Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The London Stock Exchange was hit by more bad news last week when Glencore, the mining group, said it was considering moving its primary listing to another exchange in search of a higher valuation. Glencore could join an exodus of companies such as Flutter and the building materials group CRH.

The exchange can take comfort from one thing: it is not going to lose the listing of a much larger company, the ninth most valuable in the FTSE 100 with a market capitalisation of £62bn at the start of this week. That venture has turned itself in the past decade from a takeover target into the European champion of a global industry: the London Stock Exchange Group.

The gulf in fortunes between the London Stock Exchange and its parent LSEG is striking. The flow of setbacks for the former has not impeded the steady rise in the latter’s financial value. The explanation is simple: share listing and trading only account for 3 per cent of LSEG’s revenues due to its diversification over the past decade.

LSEG’s transformation from a stock exchange to a global hub for securities trading and clearing, along with data and analytics, is hard to fault as a defence strategy. In 2016, it agreed a merger of equals with Deutsche Börse, but this was blocked by the EU. It is worth far more than the latter now, and is six times the market value of Euronext, which owns the Amsterdam and Paris exchanges.

But LSEG’s financial success story leaves it with an identity problem. The group is not considering moving to the New York Stock Exchange, but it might be worth more if it did, thanks to its highly rated global trading and data businesses. Another venture with a less weighty history in a similar financial position would be tempted to change its name or sell the lagging business.

As things stand, the exchange and LSEG are stuck in an odd relationship. LSEG gains lustre from a business that dates back to the 17th century, while the exchange benefits from being owned by a group that is not vulnerable to takeover bids. But it would be simpler for both if their financial prospects were more aligned.

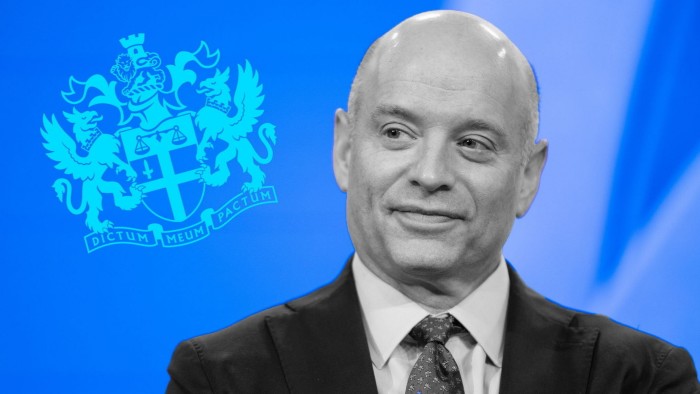

Investors will this week hear LSEG’s response when David Schwimmer, chief executive since 2018, presents its 2024 results. His predecessor Xavier Rolet started the transformation but Schwimmer, a former Goldman Sachs banker, has advanced it. He carried out its sharpest pivot, the $27bn acquisition in 2019 of the financial data provider Refinitiv.

LSEG has turned Refinitiv into a somewhat stronger challenger to Bloomberg under its Workspace brand, helped by an alliance with Microsoft. The deal also gave it a 51 per cent stake in Tradeweb Markets, a US bond and fixed-income derivatives platform that has grown rapidly. It is much less famous than the London Stock Exchange, but has higher revenues.

There is a broader lesson for exchanges and market platforms: investors often attach the highest values to the least exciting operations. LCH, which is one of the world’s largest bond and derivatives clearing houses, is among LSEG’s most highly valued assets. While equity listings get more attention, bond trading and clearing are quietly reliable.

LSEG’s antithesis is Euronext, which relies far more heavily on equities. Euronext’s market value is lower, but on measures such as the total number of new listings and trading volumes on its seven stock exchanges, it has been beating London. Stéphane Boujnah, chief executive, claimed last month that losing listings to New York was just “a London problem”.

Boujnah would clearly love LSEG to lose patience with the London Stock Exchange and sell it to him. That is implausible, given the importance of the exchange to London as a financial centre, no matter how small a share it is of LSEG’s revenues. LSEG is in a much better position to buy Euronext itself, but that would raise competition issues as well as European hackles.

The truth is that LSEG did well to remove itself from the old game of stock exchange musical chairs, and to build a broader business under a related brand. It would probably not be thanked by shareholders for turning back: there are many data, analytics and trade-related operations to build or buy instead.

But the London Stock Exchange and its parent should not drift too far apart. While it may not matter much to LSEG’s financial valuation that its original asset is having trouble, the exchange remains the heart of the brand.

Read the full article here