We present our note on Rentokil Initial plc (NYSE:RTO) (OTCPK:RKLIF), a British business services group focused on pest control and hygiene, with a Hold rating. Rentokil offers exposure to high-growth markets with consolidation opportunities. We will provide a brief introduction to the company, discuss H1 results, analyze the pest control market, and lay out our investment case and valuation.

Introduction To Rentokil

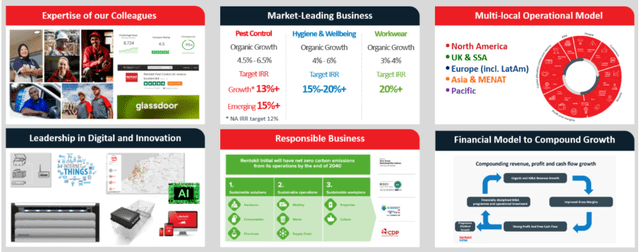

Rentokil Initial is a business services company with leading positions across three categories: pest control, hygiene, and workwear. It is the world’s number #1 commercial pest control company – the group’s growth engine with a leading international brand and strong technical expertise; and a market leader in two thirds of its markets in hygiene services. Rentokil offers a wide range of pest control services including rodents, flying or crawling insects, wildlife management, and other solutions ranging from snakes in South Africa to termites in America. Initial offers a broad range of hygiene services including provision and maintenance of sanitizer dispensers, driers, surface sanitizers, cubicle sanitizers, deep cleans, disinfection services, etc. helping businesses reduce illness from germs and viruses and mitigate liability risks. The hygiene services business is complementary to pest control and has a compatible model.

Rentokil Initial targets organic revenue growth of at least 5% over the midterm, and a group adjusted operating margin >19%, and a net debt to EBITDA ratio of 2.0x to 2.5x. The company is listed on the London Stock Exchange and has a market capitalization of £15.2 billion. Rentokil is a FTSE100 index constituent.

Rentokil Website

Pest Control – An Attractive Market With Secular Tailwinds

Pest control is a highly attractive market benefiting from multiple secular growth drivers including the rise in global living standards leading to higher requirements and increased scrutiny on pest control and hygiene, global population growth, climate change leading to an increase in pest populations, and urbanization. The market structure is highly fragmented, and Rentokil is a proven consolidator, making accretive bolt-on M&A targeting city-focused deals, extracting synergies, and benefiting from density and scale. Moreover, as a market leader, Rentokil enjoys the benefits of a strong brand and a successful operating model. The services are critical and non-discretionary and the industry is largely non-cyclical.

H1 Results

Rentokil Initial reported good H1 results slightly above sell-side consensus. Revenue came in at £2.6 billion a bit above consensus, while adjusted EBITDA margin came in at 16.3%, 150 basis points above last year and also better than consensus. Leverage decreased by more than one turn to 3.4x by the end of H1’23. The outlook was updated with leverage being expected to reach 3x by the end of the current fiscal year, or a year earlier than previously expected. Adjusted operating margin guidance was maintained. The integration of Terminix is on track with synergies being achieved as per the guidance.

Rentokil H1 Results Presentation

Terminix Deal

In December 2021, Rentokil Initial announced the combination of Terminix, which was concluded in October 2022. Terminix was valued at $6.7 billion in the transaction, with a mixed stock and cash consideration, respectively 80% and 20%. Around $150 million of synergies derived by back-office integration and financing are expected. The synergies are to be fully reached by the third year post-completion of the deal. We have a positive view of the deal as it created a leading player with improved scale and density. The completion of the synergies and removal of integration risks post-deal is a key element for Rentokil’s equity story.

Valuation And Investment Recommendation

We believe there is a lot to like about Rentokil, a high-growth and high-quality business services leader, including superior organic growth, improving margins driven by higher density, ample opportunities for value creation through M&A, a defensive profile, and the reaping of benefits coming from a transformative deal, i.e., Terminix.

We forecast net sales of £5.6 billion in FY2024e with 4% topline organic growth, in line with sell-side consensus, an EBITDA margin of 24.5% or a slight margin improvement, arriving at an EBITDA of ca. £1.4 billion, and a net margin of 9.5% arriving at a net profit of £530 million, and an adjusted net profit of £650 million. Our EBITDA and net income estimates are also in line with consensus. This implies a forward EV/EBITDA ratio of 13.5x and a forward PE ratio of 23.4x.

We forecast high EPS growth in the mid-term driven by mid-single-digit organic growth, plus additional points from margin expansion, and a few points from accretive bolt-on M&A deals. We value Terminix at 14x EBITDA at a premium to its historical median (around 12.5x) and arrive at an EV of £19.2 billion, and a market cap of £16 billion, implying a share price of 639p per share (or $40.6 for RTO) and 6% upside. We believe Rentokil is fairly priced and we issue a Hold rating.

Risks

Risks include but are not limited to weaker macroeconomic conditions leading to lower than expected growth, growth being more cyclical than expected and the multiple being penalized as a result of cyclicality, higher competition from smaller players leading to market share losses or lower margins, Terminix integration risks and inability to execute on synergies, Terminix litigation costs resulting in unexpected / higher than expected cash outflows, value destructive M&A, higher deal multiples leading to less value creation / lower IRR deals being done, etc.

Conclusion

We like several aspects of Rentokil, and it is surely a business we would like to own at a cheaper price. At the moment, we remain on the sidelines, with a Hold rating as there is not enough upside vs. other business services peers.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here