NatWest Group Plc (NYSE:NWG) offers a dividend yield above 5% based on ordinary dividends, but this is below its peer’s average and there are better alternatives within the European banking sector.

Company Overview

NatWest Group (formerly Royal Bank of Scotland) provides several financial services and products in the U.K., being one of the oldest banks in Europe. It’s also one of the largest banks in the region, measured by total assets of $890 billion at the end of last March. Its current market value is about $29 billion and its shares trade in the U.S. on the New York Stock Exchange.

NatWest was one of the European banks most affected by the global financial crisis of 2008-09, receiving at the time a state bailout of around $60 billion to stay afloat. While the British government has reduced its stake several times over the past few years, it’s still the bank’s largest shareholder with a stake of 38.8%. This stake is expected to be gradually reduced in the near future, even though at NatWest’s current share price, the government will book a loss on its disposal.

NatWest’s business profile is highly geared to the banking segment, offering retail, commercial, and institutional banking products and services, being currently divided into three main business units: Retail Banking, Private Banking, and Commercial & Institutional Banking.

Measured by revenues, its largest segment is Commercial & Institutional with a weight of 51%, followed by Retail Banking (41%), while Private Banking only represents some 8% of total revenue. Geographically, the bank is greatly concentrated in its domestic market, a profile that is not expected to change much in the foreseeable future.

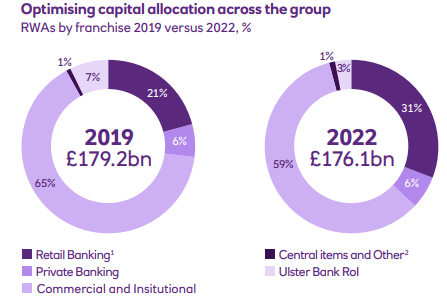

Over the past few years, the bank’s strategy has been to allocate more capital toward retail banking and reduce its exposure to more volatile activities related to capital markets, reducing risk-weighted assets (and capital allocated) to institutional banking as shown in the next graph.

RWAs (NatWest)

Additionally, NatWest has also pursued a balance sheet de-risking strategy, increasing the share of low-risk products in its loan book, namely by increasing the weight of mortgages in its loan book. Furthermore, it has relatively low exposure to unsecured personal lending, such as credit cards, given that at the end of last March some 93% of its personal loans were secured.

This means that NatWest has nowadays a relatively low-risk business profile, a situation that is not expected to change much in the coming years as the bank’s growth strategy is mainly organic across its existing business segments.

Financial Overview

Regarding its financial performance, NatWest’s financial performance has improved in recent years, as the bank evolved from a restructuring phase to seek higher levels of profitability. While its growth prospects are relatively muted due to its large exposure to its domestic market, which is mature and has fierce competition due to several challenger banks offering competitive products in the banking market, making market share gains hard to achieve.

Nevertheless, NatWest’s revenues and earnings have been supported by rising rates over the past few quarters, a trend that is likely to persist for some more time as the Bank of England hasn’t reached yet its peak rate. Indeed, the central bank’s key rate is currently at 4.5% and, according to economists’ estimates, it should peak at 5% during Q3 2023, thus higher rates should continue to boost NatWest’s net interest income (NII) for a few more couple of quarters.

In 2022, NatWest’s NII increased by 31.7% YoY to $12.7 billion, boosted by rising rates, while fees & commissions also had a good performance rising by 18.9% YoY to $4.1 billion. This means that NatWest is quite exposed to interest rates, considering that some 76% of revenues come from NII, being among the European banks with higher exposure to rates.

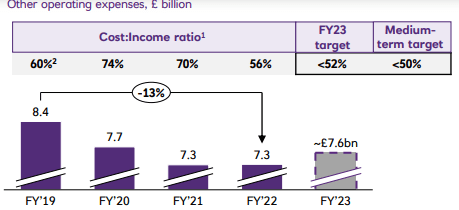

Regarding costs, total operating expenses amounted to nearly $9.9 billion, a decrease of 0.9% YoY, showing very good cost control during an inflationary environment. The combination of rapidly increasing revenues and slightly lower operating expenses led to a significant improvement in efficiency, a trend that is expected to continue in 2023.

Cost-to-income ratio (NatWest)

Credit quality also improved last year, given that its loan loss ratio decreased to only nine basis points (vs. 32 bps in 2021), being another positive factor for earnings growth. Supported by rising rates, lower costs and risk provisions, NatWest’s net income increased by 33.5% YoY to more than $6.5 billion, and its return on tangible equity (RoTE) ratio was 12.3% (vs. 9.4% in 2021).

During the first three months of 2023, the bank maintained a good operating momentum even though its growth on a quarterly basis was much softer than in previous quarters. Indeed, while Q1 revenues increased by 28.9% YoY to nearly $5 billion, compared to the previous quarter the increase was only 4.5%. This is justified by stable NII, due to higher deposits costs that offset higher lending margins in the quarter.

On the other hand, operating expenses decreased by 7% compared to the previous quarter and credit costs remained at quite low levels, which are a strong support for earnings growth. Its net profit in Q1 was above $1.5 billion (up by 1.3% QoQ and 52% YoY), while its RoTE ratio was 19.8%. This level of profitability is quite high and above the bank’s medium-term target of 14-16%.

For the full year, NatWest’s guidance is to report total revenues of about $19 billion (+11% YoY), achieve a cost-to-income ratio around 52% (vs. 56% in 2022), while credit costs should be between 20-30 bps (vs. 7 bps in Q1). This means the bank is expecting credit quality to deteriorate a little bit due to higher rates and the economic slowdown, something that so far has not yet happened.

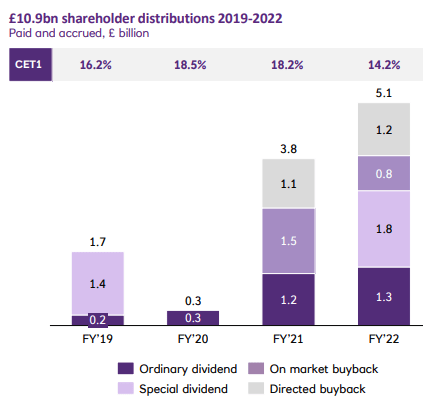

Regarding its capital position, NatWest is very well capitalized considering that its CET1 ratio was 14.4% at the end of last March, which is above its own target range of 13-14%. As the bank has a good capital generation capacity, this means it can distribute a good part of its earnings to shareholders, given that the bank is not pursuing significant acquisitions and doesn’t need to build-up its capital position.

Indeed, this has been the bank’s strategy over the past couple of years, both through dividends and share buybacks, returning close to $14 billion in capital to shareholders from 2019-22.

Capital returns (NatWest)

NatWest has gradually increased its ordinary dividend, plus it also distributed a special dividend last year and has repurchases its own shares, to total distribution of $6.5 billion related to 2022 earnings. This is a total payout of close to 100%, showing that NatWest is clearly committed to distribute most of its earnings to shareholders.

Considering only its ordinary dividend, which has a semi-annual frequency, its last annual dividend was $0.35 per share which, at its current share price, leads to a dividend yield of about 5.2%. On top of that, the bank distributed a special dividend and it may decide again to do it in the future, but for long-term investors the ordinary dividend is what should be considered as ‘recurring’.

Due to a favorable operating backdrop, its dividend is expected to grow gradually in the coming years, but NatWest is not expected to change much is dividend policy in the near future, thus its dividend yield based on ordinary dividends is likely to remain at average levels within the European banking sector for the time being.

Conclusion

NatWest has made a significant business overhaul in recent years and has nowadays a stronger business profile, but its high exposure to the domestic market and relatively weak growth prospects are two major drawbacks.

While the bank’s dividend yield is attractive, it’s below the European banking sector average (around 6%) and dividend growth prospects aren’t much impressive. Therefore, I see Intesa (OTCPK:ISNPY) as a better income investment right now, as I’ve analyzed recently.

Read the full article here