Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

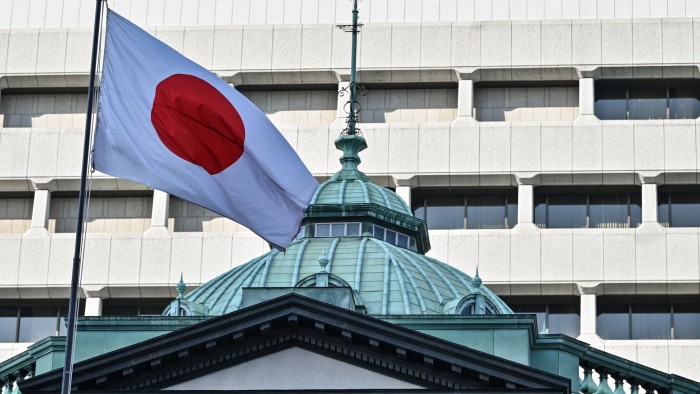

The Bank of Japan has raised short-term interest rates to “around 0.5 per cent” in a well-signalled move that extends the country’s monetary policy “normalisation”.

The central bank’s decision by a vote of 8-1 to increase rates from 0.25 per cent lifted the policy rate to its highest level in 17 years and followed weeks of speculation over whether governor Kazuo Ueda would delay the move until there was stronger evidence of rising Japanese wages and sustainable inflation.

The yen, which had been edging higher against the dollar in the weeks running up to the BoJ’s meeting, was flat on Friday, but traders said they were “ready for anything” when Ueda delivers his press conference in the afternoon.

The BoJ’s previous rate rise in July, which surprised most analysts, triggered a phase of extreme volatility in currency and equity markets

Several hours before the BoJ concluded its two-day monetary policy meeting on Friday, a report from the internal affairs ministry showed Japan’s core consumer prices rose 3 per cent in December from a year earlier.

The growth, partly driven by the cutting of government energy subsidies and partly by high rice prices, marked the highest annual pace of inflation in 16 months.

Read the full article here