The digital asset ecosystem in Europe expands as institutions broaden their services to decentralized finance (DeFi) amid market turmoil.

A new market report released by on-chain analytics from Chainalysis shows industry growth in Central, Northern, and Western Europe (CNWE) as well as the United Kingdom’s (UK) dominance in its jurisdiction and the effects of the Markets in Crypto Asset (MiCA) regulation.

According to the study, the CNWE accounts for 17.6% of global cryptocurrency transactions between July and June 2022 and sits as its second largest region in the same metric behind North America.

Recording inflow values over $1 trillion, institutions (traditional and decentralized) increase efforts to tap into the region’s DeFi space by creating several web3 initiatives targeted at growing niches.

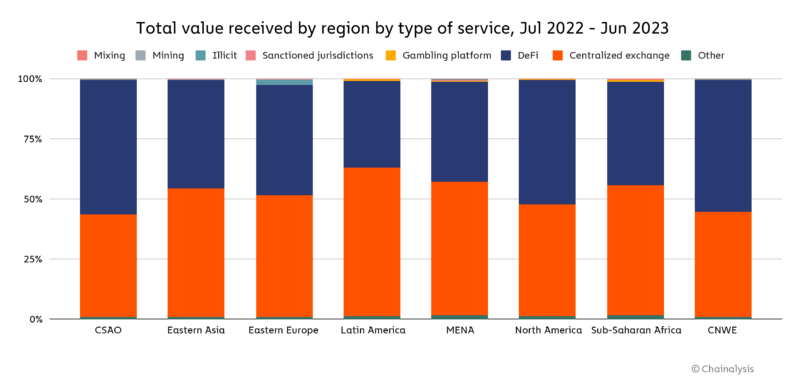

In CNWE, DeFi numbers make up 54% of total ecosystem value with countries notching growth in lending applications, decentralized exchanges, and related platforms.

“CNWE includes six of the 50 highest grassroots adopters of cryptocurrency around the world: the United Kingdom (14), Spain (22), France (23), Germany (26), Italy (37), and the Netherlands (39). Keep reading to learn more about what drives crypto adoption in these countries.”

“CNWE includes six of the 50 highest grassroots adopters of cryptocurrency around the world: the United Kingdom (14), Spain (22), France (23), Germany (26), Italy (37), and the Netherlands (39). Keep reading to learn more about what drives crypto adoption in these countries.”

A detailed comparison between activities in centralized exchanges shows a slight decline in number owing v to wider market turmoil; however, decentralized exchange inflows surged in seven countries: Albania, Luxembourg, Latvia, Spain, the United Kingdom, France, and Lithuania.

UK leads the region

This year policy watchers have projected the UK as a major crypto hub in coming years as can be seen in the deployment of industry-friendly policies and positive regulation to drive investor confidence.

In the last 12 months, the UK recorded a staggering $252.1 billion transaction volume and ranks 14th on the Chainalysis Global Crypto Adoption Index.

In June, the country passed the Financial Services and Markets Bill which adds digital assets to the regulation including vesting powers on the government to make laws around stablecoins.

Although stablecoin activities were impacted by the bill, crypto executives hailed the move by the UK with firms announcing possible migrations to the country.

“We’re thrilled to open our first international office in a jurisdiction that welcomes blockchain technology and is committed to creating a predictable business environment by pursuing regulations that both embrace web3 and protect consumers.” Chris Dixon, a founding partner at a16z.

MiCA: Game changer for Europe

Europe continues to attract more attention from developers and executives following the signing of MiCA billed to take effect in 2024.

It aims to foster financial stability in the markets through a single regime adopted by several countries and has drawn stakeholders’ attention, calling it a landmark legislation.

“Already, MiCA appears to have created favorable environments for crypto innovation. We spoke to industry leaders in France, Italy, and Germany to gain insight into these impacts,” the research reads.

In the United States, crypto regulations remain scattered with no clear pathway to follow Europe’s lead resulting in countless lawsuits involving the Securities and Exchange Commission (SEC) and several web3 companies.

Read the full article here