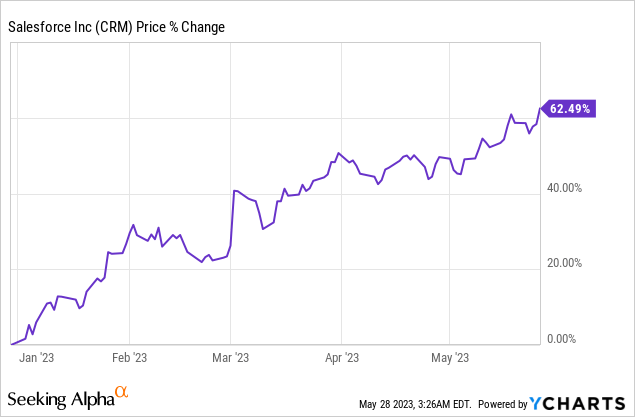

Salesforce (NYSE:CRM) is due to report earnings for its first fiscal quarter on May 31, 2023, after the market closes. The EPS revision trend is highly favorable heading into earnings and the CRM applications provider has seen a large number of EPS upward revisions in the last ninety days. I believe Salesforce could be set for a strong earnings release as the software company likely continued to see strong momentum in customer acquisition in its core businesses Sales, Service and Platform. The first fiscal quarter, together with the fourth fiscal quarter, are also typically strong quarters for Salesforce in terms of free cash flow performance. A strong earnings report and a potential ‘beat-and-raise’ could help Salesforce sustain price momentum and push Salesforce’s shares into yet another up-leg!

Market expectations for Salesforce’s FQ1’24

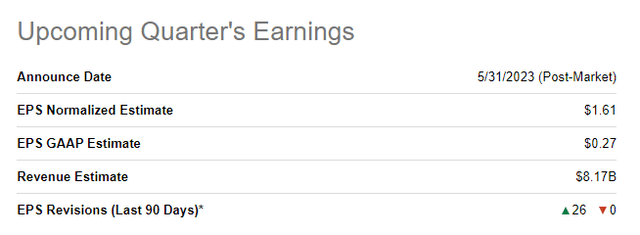

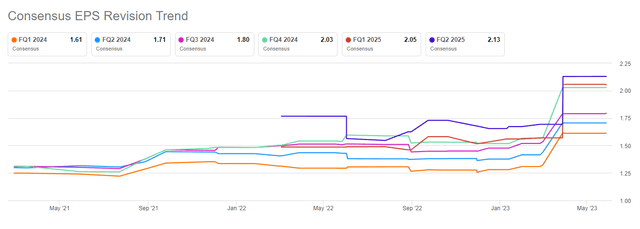

Analysts expect the CRM applications provider to report earnings of $1.61 per-share for the first fiscal quarter on revenues of $8.17B. The average EPS estimate implies 65% year over year earnings growth as the market continues to expect the software company to sustain its growth momentum, especially in the Platform business which has been the company’s growth engine in recent quarters.

Source: Seeking Alpha

Salesforce’s EPS revision trend is very positive ahead of the firm’s FQ1’24 earnings release as well: analysts have upgraded their EPS forecasts for the first fiscal quarter 26 times in the last 90 days which compares to 0 EPS downward revisions.

Source: Seeking Alpha

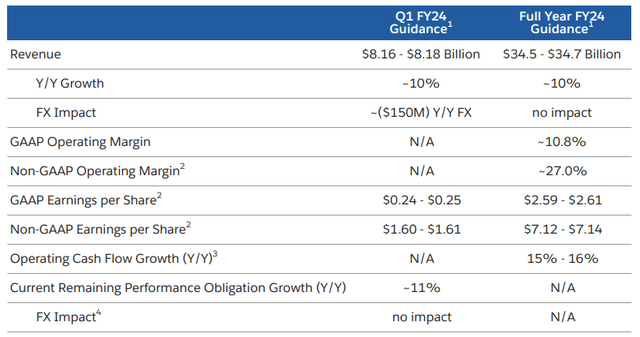

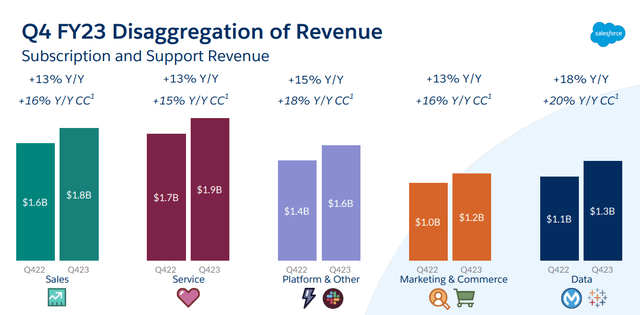

Salesforce has guided for about 10% top line growth in FQ1’24 as the company expanded its product offerings and likely benefited from continual shift of workloads to the Cloud. If customer acquisition momentum remained solid in FQ1’24, which I expect, then I see surprise potential in Salesforce’s operating margin as well. Salesforce’s operating margin soared to 29.2% in the last quarter and new product launches, such as Slack GPT, Salesforce’s proprietary AI product, could result in operating margin upside.

Source: Salesforce

My expectations for Salesforce’s FQ1’24

I believe Salesforce could be set for a very strong earnings release this week as I expect corporate clients continued to spend a lot of money on their digital transformations in the last quarter. Salesforce’s Sales, Services and Platform segments — the three largest businesses for the CRM applications provider — likely continued to see double-digit growth in the first fiscal quarter. In the fourth and first fiscal quarters, companies tend to renew their software contracts so I could even see a re-acceleration of top line growth in FQ1’24.

Source: Salesforce

Additionally, Salesforce is set to see a strong quarter regarding free cash flow as well. Historically, FQ1 and FQ4 have been very significant quarters regarding free cash flow generation as companies tend to make their software purchase decisions mostly in those quarters.

In last year’s first-quarter, Salesforce reported $3,497M in free cash flow which calculated to an enormous free cash flow margin of 47.2%. I estimate that Salesforce could report $3.4-3.7B in free cash flow for the first fiscal quarter. Based off of a consensus revenue prediction of $8.17B, the free cash flow margin for the last quarter could be an impressive 42-45%.

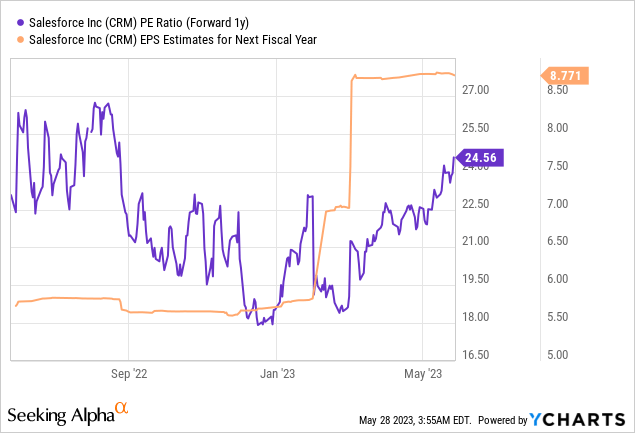

Salesforce is cheaper than you think

Salesforce is not as expensive as one would think. This is because as opposed to many other software companies that are still in the scale phase, Salesforce is already very profitable on both an earnings and a free cash flow basis. According to consensus estimates, Salesforce is expected to see 37% EPS growth this year which calculates to a very reasonable P/E of 24.6X. Considering that Salesforce is expected to grow its top line at least 10% annually over the next three years, I believe the CRM company is quite a bargain at this valuation ratio.

Risks with Salesforce

The big risk for Salesforce, as I see it, is that the company’s top line growth could slow in a recession if companies cut investments in IT spending. Microsoft (MSFT) and Google (GOOG) (GOOGL) have both seen slowdowns in corporate spending in their Cloud segments which indicates that corporate clients are growing a bit more cautious about their operating costs, especially as the economy may face the prospect of skidding into a recession. What would change my mind about Salesforce is if the company saw a steep decline in its free cash flow and operating margins.

Final thoughts

I believe Salesforce is headed for a very strong earnings release on Wednesday. The CRM applications provider likely saw continual momentum in its core segments such as Sales, Service and Platform. I further believe that Salesforce is going to see a strong first quarter in terms of free cash flow generation as both the fourth and the first quarter of each fiscal year see contract renewals, resulting in spiking free cash flow. Additionally, new product launches and new monetization efforts related to Slack GPT could result in a raised guidance for FY 2024. Lastly, I believe that CRM is a bargain ahead of the FQ1’24 earnings release as the company is valued at a P/E ratio of 24.6X. With EPS estimates also resetting to the upside ahead of earnings and shares being a bargain, I believe the risk/reward is very favorable as well!

Read the full article here