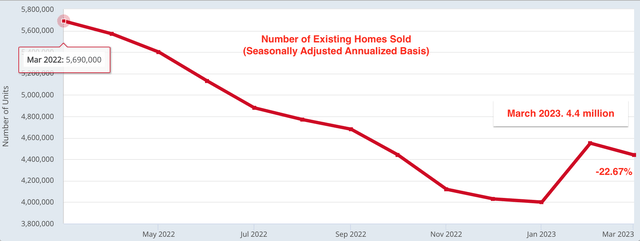

Zillow (NASDAQ:Z) is the leading online property portal in the U.S., with over 200 million unique website visitors per month. The company is still going through a business transformation/recovery after the disaster and closure of its iBuying business over one year ago. Now Zillow is coming out of the other end and has bold plans to increase the percentage of property transactions captured from 3% to 6% by the end of 2025. So far progress has been strong as the company bolstered the integration of its ShowingTime calendar booking platform, and added new features as such a “Prequalified button” which should help to boost the number of Zillow home loans. Zillow is also ahead of the curve with regards to AI and recently launched an “alpha version” of a plugin for Open AI’s ChatGPT. In my previous post on Google, I discussed how the release of these plugins is an “app store moment” and it could disrupt almost every major online platform.

Zillow also reported a beat on its top and bottom-line growth estimates. This was positive given the tough housing market. In this post, I’m going to break down Zillow’s Q1 financial results, as well as the macro picture regarding the housing market. Before revealing my valuation and forecasts for the stock, let’s dive in.

Mixed Financial Results

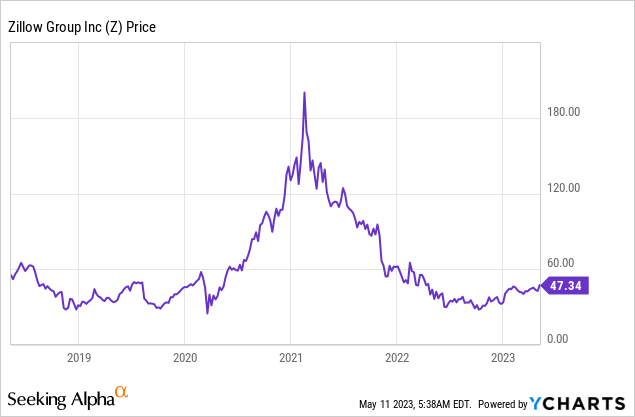

Zillow reported mixed financial results for the first quarter of 2023. Its revenue was $469 million, which beat managements guidance by $48 million and analysts outlook by $43.40 million. This wasn’t a bad result given the company reported a 12.5% decline in revenue overall. The good news is Zillow’s revenue looks to have bottomed in Q4,22 at $435 million, as a 7.8% increase was reported to $469 million in Q1,23. Next, you may assume seasonality is playing a big factor and there are fewer housing transactions in Q4,22. However, when I compared Zillow’s revenue between Q4,21 and Q1,22, I found the difference to only be $1 million higher. Therefore, I would reason that this positive sequential growth is due to core business factors, but I will cover each segment in more detail.

Revenue (Zillow with author annotations)

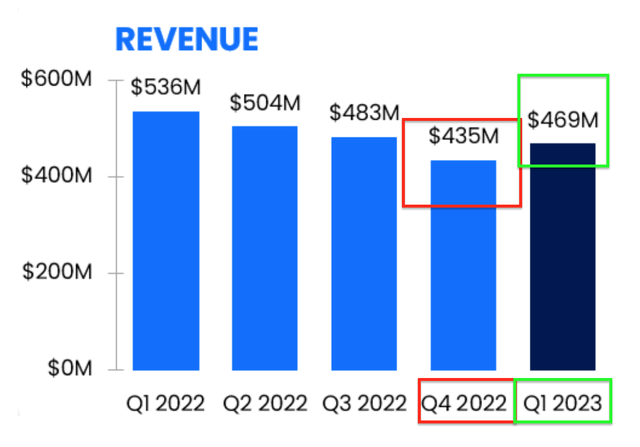

First with the negatives, Zillow’s Residential revenue continued to fall by 14% year over year to $361 million. The main driver of this was lower Premier Agent revenue which fell by 16% year over year, which wasn’t as bad as management’s forecast of between a 23% and 28% decline. Either way, this result was expected driven by the high-interest rate and “recessionary” environment, which has caused weakness in the housing market. In order to understand the impact on the housing market, I have analyzed census data on homes sold and for sale between the month of March year over year. In this case, 683,000 new houses were sold in the U.S. in March 2023, this was down 3.4% from the 707,000 sold in March 2022. Supply also increased by 5.1% over the same period from 411,000 new homes for sale in March 2022, to 432,000 new homes for sale by March 2023.

Houses Sold/For Sale (Census data with author annotations)

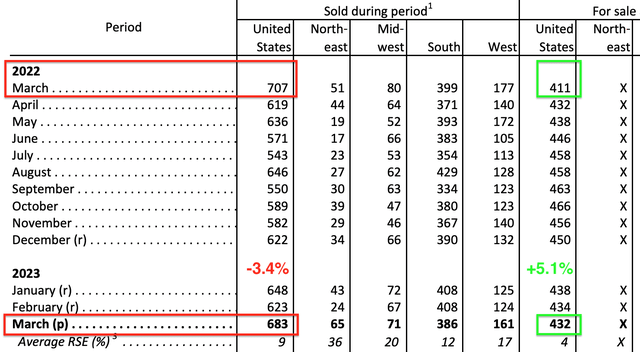

The above data may not seem too bad for new homes and but existing home sales are where I have spotted the major secular decline. On a seasonally adjusted annualized basis, the number of homes sold as of March 2023 was 4.4 million down 22.67% from the 5.69 million reported in the prior year. Keep in mind these figures are “annualized” but shown monthly, hence the numbers are really shown for a year thus they are large. Either way, the impact is pretty dramatic and of course, Zillow will feel the brunt of this, as the leading online portal.

Existing Homes sold in the US annualized (FRED economics data with author annotations)

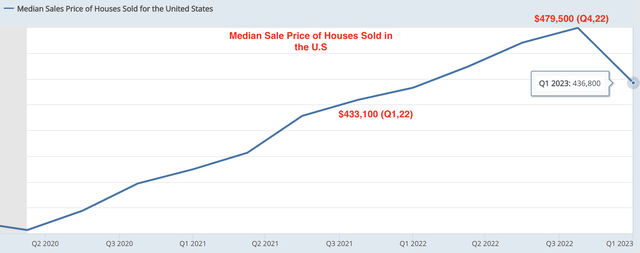

The median sale price is also an interesting metric to review. In this case, the median price was $436,800 per property as of Q1,23. This was down 8.9% from the figure reported in Q4,22. However, it should be noted this is still 0.85% higher than the figure reported in Q1,22, and given interest rates are now higher, I would predict prices have further to fall (unless the Fed suddenly drops rates).

Median Sale Price (FRED economics data with author Annotations)

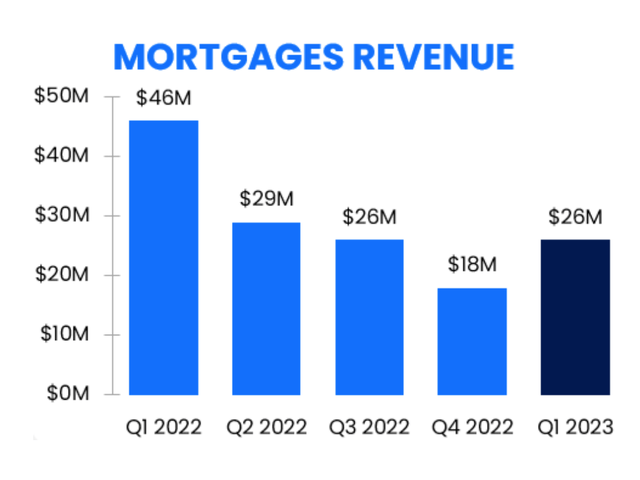

Either way for Zillow the end result was a hit in website traffic down 5% year over year, to 212 million monthly unique users. But more specifically its Mortgages revenue reported an eye-watering decline of 43% year over year.

A positive is Zillow has continued to build out its home loans business and reported a 9% quarter-over-quarter increase in loan origination volume. The company has even assigned a team of loan officers in multiple states and cities in order to enhance the loan offering through local agents. The result of this has been positive with one in three of its agent partners introducing home loans to customers, this is up from the one in five reported in Q4,22.

Mortgage Revenue (Zillow data )

A positive for Zillow’s business model as a whole is if people aren’t buying they will be likely renting. In this case, Rentals revenue rose by 21% year over year to $74 million. This was driven by a 16% increase in its rental website traffic to 29 million monthly unique visitors.

Margins and Balance Sheet

Moving onto margins, Zillow reported a net loss of $22 million in Q1,23 at a negative 5% margin. Its operating loss was $39 million which was worse than the positive $50 million reported in Q1,22 but it was an improvement over the $73 million loss reported in Q4,22. This improvement was helped by flat expenses of ~$508 million between Q4,22 and Q1,23. Its stock-based compensation also declined in Q1,23 from levels reported in Q4,22.

Overall, Zillow reported earnings per share [EPS] of negative $0.09, which beat analyst forecasts by $0.23.

The company also has a solid balance sheet to continually invest with $3.4 billion in cash and short-term investments. In addition, to $1.7 billion in convertible debt.

Valuation and Forecasts

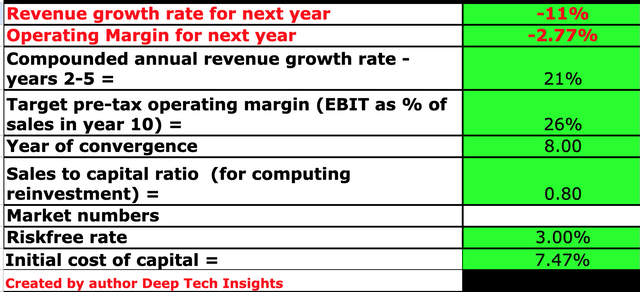

In order to value Zillow, I have plugged its latest financial data into my discounted cash flow valuation model. Relative to my prior forecasts for Zillow stock, I have revised up my revenue decline estimates from negative 15% estimated prior to just negative 11%, over the “next year” or the next four quarters. This revision has been informed by the bottom end of management guidance for Q2,23 which would represent a negative 3.9% decline sequentially. I have then extrapolated this out and also added ~7% percentage points of negative headwinds, from the macro housing market which I believe will get slightly worse before better, due to the aforementioned data I analyzed. This estimate also aligns closer to the 12.5% year-over-year decline reported in Q1,23.

In years 2 to 5, I have increased my forecasted growth rate by 2% to 20% per year. This is due to solid traction with regards to Zillow Home Loan originations, even despite the tough backdrop. Of course, the overall growth is driven by a cyclical rebound in the housing market, which has occurred historically and I forecast will occur.

Zillow could also return to prior growth rates of between 24% and 34% as the company reported between 2018 and 2016. Of course, the business is very different now, but it does have a lower revenue base, and thus percentage growth rates should be more stark.

Zillow stock valuation 1 (created by author Ben at Deep Tech Insights)

To increase the accuracy of my model, I have capitalized R&D expenses which has lifted operating income. I have forecast a target pre-tax operating margin of 26% in year 8, which is 1% higher than my prior forecast. I have informed this revision via flat expense growth recently and margin improvement sequentially.

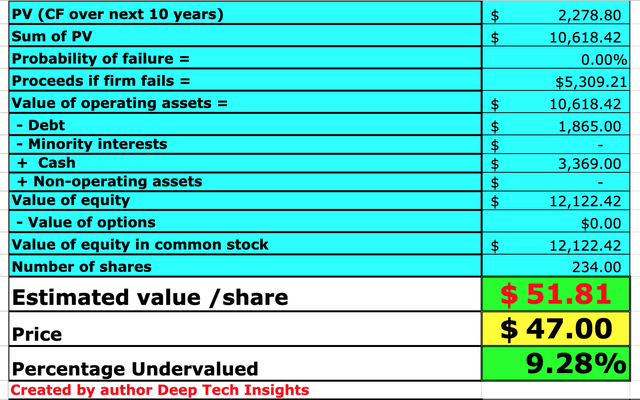

Zillow stock valuation 2 (Created by author Ben at Deep Tech Insights)

Given these factors I get a fair value of ~$52 per share, the stock is trading at ~$47 per share at the time of writing and thus it is over 9% undervalued.

Risks

Housing Market Decline

Many analysts have forecast a recession in the latter half of 2023 and thus the housing market will likely continue to decline. The question is nobody knows how much transactions will fall. There is no doubt U.S. property prices have had a tremendous bull run since the financial crisis of 2008 and I believe a correction is overdue. In my mind, for where interest rates are, property prices should be lower. But given property is an asset of fairly low liquidity, homeowners have a tendency to hold out for a stronger market.

Final Thoughts

Zillow is on track to capture a greater portion of the housing transaction market and is in a prime position to do so. The company has best-in-class management, and thus once it has survived the current housing market decline, I would expect a solid rebound. My valuation model and forecasts indicate an ~9% undervaluation, as mentioned prior this is conservative and Zillow has a strong leadership position. Therefore I will label the stock as a “buy”, although more conservative investors may wish to wait for a further pullback in the housing market for a larger margin of safety.

Read the full article here