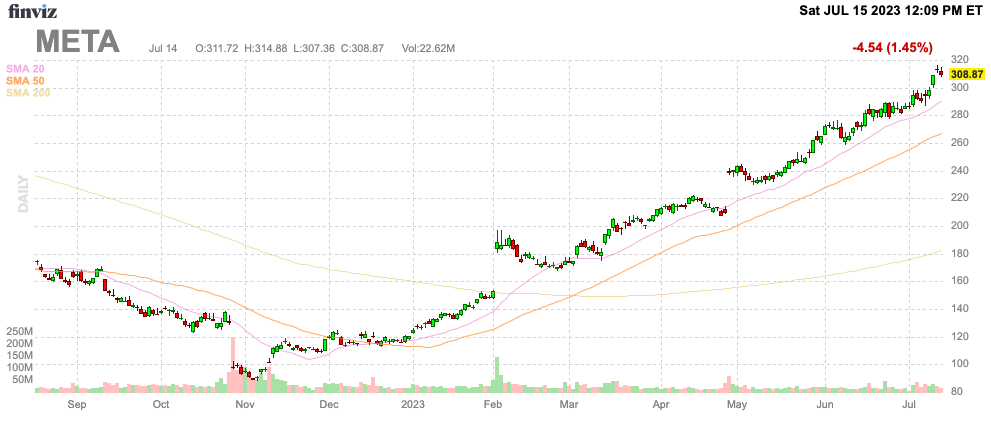

As predicted, Threads has failed to maintain initial momentum and this is good news for Meta Platforms (NASDAQ:META) shareholders. The social media company has other assets where the management team should focus on making the Twitter-like app a huge distraction from corporate priorities. My investment thesis remains ultra Bullish on the stock, assuming management quickly shifts focus back to Reels and the Metaverse.

Source: Finviz

Collapsing Traffic

Threads started off hot with 100 million app downloads in only 5 days. The app was the fastest in history to reach such a mark, even surpassing the wildly successful ChatGPT.

Source: Visual Capitalist

The problem facing Threads is that a wildly popular app better be ready for prime time or new users will quickly abandon the platform. Threads appears barebones right now and of course new users were left following random posts based on an algo, not the interests of the user.

From the beginning, Instagram head Adam Mosseri made it clear the new social platform wouldn’t focus on hot topics like news and politics. He made the following statement punctuating the sterile aspect of Threads and the likely demise as follows:

Politics and hard news are inevitably going to show up on Threads – they have on Instagram as well to some extent – but we’re not going to do anything to encourage those verticals.

The problem is that news filters into the sports, music and fashion categories where Threads wants to focus. A complete package includes all of those categories.

Just as Meta CEO Zuckerberg was proclaiming a victory with Threads crossing 100 million sign ups last weekend, the traffic on the platform was apparently already collapsing.

Source: Threads

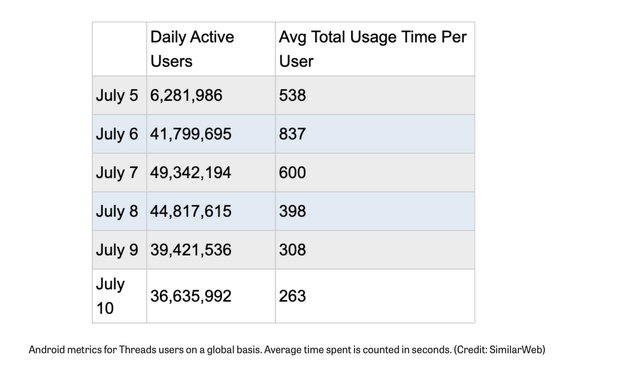

Several website traffic sources are now reporting a major dip in usage days after the app launch. Similarweb reported Android DAUs were down 20% by July 10 and more importantly engagement fell to only 8 minutes per day on July 10 after peaking far higher on July 6 at over 20 minutes.

Source: PC Mag

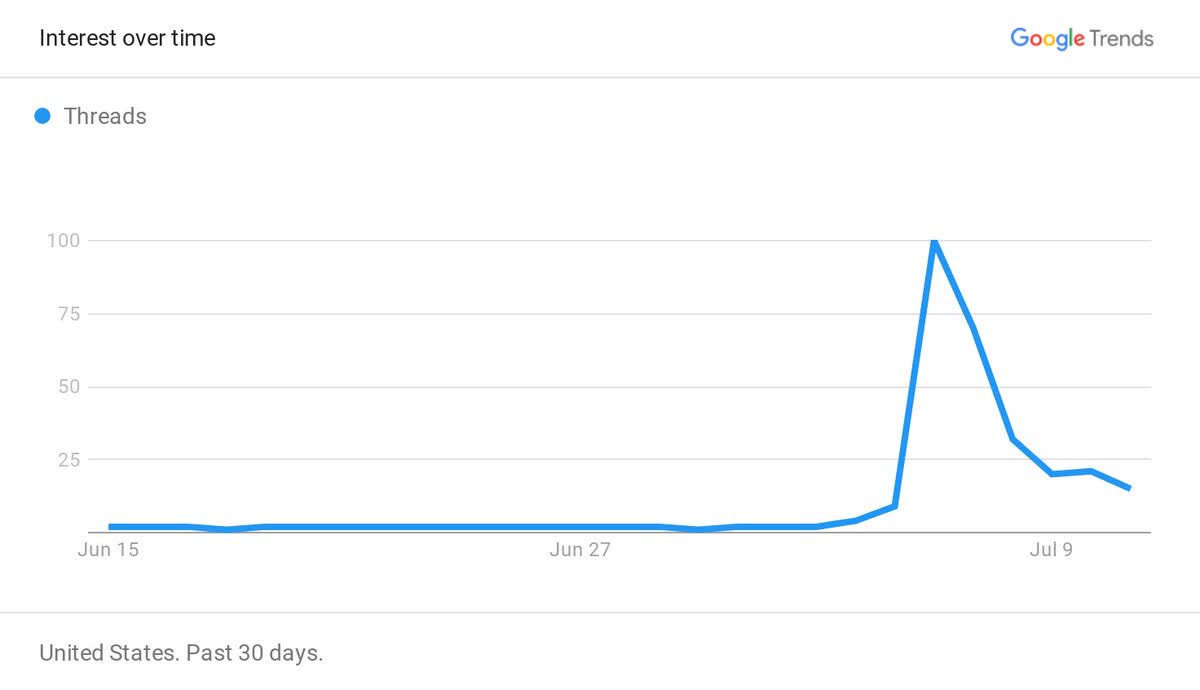

Sensor Tower reported similar numbers to CNBC with engagement already down over 50%. Even Google trends shows searches for Threads peaked on July 6 and has absolutely collapsed.

Source: Google Trends

Good News

The good news is that management can go back to focusing on the products of the future like Reels and AR/VR devices. The key to Reels is that the short video product is chasing a competitor in TikTok (BDNCE) with an estimated U.S. revenue target of $9 billion in 2023 while Twitter was only a $5 billion global business when Musk took the company private.

TikTok has the potential to be banned in the US providing a great incentive for Meta to have a solution to replace the social platform. So far, South Dakota has banned the app in the state and several government organizations have made similar moves.

While TikTok could be forced out of several countries due to the connection to the Chinese government, Twitter is set to remain a strong competitor. While Musk shook up the employee base by firing a large portion of executives and employees, the platform appears to be stabilizing and building out new monetization features along with snagging new content from the likes of Tucker Carlson after being fired by Fox News.

In addition, the Metaverse has been a huge investment and management needs to focus on building out a suite of products in the headsets to cut those losses. Meta has the potential to lead in this future growth category while competing against Twitter might provide limited upside.

Analysts have forecast the following revenue targets based off the initial hype of up to 100 million downloads in the first 5 days:

- Evercore – $8 billion, 5% revenue upside

- BoA – $2 – $3 billion,

- Wells Fargo – 1% to 3% upside

- KeyBanc – $0.9 – $6.7 billion, 1% to 5% upside

If Threads is able to turn around these user declines, the upside potential still appears limited. The average analyst revenue boost is a few percentage points to a Meta revenue base targeted to top $140 billion in 2024.

The social media giant has had so many failed product attempts that little brand damage is done to Meta on a failure. The biggest risk is that the company allows the product to become a major distraction on other key products.

Again, Meta has multiple opportunities with $10+ billion revenue streams making the focus on a killer Twitter app nonsensical. The company is trading dollars for nickels and potentially pennies with no intention to monetize Threads for a while.

On the oft chance Threads becomes an actual killer app without distracting management from Reels and the Metaverse, the investment thesis in Meta is only enhanced. The stock has actually jumped to $310 on the Threads hype.

The recent move reduces the near-term upside, but Meta still has normalized 2025 EPS of $20 from cutting the massive losses at Reality Labs. The stock has more upside, but one should wait for a dip as the Threads hype disappears and the recent ~$20 gain disappears.

Takeaway

The key investor takeaway is that Threads appears a major distraction for Meta Platforms. The collapsing traffic trend is positive for the business with management going back to focusing on fully building out short-form videos and the Metaverse.

The stock is cheap at only 15.5x normalized 2025 EPS targets, but investors can probably buy up Meta on a dip next week when the disappointing traffic trends for Threads hits recent enthusiasm.

Read the full article here