Investment Thesis

First Solar, Inc. (NASDAQ:FSLR) is cheaply valued with compelling secular tailwinds. The stock is priced at about 25x forward earnings.

Here, I describe not only the secular tailwinds driving First Solar but also how to think about its near-term prospects.

I also highlight the bearish thesis facing the stock, in that without IRA credits, this company’s profitability rapidly unwinds.

Altogether, there’s a lot to be excited about. So, let’s get to it.

Why Invest in Renewable Energy?

First Solar is a provider of photovoltaic (”PV”) solar energy solutions. First Solar manufactures solar panels, with its products used in utility-scale solar power plants and residential applications.

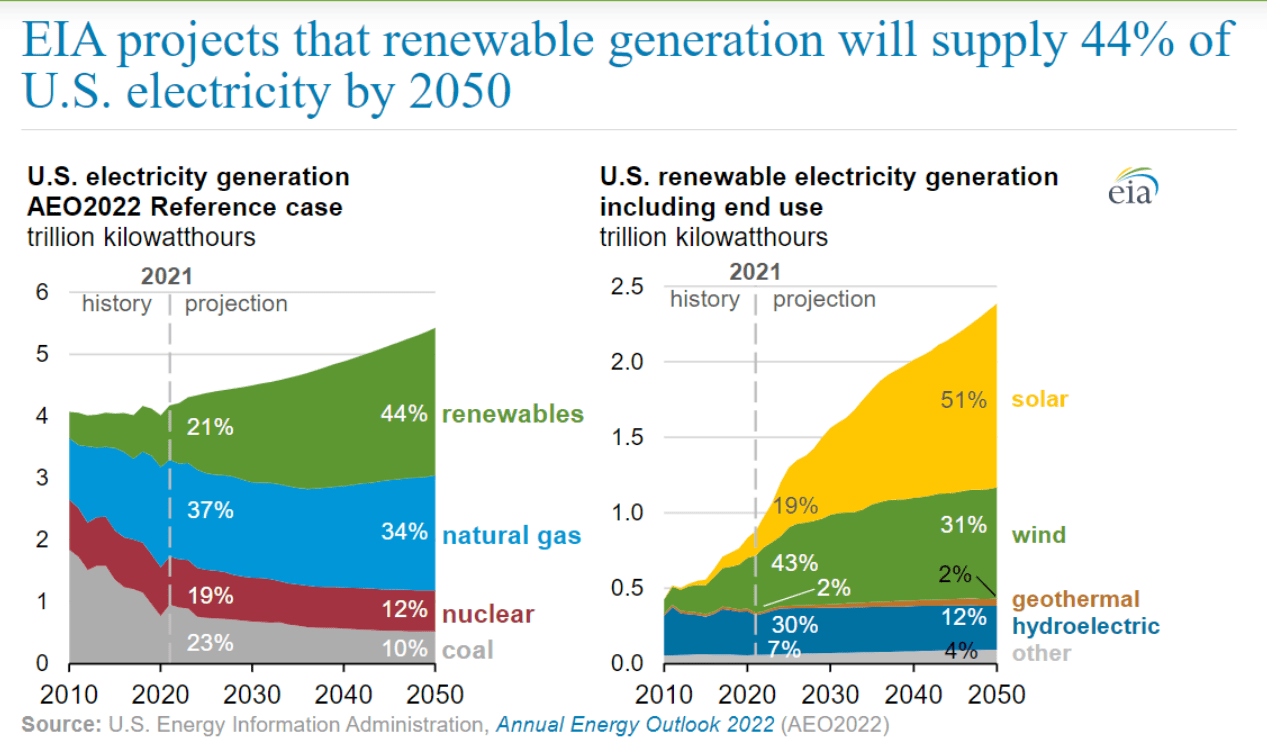

At the core of the investment thesis is this forecast:

cleantechnica.com

First Solar marries into what I call the 3 Ds. The 3Ds are:

- Deglobalization.

- Decarbonization.

- Digitalization.

Members of Deep Value Returns are very familiar with the confluence of secular tailwinds. Essentially, there’s an aspiration to take the amount of renewable energy we produce for electricity from 20% and double that in the next 30 years.

Let me make this clear, the biggest limitation of AI is cheap energy. Indeed, while I am extremely compelled by AI’s prospects, I recognize that one of the limitations of AI is the ultimate cost to enable this technology. And this leads me to a quote from Vaclav Smil’s recent book.

Unruly complexities and uncertain outcomes find no favor in the modern discourse, which swings between collapsing civilizations and ever more enticing futures.

Presently, the world has come to believe that we no longer need cheap energy. AI’s silicon chips will magically solve all of our problems. That the future is enticing.

Furthermore, to decarbonize our energy sources, we must replace this energy with something. It’s not good enough to argue that we don’t want carbon-intensive energies.

And that something, I believe, is all energy sources. From nuclear power to solar panels.

With this context in mind, let’s discuss First Solar’s outlook.

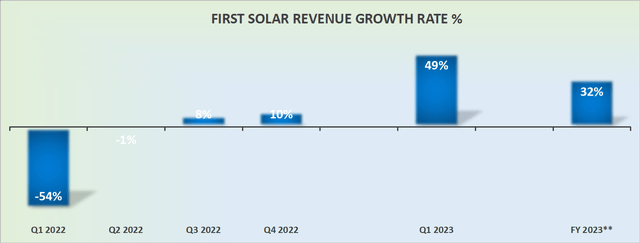

Revenue Growth Rates Are Volatile

FSLR revenue growth rates

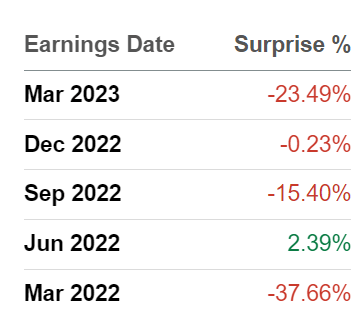

It’s old news by now, but the fact of the matter is that First Solar’s Q1 missed analysts’ revenue estimates by a wide margin. Naturally, this makes investors apprehensive.

That being said, looking back over the past few quarters, it appears that more often than not, analysts’ consensus revenue estimates often miss the mark. Or, should we phrase this as First Solar misses analyst estimates?

SA Premium

One way or another, there’s a significant gap between what First Solar is fundamentally delivering and analysts’ expectations.

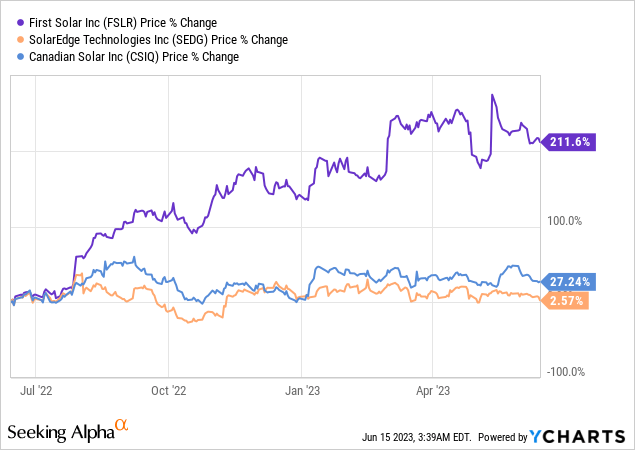

And yet, despite badly missing against analysts’ expectations, I ask that you consider how the stock has performed in the past 12 months.

The stock continues to sizzle higher, unabated. And the question is, why?

Interestingly, despite failing to match analysts’ expectations for Q1 2023, First Solar reiterated its guidance for 2023.

Meaning that, for all intents and purposes, First Solar continues to see a path that it can grow its top line this year by approximately 30% CAGR. And if that ultimately ends up being the case, given First Solar’s underlying profitability, I believe the stock is attractively priced.

How to Think About First Solar’s Stock Valuation?

At the most superficial level, First Solar stock is priced at around 25x this year’s EPS.

However, some more nuance is required here. With both positive and negative considerations.

The positive aspect is to note that in last year’s Q1, First Solar’s gross profit margin was practically non-existent. While, in the most recent quarter, it increased to 20% gross profit margins.

The negative aspect is that close to 55% of First Solar’s gross profit margins come from IRA credits. Meaning that if for whatever reason the IRA credits were to die out in the next couple of years, this would significantly alter the risk-reward profile of this investment.

The Bottom Line

First Solar has strong long-term prospects in the renewable energy sector.

First Solar benefits from secular tailwinds driven by the three key trends of deglobalization, decarbonization, and digitalization. The goal of doubling renewable energy production for electricity in the next 30 years presents significant opportunities.

However, there are challenges to consider, such as the volatility in First Solar’s revenue growth rates and the recent disappointment of missing analysts’ revenue estimates.

The stock’s attractiveness lies in its underlying profitability and the potential for continued growth. It is important to note that First Solar’s stock valuation requires nuanced analysis, considering both positive and negative factors.

The positive aspect includes improving gross profit margins, while the negative aspect is the reliance on IRA credits for a significant portion of the company’s gross profit margins. The potential risk of these credits diminishing in the future could alter the risk-reward profile of the investment in First Solar, Inc.

Read the full article here