Thesis

The Simplify High Yield PLUS Credit Hedge ETF (NYSEARCA:CDX) is a fixed income exchange traded fund. The fund is a fairly new addition to the ETF space, having its IPO in February 2022. The vehicle is a U.S. high yield fund with embedded hedges. This fund takes a holistic portfolio approach idea, with the aim to provide an investor with exposure to the high yield space but with a more muted drawdown than a pure long position. The ETF is able to potentially hedge some of the downside via a few instruments:

Credit hedging can be very expensive, so it is paramount to be flexible in our approach to hedging within the space. CDX will opportunistically invest, based on cost-to-payout ratios, in CDX calls, Quality-Junk factor-based hedges, and equity puts.

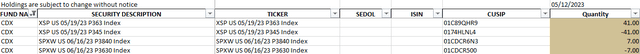

Currently, the fund only holds S&P 500 puts with May and June maturity dates, which we assume are going to be rolled in one form or another.

Conceptually, what the fund is trying to achieve is a more ‘smoothed-out’ high yield total return. The thought process here is that an active manager can hedge out some of the downside via the outlined instruments above, and thus provide an investor with a total return profile that has less volatility than an outright long position.

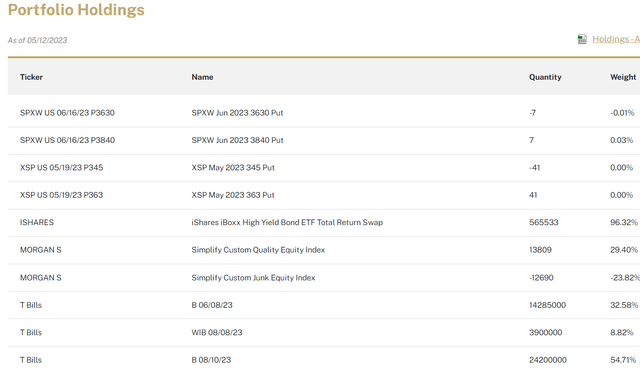

The fund currently has total return swaps that give it exposure to the iShares iBoxx High Yield Corporate Bond ETF (HYG) and also contains a few small positions in S&P 500 puts. Most of the cash is held in T-Bills. As a reminder total return swaps are synthetic long positions (i.e. a derivative) thus the fund is able to sit on a significant amount of cash while holding a synthetic long in HYG.

When looking at its historic performance though we fail to see the benefit of hedges. We are looking here at the September/October 2022 drawdown, which saw a significantly negative market performance across asset classes. A ‘hedged’ instrument should exhibit a better return than its main component, namely HYG. In the ‘Performance’ section below we outlined the graphical representation of the performance, and we do not see CDX outperforming, quite the opposite actually.

We find the general idea behind CDX as a good one, done with a small management fee of only 25 bps, but we do not think the layered hedges are significant enough to actually buffer the downside. If we look at the current collateral and hedges we notice the following:

Hedging (Fund Website)

These are put spread hedges on the SPY. For example, the first two lines are a 363/345 put spread on the SPY. If the index falls in value below 363 by May 19, these hedges will pay out. Irrespective of the actual occurrence, please note that the market value is very small: 41 contracts x 100 x 363 = $1.5 mm market value. That is very small for a $44 million fund.

The take-away here is that the hedges are very small and insignificant to make a difference for the fund, although the intent in there. The ETF’s historic performance also outlines the fact that in the September/October 2022 market sell-off the vehicle failed to protect an investor more than an outright position in HYG. While the possibility is there to do some interesting protection buying, we have not seen that yet. Expect this fund to perform very similarly to HYG until the manager proves us different.

Analytics

- AUM: $0.04 billion

- Sharpe Ratio: n/a (3Y)

- Std. Deviation: n/a (3Y)

- Yield: 5.45%

- Premium/Discount to NAV: n/a

- Z-Stat: n/a

- Leverage Ratio: 0%

- Composition: Fixed Income – U.S. HY (hedged)

- Duration: 4 yrs

- Expense Ratio: 0.25%

Performance

CDX has a performance which is in line with the iShares iBoxx $ High Yield Corporate Bond ETF:

Total Return (Seeking Alpha)

As a ‘hedged’ instrument we would expect a better performance, especially during market sell-off events. If we have a closer look at the October/November 2022 performance for the two instruments we can see that shockingly, HYG outperforms. This tells us that the ‘hedging’ done by CDX is inadequate and it only results in a portfolio carry drag. By looking at this graph, an investor is better off by just investing in HYG outright.

Holdings

The fund holds a synthetic position in HYG via swaps, put spreads on the SPY and T-Bills:

Holdings (Fund Fact Sheet)

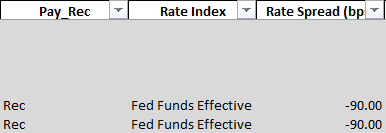

As a reminder, total return swaps are a form of a derivative that can pass to a fund like CDX the net proceeds from a certain investment (in this case HYG) in return for a fee. Funds engage in TRSs in order to avoid having to buy on their own balance sheet hundreds of bonds and constantly adjusting positions and managing them. In the detailed collateral view we can see the fund paying Fed Funds minus 90 bps for the structure:

TRS Cost (Fund Website)

Conclusion

CDX is a fixed income exchange traded fund. The vehicle mirrors the iShares iBoxx $ High Yield Corporate Bond ETF via a TRS structure, and also layers in S&P 500 put spreads to mitigate the downside. The fund also has the mandate to invest in CDX calls or quality-junk factor-based hedges. Theoretically this is an interesting structure since it will result in less of a drawdown in a market downturn, all else equal. However, CDX seems to be chronically under-hedged, with its September/October 2022 performance very much in line with HYG. In other words, the fund does not do enough hedging to make a difference in its return profile. It is the case currently as well, with its S&P 500 put spread hedges amounting to a very small notional when compared to the fund size. Unless the portfolio manager changes something in its composition, do expect CDX to perform in line with HYG, despite its interesting stated mandate.

Read the full article here