Author’s note: This article was released to CEF/ETF Income Laboratory members on May 31st.

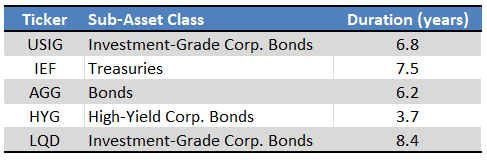

The iShares Broad USD Investment Grade Corporate Bond ETF (NASDAQ:USIG) and the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) both invest in dollar-denominated investment-grade corporate bonds. LQD is the largest, but USIG is cheaper, more diversified, and has a lower duration/interest rate risk. As such, and in my opinion, USIG is the stronger investment fund and opportunity.

USIG – Basics

- Investment Manager: BlackRock

- Underlying Index: ICE BofA US Corporate Index

- Expense Ratio: 0.04%

- Dividend Yield: 3.27%

USIG – Overview

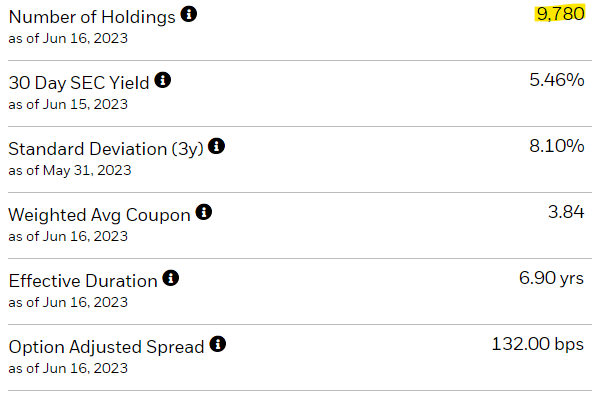

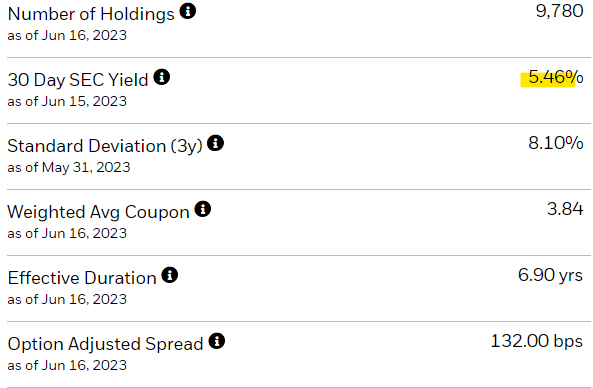

USIG is an investment-grade corporate bond ETF, tracking the ICE BofA US Corporate Index. Said index is meant to provide diversified, broad exposure to the dollar-denominated, liquid, investment-grade corporate bond market. The index is meant to be a bit broader than average, with laxer inclusion criteria. This does seem to be the case, with USIG investing in 9,780 different bonds:

USIG

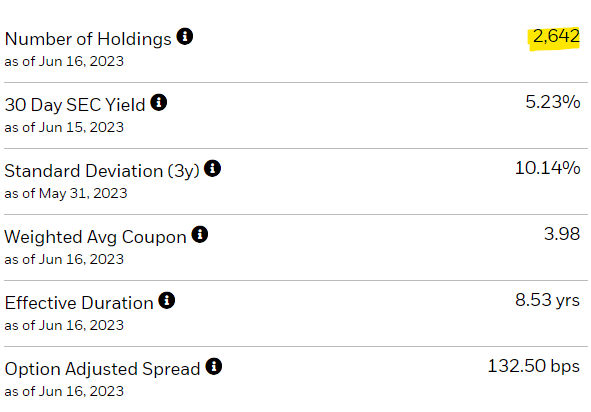

Versus 2,642 for LQD:

LQD

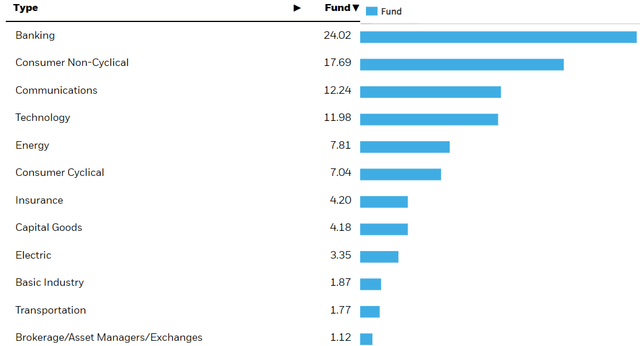

USIG is quite diversified on an industry basis, with exposure to most relevant industries. Banking is overweight, likely due to bank capital structures (tons of debt) and their strong credit ratings.

USIG

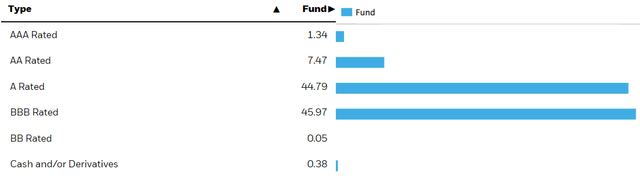

USIG focuses on investment-grade bonds with strong credit ratings. The fund is almost evenly split between A and BBB-rated bonds, with smaller allocations to AA and AAA-rated securities.

USIG

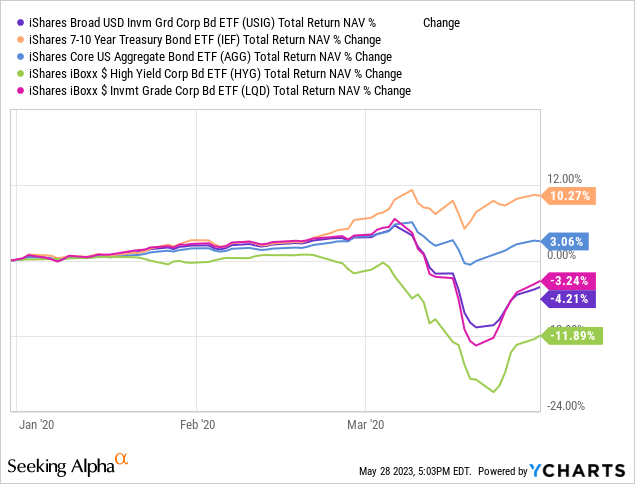

USIG’s holdings have very low default rates, and these are generally not strongly dependent or influenced by economic conditions. As such, expect relatively low losses during downturns and recessions, as was the case in 1Q2020. I’ve included other asset classes for reference.

Data by YCharts

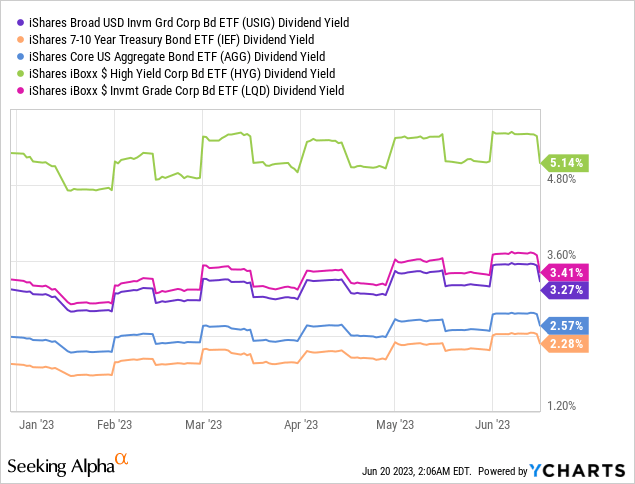

Safe investments rarely have strong yields, and that is the case for USIG, with the fund currently yielding a measly 3.3%.

On a more positive note, Fed hikes have led to higher bond yields, increasing the income generated by most bond funds. USIG’s underlying holdings currently generate 5.5% in income, as per the fund’s SEC yield.

USIG

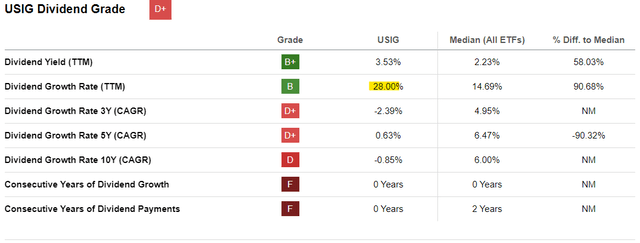

As ETFs almost always distribute any and all income generated to shareholders as dividends, USIG’s yield should increase to around 5.2% in the coming years. Fund dividends are already seeing strong growth, as expected.

Seeking Alpha

USIG currently sports a weighted average maturity of 13.1 years, and a duration of 8.4 years. Both figures are somewhat higher than average, as credit-worthy corporations took advantage of rock-bottom yields in 2020 and 2021, by issuing lots of long-term debt. Investors, including bond funds like USIG, bought these long-term bonds, hence its long average maturity and duration.

Fund Filings – Chart by Author

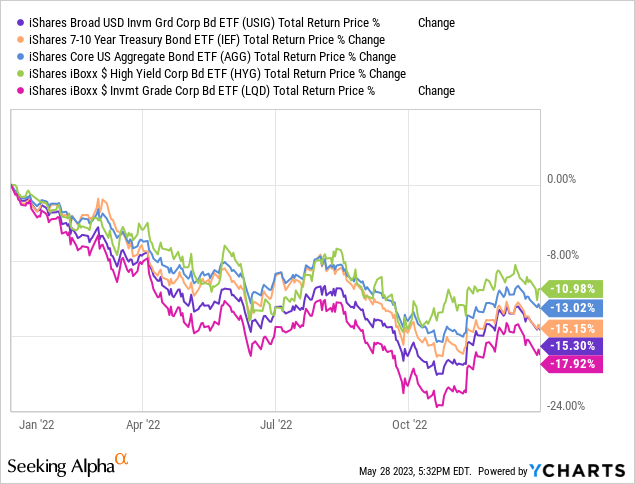

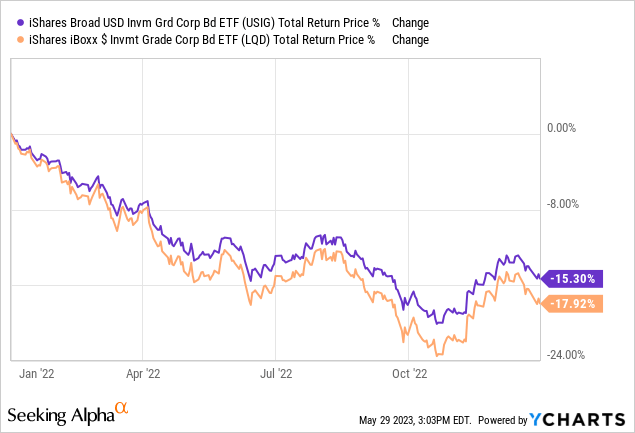

USIG’s above-average duration means above-average losses when interest rates increase, as was the case in 2022. Underperformance was quite small, however.

Data by YCharts

The flipside of the above is that USIG should see above-average gains when rates start to decrease. At the same time, USIG’s high maturity means investors can ‘lock-in’ higher interest rates for longer by investing in the fund over its peers.

USIG’s characteristics and overall value proposition are quite similar to those of LQD, the largest fund in this industry niche. USIG does have several advantages. Let’s have a quick look at these.

USIG – Advantages versus LQD

Cheaper

USIG has an expense rate of 0.04%, compared to 0.14% for LQD. USIG’s lower expenses directly increase (reduce by less) dividends and total returns, a straightforward benefit for investors. Lower expenses are particularly important insofar as they necessarily benefit investors, which is rarely the case for other things.

More Diversified

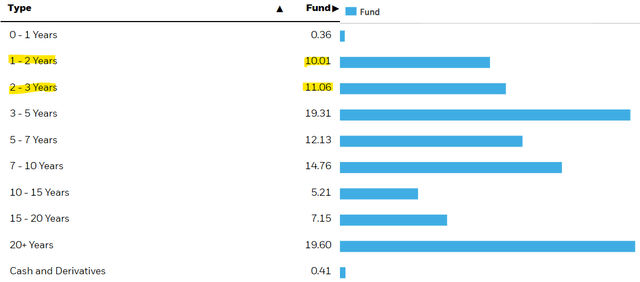

USIG is a bit more diversified than LQD, with almost 9,700 holdings versus 2,630. Greater diversification is due to laxer inclusion and exclusion standards, including the inclusion of bonds with remaining maturities of 1-3 years. These encompass around 20% of USIG’s holdings:

USIG

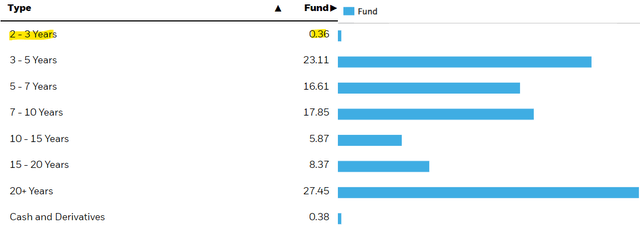

Versus effectively 0% for LQD:

LQD

USIG’s greater diversification reduces risk, volatility, and the probability / magnitude of significant losses from the default of any individual issuer.

Lower Duration/Interest Rate Risk

USIG’s greater diversification is, in part, the result of its inclusion of short-term bonds, which serves to reduce the fund’s duration. USIG currently sports an average duration of 6.8 years, versus 8.4 for LQD. Lower duration means lower interest rate risk, and lower losses/outperformance when these increase, as was the case in 2022.

Data by YCharts

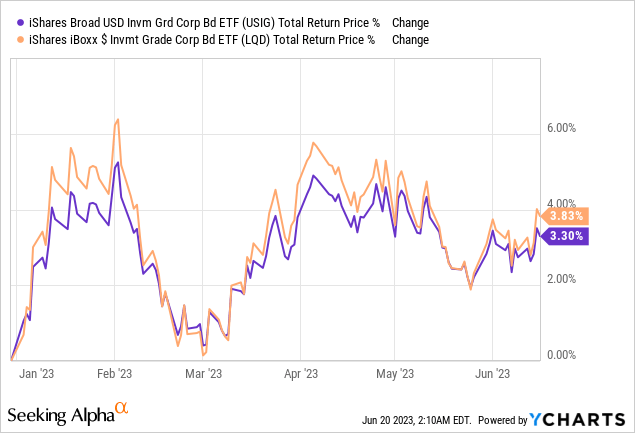

On the other hand, USIG should underperform when (investment-grade corporate bond) rates decrease, as has been the case YTD.

In my opinion, USIG’s lower duration and interest rate risk is a net benefit for investors, even though it does mean lower returns when rates decrease. The simple fact that USIG is more stable, less volatile, is a benefit, even though the stability and lower volatility does sometimes lead to lower returns.

USIG – Other Considerations

Finally, a quick look at USIG’s yield.

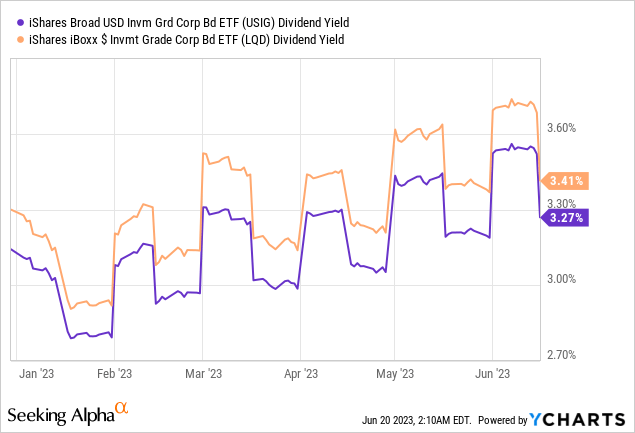

USIG currently yields a bit less than LQD.

Importantly, the lower yield is not reflective of lower underlying generation of income, with USIG sporting a 5.5% SEC yield, versus 5.2% for LQD. Meaning, USIG’s underlying holdings generate more in income than LQD’s holdings. USIG does sport a lower dividend yield, but this is almost certainly due to dividend volatility. USIG’s bonds have higher yields, and that should be reflected in the fund’s yield itself long-term. Do remember that investors are entitled to all the interest, profits, and returns generated by their investment, even if these are not reflected in the dividends themselves.

In my opinion, USIG’s higher SEC yield is more important than its lower dividend yield. Some investors might prefer LQD’s higher dividends, however, even though USIG should see higher dividends and returns moving forward.

Conclusion

USIG and LQD both invest in dollar-denominated investment-grade corporate bonds. USIG is cheaper, more diversified, and has a lower duration / interest rate risk than LQD, and so is the stronger investment opportunity, in my opinion.

Read the full article here