© Reuters. FILE PHOTO: A smartphone with a displayed AMD logo is placed on a computer motherboard in this illustration taken March 6, 2023. REUTERS/Dado Ruvic/Illustration/File Photo

By Max A. Cherney and Chavi Mehta

(Reuters) -Advanced Micro Devices on Tuesday forecast a strong finish to the year, driven by the planned launch of artificial-intelligence chips that could compete with Nvidia (NASDAQ:) semiconductors.

AMD shares rose about 3% in after-hours trading.

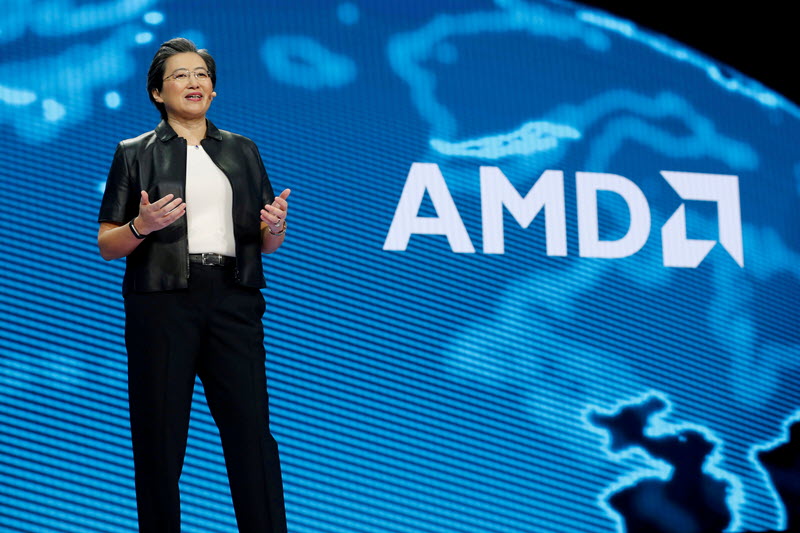

CEO Lisa Su said AMD is set to ramp up production of its flagship MI300 artificial-intelligence chips in the fourth quarter. The accelerator chips, which are in short supply, are designed to compete against the advanced H100 chips already sold by Nvidia.

Su said customer interest in the MI300 series chips is “very high” and AMD expanded its work with “top-tier cloud providers, large enterprises and numerous leading AI companies” during the third quarter.

Investors are betting that MI300 chips, due for release later this year, will challenge Nvidia in the surging market for advanced AI chips.

MI300s exceed the performance limits for sale to China under export controls issued in October, and unlike Nvidia and Intel (NASDAQ:), AMD has yet to create special chips for the lucrative Chinese market.

Nvidia modified its H100 chips to comply with U.S. Commerce Department restrictions on advanced AI semiconductor sales to China. AMD is mulling a similar strategy with its MI300 and older MI250 chips, Su said on a conference call with analysts on Tuesday.

“Our plan is to, of course, be fully compliant with U.S. export controls. But we do believe there’s an opportunity to develop product(s) for our customer set in China that is looking for AI solutions, and we’ll continue to work in that direction.”

AMD has not given a detailed full-year forecast but said it expects 2023 sales in its data center business, including MI300 chips, to exceed the $6.04 billion in 2022.

Jenny Hardy, portfolio manager at GP Bullhound, which owns Nvidia and AMD stock, said Nvidia still faces supply constraints, leaving an opening for AMD’s chip.

“If AMD can ramp production and launch those MI300 chips in the fourth quarter, they will likely see strong demand because plenty of people cannot get their hands on Nvidia chips. So we would assume that AMD can effectively kind of fill some of that supply-demand gap,” Hardy said.

AMD has enough components for MI300 chips for an “aggressive” launch in the fourth quarter, and ample supply for 2024, Su said.

Su cited “strong interest” in its older MI250 chip, which remains a “very good option” for less complicated AI tasks.

For the second quarter, revenue at AMD’s data center business fell 11% to $1.32 billion, while revenue at its client business slumped 54% to $998 million from $2.2 billion a year ago.

Large cloud players like Microsoft (NASDAQ:) and Google (NASDAQ:) plan to ramp up spending on data centers in the second half of the year, analysts said, noting that spending will skew toward AI chips and infrastructure.

However, a decline in PC shipments has moderated and demand has started showing signs of improvement.

“Looking to the third quarter, we expect our Data Center and Client segment revenues to each grow by a double-digit percentage sequentially driven by increasing demand for our EPYC and Ryzen processors, partially offset by Gaming and Embedded segment declines,” said AMD finance chief Jean Hu.

The company forecast current-quarter revenue of about $5.7 billion, plus or minus $300 million. Analysts polled by Refinitiv on average expect revenue of $5.82 billion.

Read the full article here