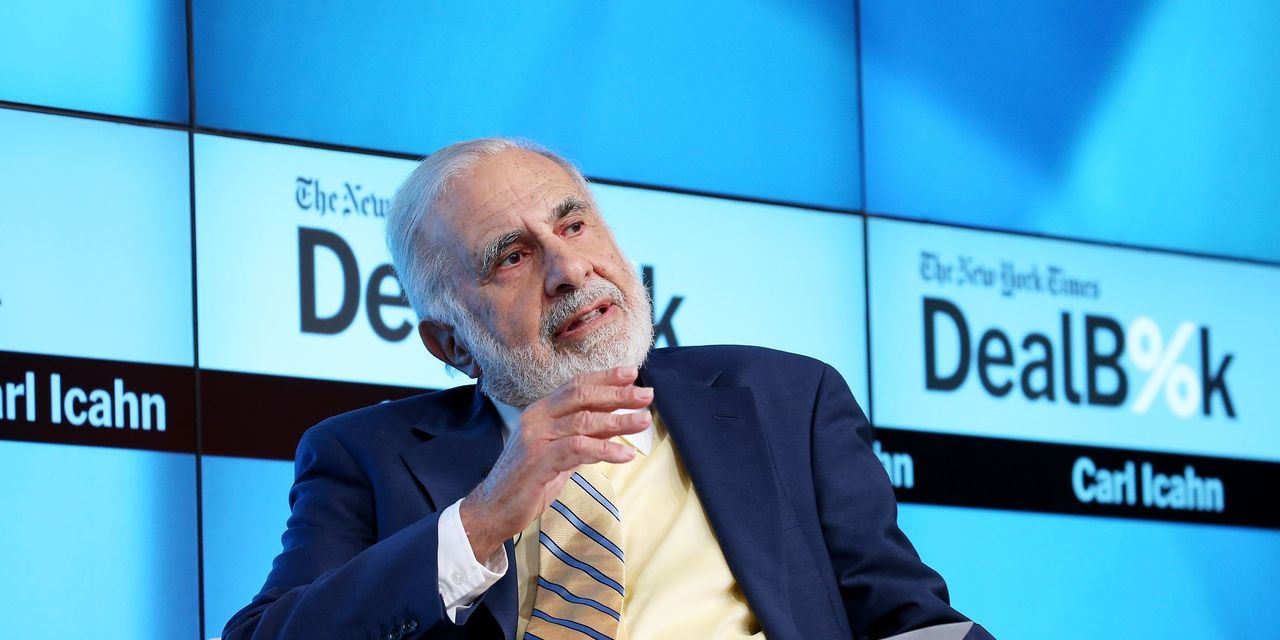

Icahn Enterprises L.P.’s stock jumped 19% Monday, after Carl Icahn and banks finalized amended loan agreements that untie his personal loans from the trading price of his company’s shares.

The news, which was first reported by the Wall Street Journal, was confirmed by Icahn in a regulatory filing.

It comes after a short-seller report published in May accused Icahn of inflating asset values in IEP

IEP,

his publicly traded investment vehicle, and said its $2 quarterly cash dividend may not be supported by the fund’s cash flow and investment performance, which has been negative for years.

The report from Nate Anderson’s Hindenburg Research also revealed that Icahn had borrowed against shares, or units, he owns in IEP.

The personal indebtedness had been fully disclosed by Icahn in securities filings, but few on Wall Street seemed to take notice. While Icahn himself can play a big role in the stock market with activist campaigns he wages against corporate boards, IEP itself isn’t a widely followed stock because Icahn and his son Brett own 84% of the units.

IEP is mostly favored by retail investors who get exposure to Icahn’s personal portfolio of public and private companies, including petroleum refineries, car-parts makers, food-packaging companies and real estate.

For more, see: Icahn calls Hindenburg short-seller report self-serving, as market value of his company’s stock plunges by $4 billion

The amended loan agreements increase Icahn’s collateral and set up a plan for him to fully repay the loans in three years. The agreements were made with Bank of America

BAC,

N.A., Bank of Montreal

BMO,

Deutsche Bank AG, New York Branch

DBK,

Morgan Stanley Private Bank, National Association

MS,

and M&T Bank

MTB,

according to the filing with the Securities and Exchange Commission. That means the only factor that could now trigger margin calls is movement in the net asset value of his investments.

The Wall Street Journal had cited people familiar with the matter saying IEP is comfortable with the asset valuations reported in its public filings.

About 60% of Icahn’s IEP shares were pledged as collateral for the personal loans, which led his lenders to privately call on him to pledge more collateral as the stock price fell. IEP’s stock is down 43% in the year to date and closed Friday at $28.86. Before the short-seller report, it was trading above $50.

Forbes estimates that the incident has cost Icahn some $8 billion in net worth.

Icahn is now putting up about $6 billion in collateral, including $2 billion of his personal funds, and about 320 million IEP shares. The billionaire disclosed to the Financial Times in May that he was using the loans to make additional investments outside of his publicly traded vehicle.

“Over the years I have made a great deal of money with money,” he was quoted as having said. “I like to have a war chest, and doing that gave me more of a war chest.”

For more, see: Carl Icahn admits he was wrong to take a huge short position on the market that lost $9 billion

Icahn has further agreed to a repayment plan, under which he will pay the banks $500 million in September, make eight quarterly payments of $87.5 million starting a year after that and repay the remaining $2.5 billion balance three years from now.

Meanwhile, investors are waiting to see the outcome of a federal probe of IEP’s corporate governance and other issues, which was disclosed along with first-quarter earnings.

Those earnings showed that IEP had swung to a loss in the first quarter from a profit a year ago, missing consensus estimates by a wide margin.

Icahn’s investment fund has performed poorly in the past decade. For many years he has publicly expressed suspicion of the bull market that raged around him. He shorted the stock market in a big way as a hedge against his long activist positions. Going into 2021, for example, Icahn’s investment fund had a short exposure of 142%, SEC filings show.

Hindenburg Research typically aims to profit from the decline in the value of the shares of the companies that it writes negative reports on. The short seller notably targeted zero-emission truck company Nikola

NKLA,

about three years ago. More recently, Adani Group

512599,

the Indian conglomerate, lost over $100 billion in value after the short seller targeted it in January.

Don’t miss: Bill Ackman resurrects billionaire feud, saying Carl Icahn needs a friend. Icahn’s company’s stock tumbles 21%.

Read the full article here