Investment Rundown

The share price of Garrett Motion (NASDAQ:GTX) has been rather stagnant in the last few months, but the valuation currently is looking very intriguing and the buyback plant for shares seems to be growing.

Being a spin-off from Honeywell International (HON) back in 2018 the company provides investors the opportunity to make a more pure play investment into vehicle components. The coming report from GTX should display an increase in equities as the management announced that the A shares will be converted into common equity. It is being achieved after an important agreement with Centerbridge and Oaktree. The buyback is valued at $570 million and will set the tone for investors to be able to finally see a lot of capital diverted to them through more buybacks ahead. In terms of the business GTX, they have been able to grow consistently and now sit at the largest amount of revenue they have ever generated. A p/e and p/s below the sector make the downside possibility limited and in my view raises the buy case for GTX right now.

Company Segments

Following the spin-off in 2018, GTX has grown consistently. The automotive industry might not be that full of strong margins or explosive growth, you’d have to look at EV companies for that. But GTX has achieved a 3-year net income growth of 9.46%.

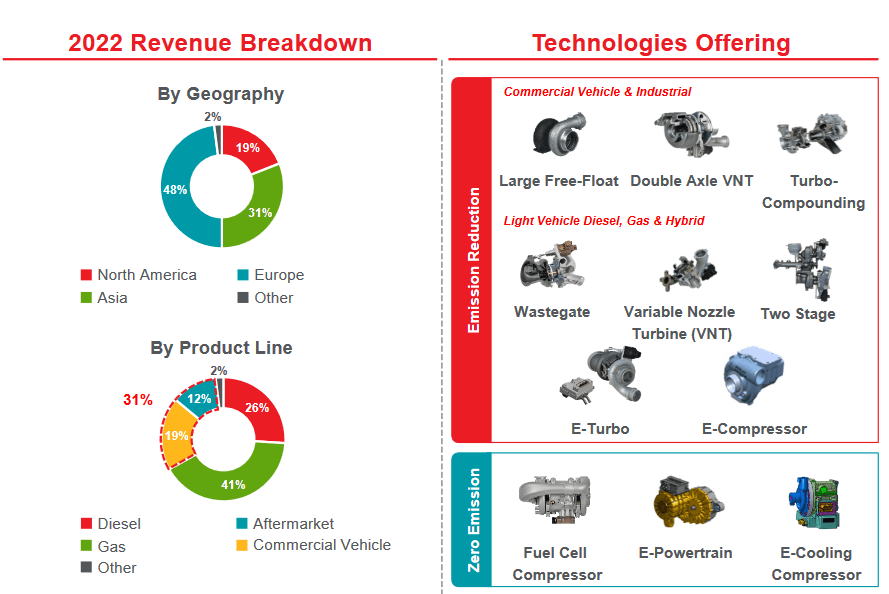

2022 Breakdown (Investor Presentation)

The company primarily engages in designing and manufacturing turbochargers and electric boosting technologies. They sell these products for light and commercial vehicles worldwide. The largest market for the business is Europe, where 48% of the revenues are being generated from. The second largest market is Asia and afterward North America.

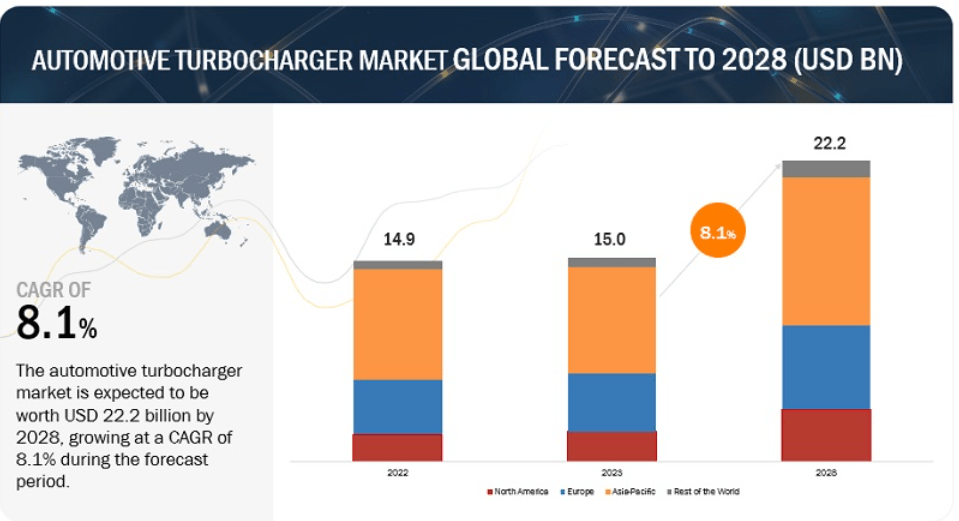

Turbocharger Market (marketsandmarkets)

GTX does boast a number one position in the turbocharger market, an industry that is expected to experience solid growth in the coming years. Until 2028 the market is predicted to have an 8.1% CAGR and it would value it at $22.2 billion in total. Revenues for GTX in 2022 were $3.6 billion which in my view leaves room for still much more growth.

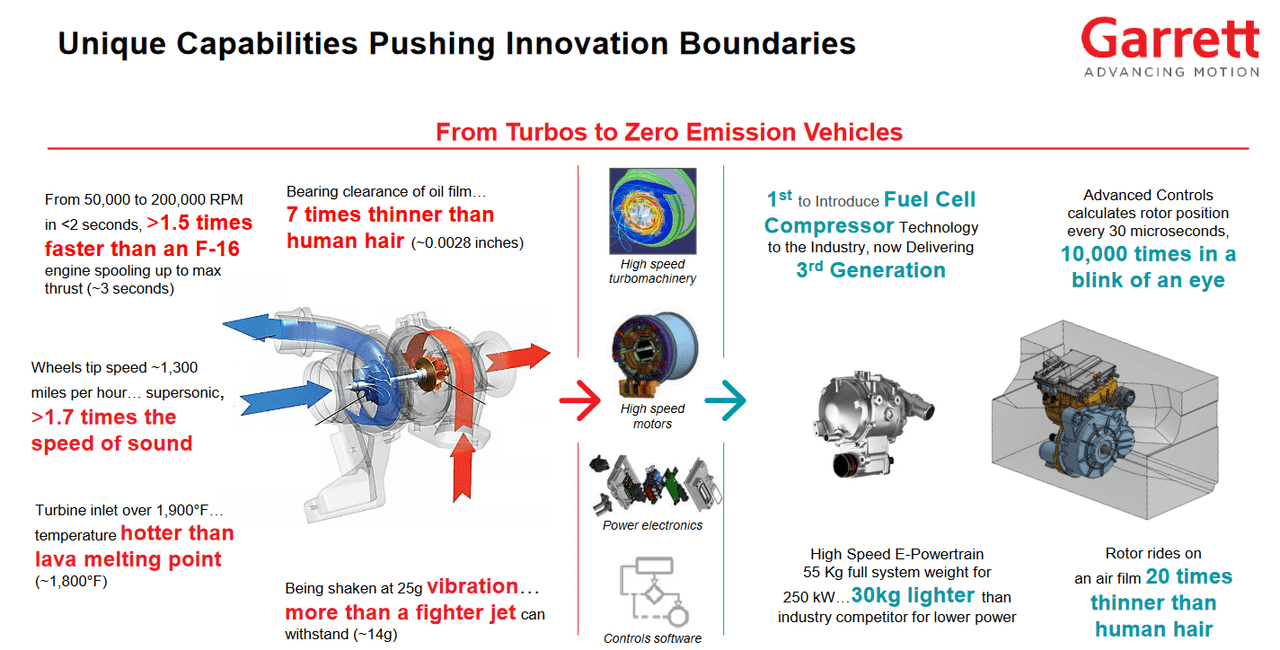

Company Product (Investor Presentation)

GTX has been gaining ground as a result of the superior technologies they have developed. They are the first to introduce a Fuel Cell Compressor to the market and are currently delivering their 3rd generation of it, showcasing that demand is strong for it and future investments worth pursuing.

Earnings Highlights

On April 24 2023 GTX announced their Q1 2023 earnings results, which in my opinion was a success. The company says net sales growing 8% on a reported basis and 13% on a constant currency. With the automotive industry, I don’t often expect to see explosive growth YoY, neither for the revenues nor margins. In the case of GTX, they grew gross margins to 19.5% in Q1 2023, a 10 basis point improvement. Operating in an environment where rates are rising and inflation still puts pressure on expenses this is a very welcomed improvement still.

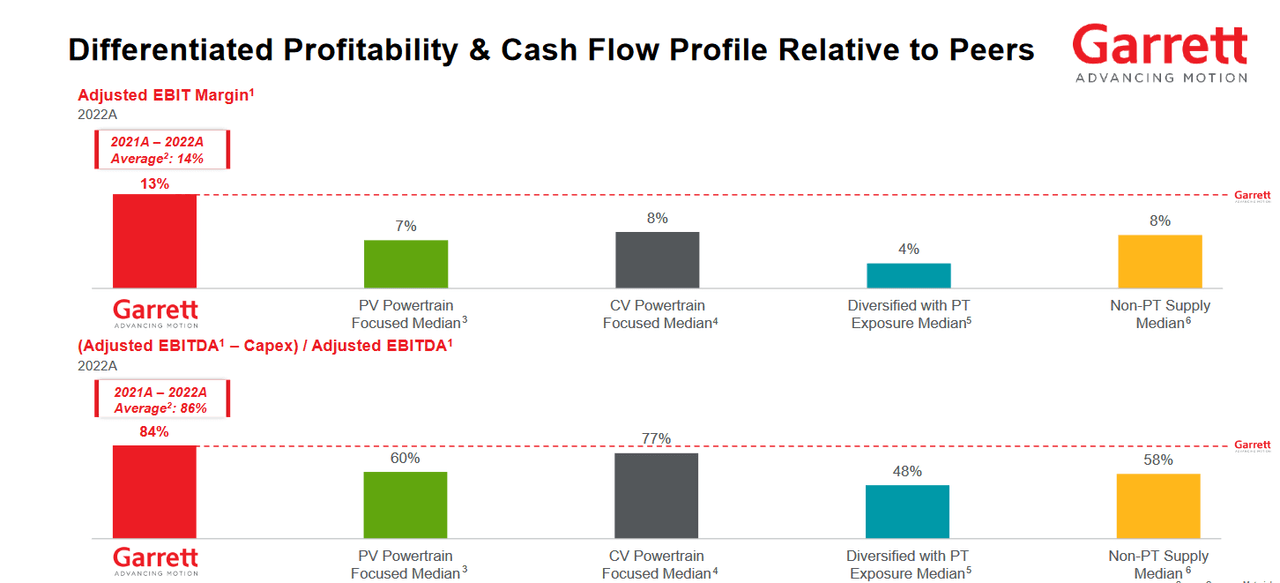

Cash Flow Results (Investor Presentation)

A highlight when looking at GTX certainly is the margins. The EBIT margin for example is beating out peers as seen above here and between 2021 and 2022 sat at 14%. I think it’s not unreasonable to expect it to drop off somewhat as the impacts of higher rates and inflated prices make their entrance into the earnings results. But having this proven track record makes me more prone to believe that the long-term remains positive for GTX and investors are good off buying the stock right now.

We aren’t far off from the next report from GTX and whilst I have spoken about some of the possible results for it, I think I am still confident enough to be rating it a buy right now. I see a scenario where the margins might take a hit as a result of a stronger USD. But recent news seems to suggest that the EUR/USD is at some of its lowest volatile points currently.

2023 Outlook (Earnings Report)

The outlook for 2023 still looks very strong though and reaching nearly $4 billion in revenues on the higher end would result in an 11% improvement. Cash flows will also be a key number to watch. The p/fcf is just 5 right now, 53% under the sector multiple. A surprise in Q2 of 2023 could translate to the share price receiving a higher price to reflect the strong results.

Risks

Seeing as GTX has a very broad diversification of revenues and doesn’t solely rely on the North American market to generate its revenues I think some form of currency fluctuation will always put the earnings at risk of not always being consistent quarter-to-quarter.

Besides that, the automotive industry which GTX serves is known to be highly cyclical. In times of great economic prosperity, more people are spending money on investments and purchases like a car. But when a recession seems to be looming and prices are rising as a result of inflation more people are putting off making these purchases. That slows down momentum for the sector and manufacturers become more careful about ordering too many supplies and materials. Ultimately this harms GTX and their revenues grow in ups and downs, but so far they have been doing that whilst rending upwards at least.

Final Words

Maintaining a diversified portfolio is essential to create long-term value in my opinion. The automotive industry is notorious for having very slim margins and in some years posts very dismal results as the economic slowdown generally affect these companies quite harshly. GTX however, seems to have set itself in a very strong position to weather some of these issues. With buyback plans being announced I think investors could be very well of starting a position right now in GTX. The p/e and p/s are both trading far below the sectors multiples which limits the downside risk in my opinion.

Read the full article here