The latest Tesla (TSLA) production and delivery data is out, and it is far below expectations. This is what the numbers mean for investors.

Tesla built 1.37 million electric vehicles during 2022, a significant miss to its internal target of 50% growth. Worldwide deliveries during the quarter also fell short of forecasts.

Bears should not get too excited, though. A big rally is likely, soon.

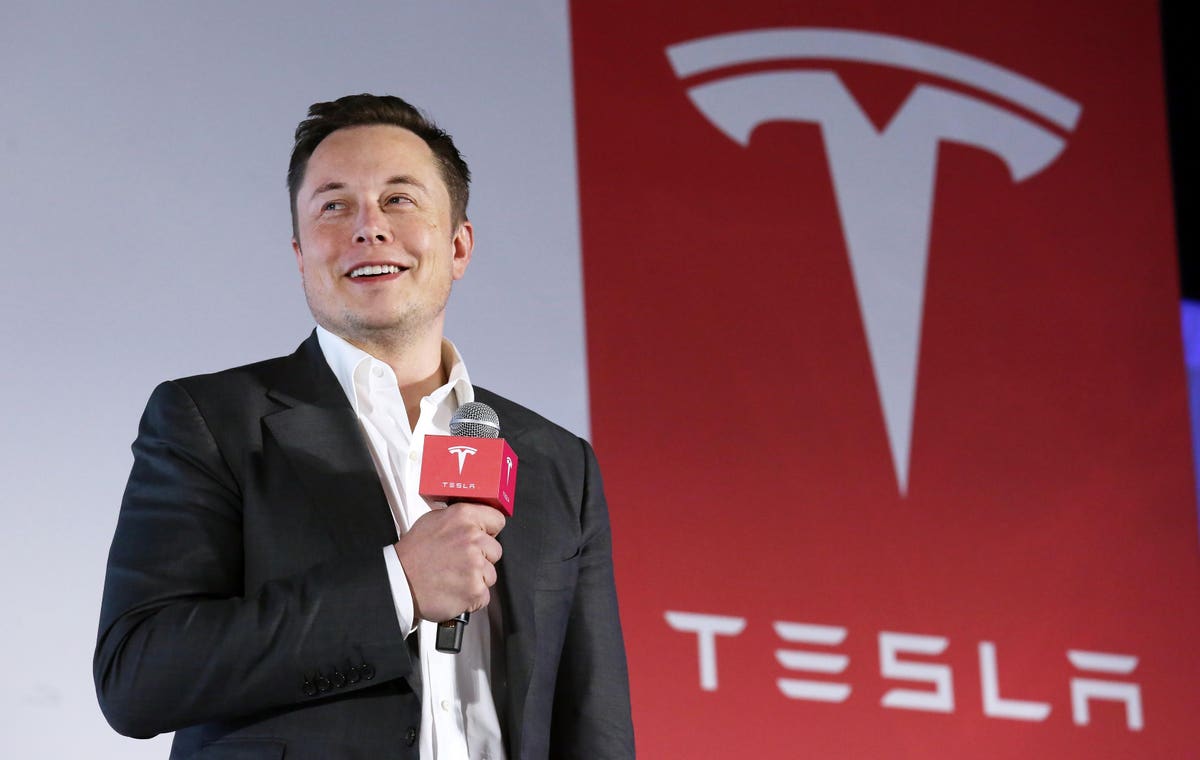

Since Elon Musk announced in April that he was interested in buying Twitter, Tesla shares have been reeling. The problem is not the distraction of running another public company, although that narrative has not helped, either. The real issue for shareholders of the EV maker is the hit to Elon Musk’s pristine reputation as an innovator.

Tesla has always been about Musk. From its initial public offering in 2010, investors have been willing to look past losses, new share offerings, and perilous investments in new factories because Mush secured a premium as a gifted chief executive officer. Within a decade Tesla overcame Toyota (TM) to become the most valuable automobile company in the world. And SpaceX, his Austin, Tex.-based rocket company, changed the economics of the aerospace sector with reusable rockets. Musk seemed to have the Midas touch.

Twitter shattered that illusion of excellence.

Beginning with the initial $44 billion bid, his botched attempted withdrawal, and later acquisition, the Twitter buyout has taken on an air of incompetence. In fairness, Twitter was a terrible business long before Musk ever expressed interest in buying the social media platform. It was never profitable, and largely a destination for impolite online arguments, and automated spam bots. The operational changes made so far by Musk have made Twitter only modestly more terrible.

However, the process has turned Musk into a more polarizing figure. His accomplishments, helping the world transition more quickly sustainable fuel sources, or upending the aerospace business have been routinely diminished by biased critics. Worse, his lofty ambitions have been summarily categorized as opportunistic lies.

Tesla shareholders have paid the price.

The stock is down from $328.33 on April 14, when Musk launched his bid for Twitter, to $123.18 at the close of 2022. The 2022 production, and fourth quarter deliveries data will give bears even more ammunition to pummel shares. Bears will be able to advance the narrative that demand for EVs is drying up. They will argue that expensive new production facilities in Austin, Tex., and Brandenburg, Germany will soon become liabilities, sucking up cash. Some of this will stick.

However, bears have their problems, too.

Most of Tesla’s near term demand issues are being caused by tax incentives. Those enticements are going away during 2023 in China, the world’s biggest new car market, and they are being phased-in stateside. Beginning January 1, 2023, American buyers of some new Teslas will begin receiving a $7,500 tax credit. It’s a reasonable assumption that many buyers put off orders until the new year. It’s also reasonable that all of the gloom about demand will subside in the weeks ahead as those orders flood-in.

Despite the prospect of tax incentives, during the fourth quarter Tesla still delivered 405,278 vehicles, against production of 439,701 units. Both of these figures set new records, representing year-over-year gains of 24.7% and 30%, respectively. Unfortunately, the median expectation by analyst for deliveries was 427,000, according to FactSet.

At a share price of $123.18, Tesla now trades at 23.2x forward earnings and 5.2x sales. These financial metrics are compelling entry points given the longer-term prospects for EVs, and Tesla’s considerable lead over the competition.

That said, new trades here are not for the faint of heart. There is resistance in the $160 level and support in $108, the recent low. I fully expect a bounce toward that level over the next several months.

Investing can be intimidating, but it doesn’t have to be. Let us be your guide to profitable investing with our Strategic Advantage newsletter. Join us for a $1 trial and see for yourself!

Read the full article here