Over the past decade, the tech industry has experienced remarkable growth. Disruptive companies could secure significant funding and operate at a loss while seeking product-market fit. Investors often prioritized metrics like user growth and total addressable market, paying little attention to how these companies would generate revenue.

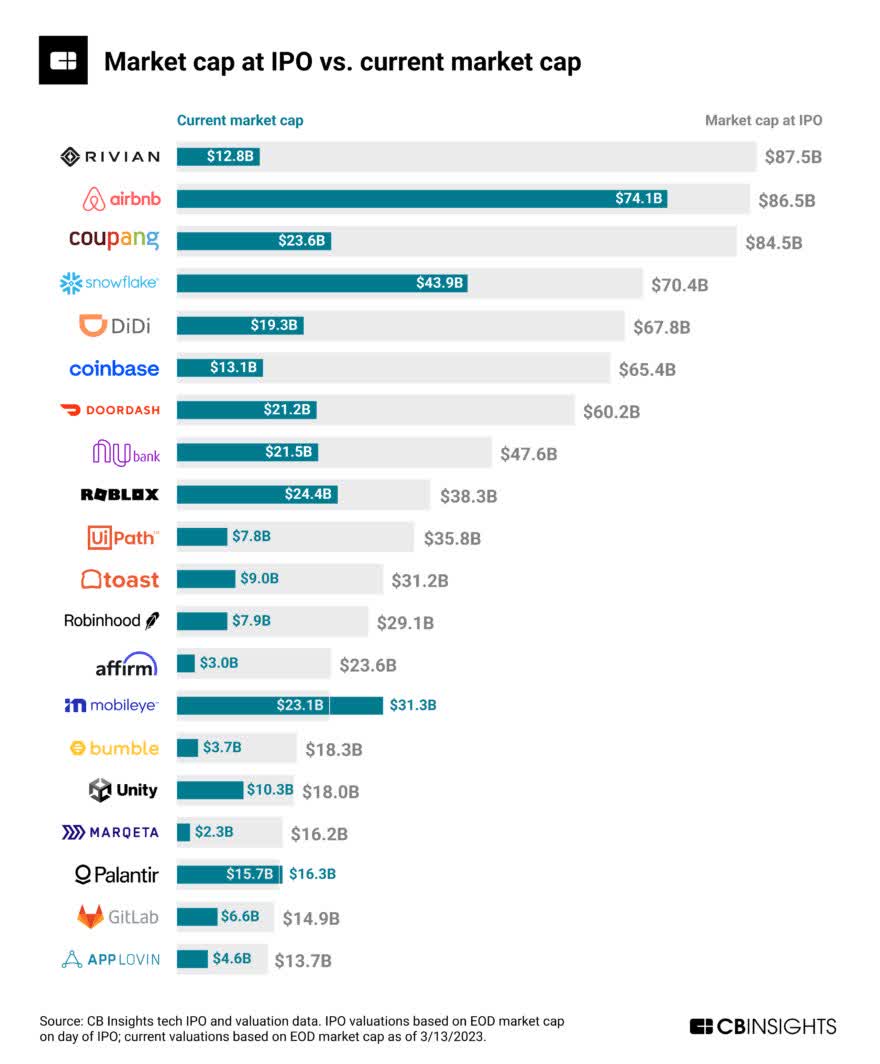

However, those days have passed. Businesses must now demonstrate pathways to profitability or face devastating consequences. The following CBInsights graphic illustrates how once-prominent companies have been reduced to mere shadows of their former selves.

CBInsights Tech co Valuations (CBInsights)

One company on that list deserves further examination, particularly as its earnings release approaches on Tuesday, May 9th: Airbnb (NASDAQ:ABNB).

Airbnb has steadily developed a robust marketplace connecting individuals with homes and rooms to rent with those in need of accommodations. Although COVID significantly impacted the business in 2020, the company has since expanded its average daily rate, the number of nights and experiences sold, gross booking values, and take rate. These critical metrics indicate that Airbnb is poised for continued growth despite challenging comparisons.

Let’s delve into why Airbnb is a tech stock worth considering for the long haul.

Metric Growth Looks Strong

The travel industry was severely impacted by COVID, making it challenging to assess Airbnb’s metrics. However, I’d like to present a few key charts that highlight the company’s promising future.

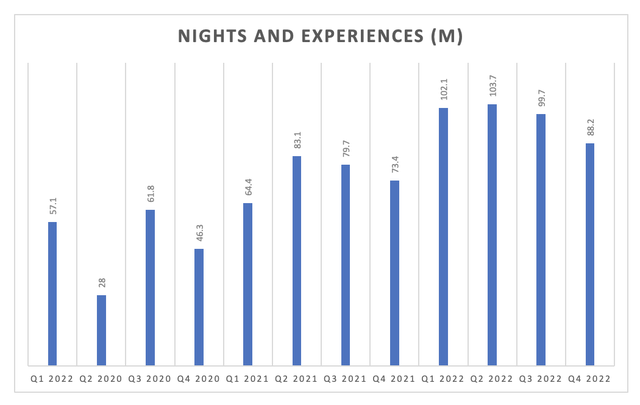

First, let’s discuss nights and experiences. A higher number of nights stayed translates to increased revenue for Airbnb, making this metric crucial to monitor.

Airbnb Nights and Experiences (Company data, author prepared)

In Q1 of last year, Airbnb recorded 102 million nights and experiences, setting a high bar for comparison. Despite the challenging macro environment, which we will explore in the next section, I believe the company can surpass this benchmark.

As evident in the chart above, nights and experiences tapered off toward the end of last year. However, this pattern is consistent with previous years, where Q1 and Q2 typically experience a surge followed by a decline (with 2021 being an exception due to the pandemic).

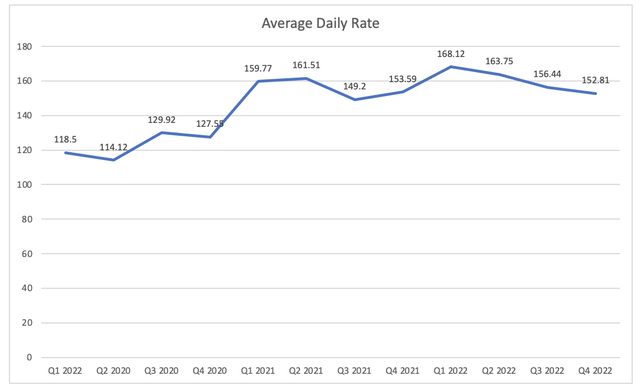

Airbnb average daily rate (Company data, author compiled)

Each night booked incurs a cost, allowing us to derive Airbnb’s average daily rate from the data. This figure surged post-pandemic but has slightly declined in recent quarters. Given inflation and demand, it is likely to rise again over the next few quarters.

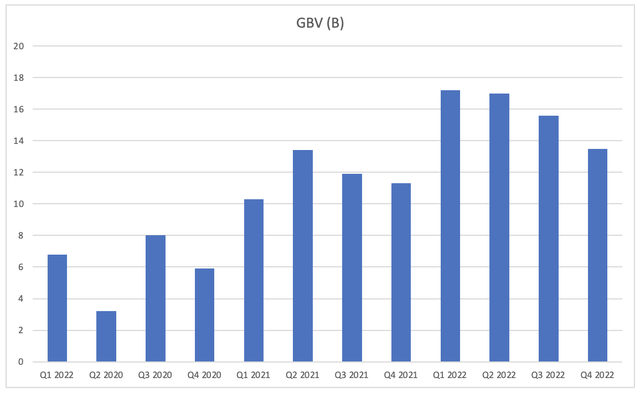

Airbnb gross booking volume (Company data, author compiled)

Lastly, by essentially combining the two charts above, we arrive at gross booking volumes. As we approach Q1 earnings, we anticipate seeing a boost in this metric.

Demand For Travel Shows No Signs of Slowing

Flights, hotels, and Airbnb stays have become increasingly expensive, with no signs of slowing down in the foreseeable future. The reason behind these high prices is the soaring demand for travel and consumers’ willingness to pay for it.

The NPD Group reported that one-third of Americans plan to travel more in 2023. This finding is supported by Ipsos data, revealing that over 50% of Americans intend to take a trip within the next six months.

Recent earnings reports from companies like Booking Holdings (BKNG) also provide valuable insights into the favorable Q1 environment. The company’s CEO stated:

We saw a strong start to the year with first-quarter room nights and gross bookings reaching our highest quarterly levels ever and both metrics surpassing our previous expectations.

These positive indicators contribute to the anticipation that Airbnb will deliver a strong quarterly report. This optimistic outlook is one of the main reasons I’ve been increasing my position ahead of the earnings release. The second key factor driving my investment decision is Airbnb’s product leadership.

Exceptional Product Leadership

It’s rare to find a company as committed to creating a product users love as Airbnb. CEO Brian Chesky actively seeks feedback on Twitter and keeps users informed about frequently requested features.

Brian Chesky on Twitter (Twitter)

Airbnb recently announced a series of new features aimed at enhancing the user experience. Looking for extended stays? Now you can search by “months.” Want to see the total cost of your trip, including fees? No problem!

Another issue, house rules. Frequent Airbnb users may have encountered excessive cleaning requests despite paying a substantial cleaning fee. The company is working to make these rules more transparent and is considering penalizing hosts with unreasonable demands.

I highly recommend that anyone investing in (or considering investing in) Airbnb follow Brian on Twitter. It’s challenging to bet against a founder-led business with a CEO who is as deeply invested in the customer experience as Brian appears to be.

The Upside

Airbnb has become the go-to name for short-term rentals. The company can maintain growth in this sector by providing a reliable experience for customers, whether they’re vacationing or working remotely.

Achieving this is challenging with over 4 million hosts on the platform, but Airbnb must ensure all hosts prioritize the customer’s best interests. While most do, the company must go the extra mile in cases where they don’t.

Recent product releases and updates from CEO Brian Chesky have focused on enhancing customer trust, such as reducing support response times and simplifying post-visit reviews. As Airbnb continues to improve its marketplace, trust will be the primary objective, and it seems the company is making significant strides in fostering that trust.

For FY23, I anticipate Airbnb’s growth will slow compared to last year but will remain in double digits. I expect the company to sell 460 million nights and experiences, a 16.8% growth over this year. This expansion will result from broader market travel growth and increased trust in the platform.

With a slightly higher average nightly rate, gross booking value should reach approximately $75 billion. Assuming a slightly reduced take rate of 13%, compared to 13.3% last year, Airbnb’s 2023 top-line revenue should be around $9.75 billion. If the company maintains a net margin of 23%, that would result in $2.25 billion in net income for the year.

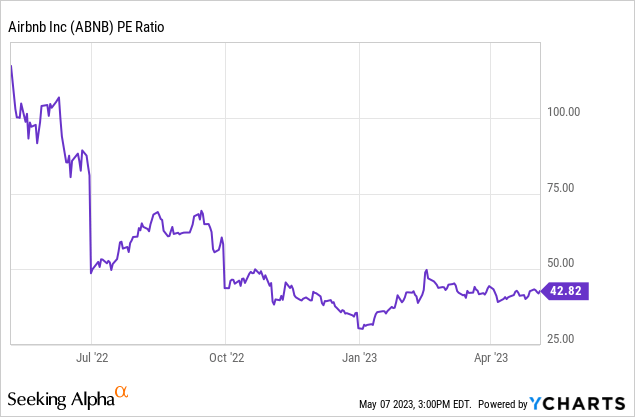

At a reduced PE of 38, this leads to a market cap of $85.2 billion, a 12.7% increase over today. Although the PE is below Airbnb’s average, it’s not the lowest the company has seen. Its strong association with short-term rentals and ability to outperform competitors like VRBO justify this higher PE ratio.

The Opposing View

It’s essential to consider the opposing view, and for Airbnb, that perspective boils down to reduced growth leading to contracting multiples.

Assuming all other growth elements mentioned earlier but contracting the multiple to a still-high 30x PE, Airbnb would have a $67 billion valuation (or be 11% overvalued today).

Even worse, if the company were to fall more in line with the market at a 22x PE, Airbnb’s valuation would need to drop by around 35% to reach that level.

As a long-term investor planning to hold Airbnb, I’ll also be keeping an eye on the company’s relationship with “Superhosts.” These hosts play a crucial role in Airbnb’s future, and the platform must ensure their satisfaction. There have been reports of some Superhosts developing their own tools to bypass Airbnb’s 10-15% fees. If this trend becomes more widespread, I may need to reassess my position.

Conclusion

Investing indeed relies on narratives, and for me, the story here revolves around the continued growth and eagerness of millennials to travel, combined with a company that genuinely cares about its customers and strives to provide an exceptional experience.

Could one argue that a 38x PE is too high? Certainly. Is it possible to argue that travel could be negatively impacted by an impending recession that has been “looming” for the past 18 months? Absolutely. However, countering these concerns is a company that has become synonymous with a thriving travel segment, demonstrating strong execution and showing no signs of slowing down in the short term.

I have a ‘buy’ rating on Airbnb and will be buying into earnings on May 9th.

Read the full article here