Subsea 7 (OTCPK:SUBCY) is a company that operates in an oligopoly market that procures and executes projects for energy clients to set up key infrastructure related to oil production and transport. We have covered the business for a long time, and the dynamic we pitched to readers was that lots of new projects spurred by higher energy prices have had time to age, where projects closer to completion have higher margins. Despite seasonality in the Q1, we are seeing that margin accrue, and it should continue to improve going forwards as projects are priced better with regards to inflation, and as backlog continues its slow but deliberate build. With a more active middle-year for Subsea 7, major projects should come to completion once greater activity levels can be reached outside of the winter months.

Q1 Look

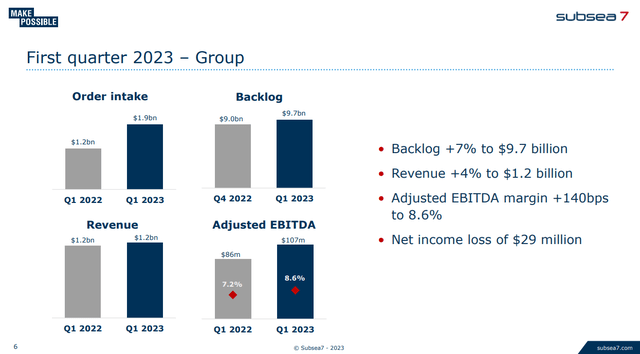

Let’s start with backlogs. They’ve grown pretty meaningfully, and this is despite growth of delivery and workloads by the company in the high-teens. Backlog growth is being driven by growth in renewable backlogs, which has come up quite substantially since Q4 last year by more than 50%, and order intake has skyrocketed as funds get ploughed into offshore wind projects where Subsea 7 provides cabling procurement and engineering services. However, drops in revenue for the renewable related to idiosyncratic phasing frictions in the major Seagreen project meant less backlog was liquidated, so the renewable backlog growth is a little overstated. Seagreen was 97% complete, so the payday should come next quarter. It should be said that despite a 40% decline in revenues for renewables, the margin growth actually grew adjusted EBITDA.

Sequential growth was good in the conventional business as well by about 5%.

Group Results (Q1 2023 Pres)

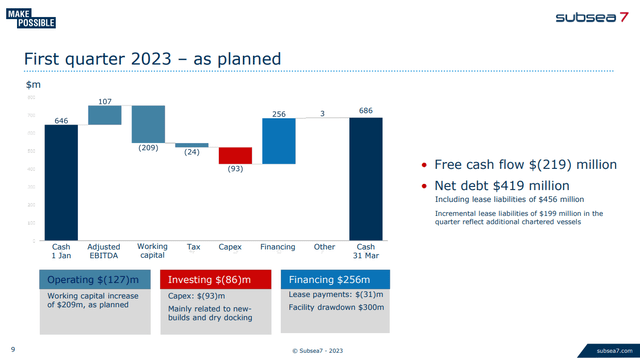

Seasonality is something to consider in this business. The winter months tend not to be very active, yet Subsea 7 still managed performance in the current Q1 in line with last year’s Q2, where Q2 tends to be more active. This is why the cash flows were also under pressure this quarter from working capital build as the company prepares itself for more active quarters to come.

Cash Flows impacted by WC build (Q1 2023 Pres)

The outlook remains strong in subsea markets thanks to initiatives by the Norwegian government to develop further the Continental Shelf in light of energy scarcity, as well as other countries who are looking to develop their oil assets while it’s clear that OPEC will continue to keep prices high. With major projects nearing the finish line as we approach the middle of the year, we should expect more fixed cost absorption as the pace of project delivery increases with a margin lift from the projects arriving at the more profitable late-stage points.

Pricing on projects has also been better in the recent waves of backlog, and to the extent that some of those projects are not as inflation-indexed, a retreat in inflation should contribute to further margin uplift.

Bottom Line

We should note that there are some latent hits to free cash flow coming. Subsea 7 is paying to have a stake in joint venture between Schlumberger (SLB) and Aker Solutions (OTC:AKRTF). Subsea is paying around $300 million, where half will be paid at closing in late 2023 and the other half can be paid a little less than a year after. That year delay is helpful for Subsea 7 cash flows, and likely gives the company time to benefit from what might be an eventual reduction in global rates, although Norwegian interest rates are still very low due to demographic and urbanisation dynamics and the housing market. Subsea 7 are paying about a 0.7x EV/Revenue multiple for the transaction, in line with their own multiple and what would be probably fair for a subsea business with an implied commercial alliance attached, since this J.V is a continuation of the Subsea Integration Alliance that helps the business for Subsea 7 keep flowing from their partners in SLB and Aker Solutions. We approve of this move.

Besides that, we expect a revenue jump in renewables and continued strength in revenues for the conventional business. Across all, we expect margin uplift. With OPEC likely to keep committing to price cuts, probably due to the fact that they don’t need to rush to deplete assets anymore since the peak oil discussions are largely dead given the Ukraine war (so less stranded asset risk if they slow down), the secular environment for oil and energy development should be strong. So while Subsea 7 is at risk if activity dries up, since its economics are strongly levered to continued activity, we think the picture is actually rather great, and remains bullish on the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here