Warner Bros. Discovery, Inc. (NASDAQ:WBD) has had continued weakness since its IPO, with its market cap dropping to below $30 billion. At the same time, the company was caught up in the expensive streaming wars, weakening its position. Despite this, the company has the financial strength to work towards strong future returns, making it a valuable investment.

Warner Bros Discovery Financial Results

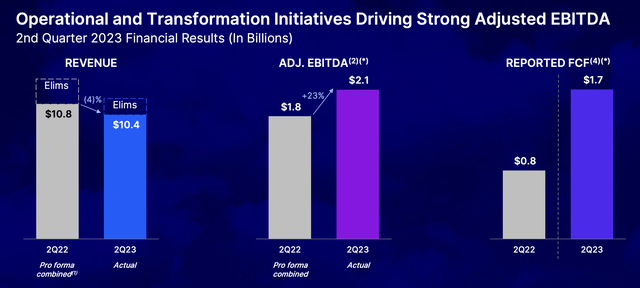

The company has worked to improve its financials substantially, especially free cash flow (“FCF”).

Warner Bros Discovery Investor Presentation

The company’s revenue has decreased slightly from $10.8 billion to $10.4 billion. That top line number might concern you, but its overall business has improved substantially. The company’s adjusted EBITDA grew more than 20% YoY to more than $8 billion annualized. At the same time, the company’s FCF more than doubled.

The company’s annualized FCF is now almost $7 billion, incredibly strong for a company with a market cap of just under $30 billion. That’s true even when accounting for the company’s debt load.

Warner Bros. Discovery Studios and Networks

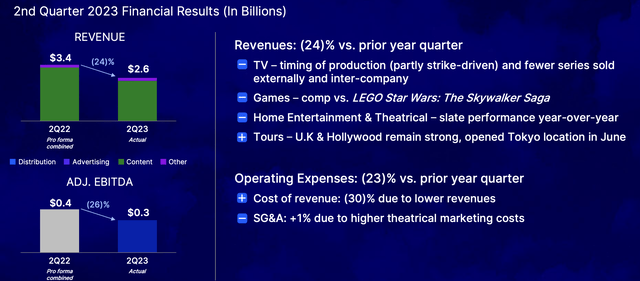

The company’s business does have a few segments that have underperformed, affecting its business.

Warner Bros Discovery Investor Presentation

In the company’s studio and networks division, revenue declined 24%. That was due to a mix of both TV production (strike driven) along with some slower releases etc. Of course, the company’s cost of revenue also dropped 30% and operating expenses dropped 23%, so it does line up well with the revenue decline.

The company’s network division also underperformed, with revenue declining by 5%, mainly driven by timing. Here the company also managed to decrease operating expenses by the same amount. There were some tough comparisons here for the company, but its ability to line up operating expense declines shows its strength.

Warner Bros Discovery DTC

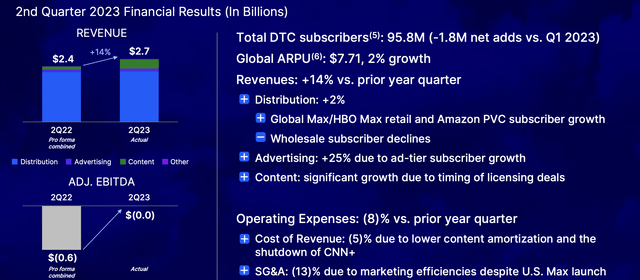

The company’s direct-to-consumer, or DTC, business is a new business and one that we need the company to achieve success in.

Warner Bros Discovery Investor Presentation

The company’s YoY revenue growth is 14% here, from $2.4 billion to $2.7 billion. The company has faced the same difficulty as other streaming services, and its total DTC subscribers decreased by 1.8 million QoQ. However, global average revenue per user, or ARPU, increased by 2%, matching up with the QoQ subscriber change. The company’s business here remains strong.

The company has seen content revenue grow, and advertising revenue has been benefited due to subscriber growth. Operating expenses also helped declined due to the shutdown of CNN+, which enabled overall EBITDA to improve dramatically. EBITDA is now at breakeven, and we expect it to continue improving.

Warner Bros Discovery Debt Improvements

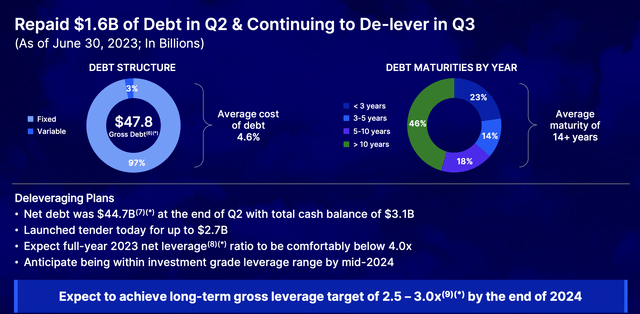

The company has continued to work on its main priority of de-levering and improving its debt structure.

Warner Bros Discovery Investor Presentation

The company has $47.8 billion in gross debt, although it does have the benefit that 97% is fixed with an average cost of debt of 4.6%. It at least enables the company to pay down its debt as it comes due. However, with 23% due in <3 years, the company does have some debt it needs to pay down sooner than later.

The company managed to repay $1.6 billion in debt at the most recent quarter though, in line with its reported FCF, and has launched a tender offer for another $2.7 billion. The company expects its leverage ratio to be <4.0x by year-end as the company comfortably hits investment grade and ~2.7x by YE 2024.

Unfortunately, with the spin-off, AT&T (T) saddled the company with a bunch of debt, but fortunately it’s fixed rate. The company is working to improve its positioning here, but it’ll take several years to clear up.

Warner Bros. Discovery Guidance

Over the long term, we expect the company to achieve strong returns.

Warner Bros Discovery Investor Presentation

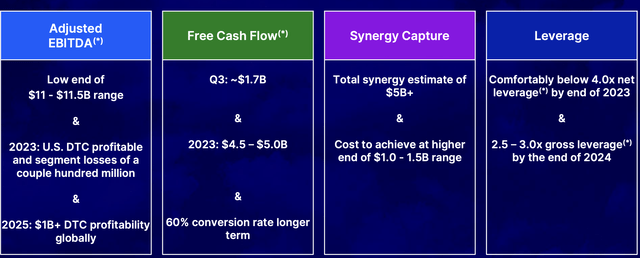

The company is expecting EBITDA to be on the lower end of its range, likely due to the current Hollywood strikes. However, U.S. DTC is expected to become profitable, a target for the company. Annualized FCF is expected to be ~$4.8 billion, or a 40% conversion rate on EBITDA and the company continues to work to move that to 60%.

The company is still targeting $5+ billion in synergies, although it expects that’ll cost close to $1.5 billion to achieve. However, that will still be highly profitable, with the company’s leverage near targets. Continued deleveraging here will bring strong shareholder returns in upcoming years.

Thesis Risk

The largest risk to our thesis is this is a difficult industry and its fundamental business model is changing. A basket of streaming services might be the same price as a cable subscription, but there are alternatives and customers don’t need them all. It can make it much harder to easily make up the same revenue and performance.

Conclusion

Warner Bros. Discovery, Inc. was saddled with an enormous amount of debt after its spinoff from AT&T. The company is still working on clearing that, however, it has been impacted by the same negative industry impacts that its competitors are seeing. Still, it has an incredible portfolio of assets, and the company is working on what counts, its financials.

The company’s current FCF conversion rate is 40%. The company is working on getting that to 60%, while it pays down its debt. Unfortunately for investors, they need to be patient, waiting the 2-3 years for the company to clear up its debt load. Still, the company has the ability to drive long-term shareholder returns, making it a valuable investment.

Read the full article here