By Fawad Razaqzada

As we look forward to the rest of the week, it remains to be seen whether the recovery will hold this time around. For what it is worth, I maintain a bullish view of gold prices.

Long-Term Gold Outlook Remains Positive

While the short-term gold outlook remains a little murky, there is little doubt in my mind that the longer-term gold forecast is positive, owing to the fact global monetary policy can only start to loosen from here.

Hawkish Fed Repricing Likely Priced In

Granted, there has been a bit of hawkish repricing in US interest rates of late, thanks to US data remaining resilient and inflation sticky. A final 25 basis point Fed rate hike in June appears to be a foregone conclusion and most likely priced in by now. But the higher the interest rates go, the sharper the eventual economic slowdown is likely to be. So, interest rates will come back down and perhaps more sharply than would appear right now.

Weaker Chinese and European Data Point To Looser Monetary Policy

The economic slowdown for the rest of the world, while not as bad as it could have been in these circumstances, certainly points to falling interest rates.

Indeed, we saw that with the latest manufacturing PMI data from Europe highlighting growth concerns last week. The PMI data indeed suggest the “higher for longer” interest rates narrative may soon become a thing of the past.

Today, we had a smaller-than-expected rise in Spanish CPI, which came in at a 3.2% annual rate compared to the 3.6% expected and 4.1% previously. The sharper drop in Spanish CPI has boosted hopes that German and Eurozone inflation data, due for release later in the week, would also surprise to the downside, reducing the need for the ECB to remain uber-hawkish.

Emerging Market Turmoil Boosts Appeal of Gold

Meanwhile, you have economic crises in many other parts of the world, most notably in some emerging market countries, where inflation has been spiraling out of control like Argentina, Turkey, and Pakistan. What’s more, China is continuing to struggle as reflected by its slumping equity market and yuan, with the latter weakening past 7.1 per dollar for the first time since November.

The economic struggles in these countries should hold back output in the rest of the world to some degree, which should mean looser monetary policy, ceteris paribus. But more to the point, economic uncertainty and high inflation is precisely why gold prices are at or near record.

Yields fall as debt ceiling deal gets closer.

Meanwhile, it looks increasingly likely that Congress will pass a debt deal to prevent a default. Investors’ required rate of return has thus fallen by holding US government debt, as the risk of default has fallen in their eyes. This is reflected in falling bond yields. As yields dip, up goes the appeal of zero-yielding assets on a relative basis. The yen has risen sharply along with gold and silver, precisely for this reason. The US dollar index was displaying a bearish-engulfing candle on its daily chart, at the time of writing.

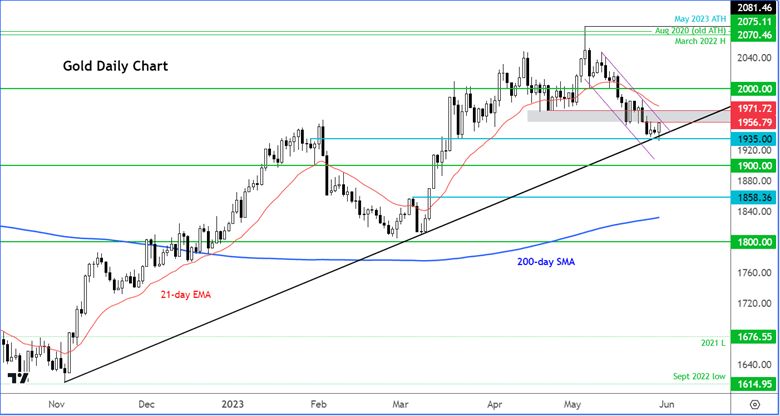

The XAUUSD has bounced right from where it needed to: around $1,935. This is where its bullish trend line and horizontal support converge.

Despite today’s bounce though, the near-term outlook remains murky as prices remain inside a short-term downward channel. The bulls will want gold to break out of this channel to the upside to signal that the short-term bear trend is over.

Recent price action on gold has frustrated the bulls ever since it failed to hold its break out to a new record high earlier this month. Every time it has printed some bullish-looking candle traders have sold into it.

Will that change in light of today’s recovery remains to be seen? At the time of writing, gold was testing prior support just below $1,960. Gold still needs to move above the $1,970ish resistance to tip the balance back in the bulls’ favor. In this event, we would become more confident in providing a more positive gold forecast.

TradingView

Originally published on MoneyShow.com

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here