Introduction

Nvidia Corporation (NASDAQ:NVDA) is a fabless chip designer and one of the world’s leading suppliers of GPUs, and has been for many years. Rather than manufacturing wafers, they partner with companies such as Taiwan Semiconductor Manufacturing Company Limited (TSM) and Samsung Electronics Co., Ltd. (OTCPK:SSNLF) for chip development.

Founded in 1993 as a PC graphics supplier, Nvidia became a significant player in the industry by producing graphics chips with outstanding performance and short inventory cycles. In 1999, they popularized the term “GPU” with the Nvidia GeForce 256, which shifted all parts of the graphic pipeline from the CPU to the GPU. Nvidia survived as one of two graphics chip companies in the industry, the other being ATI, which was acquired by AMD in 2006.

That same year, Nvidia launched the first GPU for general-purpose computing, enabling analytics, deep learning, high-performance computing, and scientific simulations. Nvidia is the leading company in the semiconductor industry, specializing in graphics processing units (GPUs) and accelerated computing solutions.

Nvidia’s GPUs are widely used for gaming, visual computing, and artificial intelligence applications. Nvidia also develops data center platforms and systems for high-performance, cloud, and edge computing. Nvidia competes with other semiconductor companies such as Intel, AMD, and Qualcomm, as well as tech giants like Alphabet and Amazon, which are developing their own AI chips.

Nvidia has a strong market position and a loyal customer base, making it a formidable player in the semiconductor industry. However, the recent increase in the stock price of NVDA prompts a reconsideration of whether it is overvalued relative to its industry counterparts.

Nvidia: A Goliath in The Tech Industry

Speaking of AI, NVDA is in a rather interesting position in the worldwide AI fad. As the demand for AI development grows, companies and researchers must find cost-effective ways to access the necessary computing resources. While larger companies and well-funded startups can afford to purchase server GPUs or rent cloud GPU capacity, smaller startups and budget-constrained researchers and entrepreneurs may turn to gaming GPUs for their AI development needs.

Building a deep-learning computer with a high-end GPU can be significantly cheaper than utilizing cloud services like Amazon.com, Inc.’s (AMZN) Amazon Web Services (“AWS”). For example, making an expandable deep learning computer with a top-of-the-line GPU costs approximately $3k, which is far more cost-effective than renting GPUs on AWS at a rate of around $3 per hour, or roughly $2100 per month.

However, Nvidia’s contractual restrictions force cloud service providers like AWS, Google (GOOG) Cloud, and Microsoft Corporation (MSFT) Azure to use more expensive GPU versions, driving up the cost of renting their GPU-equipped machines. The primary reason for this cost difference is that these providers cannot use GeForce and Titan cards in their data centers.

When building your computer, you can use gaming GPUs like the Nvidia 1080 Ti, which is powerful and performs at 90% the speed of the more expensive Nvidia V100 GPU used in cloud services. Another advantage of building your own computer is using M.2 SSDs that offer blazing-fast IO speeds. On the other hand, cloud instances and GPUs may experience slower input/output (IO), which can affect their performance.

When it comes to generative AI, which generates text through chatbots or chatting interfaces like ChatGPT, the algorithm must first be trained to learn the language and how information is communicated. This requires substantial computing resources, and Nvidia’s Tensor-based A100 GPU plays a vital role in this process.

However, Alphabet has been developing its TPUs since 2016 and has developed a supercomputer powered by its TPU-version 4 that has proven to be 1.5 to 1.7 times faster than Nvidia’s systems and uses 1.3 to 1.9 times less power than the A100. The promising results for Alphabet and its entry into the generative AI market create significant competition for NVDA and pose a threat to its market position.

Navigating the growing need for semiconductors and the supply-side challenges

GPUs and many other sectors also need semiconductors as the world digitalizes. This section will explore how much different industries heavily relying on semiconductors are expected to grow.

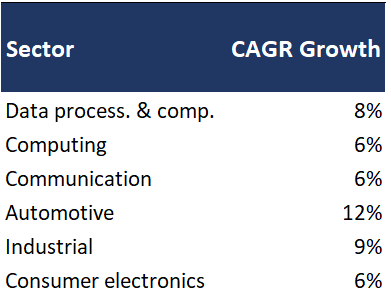

The semiconductor industry has been experiencing rapid growth in recent years. As of 2021, the global semiconductor market was valued at US$528 billion, with the data processing and communication segments accounting for about 70% of sales. In addition, the industrial, automotive, and consumer electronics sectors accounted for about 10% each. With increasing demand, McKinsey projects that the global semiconductor market will surpass US$1 trillion by 2030 and that the primary semiconductor-usage sectors will grow with the following CAGR rates:

Stock Info

As governments worldwide aim to promote electric vehicles and reduce gas-powered vehicle purchases, car manufacturers are actively developing various types of hybrid or battery-electric vehicles.

This has encouraged a surge in demand for components, including sensors, computing, and control chips, and semiconductor vendors in the automobile sector will benefit from this trend. In addition, electronic systems have grown explosively in the automobile sector, with automation, electrification, and vehicle-to-everything communication systems leading to great business opportunities.

The Internet of Things is also poised to drive growth in the semiconductor industry at the industrial and consumer levels. In addition, there is a higher demand for power and, thereby, analog integrated circuits for industrial applications due to the higher power requirements.

The semiconductor industry, which has been facing supply chain shortages due to the COVID-19 pandemic, is expected to see an improvement by 2024, according to a survey conducted by Accenture, a global professional services company. The survey found that 70% of semiconductor executives believe the shortages should ease by 2024.

The survey also found that the COVID-19 pandemic had accelerated the industry’s shift toward digitalization and automation and that semiconductor companies were investing heavily in research and development to mitigate future supply chain disruptions.

The article notes that semiconductor shortages have significantly impacted the global economy, particularly in the automotive and electronics industries. However, the executives surveyed by Accenture expressed confidence in their ability to manage the current challenges and adapt to future disruptions.

Overall, there is optimism within the semiconductor industry regarding its ability to address the current supply chain shortages and continue to drive innovation and growth in the future.

The easing of semiconductor supply constraints could have positive implications for NVDA. As more semiconductors are available, it could increase production and sales of its GPUs, potentially expanding its market share and driving revenue growth. Additionally, if semiconductor costs come down due to the easing supply constraints, this could improve profit margins for Nvidia.

Furthermore, easing constraints could allow Nvidia to better meet the demands of its customers, particularly those in the gaming and data center industries, which are significant consumers of GPUs. Overall, while the impact of easing semiconductor constraints on Nvidia’s business remains to be seen, it can create opportunities for growth and increased profitability.

GPUs are essential to the way of living in 2023 and beyond

Since Nvidia is mainly known for its high-end, groundbreaking GPUs, it is only natural to look at the expectations and usage of their GPUs. The gaming GPU market is projected to grow at a CAGR of around 15.23% over the next five years, driven by the increasing gamification trend among millennials and the rise in the adoption of a virtual world for video gamers. Gaming machines have evolved from powerful location-based devices in restaurants, arcades, and bars to in-home appliances such as gaming consoles and PCs.

With the increase in sales of gaming machines, the demand for gaming GPUs has grown significantly, especially for high-end computing systems for graphics-intensive gaming applications. In addition, the need for specialized processors that can handle increasingly better 2D and 3D graphics required for gaming further drives growth in the GPU market.

Technological advancement in high-performing computing may also develop an opportunity for GPU vendors. For instance, researchers discovered trends in Hubble data using a supercomputer with Nvidia GPUs, as stated by Nvidia.

Furthermore, the gaming industry is witnessing a surge in demand for gaming consoles, augmented reality, and virtual reality. In addition, the adoption of esports and online gaming has led to a rise in video games on consoles, creating more opportunities for growth in the coming years. Service providers could monetize this audience by offering console-related video services like fast broadband and live sports.

In addition, game developers could offer premium pricing for gaming subscription services that include access to esports events and original content.

Apart from the gaming industry, other verticals such as automotive, manufacturing, real estate, and healthcare are also driving the market due to the increasing usage of processors to support graphics applications and 3D content. The production of gaming GPUs is expensive, which contributes to the high price of the current GPUs, and manufacturers are looking to maximize their profits without sacrificing the quality or quantity of the product.

The COVID-19 pandemic has affected the production of many components, including gaming GPU circuits. However, semiconductor foundries resumed production. The market is expected to revive its growth in the later part of the pandemic due to the increasing demand for cloud computing, gaming, data center servers, automation, and AI technologies.

Cloud gaming has also contributed to the growth of the GPU market, with companies offering cloud computing services for gamers. Major game developers focus on developing high-quality console-based games to meet consumer demand, with Sony Group Corporation (SONY) and Microsoft prioritizing refresh rates over 8K capability for a seamless gaming experience. Nvidia’s RTX 3090 graphics card pushes beyond 4K with 8K gaming for PCs.

Console developers are competing in the market with new product development, with Sony offering variable GPU and CPU speeds and Microsoft sticking to more traditional fixed rates. The increasing adoption of AR and VR in various applications is also expected to drive GPU adoption. Companies aim to create a compelling user experience with true AR and VR. As a result, many companies are developing GPU systems for AR and VR applications to redefine how people experience computing and gaming. In one of our other articles, we also discussed the increased usage of AI and VR applications.

Risks

The risks associated with owning NVDA have been discussed in numerous articles on this site, and we have already touched upon some of them in the previous section. Thus, we will not go into detail surrounding these risks, as our primary focus remains on the value of NVDA.

However, the most prominent risks NVDA faces are market risks in the form of the demand for GPUs in the future and whether the expected growth lives up to what is projected by analysts.

In addition, Advanced Micro Devices, Inc. (AMD) has been flexing its muscles lately, and thus NVDA faces significant competition from them. Furthermore, supply chain risks and global economic factors will always play an essential role in the outlook for NVDA. An economic slowdown or even a global recession can significantly affect their earnings.

Financials

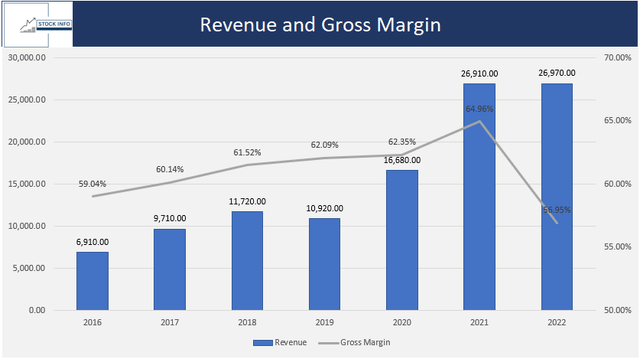

Nvidia Corporation has gone through several years with robust revenue growth. The COVID-19 pandemic that forced most of the world into a lockdown turned out to be a key event for NVDA, as the disruptions to the global supply chain caused a shortage of GPUs in higher demand since more people sought entertainment from gaming as many other places of entertainment remained closed. As a result, as seen in the figure below, NVDA’s revenues grew from just shy of $11B in 2019 to just under $16.7B in 2020, which then grew to almost $27B in 2021!

Stock Info

While NVDA’s gross margin steadily increased over the period represented in the figure above, 2022 ended up being the first year in 7 years that NVDA’s gross margin declined. In addition, the fall in their gross margin is quite significant at around eight percentage points, primarily due to the rising cost of revenues. Therefore, if you are an investor, you would hope not to see further margins decline once their 1st quarter earnings for 2023 come out on the 24th of May.

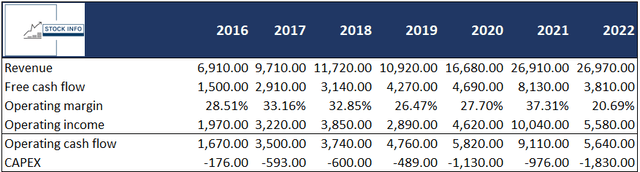

Furthermore, while their revenues stagnated between 2021 and 2022, one measure to pay attention to is their free cash flow, which more than halved between 2021 and 2022, as seen in the table below.

Stock info with Seeking Alpha

In addition, their operating income and cash flow also nearly halved in the same period, and as an investor in NVDA, you would hope this is not the beginning of a downtrend.

Although their growth slowed in 2022 relative to the past few years, NVDA’s forecasted revenue is projected to be upwards of $60B in 2026, according to Tradingview – more than double 2022’s revenues. However, this only shows that NVDA’s role as one of the front-running companies in the semiconductor industry will likely remain unchanged.

If we look at their balance sheet, NVDA ended 2022 with $41.18B in assets, with around $13.30B being in cash and short-term investments and $19.08B in total liabilities. Thus, NVDA remains highly solvent should the global economy take a turn for the worst and be able to handle eventual losses that should arise from such an event.

Valuation: Is market sentiment out of touch with the fundamentals?

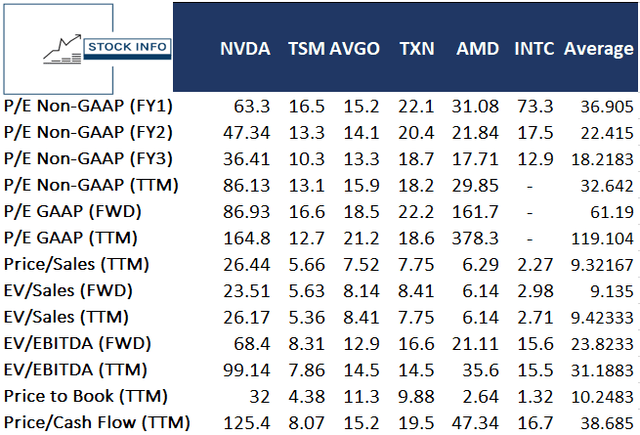

Although NVDA has a compelling bullish outlook over the long term, the current valuation of NVDA must be addressed. The company is trading around 26 times its sales, an astonishing multiple considering that its revenue growth is projected to accelerate to the mid-twenties in any recovery. Moreover, if we compare it to their closest competition, it truly puts into perspective just how high of a price NVDA currently trades at.

In addition, from the figure below, we see that none of the five other companies that are direct competitors to NVDA trades at a P/S ratio of over 8. Furthermore, NVDA currently trades at a forward P/E of just under 87, whereas only AMD trades at a higher ratio at 161.7.

Stock Info with Seeking Alpha

Let’s look at the TTM EV/EBITDA ratios. It becomes evident that NVDA may be trading at a high price compared to its competitors as NVDA’s ratio is almost triple that of AMD, which is the company with the second highest ratio. Furthermore, NVDA currently trades at a P/Cash flow multiple of 125.4, with AMD trading at a third of that multiple, again demonstrating the high price NVDA currently trades at.

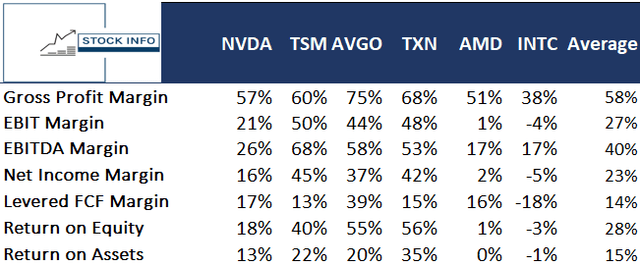

Although some investors might find such a value proposition adequate considering the long-term growth opportunity of the company, we are not of the same view. This is mainly due to their high multiples compared to their peers, as presented in the table above.

In addition, while NVDA may seem to be a dominant market leader in an attractive secular growth market, there is no guarantee that disruption will not occur. As mentioned earlier, Alphabet Inc. came out touting their custom chips, and AMD has also made significant progress in catching up with the competition.

To end, looking at the table below, which shows various profitability measures among NVDA and its competitors, it becomes apparent that NVDA is not the most profitable company based on these measures. NVDA’s margins are below the average of the six companies, apart from its leveraged FCF margin. Furthermore, NVDA’s RoE and RoA are also below its competitors.

Stock Info with Seeking Alpha

While the market believes in NVDA’s potential for immense growth in the future, it cannot be overseen just how high this stock trades presently compared to its competitors.

There is a widespread belief that NVDA holds a competitive advantage over its rivals, given that the company is at the forefront of the industry; however, if the market suddenly decides to discount this in the event of a significant global economic slowdown, compression of their multiples, or others.

As a result, we could see NVDA’s stock price drop back to fundamentals closer to its competitors; this would be a substantial drop in share price.

Technical Analysis

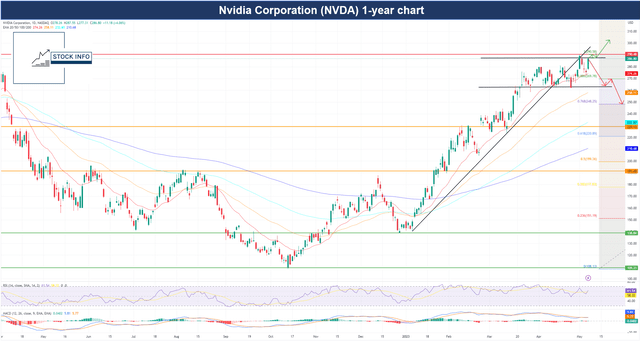

If we look at NVDA’s charts, starting with the 1-year chart as seen below, we should notice that the stock is currently meeting relatively significant resistance, which stems from April 2022.

We saw the first rejection of this level last week, and the stock is once again testing the $290 level and has been trading sideways for the past couple of weeks. We see two outcomes in the following weeks. If $290 is once again rejected, it could mean a further drop in share price, possibly down to the mid $260s, which is the resistance level for the sideways channel the stock currently trades in.

Alternatively, the stock could break $290, in which case there is still some upside potential. The EMAs now act as support for NVDA, and especially the 20-EMA has offered support for the stock since the beginning of the year. However, this could change as the stock has recently broken this trendline.

Stock Info with Tradingview

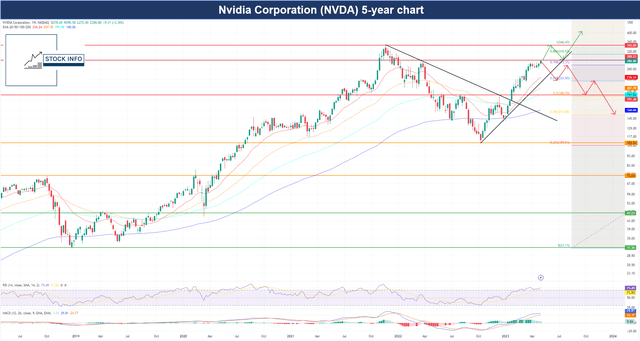

If we consider the 5-year chart below, the $290 resistance is more prominent, and the rejection back in April 2022 ended up causing the share price to drop.

Furthermore, the stock is currently relatively far away from the trendline it has been following on its way up since the beginning of the year, leaving room for some downside. In addition, the nearest EMA is currently at $226, meaning rejection at $290 could mean a move toward $230.

Stock Info with Tradingview

It should also be noted that, based on the 5-year chart, the RSI is currently 75, meaning Nvidia Corporation stock is in overbought territory. In addition, the MACD is showing signs of slowing upward momentum and could very likely turn negative in the near future.

How To Protect Your Position

As some of you might know, I’m an advocate of using multiple different option strategies in investing. In this paragraph, we will discuss how you could protect your NVDA position if you don’t want to sell your shares. We will discuss 2 different simple strategies that you can utilize to protect your gains. We will take a look at Covered Calls and at the Collar Strategy.

Let’s start with covered calls. We wrote an article about covered calls a while ago, which we advise you to read if you aren’t that familiar with covered calls or options in general. When writing this paragraph, it is currently premarket on the 9th of May, and NVDA trades at $289.22 per share. In general, we prefer selling short-term options to maximize cash flow, but this requires more time and that’s why we will discuss options with a further-out expiration as this requires less time to manage.

Let’s say you are not willing to let go of your shares at the current price but would be willing to sell your shares at $340 (around the all-time high). You could decide to sell 1 January 19’24 $340 call for each 100 shares you own. At the moment of writing you would receive around $3150 in your account for each January 19’24 call you sell. On the 19th of January, there are 2 possibilities for your position.

- NVDA is above $340

- NVDA is below $340.

In situation one, your shares will get called away at $340 per share. This means that you would receive $34,000 (remember each option consists of 100 underlying shares). In addition, you would still have received the full premium. This means this position would be better than holding shares as long as NVDA isn’t above $371.50 at expiration. Even if NVDA would come close to the strike price you could decide to roll your call further out and collect even more premium.

In situation two, your shares won’t get called away, which means you will still have 100 shares of NVDA in your account. In addition, you still have all the premium as well. This means that this gives you quite some downside protection as writing this contract would lower your average per share by $31.5.As an NVDA holder, you probably can figure out what the most ideal scenario would be when writing this call (in case we don’t manage our position before expiration). Ideally, you would like NVDA to close at $339.99, this means you would have captured as much upside as possible and will have collected the full premium. Afterward, you can decide to write a new covered call.

Now let’s take a look at the collar strategy, the collar strategy starts of in the same way as the covered call strategy. The difference here is that we will use the premium we received from writing the covered call to buy a put option. This means while we only capped the upside with the covered call, we now also capped the downside by buying a put option.

For simplicity, we will write the same January 19th’24 $340 call. This gives us $3150, right now, this $3150 allows us to buy the January 19’24 $270 put. This means that your max loss at January 19th your max loss would be $19.22 ( current share price – $270) per share if NVDA would be lower than $270 at expiration. This gives you solid downside protection while still leaving close to 18% of upside potential.

We could also discuss multiple other strategies, which we will gladly help you with in the comment section.

Conclusion

Nvidia Corporation looks to benefit from the generative AI market and a generally higher dependency on GPU units worldwide – which is also expected to grow rapidly in the next decade.

Nvidia faces competition from Alphabet, Apple, Meta Platforms, Inc. (META), and other tech giants looking to expand into AI technology. And other players in the AI chip market and increasing demand for semiconductors from various sectors such as automotive, industrial, and consumer electronics.

However, Nvidia Corporation has seen impressive revenue growth over the past few years. Furthermore, there are no indications that NVDA’s growth will slow down in the future, as it has established itself as a driving force in the advancement of AI technology. Currently, we identify $290 as a critical resistance level that could determine the future direction of the stock.

In addition, if Nvidia Corporation stock fails to break above $290, it could face a significant correction, as it is overbought and far from its trend line. We believe the future is bright for Nvidia; however, the fundamental valuation metrics tell us this company is far overpriced compared to its peers. A potential economic slowdown or a compression of the fundamentals could mean a decline in the stock price.

We, therefore, believe Nvidia Corporation is a sell in the short term, as it remains significantly overvalued compared to its peers, but several potential tailwinds in the future could drive the stock price up. If you don’t want to sell your Nvidia Corporation position, you could protect your position with one of the option strategies provided in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here