Introduction

Zynex (NASDAQ:ZYXI), a Nevada-based corporation, is the parent company of various active and inactive subsidiaries. The key active subsidiaries include Zynex Medical, Inc. (ZMI) and Zynex Monitoring Solutions, Inc. (ZMS), both based in Colorado. ZMI designs, manufactures, and markets medical devices for chronic and acute pain management, as well as muscle rehabilitation using electrical stimulation, with NexWave as their primary product. ZMS, on the other hand, develops non-invasive patient monitoring devices, notably the CM-1500 monitoring system and the upcoming CM-1600. In 2021, Zynex acquired Kestrel Labs, integrating its noninvasive patient monitoring technology into ZMS. ZMI currently drives most of the company’s revenue.

Recent developments: Zynex has received FDA clearance for its non-invasive, wireless fluid volume monitoring device, the CM-1600, and plans to seek FDA approval for a laser-based pulse oximeter in the fourth quarter of the year. Additionally, Zynex has successfully priced a private offering of $52.5M worth of 5% convertible senior notes due 2026. In a move that led to an approximately 8% increase in stock value, Zynex’s board approved a $10M common stock buyback program.

Q1 2023 Earnings

In the first quarter of 2023, Zynex reported a 36% year-over-year increase in revenue, reaching $42.2 million. The company also saw a 14% year-over-year increase in net income, amounting to $1.6 million. The quarter marked the highest number of orders in the company’s history for the fourth consecutive time, with a 61% year-over-year increase. Zynex’s working capital stood at $44.1 million as of March 31, 2023, and cash on hand amounted to $16.8 million. The company generated $1.9 million in cash from operations, a 10% increase from the first quarter of 2022. Zynex also repurchased $3.4 million of its common stock during the quarter.

For the full year 2023, the company reiterates its guidance of revenue between $180 – $200 million and EPS between $0.40 – $0.50. The second quarter orders increased by 51% from 2022, and the company confirms its estimates for Q2 revenue of $43.5 – $45.5 million.

ZYXI Stock Assessment

Per Seeking Alpha data, ZYXI demonstrates strong profitability and growth potential. The company has an impressive gross profit margin of nearly 80% and a substantial return on equity of 24.58%. The firm also boasts a net income margin of 10.19%, indicating efficient cost control. Revenue growth is steady, with YoY growth of 23.31% and a three-year CAGR of 48.67%. This solid growth performance is projected to continue, with expected YoY sales growth of over 21% until 2025.

However, Zynex’s earnings per share [EPS] estimates reveal a potential area of concern. The YoY EPS shows a decline of -4.83%, but projections indicate a recovery, with a 52.59% increase by 2024 and a further 31.80% increase by 2025. Still, the firm’s valuation may be considered high, with a forward non-GAAP P/E of 20.69 and an EV/EBITDA of 13.98.

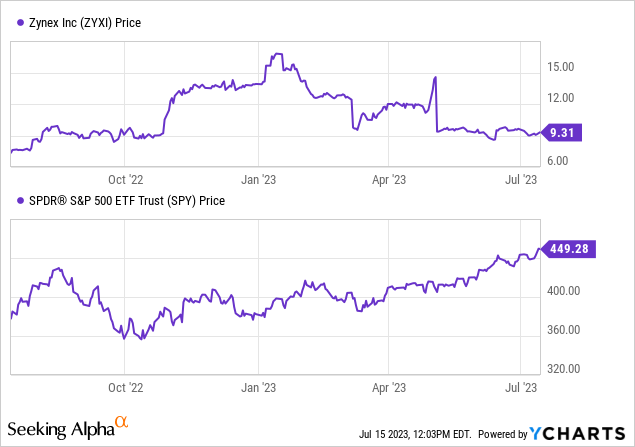

Zynex’s stock has been underperforming in the short term, down 22.03% in the last three months and 44.58% in the past six months. Nevertheless, it’s shown positive momentum over the past year, up by 26.49%.

The company’s capital structure is worth watching with a total debt of $24.37M and cash on hand of $16.79M (values are prior to convertible note offering), leading to an enterprise value of $343.36M.

Short interest in Zynex is high at 27.75%, which could indicate a potential risk of a short squeeze, but it’s somewhat offset by an Altman Z Score of 7.88, suggesting the company is not currently at risk of bankruptcy.

Zynex Raises ~$50 Million in Convertible Notes Offering for Strategic Growth

Zynex recently completed a private offering of convertible notes, raising approximately $50.0 million. If the initial purchaser exercises its option to buy additional notes, this amount could reach $57.2 million. The company intends to allocate around $8.5 million from this funding to repay its existing term loan of $16.0 million, which will aid in reducing its current debt burden.

The remaining funds will be utilized for general corporate purposes and to support working capital. This strategic decision is significant for Zynex as it will enhance its cash reserves. We had previously identified the company’s modest cash on hand as a concern. By repaying a portion of the term loan, Zynex will decrease its interest expenses, thereby positively impacting its overall financial performance. Moreover, utilizing the proceeds for working capital will provide the company with additional resources for its day-to-day operations, a crucial aspect of its ongoing growth strategy.

Nevertheless, it is important to consider that convertible notes may contribute to potential dilution in the future. Upon conversion into equity, the number of outstanding shares will increase, potentially diluting the value of existing shares. Investors should remain mindful of this possibility when evaluating Zynex. Overall, this action reflects Zynex’s proactive approach to managing its balance sheet, strengthening its financial position, and supporting its growth objectives.

Zynex’s Strategy for Growth

Zynex is currently pursuing the pain management market, experiencing a substantial year-over-year revenue increase of 36% in this division during the recent quarter. The company attributes this growth to the consistent and profitable performance of its expanding sales team.

Strategies for growth include enhancing sales productivity, which they have already seen an increase of 24% on a per-rep annualized basis over the first quarter of 2022. Zynex has focused on integrating new hires more quickly into the organization and optimizing performance through an implemented sales management structure. Despite facing labor market challenges, the company is committed to recruiting and retaining a high-quality sales and corporate team.

Zynex is also expanding into additional sales territories, aiming to reach around 525 to 550 sales representatives by the end of the year to capitalize on the growing orders. Its ability to work with all payer types and insurance providers, processing all orders it receives and working directly with patients and their insurers, is seen as a key differentiator from competitors.

Zynex anticipates another profitable year for the pain management division and plans to provide updates on its market expansions in future calls.

My Analysis & Recommendation

In conclusion, Zynex demonstrates strong growth and profitability, particularly in its pain management division. The company’s impressive gross profit margin, substantial return on equity, and consistent revenue growth indicate a solid market position and operational efficiency. The firm’s ongoing expansion of its sales team and focus on improving sales productivity further emphasize its robust growth strategy.

However, there are some concerns to consider regarding Zynex’s financial position and stock performance. While the company has managed to avoid immediate dilution, its limited cash reserves and increasing debt burden raise potential vulnerability, especially during an economic downturn. From my perspective, Zynex could be seen as a “house of cards” in the sense that any economic hardship could significantly impact its financial stability. Furthermore, the high short interest in Zynex may reflect market skepticism, possibly due to its relatively high valuation and recent underperformance.

Despite these concerns, Zynex’s strong growth strategy, commitment to operational efficiency, and expanding market presence indicate a promising outlook. Therefore, as an investor, I would recommend maintaining a ‘Hold’ position on Zynex. While valid concerns exist regarding financial stability and stock performance, the company’s growth trajectory and potential profitability provide a counterbalance, making it worthwhile to monitor closely in the near term. Continual and careful monitoring of performance will be crucial for adjusting the investment strategy accordingly.

Read the full article here