One main reason for the drop in the share price of Big Lots, Inc. (NYSE:BIG) is due to the low numbers posted by the company in Q4 of 2022. It saw a fall in its sales of -10.9% year-over-year. The company believes that the primary reason for this fall is the sudden collapse of its major vendor in furniture, United Furniture Inds.

Furthermore, the company’s e-commerce sales couldn’t hit its target, which impacted the share price. In addition, the company had to close down a huge number of stores throughout the US due to low customer traffic.

There were also rumors that the company would go bankrupt after its sales were not able to get to a decent mark after the Covid-19 pandemic. These stories have stirred up negative sentiment about the company and may be influencing investors to sell. However, it is important to know the facts about this company’s financial situation before making any investment decisions.

When considering these current stories about BIG, we need to determine which news topics will have a long-term and ongoing effect on the company and its share price.

While current news stories, good or bad, can sway our opinion about investing in a company, it’s good to analyze the company’s fundamentals and see where it’s been in the past and in which direction it’s heading.

This article will focus on the long-term fundamentals of the company, which tend to give us a better picture of the company as a viable investment. I also analyze the company’s value versus the price and help you determine if BIG is currently trading at a bargain price. I provide various situations which help estimate the company’s future returns. In closing, I will tell you my personal opinion about whether I’m interested in taking a position in this company and why.

Snapshot of the Company

A fast way for me to get an overall understanding of the condition of the business is to use the BTMA Stock Analyzer’s company rating score. If we look at the overall value score of the BIG, then we see that it has scored around 36 out of 100. This is an awful score and indicates that there are likely many issues with the company’s fundamentals.

BTMA Stock Analyzer

Before jumping to conclusions, we’ll have to look into individual categories to see what’s happening.

Fundamentals

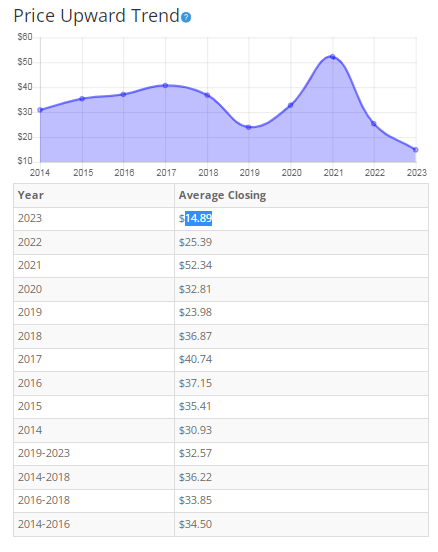

Let’s examine the price per share throughout the years. Share price was mostly consistent at increasing with slight variation until a big dip in 2019. Then sales actually surged during COVID. However, after society “normalized” and the threat of COVID subsided, the share price has been on a downward trend. We’ll need to look at earnings in more detail to help determine why the share price experienced these price swings.

Overall, the share price average has shrunk by about 51% over the past 10 years or a Compound Annual Growth Rate of -7.8%.

BTMA Stock Analyzer

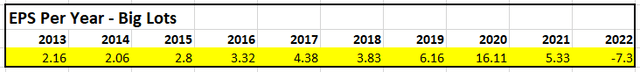

Earnings

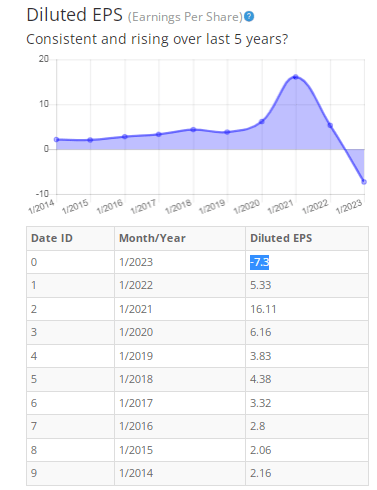

A closer look at the long-term EPS reveals that the earnings were mostly consistent at improving up until 2020. Then surprisingly, sales greatly increased during COVID. Deemed as an essential business, Big Lots was allowed to keep its stores open during the coronavirus pandemic. Possibly when people were off work for COVID, they took advantage of shopping at stores like Big Lots, which offer necessity food goods along with various household items. People had more free time to shop and expendable cash to purchase these products.

Possibly, as the precautions of COVID eased, people returned to work. They had less time to shop and as inflation grew, they became more cautious about how to spend their money. In addition, Big Lots heavily invested in more inventory to satisfy the increased selling during COVID, but after sales decreased post-COVID, Big Lots was stuck with loads of inventory, debt from the inventory, and less sales.

This along with added debt from remodeling stores has hurt earnings in recent years.

BTMA Stock Analyzer

Return on Equity

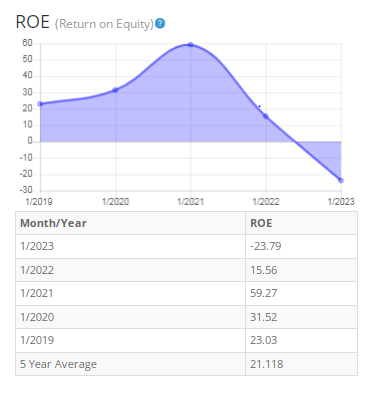

Since earnings and price per share don’t always give the whole picture, it’s good to look at other factors like gross margins, return on equity, and return on invested capital. At first glance, the ROE chart looks grim. But upon closer examination, we can see that ROE was steadily climbing from 2019 to 2021 and was at excellent levels during this time.

Then as we discussed, “post COVID” earnings shrank and continued to shrink in 2022 and 2023. This is the cause of the poor ROE for these years.

For return on equity (ROE), I look for a 5-year average of 16% or more. Since BIG has a 5-year average of 21.118, it easily meets that requirement. However, investors should keep an eye on the earnings to make sure that Big Lots begins to increase earnings in the future, in order to improve the overall fundamentals of the company.

BTMA Stock Analyzer

Let’s compare the ROE of this company to its industry. The average ROE of 32 companies in the Furniture/Home Furnishings industry is 5.45%.

Therefore, BIG’s 5-year average of 21.118% is well above average, but its current ROE for 2023 is way below that at -23.79% and needs to see much improvement.

Return on Invested Capital

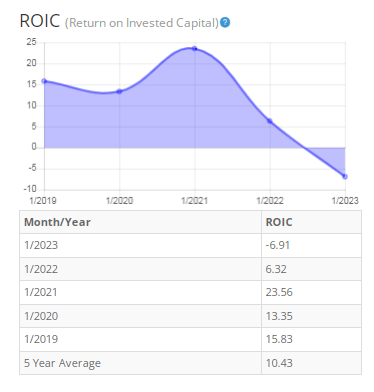

The ROIC paints a similar picture to the ROE. Levels were within good range from 2019 to 2021. Then post-COVID, ROIC took a dive. Again, the headwinds that Big Lots has been facing post-COVID, have also negatively affected the ROIC.

For return on invested capital (ROIC), I also look for a 5-year average of 16% or more. So, unfortunately, its five-year average of 10.43% doesn’t meet my standards.

BTMA Stock Analyzer

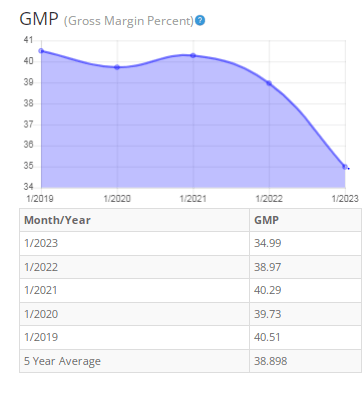

Gross Margin Percent

The GMP has stayed between the range of 38 to 40 throughout the period of 2019 to 2022. However, it dipped to 34.99% during 2023.

I typically look for companies with gross margin percent consistently above 30%. Since BIG has a five-year average of around 38%, it has proven that it can maintain sufficient margins for the long term, even during times of adversity.

It’s worth noting that margins have been steadily decreasing, so Big Lots will need to turn things around to stay competitive.

BTMA Stock Analyzer

Financial Stability Indicators

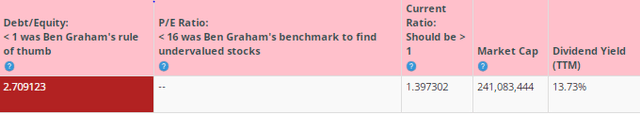

Looking at other fundamentals involving the balance sheet, we can see that the debt-to-equity is greater than 1. This is a negative sign, showing us that the company owes more than it owns.

Why is Big Lots’ Debt-to-Equity bad and has it always been this bad or is it something temporary?

From 2010 – 2018, Big Lots had been very good at maintaining low debt-to-equity of less than 1.

Around 2017 and after, Big Lots started increasing its debt by investing money back into the company. The idea was to remodel its stores into a “store of the future” theme. This investment into its stores hasn’t had the time to pay off, and it’s not certain how well it will pay off.

Furthermore, during COVID, when sales were surging, the company increased its inventory costs from $940 million to $1.14 billion (21% increase). This added to BIG’s debt, and the company still needs to sell off this excess inventory to pay off said debt.

Therefore, from what I’ve found, it seems that Big Lots has been a long-time stable company with a strong business model that has maintained good fundamentals. The inadequate debt-to-equity and poor fundamentals in the past couple of years seem to be the result of some temporary issues.

The current ratio of more than 1, indicates that the company could pay off its short-term liabilities with its cash. This is a good indication of the company’s current stability.

Overall, the company’s balance sheet indicates that Big Lots needs to improve their debt-to-equity, but there are some temporary issues that have negatively affected this indicator. The current ratio assures us that the company is not in any immediate danger.

The dividend yield (TTM) of BIG is 13.73%.

BTMA Stock Analyzer

This analysis wouldn’t be complete without considering the value of the company vs. share price.

Value Vs. Price

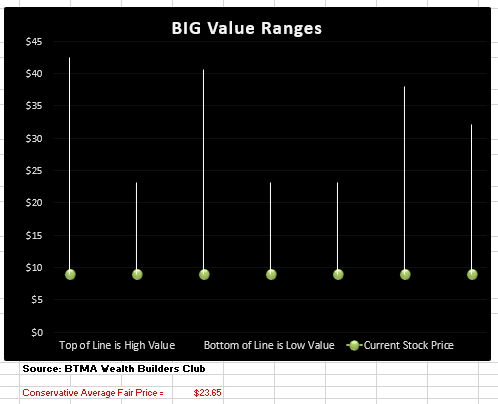

It can be difficult to estimate the true value of this particular stock since it has a highly unreliable valuation due to the recent negative earnings.

BTMA Wealth Builders Club

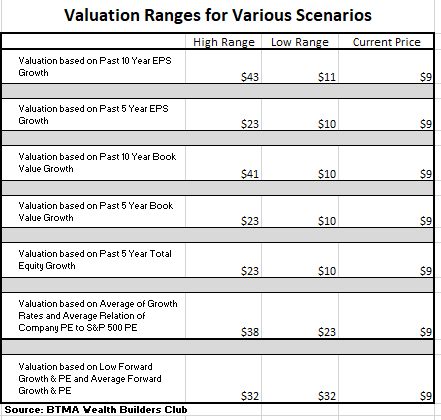

Since we have determined that the recent negative earnings and debt of Big Lots is likely temporary, we will try to determine a more realistic value of Big Lots based on a more normal earnings range.

Therefore, I will do a more normalized valuation model. It will be using a very conservative EPS based on the pre-COVID and conservative EPS of $3.83 from 2018. I’ve used various past averages of growth rates and PE Ratios to calculate different scenarios of valuation ranges from low to average values. The valuations compare growth rates of EPS, Book Value, and Total Equity.

In the table below, you can see the different scenarios, and in the chart, you will see vertical valuation lines that correspond to the table valuation ranges. The dots on the lines represent the current stock price. If the dot is towards the bottom of the valuation range, this would indicate that the stock is undervalued. If the dot is near the top of the valuation line, this will show an overvalued stock.

BTMA Wealth Builders Club BTMA Wealth Builders Club

According to this valuation analysis, assuming that BIG Lots is able to settle back into its more normalized pattern of business, the stock should be valued at around $23 once its earnings would return to its 2018 conservative pre-COVID level of $3.83.

From my observation, this earnings level is within reason. Nobody knows when Big Lots will achieve this earnings level again. But in my opinion, it gives a more reliable indication of what the stock is worth during a normal situation.

Otherwise, if we try to determine a valuation based off its 2022 negative earnings of $-7.30, it will be too unreliable.

Summarizing the Fundamentals

In a nutshell, long-term fundamentals of BIG have been very good when looking prior to 2022. However, the most recent year has been dismal for Big Lots and all fundamentals have been on a declining trend.

Improvements need to be made and Big Lots seems to be tackling these issues with plans in place. One main strategy is the rebalancing of its stores. It plans to now close more of its worse performing stores than originally planned and to focus more on rural store locations with less competition.

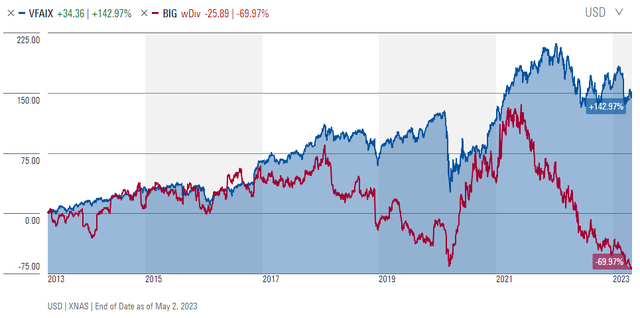

BIG Vs. The S&P 500

Let’s see how BIG compares to the US stock market benchmark S&P 500 over the past 10 years. From the chart below, we can see that the S&P 500 outperformed BIG overall. We can also see that BIG is much more volatile than the market benchmark.

Finally, we can notice that Big Lots is selling at one of its lowest points within the past 10 years. The only other similar low point has been during the onset of COVID in 2020. This was a time when I bought when there was blood in the streets. Big Lots was getting slaughtered, investors were running away from the stock. I waited patiently and soon reaped a handsome return as Big Lots surged during the pandemic.

Morningstar

Forward-Looking Conclusion

Over the next five years, the analysts that follow this company are expecting it to see a decrease in its earnings at an average annual rate of -23.41%.

In addition, the average one-year price target for this stock is $12.13.

Does BIG Pass My Checklist?

- Company Rating 70+ out of 100? NO (36)

- Share Price Compound Annual Growth Rate > 12%? NO (-7.8%)

- Earnings history mostly increasing? NO

- ROE (5-year average 16% or greater)? YES (21.18%)

- ROIC (5-year average 16% or greater)? NO (10.43%)

- Gross Margin % (5-year average > 30%)? YES (38%)

- Debt-to-Equity (less than 1)? NO

- Current Ratio (greater than 1)? YES

- Outperformed S&P 500 during most of the past 10 years? NO

- Do I think this company will continue to successfully sell the same main product/service for the next 10 years? YES

BIG scored 4/10 or 40%. Therefore, BIG shouldn’t be an option worth considering for most investors.

On the contrary, I’ve been following Big Lots for over a decade. I’ve invested in this company many times and there’s one thing that I really like about this company and that is its volatility. When things are going well with the economy and retail, Big Lots seems to swim along with the market nicely. But when things get bad, they really get bad for Big Lots.

For some reason, Big Lots quickly goes out of favor among investors. Dips in the market or in the retail or furniture business usually mean huge price declines for Big Lots. But that also means that you can often pick up shares of BIG at great bargain prices a few times throughout the year.

It’s not a stock to own for the faint of heart. But if you follow this company, you know that there’s good money to be made when the market over-punishes BIG’s share price.

Now is a perfect storm for Big Lots and it’s getting beat up from seemingly every angle. I’m familiar with the company and its price swings. So, I’m confident to buy when it’s at a bargain price and to buy even more when it’s getting hammered. If you’re not familiar with this stock, aren’t a patient investor, and aren’t confident about BIG, then I don’t recommend it as an investment for you.

BIG is facing major temporary issues, which are smashing its bottom line. First, it’s already in debt from heavily investing in remodeling its stores. Next, it overbought too much inventory to capitalize on the increased sales during COVID. Now, it’s indebted to this stockpile of inventory and needs to sell it off.

In addition, its main furniture vendor (United Furniture Industries) unexpectedly closed shop last year and left Big Lots scrambling to find a replacement.

Inflation and a poorly performing economy are affecting Big Lots along with the entire retail sector. I also believe that the recent bankruptcy of Bed Bath & Beyond scared investors and cast a negative shadow over Big Lots. All of these circumstances have left Big Lots crumbled up and looking like a piece of trash in the ditch.

Big Lots’ current situation reminds me of Warren Buffett’s saying “The best thing that happens to us is when a great company gets into temporary trouble… We want to buy them when they’re on the operating table.”

Believers in Big Lots realize when value is selling at a bargain price. Speaking of value, the latest quarter’s book value per share is $27.01. This would indicate that Big Lots is currently selling at less than a third of its value and for the time being it’s paying a dividend of around 14%.

Big Lots will certainly need to overcome its obstacles to gain back investors and to increase its share price.

To do this, Big Lots is being proactive with its new strategy of closing underperforming stores and expanding more into rural areas, where business costs are cheaper and there’s less competition. This plan intends to increase their profitability.

The company will continue to sell its excessive inventory to pay off debt.

Additionally, Big Lots needs to overcome the loss of its primary furniture vendor, United Furniture Industries Inc. (“UFI”), which supplied roughly 7% of BIG’s merchandise purchases in 2022.

Big Lots stated “…we are identifying and believe that we have identified merchandise sourcing alternatives to fill near-term gaps in our product offerings that may result from UFI’s cessation of operations, including, among other things, obtaining merchandise from other furniture vendors, pursuing closeout opportunities and acquiring additional non-furniture merchandise.”

I don’t know when Big Lots will overcome these obstacles to get back to a more normal situation or when its earnings will stabilize. But I’m confident that Big Lots will rise again like it has so many times before.

Read the full article here