Investment Thesis

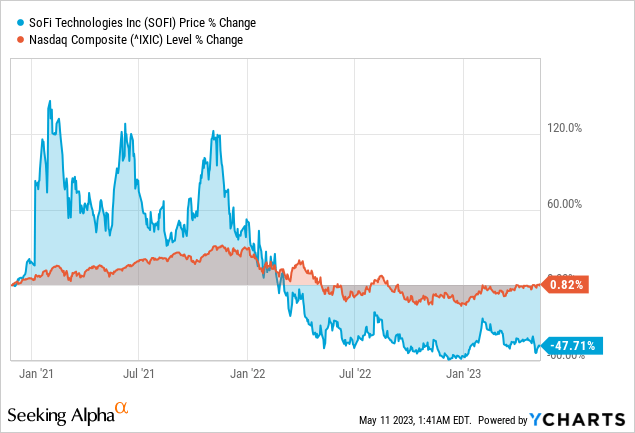

Since I initiated coverage on SoFi Technologies, Inc. (NASDAQ:SOFI) in November, the stock has gained 20% amidst the banking crisis. Over the past three years, the NASDAQ composite had a muted return, while SOFI is down nearly 48% for a similar period and around 78% since its all-time high.

In my previous analysis of SOFI, I emphasized the bank’s credit profile and why SoFi is agile and can move debt assets from available-for-sale to held-to-maturity to protect its portfolio from further write-downs owing to impairments and lower the volatility of its regulatory capital.

In today’s analysis, we review SoFi’s outlook, performance, and the bank’s progress. Nevertheless, financial institutions are inherently complex, and it is hard to predict how the business would respond to a downturn, leading to my hold rating for the foreseeable future. Accordingly, I maintain a buy position with SOFI but am looking for more attractive entry points and a better risk/reward.

SoFi’s Market Outlook & Challenges

SoFi faces a challenging and evolving environment in the financial services industry, such as the exposure to student loans, which has been affected by the moratorium put in place by the Biden administration. For example, if student loans were forgiven or canceled on a meaningful scale or federal loan borrowers were allowed to refinance at lower interest rates, SoFi’s student loan refinancing business could be materially and adversely affected.

As per the civil action (filed on March 03, 23), the company alleges that the government’s actions and policies have violated their constitutional rights and caused them harm, seeking relief from the court to address these issues. SoFi has lost nearly $300 to $400 million in revenues and $150 to $200 million in net income. Nevertheless, SoFi’s recent bank charter enables it to cross-sell other financial products, such as checking and savings accounts, which could diversify its revenue stream and mitigate some of the impacts of the student loan market.

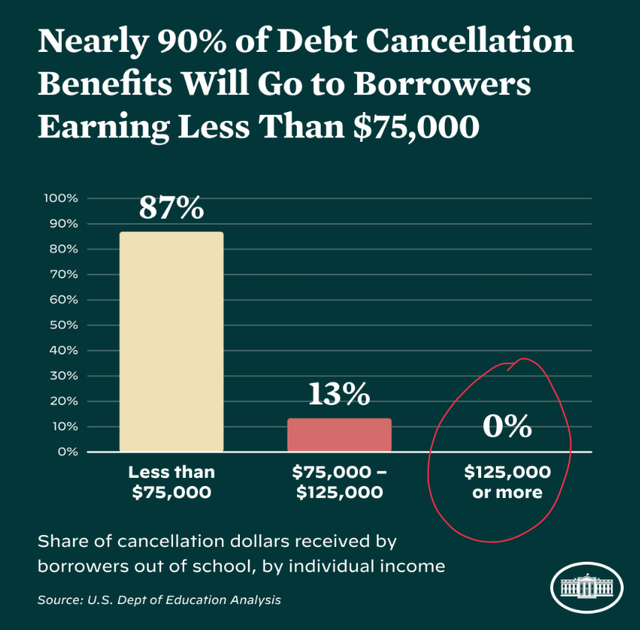

Additionally, SoFi has an impressive borrower base to counter the impact. With an average income of $173,000, SoFi’s student loan borrowers easily surpass the $125,000 forgiveness threshold, and their outstanding FICO score of 769 further solidifies their financial stability. Therefore, it’s only logical to infer that only a fraction of SoFi’s borrowers qualify for the $10K forgiveness. Besides, given that the average loan size is $70,000, the $10K forgiveness seems like a mere drop compared to the overall balance.

US Gov

Next, SoFi’s ability to weather the recent banking crisis and increase its deposit growth underscores the resilience of its brand and the trust it has built with its customers. In addition, the company’s commitment to expanding its FDIC insurance coverage could further boost customer confidence in its financial stability. Favorably, 91% of SoFi’s deposits as of December 31 are FDIC-insured, allaying investor and customer worries. Moreover, its checking and savings accounts offer enhanced FDIC insurance through a partnership with multiple banks, providing up to $2 million in coverage, compared to the industry standard of $250,000 per account.

Last but not least, SoFi could benefit from potential changes to financial regulation under the Biden administration, such as the possible expansion of the Community Reinvestment Act. This could increase credit availability and support the growth of financial services companies like SoFi that target underserved markets. Furthermore, the company’s focus on technology-driven innovation and its cloud-native infrastructure could help it adapt to changing consumer preferences and compete with traditional financial institutions.

SoFi’s Performance Overview

SoFi Technologies’ Q1 2023 results demonstrated continued growth. The company’s focus on providing a full suite of differentiated products and services, along with the advantage of having a bank charter, has allowed it to weather market cycles and exogenous factors.

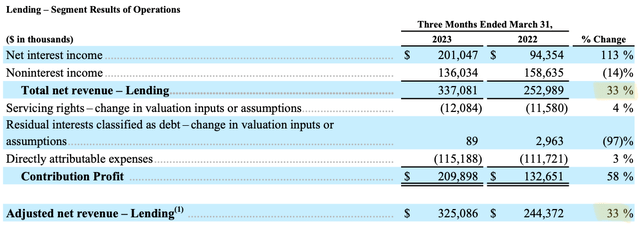

SoFi’s deposit base and loan book have expanded quickly since gaining its charter and have skyrocketed around 6.5x times to over $7 billion at the end of December 2022. Thus, the greatest source of revenue for SoFi is lending, which had a 33% increase from the previous year. In addition, because of the greater deposit base, SoFi has increased the size of its balance sheet; as a result, the company’s loan book has grown by 123% annually to $16.2 billion. Lastly, following SoFi’s success in attracting deposits, the bank’s net interest income climbed 37% from the previous quarter to $10.1 billion.

The majority of SoFi’s income comes from its lending operations, which follow an originate-to-distribute model in which the loans that SoFi makes are either sold for profit or transferred through securitization. Although personal loans continue to be a strong area for SoFi, with total origination of $2.95 billion, up 46% from last year and 19% from the previous quarter, loan origination is still facing challenges, with overall origination up just 7% from last year.

SoFi’s Results Summary

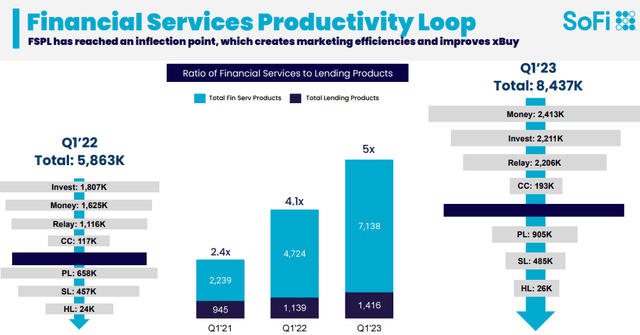

Looking forward, SoFi’s strong liquidity position and funding sources allow it to capture more net interest income and optimize returns, which will be especially important in times of excess volatility. The company’s lending capacity remains robust, with over $20 billion in the ability to fund loans and meet liquidity needs. Additionally, SoFi’s focus on cross-buy trends and decreasing marketing spend intensity bodes well for continued growth in members and products.

The Financial Services segment also saw impressive growth, with net revenue more than tripling year-over-year in Q1 to $81 million from $23.5 million. The segment achieved variable profitability for the first time. SoFi has continued to iterate on products to ensure they are differentiated and invested in making them work better when used together. The company’s new product, SoFi Travel, in partnership with Expedia, represents its first non-financial product effort to help members achieve financial independence.

A Growing Network Effect

Meanwhile, SoFi aims to scale its top-of-the-funnel products and capitalize on their improved brand awareness and network effects. It will continue to focus on larger customers with large installed basins to drive growth in new verticals, products, and geographies in its Technology Platform segment. The recent acquisition of Galileo will enable SoFi to sell Galileo and Technisys offerings to an expanded customer base. SoFi has made strides in its strategy, with 80% of newly signed clients having existing customers or portfolios. Technisys has also entered a proof-of-concept stage with a large U.S. legacy financial institution, which could open up further opportunities for growth.

Furthermore, SoFi’s diversified revenue streams, efficient capital sources, and focus on quality credit, position the company well for continued growth. However, macro factors such as extending the federal student loan moratorium and potential interest rate increases could pose challenges for the lending and financial services industries. Lastly, SoFi’s focus on more significant potential partners and B2B customers with longer sales cycles may also result in slower revenue growth in the tech platform segment.

The Path Toward Growth

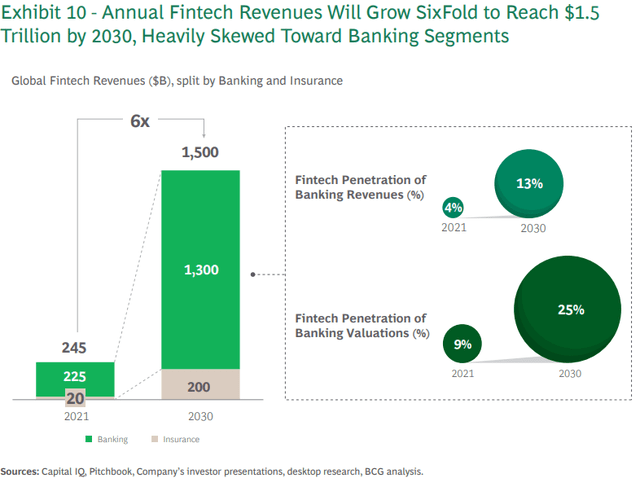

SoFi is well-positioned to benefit from the ongoing growth of the fintech industry. As the report cited earlier notes, the fintech sector is projected to reach $1.5 trillion in annual revenue by 2030, and SoFi is likely to be a key player in this growth story. In addition, the bank has a strong brand and a loyal customer base that breed further expansion of its product offerings and capture market share.

One area where SoFi is particularly well-positioned is in serving small to mid-sized businesses (SMEs). SMEs have an estimated $5 trillion in annual unmet credit needs, providing a significant growth opportunity for fintech that can address this gap. SoFi has already made inroads in this area, offering small business loans and other financial services oriented toward SMEs. Focusing on serving SMEs could help SoFi differentiate itself from other fintech and capture a larger market share.

Global Fintech 2023

Another area of potential growth for SoFi is wealth management. Disruptive models in wealth management will likely be challenged in the coming years, but B2B2X (enablers) are well-positioned to seize significant opportunities. SoFi has already pushed into wealth management, launching its own robo-advisor platform and offering its customers a range of investment products. As the company grows, it could expand its offerings in this area and capture a larger share of the wealth management market.

Acquisitions & Partnerships Support Growth

SoFi’s recent achievements, such as obtaining a national bank license and launching SoFi Checking & Savings, have been instrumental in the company’s success. In addition, the launch of SoFi Plus and the acquisition of Technisys are also noteworthy milestones that will contribute to the company’s future growth.

With continued momentum, SoFi has grown tremendously in membership engagement and product adoption. This recognition from Fast Company underscores the value of its diversified business model, which has positioned it as a winner in the secular transition of financial services to digital.

Notably, SoFi’s acquisition of Wyndham Capital Mortgage will allow the company to expand its suite of mortgage products, enhance unit economics, and own a scalable platform for a fully digital mortgage experience. The acquisition will also help SoFi minimize its reliance on third-party partners and processes while fostering growth that brings value to members through sales and operational efficiencies.

The acquisition is a strategic move by SoFi, as it positions itself to take advantage of the changing U.S. real estate market conditions. With high inflation and rising mortgage rates, it is more important than ever for borrowers to have a trusted partner to guide them through the mortgage process. By acquiring Wyndham Capital, SoFi can scale and keep pace with accelerated growth while fostering growth that brings value to its members.

Moving forward, SoFi will be working to integrate Wyndham Capital’s talented team and robust technology platform into its lending business, adding strength and efficiency to the home loans segment of the company’s Financial Services Productivity Loop strategy. This acquisition is a positive development for SoFi and its members, as it will enable the company to offer a broader range of mortgage products and provide a seamless and efficient mortgage application process.

As the U.S. real estate market continues to evolve, SoFi is well-positioned to be a leader in the industry and help its members get their money’s worth when it comes to one of life’s most significant financial milestones.

SoFi’s presentation

Further, the partnership between SoFi and Expedia Group to launch “SoFi Travel powered by Expedia” is a strategic move for both companies. For SoFi, it represents an opportunity to diversify its product offerings beyond its core financial services and into the travel space, tapping into a growing market as the world recovers from the COVID-19 pandemic. For Expedia, the partnership enables the company to expand its reach and tap into SoFi’s customer base, potentially driving more business to its platform.

Finally, integrating SoFi’s credit card into the travel platform also provides a unique value proposition for customers, allowing them to earn cash-back rewards on travel bookings made through the platform. Furthermore, SoFi’s suite of financial products, such as savings accounts and investment services, provides additional support for customers as they prepare financially for their travels.

Overall, the success of this partnership will depend on the ability of both companies to effectively market and promote the travel platform to SoFi’s customer base and deliver a seamless customer experience. It will also be necessary for the platform to continually innovate and offer unique value propositions to customers to remain competitive in the crowded travel industry.

Risk & Reward

Despite its strengths, SoFi may face challenges competing with established banks and other digital finance companies. Regulatory scrutiny will also increase as the company grows and expands into new markets. In addition, as a public and bank holding company, SoFi is subject to evolving regulatory requirements, which could increase compliance costs and administrative expenses. Therefore, it will need to manage these expenses effectively to remain profitable.

The concentration of Galileo and Technisys’ clients poses a significant risk, as any loss of one or more clients could have a material and adverse impact on their results of operations. Disruptions in the processes of crucial clients have disrupted Galileo’s operations in the past, and any further disruptions could have similar effects.

Another risk for SoFi is the high level of investment needed to sustain its growth and profitability. SoFi has endured constant net losses in the past, and it will need to generate significant revenues and operating cash flows to achieve, maintain, or increase profitability. This will require continued investment in sales and marketing, technology, and new products and services to enhance its brand recognition and value proposition.

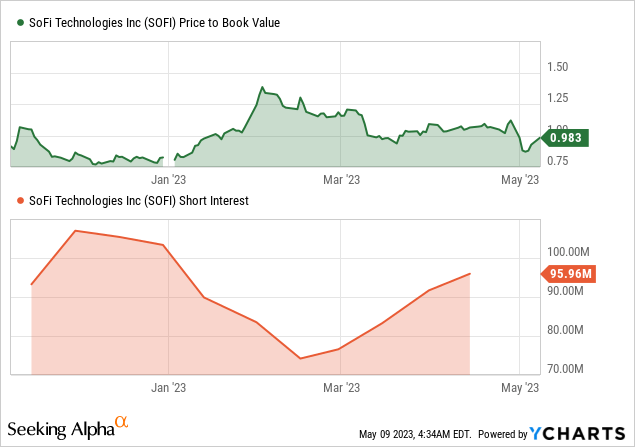

Regardless, SoFi’s CEO has been buying shares, indicating confidence in the company’s future growth. As the crisis fades and attention returns to company-specific factors, shares could bounce back fully and continue to rise toward higher price levels. The technology platform segment could also significantly contribute to the company’s bottom line, sustaining a more tech-like valuation. Despite the discount to book value, which suggests an attractive entry point for bank stocks, the climbing short interest, might put additional downward pressure on the stock for the foreseeable future.

Takeaway

In conclusion, SoFi’s transformation into a full-fledged bank has enabled it to offer differentiated products and services, leading to strong growth and improving financials across all three segments. In addition, its technology-driven approach, strategic acquisitions, and potential regulatory changes present compelling investment opportunities in fintech.

However, SoFi may face challenges from established banks and regulatory scrutiny, and its exposure to student loans and the cost of funding could impact profitability. On the other hand, SoFi’s focus on financial wellness, technology-driven solutions, and commitment to innovation could position it as a leading digital personal finance behemoth.

Read the full article here