of such incentive schemes is that these may lead to acquisition or origination of poor-quality loans in order to enhance the volume of assets. It leads to greater conflicts of interest on part of asset managers. mREITs are thus aggressively financed loan and securities investments that go through boom-and-bust cycles resulting from unpredictable macro factors, unsound business models, excessive leverage, and conflicted management.

AOMR Stands to Benefit from Significantly More Favorable Market Conditions

Angel Oak Mortgage has a forward price to earnings (PE) of 21.36, funds from operations (FFO) 0.37, and a price to book value (P/B) ratio of 0.81. These figures boast well for AOMR and are suggestive of investor’s confidence in the stock. A Short interest of 7.04 percent suggests that investors are not at all bearish about Angel Oak Mortgage. Investors would be wise to hold this stock for a further 18 months, as I believe, AOMR will benefit from significantly more favorable market conditions. Fed’s return to low interest rate policy to support the post-recession cycle, will result in a strong rebound in demand for mortgage loans. In addition, a favorable environment for businesses will lead to renewed investor interest in corporate bonds. As credit spreads ease out, market conditions for bonds and securitizations would set to favor AOMR.

About the TPT service

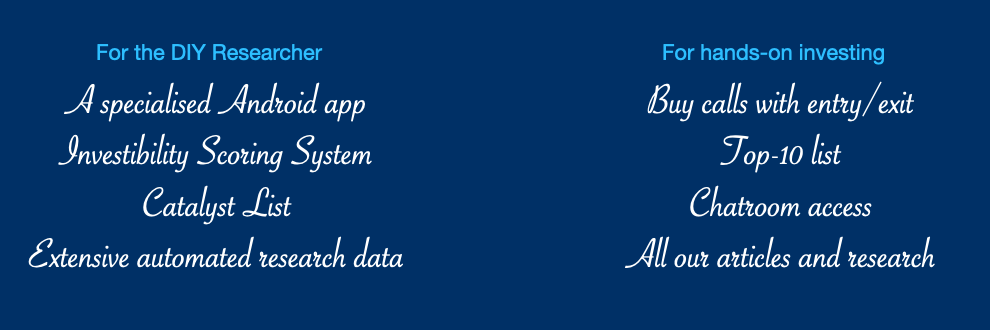

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Read the full article here