Investment Thesis

GoGold Resources Inc. (OTCQX:GLGDF) did today release the long awaited preliminary economic assessment (“PEA”) on Los Ricos North after almost three years of drilling in the area, where the first drill holes out of Los Ricos North were announced in August of 2020. To be precise, this is the summary information, and the actual technical report will be published within 45 days.

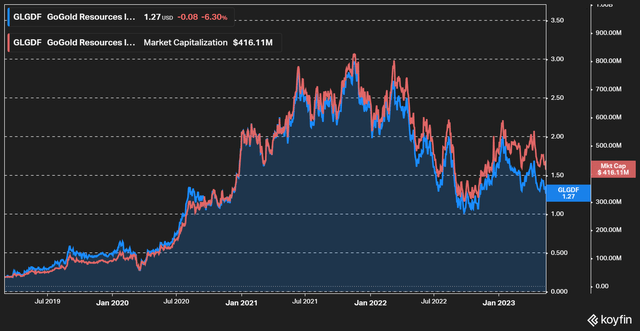

Los Ricos was purchased in March of 2019 for a rather insignificant amount given its estimated value today, and has been the main driver of value appreciation for GoGold since then.

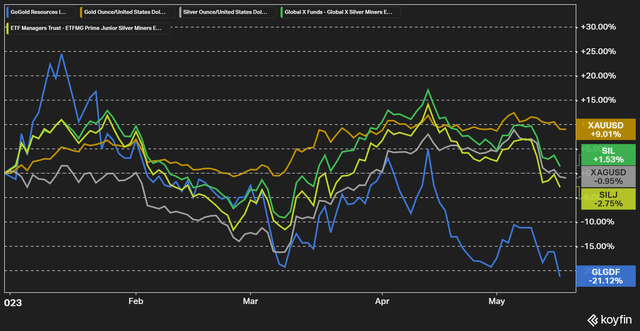

Figure 1 – Source: Koyfin

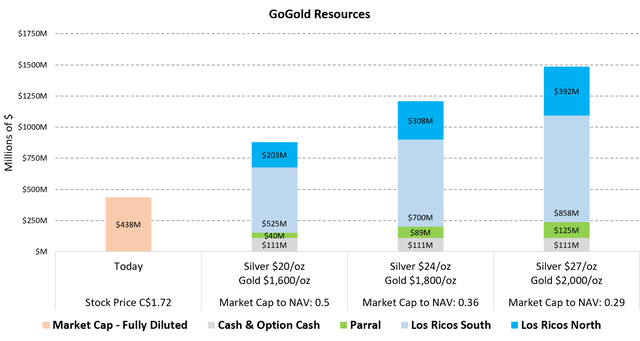

Los Ricos South is a couple of years ahead of Los Ricos North in the development cycle, but both the south and north areas are highly prospective, where GoGold has by my count drilled just over 750 mineralized drill holes to date. We are looking at a combined NPV above $1B using current spot prices, while the enterprise value of GoGold is today only $326M. GoGold also has the small producing asset Parral apart from Los Ricos.

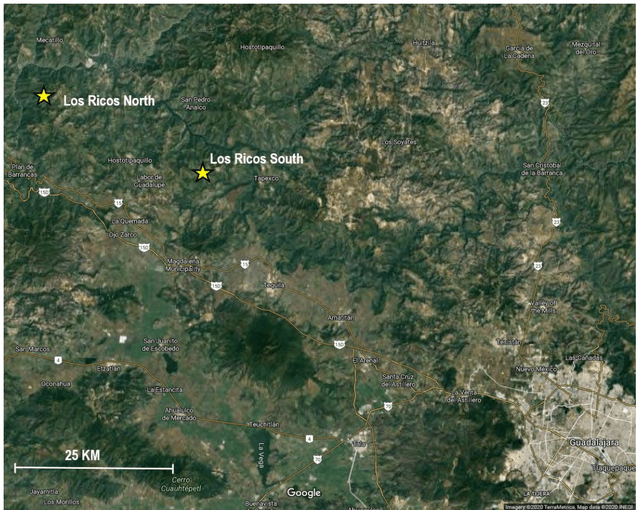

Figure 2 – Source: GoGold Corporate Presentation

I have written many articles on GoGold over the last 5 years, which can be found here.

Los Ricos North PEA Result

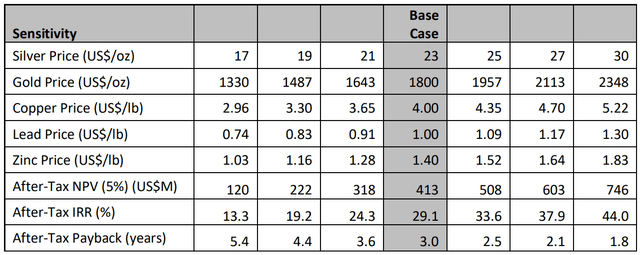

The after-tax net present value (“NPV”) was slightly below my estimates, but still solid using anything close to current metal prices. The NPV is estimated to $413M using a $1,800/oz gold price and a $23/oz silver price, which implies a 3-year payback period. At current spot prices, the NPV is closer to $500M, where I reiterate the fact that GoGold’s total enterprise value is only $326M today.

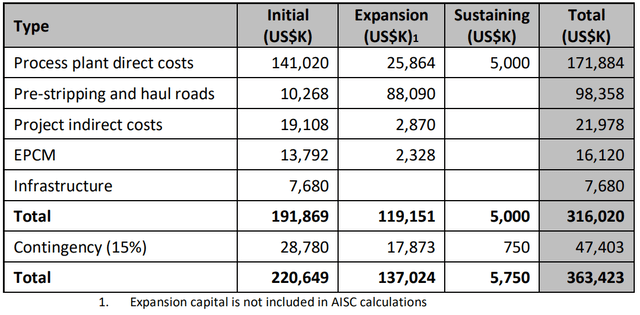

Figure 3 – Source: GoGold Press Release

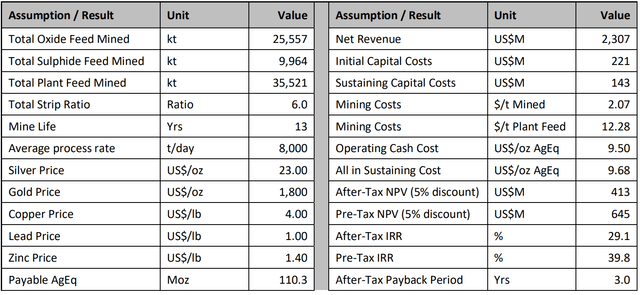

The proposed mine plan would see 8.8Moz of silver equivalent production for 13 years, with a cash cost of $9.50/oz and an AISC of $9.68/oz. These are very respectable cost figures given that we have seen the industry average costs increase lately. I would note that the $137M of expansion capital is not included in the AISC figure, which would probably add $3-4/oz to AISC if included.

Figure 4 – Source: GoGold Press Release

The IRR is a decent 29% with a $1,800/oz gold price and a $23/oz silver price, while the initial capital cost is estimated to $221M, which includes a contingency of $29M. The initial capital cost for Los Ricos North is likely substantially higher than what we will see for the underground project at Los Ricos South.

While the initial capital cost might look daunting, if GoGold ends up taking Los Ricos North to production, it will be behind Los Ricos South in the development pipeline. So, any cash flows from Los Ricos South should make the initial capital cost for Los Ricos North more manageable.

Figure 5 – Source: GoGold Press Release

Valuation & Conclusion

In my estimated valuation of GoGold, I have assumed some more conservative assumptions for Los Ricos North, than what the PEA confirms. That is because Los Ricos North is today viewed as an open pit project, which is exceedingly difficult to get a permit for in Mexico, with the current administration. Permitting Los Ricos North is likely a few years away, when the permitting rules could possibly be more accommodative.

I have written down the NPV estimates from the Los Ricos North PEA by 30%, due to a potential pivot to an underground project, which might be required to get this to production, where some of the lower grade ounces would be lost.

Figure 6 – Source: My Estimates for the Valuation

We can in the chart above see how extremely attractive the valuation is for GoGold, even with a very conservative value for Los Ricos North. Using spot prices and the 30% write-down of Los Ricos North, the company has a market cap to NAV for the combined assets just above 0.3.

I do think the updated PEA on Los Ricos South, which incorporates the high-grade Eagle zone, presently due to be released in the summer of 2023, is the bigger near-term catalyst for GoGold Resources Inc. With that said, this Los Ricos North PEA does more than double GoGold’s “official” NPV estimates. So, it can hopefully provide a good tailwind for the stock price, which has lagged peers substantially since the larger bought deal earlier this year.

Figure 7 – Source: Koyfin

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here