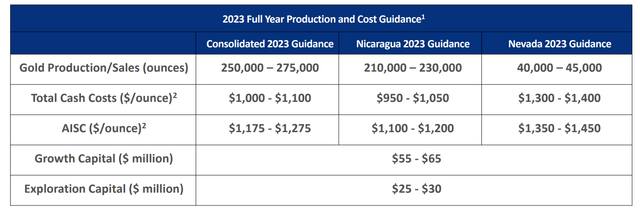

The Q1 Earnings Season for the Gold Juniors Index (GDXJ) is finally over, and one of the first companies to report its results was Calibre Mining (OTCQX:CXBMF). Fortunately, unlike some sector peers that struggled to grow production and revenue in Q1, Calibre enjoyed another quarter of phenomenal results with record revenue and gold sales despite a slightly lower average realized gold price (year-over-year basis). This has left the company tracking ahead of its FY2023 guidance midpoint of 262,500 ounces and while inflationary pressures continue to affect margins, the company has a path to claw back lost margins into 2025 as it feeds high-grade material to its Libertad Mill, which benefits from excess processing capacity. Let’s take a look at the Q1 results below.

Q1 Production & Sales

Calibre Mining (“Calibre”) reported its Q1 results last month, reporting quarterly production of ~65,800 ounces, a ~27% increase from the year-ago period. Higher gold production was related to a full quarter of contribution from the Pan Mine in Q1 2023 vs. a mid-January closing for the Fiore Gold acquisition, and higher throughput and recoveries at its Nicaraguan assets, which combined for ~55,000 ounces of production in the quarter. This strong production translated to a material increase in sales volumes and revenue to ~65,800 ounces and $126.9 million, respectively, with the record revenue figure achieved despite a slight dip in the average realized gold price year-over-year ($1,891/oz vs. $1,897/oz). Based on these results, Calibre is at 25% of its FY2023 guidance midpoint, with a stronger back half of the year ahead.

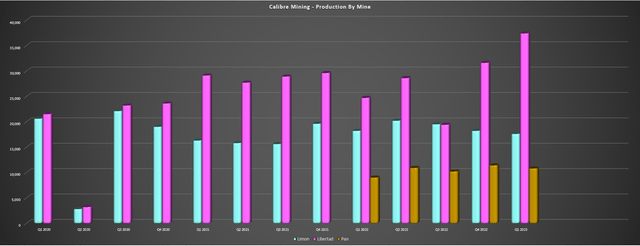

Calibre – Quarterly Production by Mine (Company Filings, Author’s Chart)

Beginning with the company’s Limon Operations in Nicaragua, Calibre produced ~17,600 ounces, a slight decrease year-over-year (Q1 2022: ~18,200 ounces) due to lower grades and offset by slightly higher throughput. Fortunately, this was offset by significantly higher production at Libertad, which benefited from a significant increase in average ore delivery rates from its spokes to ~2,294 tonnes per day (+11% year-over-year) in Q1, with contributions from Pavon Norte, its Limon mines, and the most recent contributor as of quarter-end, Pavon Central. Libertad processed ~357,700 tonnes at 3.22 grams per tonne of gold in total during the quarter, translating to ~37,400 ounces or a 51% increase year-over-year. The major contributor to grades was Pavon Central, which began contributing earlier than planned in Q1, contributing ~71,600 tonnes at 7.05 grams per tonne of gold.

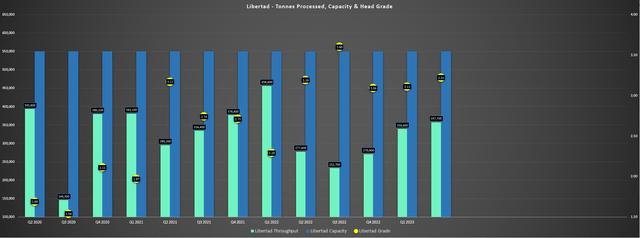

Libertad – Tonnes Processed, Installed Capacity & Head Grade (Company Filings, Author’s Chart)

While this was an incredible quarter for the asset as shown by the above chart, it’s important to note that there’s still significant excess capacity at the Libertad Mill, as evidenced by the chart below. And with another of the highest-grade open pits globally (Guapinol at Eastern Borosi) already contributing as of May, Calibre is set up for more records at Libertad, and a strong finish to the year with what will be two full quarters of high-grade feed from this asset as well. Meanwhile, at the company’s Pan Mine in Nevada, production came in at ~10,800 ounces, with ~1.3 million tonnes stacked at an average grade of 0.37 grams per tonne of gold. And while costs were above the industry average at $1,363/oz, work continues to optimize this asset and Calibre has made relatively higher-grade oxide discoveries, with its ultimate goal being to grow its Nevada production profile long-term.

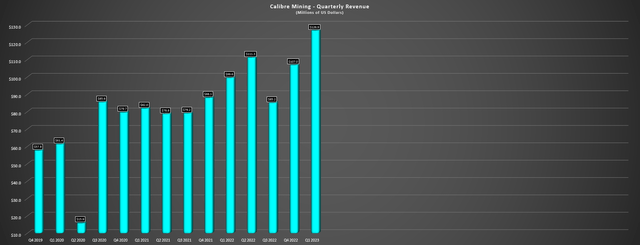

Calibre – Quarterly Revenue (Company Filings, Author’s Chart)

Finally, from a cash flow standpoint, the increase in revenue helped Calibre to report $26.7 million in operating cash flow, a meaningful improvement from $18.3 million in Q1 2022, with operating cash flow now sitting above $100 million on a trailing-twelve-month basis. This was despite limited help from the gold price in the trailing-twelve-month period and without production growth at Libertad from Eastern Borosi, which will contribute 6.0+ grams per tonne material. So, even under a conservative gold price assumption and assuming the company delivers into the upper end of its FY2023 production guidance range, Calibre should generate upwards of $165 million in cash flow this year, an impressive figure for a company with a sub $600 million market cap. And with capex being front-end weighted this year, we should see material free cash flow generation in H2-2023.

Costs & Margins

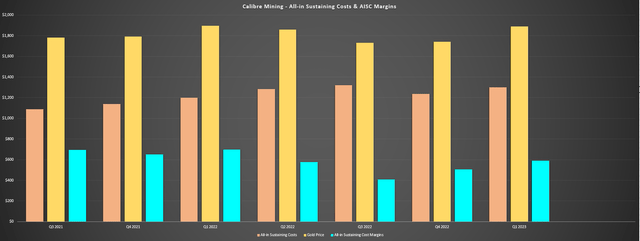

Looking at costs and margins, Calibre saw a material increase in all-in sustaining costs (AISC) on a year-over-year basis, with AISC increasing to $1,302/oz on a consolidated basis. This resulted in AISC margins contracting to $589/oz. That said, this was partially affected by its higher-cost Pan Mine, which reported AISC of $1,363/oz, higher sustaining capital of $5.5 million and inflationary pressures, with higher fuel and consumables costs on a year-over-year basis. Plus, the inflationary pressures that have led to margin compression are not company-specific to Calibre. However, with a Hub & Spoke model with considerable ore haulage, and a high-volume and low-grade operation in Nevada, it is a little more sensitive to fuel prices than some of its other high-grade producer peers.

Calibre Mining – All-in Sustaining Costs & AISC Margins (Company Filings, Author’s Chart)

The good news is that while many junior producers will struggle to bring down unit costs with inflationary pressures being sticky, and especially labor, Calibre can claw back lost margins with relatively low capex. This is because it has an excess capacity of ~800,000 tonnes per annum at its Libertad Mill relative to Q1 2023 levels, and it has a new high-grade spoke coming online (Guapinol) and continues to make new mid to high-grade discoveries across its portfolio. So, even with the Pan Mine being a ~$1,400/oz cost operation, Calibre should be able to pull AISC back below $1,150/oz by 2026 (consolidated basis) with the potential to fill the mill with material from Panteon Norte (H1 2026?), Volcan, and Eastern Borosi. Plus, we should see margins improve in H2, with a higher gold price and a slight improvement in unit costs.

Valuation & Technical Picture

Based on ~502 million fully diluted shares and a share price of US$1.18, Calibre trades at a market cap of $592 million, making it one of the cheaper names in the 250,000+ ounce producer space. This valuation compares favorably to names like Centamin Egypt (OTCPK:CELTF) with attributable production of ~250,000 ounces when adjusting for profit-sharing, Karora Resources (OTCQX:KRRGF) which is working to grow into a 200,000-ounce producer, and names like Silver Lake Resources (OTCPK:SVLKF) and Ramelius Resources (OTCPK:RMLRF). Plus, while these companies have similar production profiles, Calibre arguably has one of the simplest organic growth profiles of the group, with 800,000 tonnes of excess processing capacity sitting at Libertad. So, with new discoveries being made and the ability to put these deposits into production rapidly with a successful Hub & Spoke model, Calibre is certainly a unique growth story.

Calibre 2023 Guidance (Company Presentation)

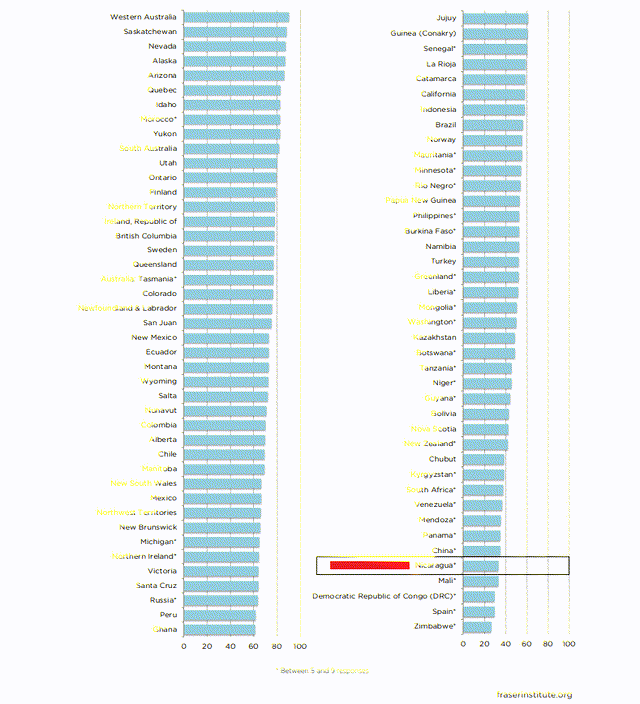

That said, the one negative attribute is that the bulk of its cash flow and production is coming from a Tier-3 ranked jurisdiction, Nicaragua, and while it has not disrupted operations to date, Nicaragua ranks among the least favorable jurisdictions globally, which could continue to impact Calibre’s multiple from a perception standpoint. However, even if we use conservative cash flow per share estimates of $0.37 in FY2023 ($168 million in operating cash flow on ~454 million shares), this translates to a fair value for Calibre of $1.48. This points to a 25% upside from current levels, suggesting that on valuation alone, Calibre could rally to new 52-week highs before the end of the year and this wouldn’t be unjustified, and this is despite using a conservative multiple to value the stock.

Fraser Institute Investment Attractiveness Index 2021 (Fraser Institute)

So, is the stock a Buy?

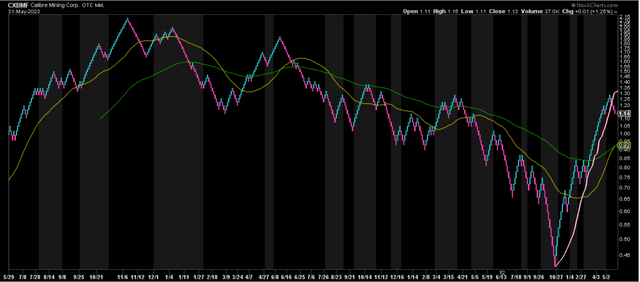

While Calibre has material upside to fair value (24%), I require a minimum 45% discount to fair value for small-cap producers in Tier-3 jurisdictions, and after applying this discount to an estimated fair value of US$1.48, Calibre’s low-risk buy zone doesn’t come in until US$0.82 or lower. Plus, the technical picture corroborates this view that Calibre is not yet in a low-risk buy zone, with Calibre trading in the upper portion of its support/resistance range, and momentum recently shifting to the downside on a short-term basis after Calibre broke its steep uptrend line. Hence, while Calibre could see an oversold bounce after two consecutive weekly declines, I would expect any rallies above US$1.26 before July to run into resistance, suggesting that this would provide an opportunity to book some profits.

CXBMF – 1-Year Chart (StockCharts.com)

Summary

Calibre Mining continues to fire on all cylinders and continues to be one of the more undervalued names in the sector, trading at less than 3.6x FY2023 cash flow estimates despite its outperformance since Q3 2022. That said, the stock is back to trading in the upper portion of its expected range, and I don’t see enough margin of safety at current levels, even if I wouldn’t be shocked to see the stock hit new 52-week highs before year-end above US$1.32. So, while I continue to see Calibre as a name worth monitoring in case we see a deeper pullback, I remain focused on other opportunities elsewhere in the sector currently which appear more attractive on a risk-adjusted basis.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here