By Blu Putnam

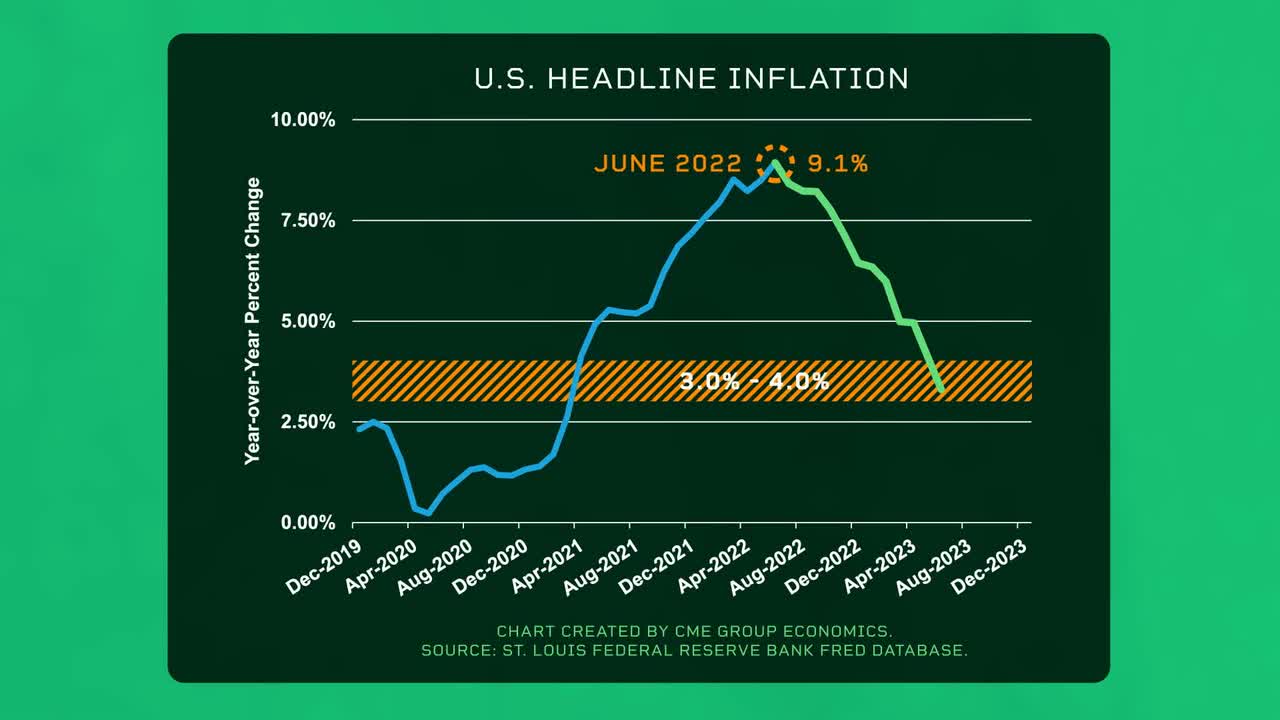

U.S. headline CPI inflation has been coming down relatively consistently since it peaked in June 2022 at around 9%, into the 3% to 4% territory. It has been a great ride, yet the path ahead will be much bumpier for those following the headline year-over-year percent change metric.

The June data was the last headline inflation rate to benefit from easy 2022 comparisons. By contrast, the July data to be released in mid-August is likely to bounce upward and stay there for another month. Again, this is all due to what we know happened back in the summer of 2022 and tells us nothing about inflation’s path forward. These anomalies are due to what economists call “base effects,” since old data gets equal weight with new data in year-over-year comparisons.

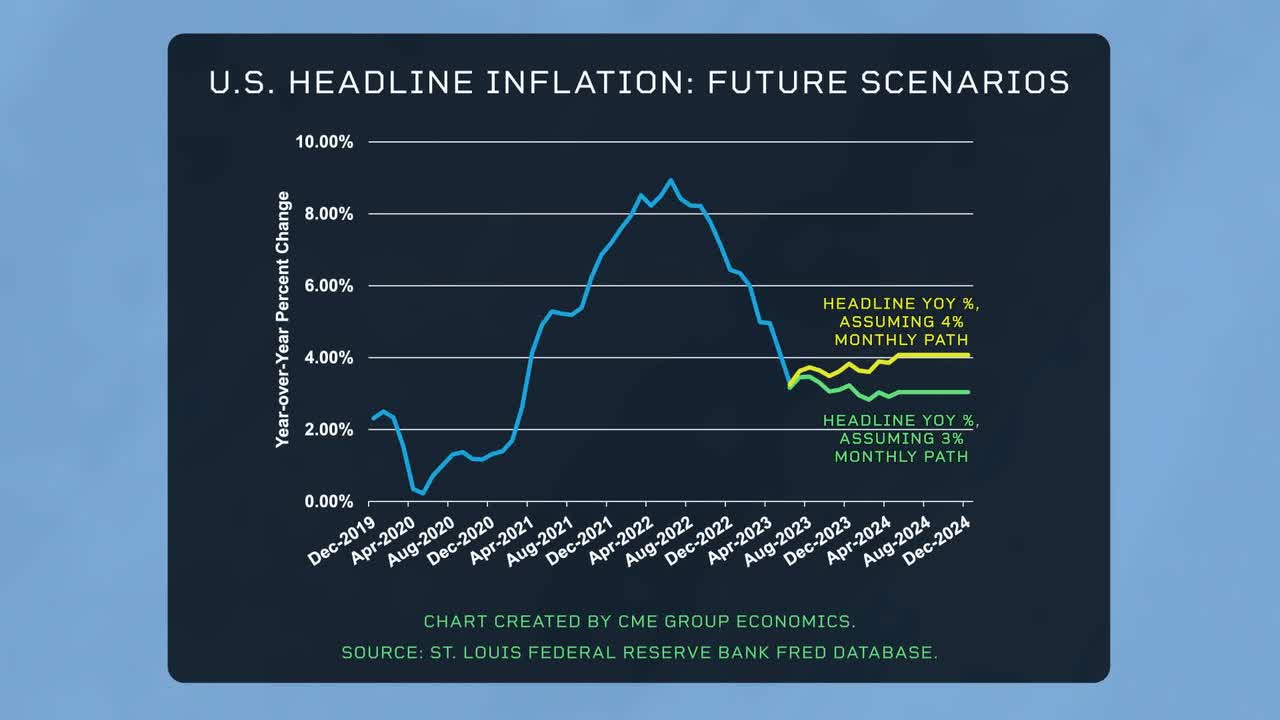

Market participants, however, know that more recent data is much more valuable than year-old data. To strip out the base effects, market participants will be paying close attention to month-over-month numbers, averaging this volatile data over the past three to six months to smooth it out. For the last six months, the month-over-month headline rate has been trending at just over 0.25%, or a touch over 3% annualized. If that path is maintained, which is a big if, the headline rate will be very close to 3% by year-end 2023. Of course, the shelter-challenged core inflation rate is likely to remain above the headline rate well into the future, which will make Federal Reserve decision-making all the more difficult and uncertain.

Should the Fed push rates higher just because shelter inflation is a problem when most everything else is much improved? If the inflation path has settled around 3%, should the Fed push people out of work and the economy into recession just to get to 2% inflation? These hard questions and the big debates to come will keep market participants on pins and needles.

Original Post

Read the full article here