Introduction

Indonesia has weathered the difficult global economic environment well: GDP growth is forecast at 4.8% in 2023 and 5% in 2024, thanks to a recovery in domestic demand and solid export performance. The country’s economy, on the one hand, depends on demand for raw materials from China and India. On the other hand, private consumption accounts for 53% of the country’s GDP. That is why the growth rate will be faster, the more expensive the raw materials are and the more lenient the monetary policy, which boosts the domestic demand. Household consumption growth accelerated slightly to 4.54% in Q1 2023, up from 4.48% in Q4, while government spending rose 4% from the previous 4.8% contraction. In an effort to improve investment attractiveness and get off the “raw material needle,” the government is reforming the labor market and the financial sector. The result is not bad: Indonesia received $43 bn of foreign investment in 2022 (comparable to India; +44% y/y), the highest in the country’s history. The country is similar to India in this respect, as it too is characterized by a large amount of cheap labor and low production costs.

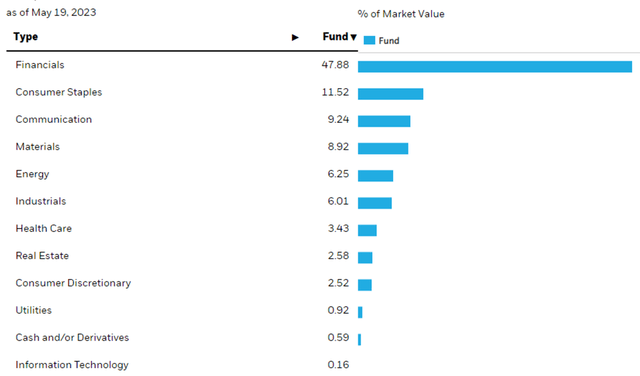

Why in the fund, despite the industrial focus of the Indonesian economy, 48% of assets are allocated to the financial sector? Bank Central Asia alone accounts for 20% of the ETF structure. The financial system in the country is less developed than in India, and it needs to be dramatically improved to fit the new economic model (expansion of lending, introduction of digital financial services, increase the share of institutional investors in project financing). The country has even issued a law on the development and strengthening of the financial sector. The beneficiaries are the largest private and state banks, which is why we see a significant share of them in EIDO.

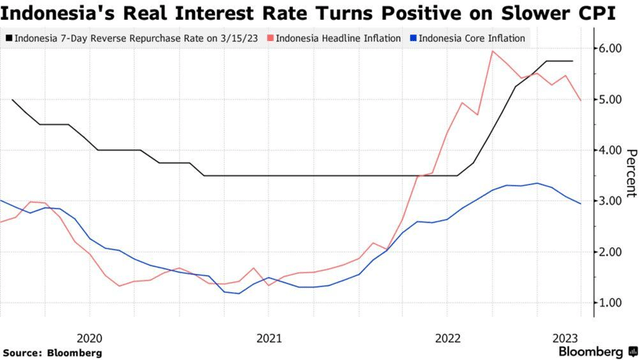

Indonesia Interest Rate (Bloomberg)

General information and Market overview

Launched on May 05, 2010, follows the MSCI Indonesia IMI 25/50 Index, covering 79 mid- and large-cap companies listed on the Indonesian stock market.

- 99.41% of assets are invested in index securities, 0.59% in the BlackRock bond fund (dollars + US treasuries maturing 1 year or slightly more) and cache in Indonesian rupiah.

main fund holdings by sectors (fund data)

Almost half of the assets are allocated to the financial sector. It is small compared to comparable countries (e.g., India), and efficiency and accessibility also lag behind. But Indonesia will need to continue to develop its financial system if it wants to overcome the average income ceiling. All the more so, the country has embarked on a shift from a resource-based economy to a manufacturing economy. All high-income countries have grown by expanding the reach, depth, and efficiency of their financial sectors. Also, issuers from the consumer, communications, and mining sectors are present. The main bet is on the sectors:

- Consumer, food manufacturers and retailers. Forecast national retail market growth rate for the period 2021-2026: 4.6%. The key growth trigger is the expansion of the retail network, the displacement of the traditional unorganized retail segment in the form of small roadside kiosks and small vendors, and the growth of a middle class population with higher purchasing power. The low growth rate is due to the fact that the redevelopment of the sector has so far been limited to cities, with this segment primarily serving the needs of upper middle class and wealthy consumers. Even if we add a middle class stratum with incomes at the median level, we get about 60% of the country’s population.

Indonesian economy (technavio)

- Communications, Telecoms. Annual revenue growth forecast for 2023-2028: 2.71%. The steady but slow pace is a consequence of geographical obstacles in terms of broad access to quality telecommunications services. The country has many sparsely populated islands, making large-scale deployment of fixed-line infrastructure impractical. The fixed-line infrastructure that does exist is still concentrated around large urban centers. Add to this the dependence on the growth of incomes of citizens and the 40% share of the country’s population below the middle class, which does not have the financial ability to fully use communications services.

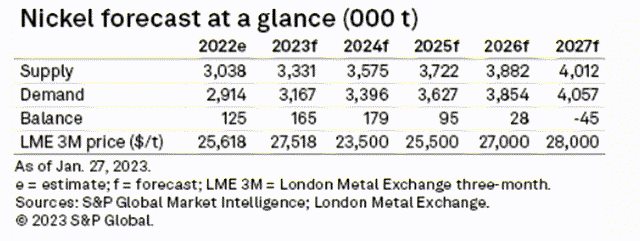

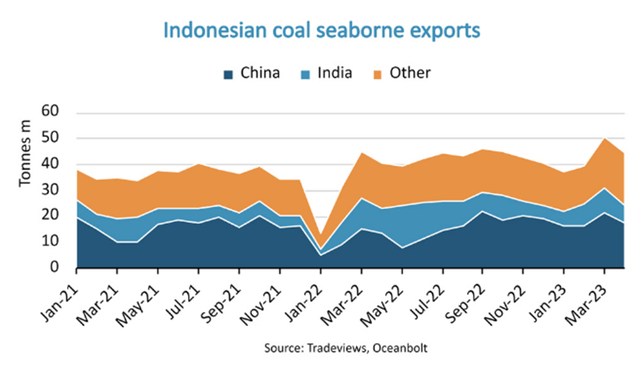

- Mining, coal and industrial metals. The main metal is nickel, and Indonesia has 22% of the world’s reserves. The surplus in the metal market is projected to grow until 2025, and then under the influence of the transition to EV transport, the balance will begin to shift to a deficit, which will cause the price of the metal to rise. The country’s coal market depends on the growth activity of the economies of China and India as major consumers. Coal exports to China are estimated to have increased 65% y/y in the first four months of 2023 after the removal of covid restrictions. High temperatures in India are already causing record high demand for electricity. As summer approaches, electricity demand may increase even more in both India and China due to air conditioning (coal-fired power generation in India and China is 61% and 63%, respectively). This, combined with China’s economic recovery, could ensure high coal exports from Indonesia in the coming months.

Nickel forecast at a glance (S&P Global)

Source: S&P Global Markets Intelligence and LME

Indonesian coal seaborne export (Tradeviews)

Source: Tradeviews and Oceanbolt

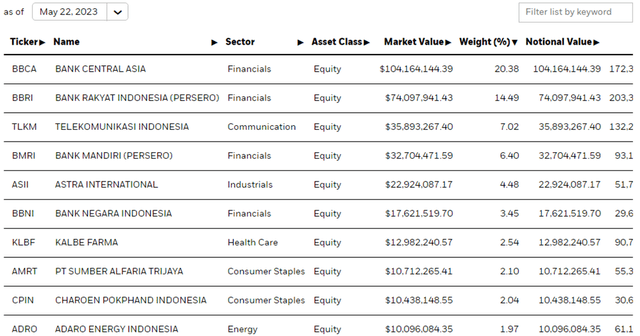

Top 5 holdings

Bank Central Asia (OTCPK:PBCRF) [BBCA] is Indonesia’s largest private bank and the country’s 3rd largest bank by assets. FWD P/E: 25.0x;

Bank Rakyat Indonesia (OTCPK:BKRKY) [BBRI] – banking and investment services. FWD P/E: 14.0x;

Telekomunikasi Indonesia (TLK) [TLKM] – mobile and wireline communication, television, Internet. FWD P/E: 15.0x;

Bank Mandiri (OTCPK:PPERF) [BMRI] is the country’s largest bank by assets. FWD P/E: 10.0x;

Astra International (OTCPK:PTAIF) [ASII] – cars, mining equipment. FWD P/E: 10.0x;

main fund holdings (fund data)

Valuation and main problems

Unlike the Indian fund (INDA), the ETF in question is priced at a lower multiple. EIDO P/E – 12.0x, forward P/E of MSCI Indonesia index – 13, forward P/E of MSCI EM – 12.0x, forward P/E of S&P 500 – 18.0x. The reason is the continued cyclicality and commodity orientation of the economy. Commodity prices are declining (nickel down 20% YTD, Indonesian coal down 32%). As a result, export growth in Q1 2023 slowed down to 11.68% from almost 15% in Q4 2022 (despite the growth of coal exports to China). Key rate – at local highs of 5.75%, restraining not only inflation but also domestic demand.

Bottom line

In anticipation of a new commodity cycle, which is emerging as the world economy recovers, EIDO quotations are stuck in a sideways range of $20-25. While commodity prices are declining, their departure to the lower end of the $20 range, where EIDO’s undervaluation will become even stronger, is not ruled out. The ETF is another interesting option in the medium term for the new commodity cycle, and in the long term for the turnaround of the economy from mining to manufacturing. The global one is spoiled by the very high share of the financial sector, which, on the other hand, is compensated by the low valuation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here