Stacks of Hundred US Dollars. 3d illustration

“Rome wasn’t built in a day” is a fitting adage that can be applied to many aspects of life, including dividend growth investing. Short of a windfall like an inheritance or lottery winnings, we all must start our journey to the top of the dividend growth investing mountain from the bottom.

As an investor with a hybrid investing strategy that is focused on income and capital appreciation, Iron Mountain Incorporated (NYSE:IRM) is one of my favorite investments. Let me elaborate on why I like the stock so much since I last covered it in April.

A Secure, Market-Trouncing Dividend

Iron Mountain’s 4.48% dividend yield is well above the specialty real estate investment trust (“REIT”) industry average yield of 3.62%. As strikingly generous of a payout as the IRM REIT offers to investors, this doesn’t appear to be a yield trap.

This is because Iron Mountain recorded $3.80 in adjusted funds from operations per share for 2022. Compared to the $2.47 in dividends per share that it doled out that year, this works out to a 65.1% adjusted funds from operations (“AFFO”) per share payout ratio.

As if this wasn’t enough, the company’s AFFO per share payout ratio is set to improve further in 2023. Assuming the dividend per share obligation remains unchanged for one more year at $2.47, the payout ratio will be around 61.9% to 63.3% for the year. This payout ratio is based on the company’s AFFO per share guidance of $3.91 to $4 for 2023. For context, this would put Iron Mountain right within its low- to mid-60% target payout ratio moving forward (per slide 53 of 70 of Iron Mountain September 2022 Investor Presentation)

My growth forecast is that Iron Mountain Incorporated can continue to generate mid- to upper-single-digit annual AFFO per share growth in the long term. This is why I am reiterating my projection of a 5% annual dividend per share growth over the long run.

Steady As She Goes

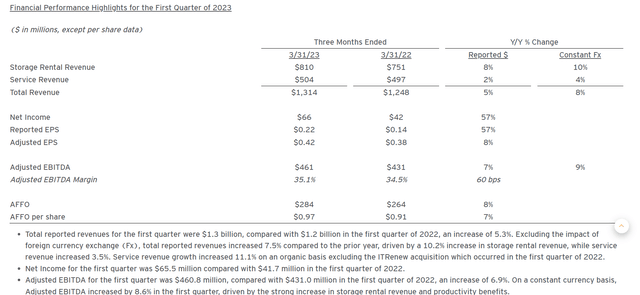

Iron Mountain Q1 2023 Earnings Press Release

Iron Mountain continued to deliver solid results to its shareholders in the first quarter that ended on March 31. The company’s total revenue increased by 5.3% year over year to $1.3 billion during the quarter. And adjusting for the 2.2% headwind that was unfavorable foreign currency translation, Iron Mountain’s currency-neutral revenue surged higher by 7.5% for the quarter.

This respectable topline growth was primarily driven by predictably strong storage rental revenue growth: The segment’s revenue grew by 7.9% over the year-ago period to $810 million in the first quarter. Service revenue played a lesser role in Iron Mountain’s topline growth during the quarter, rising by 1.4% year over year to $504 million.

The REIT’s AFFO per share climbed by 7% over the year-ago period to $0.97 for the first quarter. Buoyed by its great start to the year, Iron Mountain was confident enough to maintain its midpoint AFFO per share guidance of $3.955. This would represent a healthy, 4.1% AFFO per share growth rate over 2022 (all details in the previous three paragraphs sourced from Iron Mountain Q1 2023 earnings press release and Iron Mountain Q4 2022 earnings press release).

Risks To Consider:

Iron Mountain looks to be poised to turn out a great 2023 for its shareholders from an operational standpoint.

But it’s worth noting that the current economic environment could get in the way. This is because as recently as April, the nonprofit think tank called The Conference Board estimated the probability of a U.S. recession within the next 12 months at 99%. If an economic downturn does present itself soon, Iron Mountain could have mild difficulty in receiving all its rent revenue from tenants operating in more economically cyclical industries.

The Valuation Is Fair

Regardless of how great Iron Mountain’s underlying business is, that doesn’t mean investors can just pay as much as they feel for ownership. That is if investors desire a successful investment. Therefore, I will be highlighting two valuation models to assign a fair value to shares of Iron Mountain stock.

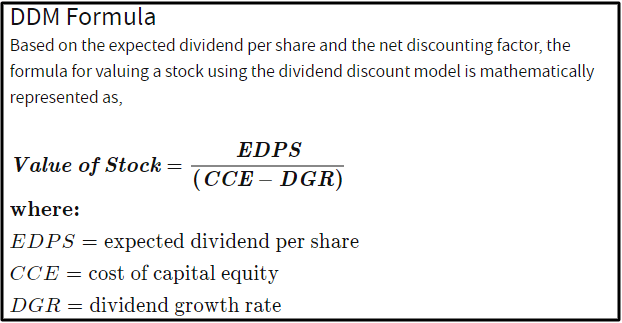

Investopedia

The first valuation model that I will utilize to value Iron Mountain’s shares is the dividend discount model (“DDM”). This valuation model is made up of three inputs.

The first input into the DDM is the expected dividend per share, which is another way of saying the annualized dividend per share. Iron Mountain’s annual dividend per share is $2.474.

The next input for the DDM is the cost of capital equity, which is simply the annual total return rate required by the investor using the valuation model. Since I target 10% annual total returns, this is what I will be using as my input.

The final input into the DDM is the annual dividend growth rate. For this input, I will use 5%.

Plugging these inputs into the DDM, I get a fair value of $49.48 a share. This suggests that shares of Iron Mountain are trading at an 11.6% premium to fair value and pose a 10.4% downside from the current price of $55.23 a share (as of June 2, 2023).

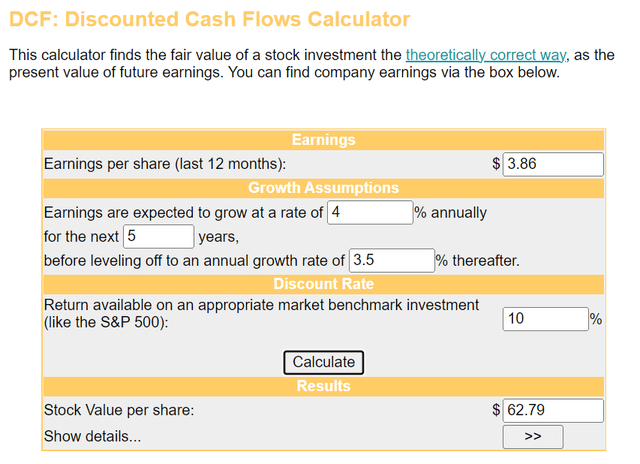

Money Chimp

The second valuation model that I will employ to appraise Iron Mountain’s shares is the discounted cash flows model, or DCF model. Like the DDM, this valuation model also has three inputs.

The first input for the DCF model is trailing-12-months adjusted funds from operations per share. This figure is $3.86 for Iron Mountain.

The second input into the DCF model is growth. I will stick with 4% annual AFFO per share growth through the next five years and deceleration to 3.5% annually in the years that follow.

The third input for the DCF model is the discount rate. This is lingo for the required annual total return rate. I will again use 10%.

Putting these inputs into the DCF model, I arrive at a fair value output of $62.79 a share. This signals that shares of Iron Mountain are priced at a 12% discount to fair value and offer 13.7% capital appreciation from the current share price.

Averaging these two fair values, I compute a fair value of $56.14 per share. That means Iron Mountain’s shares are trading at a 1.6% discount to fair value and could have a 1.6% upside from the current share price.

Summary: Iron Mountain Has Something For Everyone

Iron Mountain’s dividend yield is nearly three times the S&P 500 index’s 1.6% yield. And considering the company’s manageable payout ratio, I would be surprised if the dividend didn’t resume growth in 2024 and beyond. Taking into account the company’s mid- single-digit annual AFFO per share growth potential, Iron Mountain offers a nice mix of starting income and future growth.

Best of all, Iron Mountain Incorporated’s valuation makes it a wonderful business trading at a favorable valuation for the long haul. That’s why I currently recommend Iron Mountain Incorporated stock to income investors looking for some growth as well.

Read the full article here