Shipping Equities: Selective Buying Opportunities

Although shipping equities have performed decently so far this year, sentiment has been poor for the past year with the exception of a brief tanker craze last fall. Even today, sentiment remains quite weak, as evidenced by near-record low valuations in all three picks I will cover in this report.

These picks span three different segments: dry bulk, tankers, and containerships and are curated from a broader and more diversified selection of top industry picks, which we cover closely on our Value Investor’s Edge research platform. I don’t believe in burying the lede, so today’s top picks are (in alphabetical order):

- Danaos Corp. (DAC)

- Eagle Bulk (EGLE)

- International Seaways (INSW)

I will briefly discuss the high-level bullish case for each of these stocks in the section below, but first, it’s worth reviewing the performance from our controversial bullish sector call last fall.

Recent Performance in Shipping

Last fall, I wrote a report titled “Excellent Time to Overweight Shipping”, which was highly criticized by those who expected an imminent global recession (the comments section is interesting). Of course, what the critics overlooked at the time was the excellent supply/demand balances in key segments, rock-solid balance sheets, and very attractive equity market valuations.

In the previous report, published on 26 September, I highlighted four firms:

- Genco Shipping (GNK) at $12.06

- Global Ship Lease (GSL) at $15.31

- International Seaways at $34.04

- Textainer Group (TGH) at $26.75

At the time, the S&P 500 (SPY) traded at $3,655 and is now up nearly 21% in nine months, which is quite the return! How have our shipping picks performed? Keep in mind that these were extremely controversial last fall and certainly not “popular”. As of closing prices on Friday, 16 June:

- GNK: $14.36 + $1.43 dividends = 30.9% Return

- GSL: $18.88 + $1.125 dividends = 30.7% Return

- INSW: $37.65 + $4.74 dividends = 24.5% Return

- TGH: $40.21 + $0.80 dividends = 53.3% Return

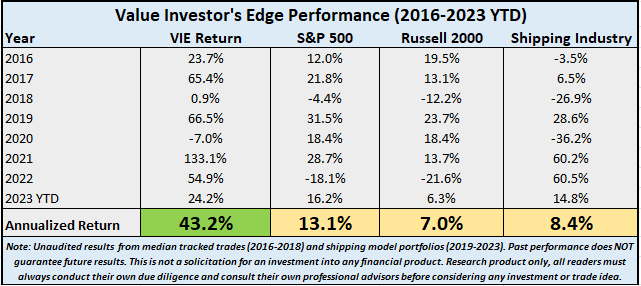

The average return from my previous top four public picks was +34.9% in nine months. Of course, past performance does not guarantee any level of future performance, but we do have a long-term track record at our service, which has driven a 43.2% IRR over the past 7.5 years:

Value Investor’s Edge

I have been following this industry for 15 years and have served as Head of Research at Value Investor’s Edge since 2015, where shipping equity research is our core competence. Our performance has been achieved by selecting only the best risk/reward positions across the various shipping sectors. We buy when others are too afraid and prefer to trim when enthusiasm gets elevated.

Why Invest in Shipping Picks Today?

I believe shipping stocks are once again offering investors an exceptional investment setup, certainly one of the best opportunities I have seen in my career. This opportunity is available because all three of the names mentioned today trade at near-record low valuations while balance sheets are pristine, shareholder returns are improving, the supply-side setup is the best in modern history for bulkers and tankers, and the locked-in cash flow is exceptional for containers.

Although the supply-side is attractive for dry bulk and amazing for tankers on its own accord, things are getting even better! The largest maritime environmental regulation in history, EEXI 2023, has recently began and comes with a multi-year phase-in period through 2027. The first year (2023) is designed to establish baselines, whereas a variety of measures including stringent carbon-emission regulations (“CII”), which will significantly slow down much of the global fleet, begin to bite in 2024, with increasing impact each year through 2027. These regulations will further constrain a supply-side which already offers the best setup in modern history for tankers and one of the best for dry bulk.

Of course, the demand-side is more volatile and uncertain. Tankers continue to benefit from the sanctions regime against Russia, but recent OPEC+ cuts overshadow the weaker global oil demand and questionable recovery into 2023. Dry bulk is heavily dependent on iron ore, coal, and grain flows and is primarily a bet on Chinese reopening. As recent macro data suggests, the Chinese reopening is off to a shaky start, which is not good for dry bulk. Unsurprisingly, dry bulk spot rates have been lackluster so far in 2023. Containerships were previously a post-COVID congestion-driven story, but the ship owners locked in multi-year charters at record rates and are now a massive free cash flow play.

There are never any guarantees in shipping! Demand-side outcomes can be finnicky and are prone to black swan events in both directions. However, the best time to get long is when valuations are cheap, balance sheets are strong, and the supply-side is lopsided in the favor of owners and investors.

As noted, this update includes three overall picks which are poised to benefit from the current environment (below in alphabetical order):

- Containers: Danaos Corp at $65.33

- Dry Bulk: Eagle Bulk at $45.31

- Tankers: International Seaways at $37.65

Brief Overview of Our Top Public Picks

I believe that the following three picks are incredibly attractive at this juncture due to discounted valuations and promising fundamental outlook due to the massive EBITDA backlog in containers, the attractive valuations in dry bulk, and the amazing supply setup in tankers.

Danaos Corp: ‘Fair Value Estimate’ of $95.00 (45% Upside)

Danaos Corp is a phenomenally valued and operationally well-managed company, but they have been a lightning rod for public criticism over the lack of sufficient buybacks and the conservative decision to not raise the regular dividend this past quarter. The net present value of contracted fleet EBITDA plus conservative demolition assumptions already results in a share valuation well north of $100/sh. With only moderate terminal valuation assumptions, our models suggest a valuation of around $130/sh.

We currently have a $95 ‘fair value estimate’ primarily due to the lack of heavy shareholder returns. However, DAC has recently resumed repurchases and a recent proxy update also suggests they have been repurchasing shares at a steady clip in Q2-23 (note the total share count below 20M on page 2). Furthermore, DAC has fully fixed their first 6 newbuilds and printed rumors suggest they have forward fixed a raft of larger ships at exceptional rates (wildly higher than we had previously modeled!). DAC is firing on all cylinders, and I maintain very strong conviction here (previous public report).

In a sort of ironic twist, a recent SEC filing shows that DAC has acquired a 10% stake in our other top pick: Eagle Bulk. Although I would rather see a more direct repurchases and/or a special dividend, I cannot argue with the merits of this investment!

Eagle Bulk: ‘Fair Value Estimate’ of $60.00 (32% Upside)

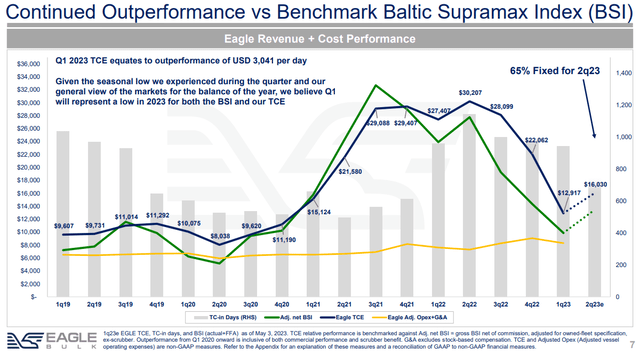

Eagle Bulk is a very well managed midsize dry bulk play with exceptional corporate governance. The current spot rates are challenging, but EGLE manages to heavily outperform its index comps due to its high-spec fleet which also have exhaust gas scrubbers.

Eagle Bulk

EGLE earns top markets for solid corporate governance with a US-headquarters and independent Board structure. CEO Gary Vogel provides solid leadership and is accessible to investors. He has participated in several interviews (latest from January 2023) at Value Investor’s Edge as well as in other forums.

As mentioned above, even Danaos Corp. management recognizes the value in EGLE shares. That is quite the endorsement!

International Seaways : ‘Fair Value Estimate’ of $55.00 (46% Upside)

International Seaways is in the sweet spot of the tanker market with a nice balance of both crude and product tankers. INSW has a very clean balance sheet and has recently pivoted towards larger shareholder returns, including a $60M repurchase program and three back-to-back special dividends of $1.00, $1.88, and $1.50 respectively.

INSW has a solid management team, great market exposure, and is shifting towards higher shareholder returns, yet the stock continues to trade at a discount to most peers. To make matters more interesting, legendary tanker investor John Fredriksen of Frontline (FRO) has recently taken a large activist stake and is clamoring for change. Although I believe INSW is well managed and I am very pleased with their operational results, a competent activist investor is a clear positive here and investors have the opportunity to invest along Fredriksen at a significant discount to current net asset value, which we currently estimate at roughly $56/sh.

Selective Shipping Picks Poised to Outperform

The best time to buy shipping stocks is when there is a significant disconnect between share price valuations and underlying segment fundamentals. This typically occurs when the global macro situation is uncertain because generalist investors often associate shipping as a proxy to global growth without understanding the actual supply/demand dynamics.

While future returns can never be guaranteed, and shipping stocks will likely remain very volatile over the near and medium term, I believe the risk/reward setup is exceptional for these selective names. I have recently been adding to selective shipping positions, and I look forward to continued significant market outperformance.

Read the full article here