Stocks fell Friday as bond yields remained elevated. Comments from Federal Reserve Chairman Jerome Powell suggested the central bank would hold short-term interest rates steady at its next meeting, but that a stronger economy could lead to higher-for-longer interest rates.

These stocks made moves Friday:

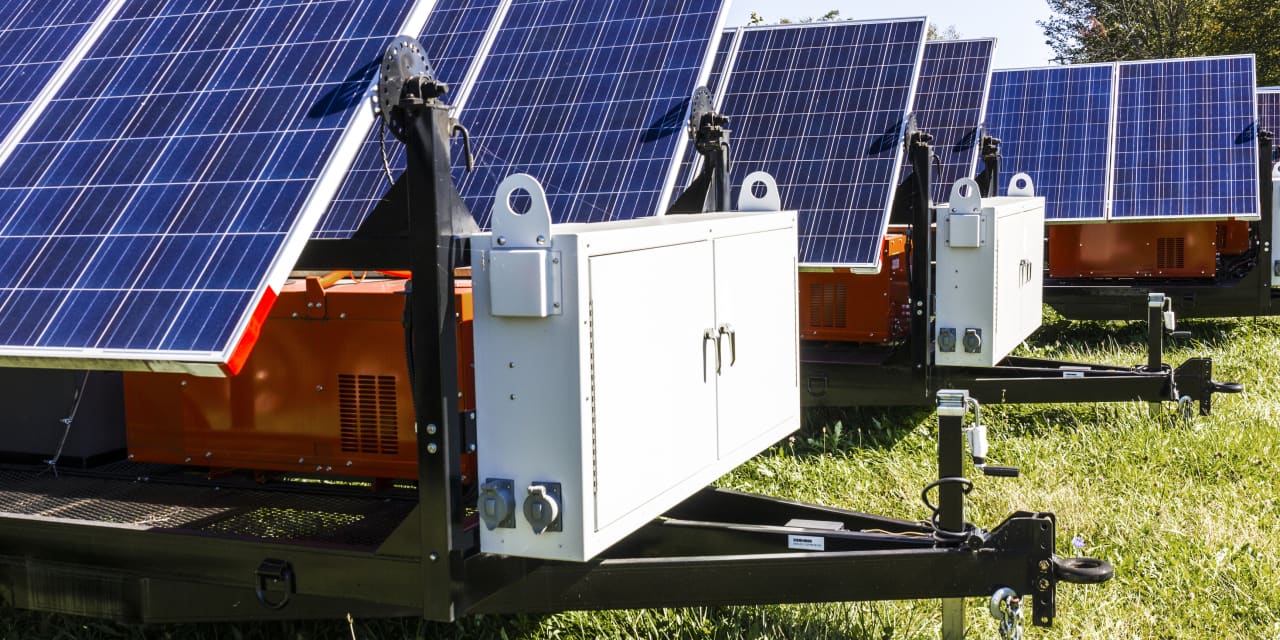

SolarEdge Technologies

(SEDG) warned that demand in Europe has slumped significantly and the solar-equipment maker slashed its estimates for third- and fourth-quarter revenue. The stock fell 27% after

SolarEdge

said it experienced “substantial unexpected cancellations and pushouts of existing backlog from our European distributors” during the second half of the third quarter. Competitor

Enphase Energy

(ENPH) sank 15%, and shares of solar developers

Sunrun

(RUN) and

SunPower

(SPWR) dropped 6.9% and 8.6%, respectively.

American Express

(AXP) reported better-than-expected third-quarter earnings of $3.30 a share and its sixth consecutive quarter of record revenue. Total card member spending climbed 7% to $420 billion on a currency-adjusted basis. In the U.S., card spending climbed 9% year over year. The stock fell 5.4%.

Regions Financial

(RF) fell 12% after the regional lender posted third-quarter earnings, net interest income, and revenue that missed analysts’ estimates.

Knight-Swift Transportation Holdings

(KNX), the North American truckload carrier, said revenue in the third quarter rose 6.5% to $2.02 billion, topping analysts’ estimates. The company’s less-than-truckload segment rose 7%, helping to offset a revenue drop of 22% in its core truckload segment. The stock rose 12%.

Hewlett Packard Enterprise

(

HPE

) fell 6.6% after the enterprise hardware and services company said it expects adjusted earnings in fiscal 2024 of $1.82 to $2.02 a share, below analysts’ forecasts of $2.15. HPE forecast revenue growth in fiscal 2024 of 2% to 4%.

Comerica

(CMA) shed 8.5%. The bank reported third-quarter earnings of $1.84 a share, sharply down from $2.60 a year earlier.

Intuitive Surgical

Intuitive Surgical

(ISRG) slipped 2.4% after third-quarter revenue of $1.74 billion at the surgical robotics company missed analysts’ estimates. Adjusted earnings of $1.46 a share beat forecasts of $1.42.

SLB (SLB), the oil-field services company formerly known as Schlumberger, reported third-quarter earnings of 78 cents a share, beating analysts’ expectations of 77 cents, but revenue of $8.31 billion that just missed forecasts.

SLB

stock declined 2.9%.

Merck

(MRK) was upgraded to Buy from Neutral at

UBS

after analyst Trung Huynh assumed coverage on shares of the drug maker. Merck said Friday that cancer drug Keytruda achieved positive results in a confirmatory trial as a treatment for a rare form of esophageal cancer. The stock rose 2.2%.

Write to Joe Woelfel at [email protected]

Read the full article here