Investment thesis

Our current investment thesis is:

- KOF is an attractively positioned company owing to the brands it bottles and the market within which it has a monopolistic position.

- KOF has faced some margin erosion but we believe the company will rapidly will this back once inflationary pressures subside.

- KOF is an attractive investment proposition relative to its peers, trading at an attractive level.

Company description

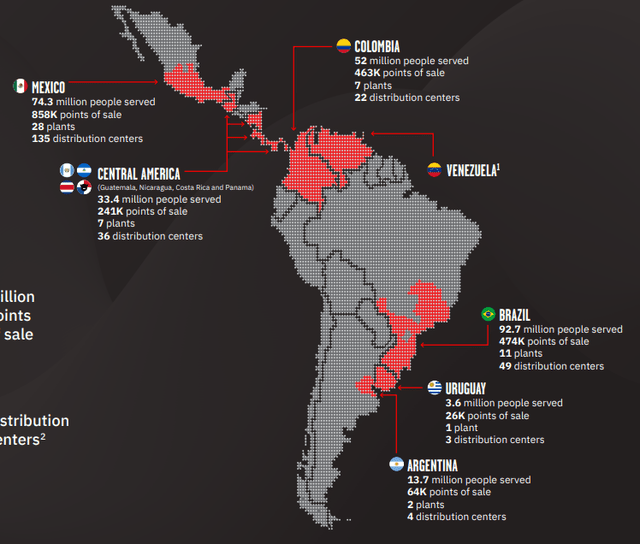

Coca-Cola FEMSA (NYSE:KOF) is the largest franchise bottler of Coca-Cola beverages in the world, serving a population of over 261 million people across Latin America. With operations in Mexico, Central America, South America, and the Caribbean, the company manufactures, distributes, and markets a wide range of Coca-Cola products to meet consumer demand.

In addition, the company distributes and sells Heineken, Estrella Galicia, and Therezópolis beer products in its Brazilian territories.

KOF is a subsidiary of FEMSA, which owns 47.2% of its stock, with 27.8% held by The Coca-Cola Company (KO), and the remaining is listed publicly on the Mexican Stock Exchange and the New York Stock Exchange.

Share price

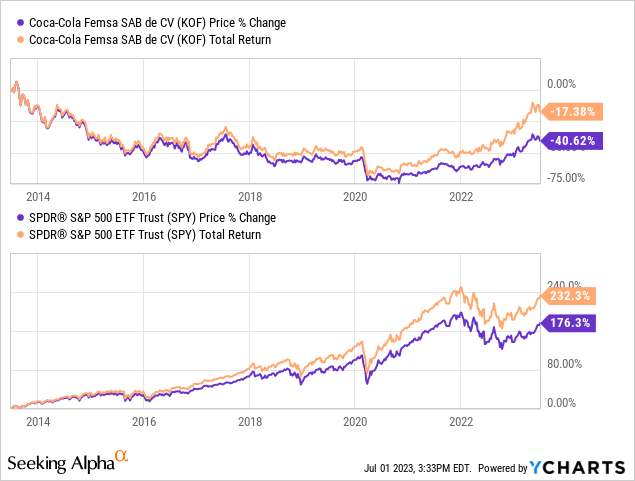

KOF’s share price performed poorly in the last decade, likely due to a change in sentiment and negative FX movements, contributing to a valuation adjustment.

Financial analysis

Coca-Cola FEMSA financials (Capital IQ)

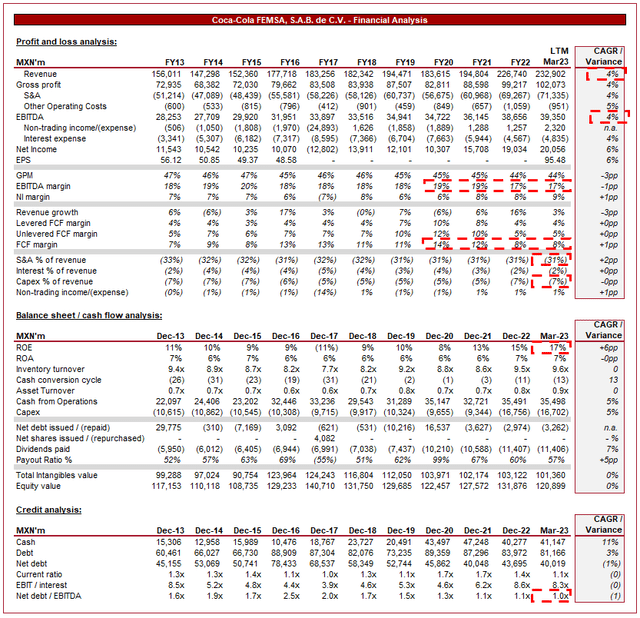

Presented above is KOF’s financial performance for the last decade.

Revenue & Commercial Factors

KOF’s revenue has grown at a CAGR of 4% in the last 10 years, with relatively consistent gains. The company has experienced only 3 periods of negative growth, one of which was due to Covid-19.

Business Model

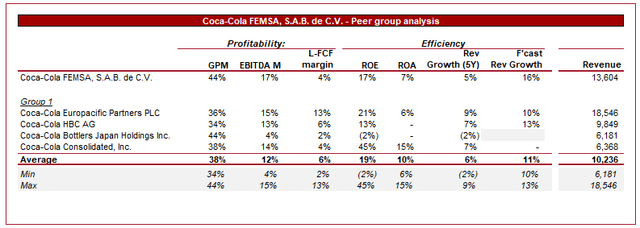

KOF operates under a long-term bottling agreement with The Coca-Cola Company, allowing the company to bottle and distribute the product in LatAm. Coca-Cola’s largest bottlers are Coca-Cola Europacific Partners PLC (CCEP), Coca-Cola HBC AG (OTCPK:CCHBF), and Coca-Cola Consolidated (COKE). Coca-Cola is incentivized to create this relationship as it reduces the company’s fixed costs and capex requirements.

KOF focuses on leveraging its extensive distribution network, brand portfolio, and strong relationships with customers and suppliers to drive sales and market penetration. Given the monopolistic position it is afforded through its agreements with The Coca-Cola Company and others, the business is able to aggressively expand its reach within these markets, as well as focus on operational excellence to drive value.

As the following illustrates, the company has an unrivaled position in LatAm, selling directly to almost every major economy in the region.

Geographical Profile (Coca-Cola FEMSA)

This reach provides KOF with exposure to a high-growth region, as well as a highly populated one. This will act as a natural tailwind that contributes to continued growth. Further, the geographical proximity in conjunction with the number of people served affords the business significant economies of scale, utilizing its key capabilities across the range of brands.

KOF employs a direct store delivery (DSD) system in order to facilitate this significant operational task, ensuring timely and efficient product delivery to a broad customer base, including retailers, restaurants, and convenience stores.

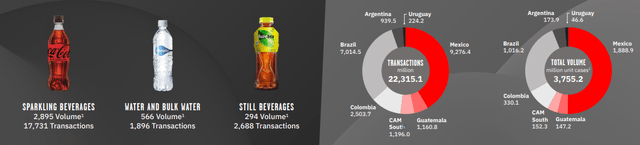

The company benefits heavily from the fact it stocks a wide variety of beverages across the value spectrum, such as Water, Soft Drinks, Still Beverages, and Alcohol. This reduces its reliance on any one segment or brand, while also allowing it to exploit trends.

Volume profile (Coca-Cola FEMSA)

Beverage Industry

In recent years, there has been a social push toward healthier beverages, including low-sugar and functional drinks, as consumers are more conscious of the implications of their diet. This has contributed to increased demand for sugar-free alternatives, as well as healthy still beverages. Opposing this is the suggestion that sparkling beverages are at risk of a decline. We consider the latter to be unlikely, as although individuals may consume less when factoring in population and wealth growth, there is a naturally offsetting impact. The former, however, does represent a potential avenue for growth. The Coca-Cola Company is active in acquiring and developing brands in areas of growth, which will trickle down to the benefit of KOF.

There is increased pressure, from both society and legislation, to use sustainable packaging and eco-friendly production practices. The Coca-Cola Company will have its corporate expectations, with audits to ensure compliance. KOF is performing well against its key criteria and is on course to have at least 50% recycled content in its packaging by 2030. This has been accomplished without a material impact on margins, an impressive achievement.

Margins

KOF boasts strong margins, with a GPM of 44%, EBITDA-M of 17%, and a NIM of 9%. Margins had trended flat until the most recent year when the company experienced a decline.

Margin erosion has been caused by inflationary pressure, with higher concentrated costs in Mexico and higher PET resin and sweetener costs, as well as higher fuel and maintenance expenses operationally. The expectation is for this to subside in the coming quarters, potentially contributing to margin improvement.

Balance sheet & Cash Flows

KOF is conservatively financed, with a ND/EBITDA ratio of 1x. This gives the business sufficient flexibility to raise debt if required.

Further, the business remains operationally efficient, with inventory turnover consistently increasing over time, improving cash flows.

FCF has been incredibly consistent and is at an attractive level relative to profitability, allowing for strong distributions.

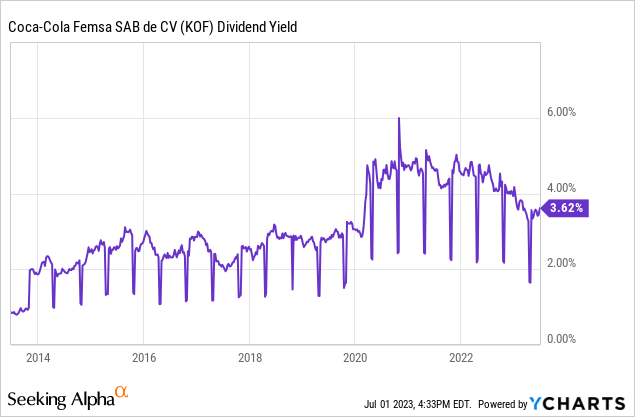

Dividends have grown at a CAGR of 7% while its payout ratio remains at a sustainable level. We expect continued growth in the coming years.

Outlook

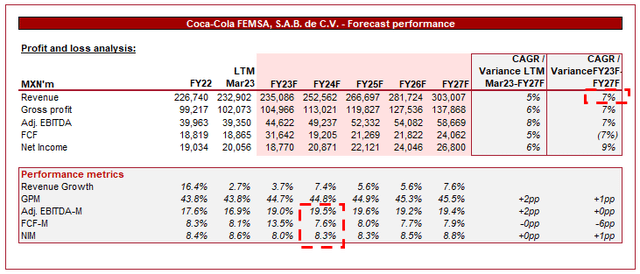

Forecast (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting continued growth in the coming years, as economic development and the fundamental strength of the brands drive value.

Margins are also expected to improve, likely for the reasons we have discussed previously.

Peer analysis

Coca-Cola bottlers (Capital IQ)

Presented above is a comparison of KOF to a cohort of its other Coca-Cola bottlers.

KOF performs extremely well on a relative basis. It is comfortably the most profitable of the group while growing at a similar level. This is a reflection of the company’s scale and target market, allowing the business to benefit from a larger market. The only weakness is its L-FCF, which trails the average.

MXN

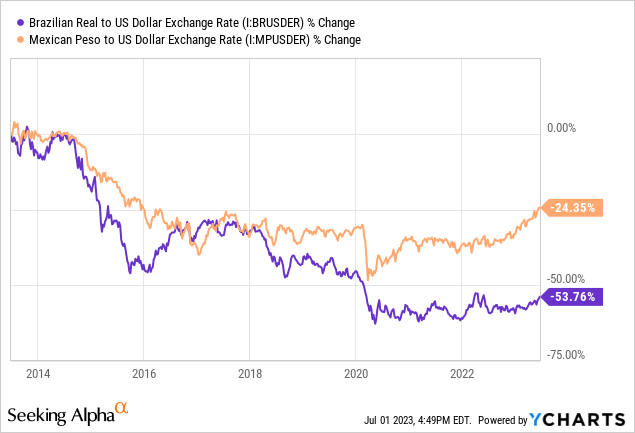

KOF generates its earnings in a range of LatAm currencies while reporting in MXN and USD. This creates significant FX risk for investors, as KOF could be generating improved returns (and paying higher dividends) while said Dollar investment depreciates in value. In the last 10 years, the MXN has lost 24% against the dollar, while the Real has lost 54%.

Valuation

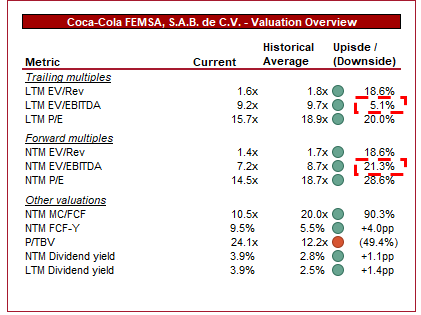

Valuation (Capital IQ)

KOF is currently trading at 9x LTM EBITDA and 7x NTM EBITDA. This is a discount to its historical average.

A discount is reasonable, as KOF has experienced margin deterioration and weakness in the MXN relative to the Dollar.

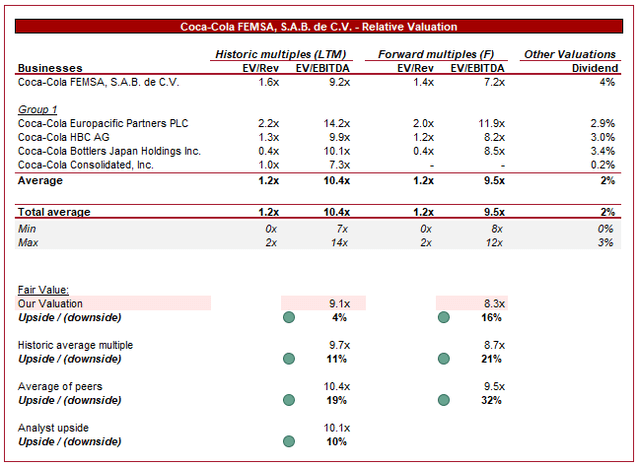

Valuation (Capital IQ)

KOF is trading at a 32% discount to the peer group on a NTM basis. This, similar to the historical valuation above, looks to be an overly steep discount.

In order to assess KOF’s valuation, we have applied a 12.5% discount to the peer group, reflecting the FX risk and weaker FCFs, offset by its superior profitability and growth.

Based on this, we derive a NTM upside of 16%, which is the valuation we lean toward given the scope for near-term margin improvement.

Key risks with our thesis

The key risks to our current thesis are:

- A further adverse FX movement, as previously discussed. This has the potential to erode underlying growth and thus investor returns.

- Inability to achieve margin improvement. Given the competitiveness of the industry, there is a risk that although cost pressures subside, margin pressures remain.

- LatAm economic exposure. Despite the view of LatAm being a growth area, there is heightened political risk, as well as economic uncertainty. Charles de Gaulle famously said, “Brazil is the country of the future… and always will be”.

- Finally, brands’ relative competitiveness. As a bottler, KOF is reliant on the development of key brands by the Coca-Cola Company. This exposes the business to the risk of a strategic misstep, although we consider this unlikely.

Final thoughts

KOF operates a monopolistic position in a highly lucrative and growing market. We believe these factors, in conjunction with its leading brands will drive future growth. Our concerns are around margin improvement and adverse FX movements; however, we believe the valuation wholly prices this in.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here