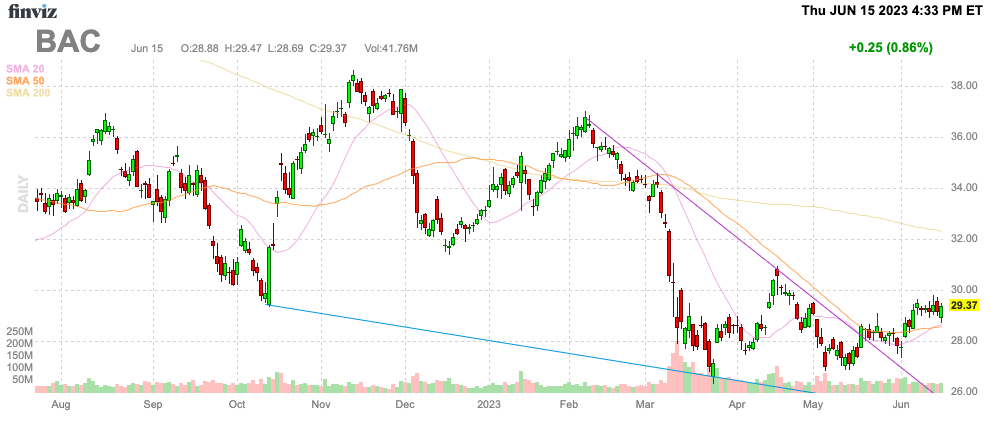

The banking sector is one of those sectors where the benefits seem to always turn into perceived negatives. Bank of America Corporation (NYSE:BAC) aka BoA was set to benefit dramatically from higher interest rates, at least until the large bank became perceived as being harmed from the higher costs of deposits linked to customers desire for higher rates. My investment thesis is ultra Bullish on the stock after the dip back below $30 despite the greatly reduced analyst expectations.

Source: Finviz

No Deposit Crisis

The banking sector ran into a crisis in the regional sector earlier this year. The crisis appears to have mostly passed, and the Fed pausing on interest rate hikes after 500 basis points of hikes this cycle should help the sector stabilize going forward, though the biggest risk to BoA is likely the demand for higher deposit rates.

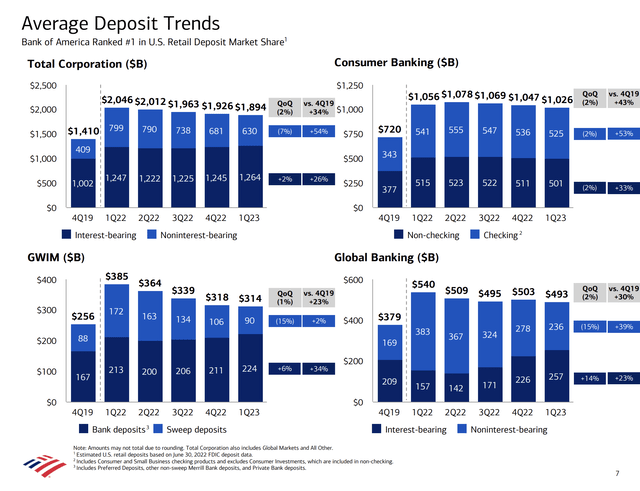

The company has done a great job of pushing back on this fear, though. BoA ended Q1 with total deposits of $1.9 trillion, far above the pre-covid levels of only $1.4 trillion.

Source: BoA Q1’23 presentation

The amazing part of what the market doesn’t really understand is that the large bank has $630 million worth of deposits in non-interest bearing accounts. The bank has millions of accounts, and all of those customers need a certain balance level for transactions.

The Consumer Banking segment has $1.05 trillion of those deposits, paying a meager rate of 12 bps. The amount increased 6 bps from the prior quarter, and with ~50% of deposits in interest bearing accounts, BoA is only paying 24 bps on these deposits. Smaller banks have offered much higher interest rates to entice customer balances, yet limited amounts have moved.

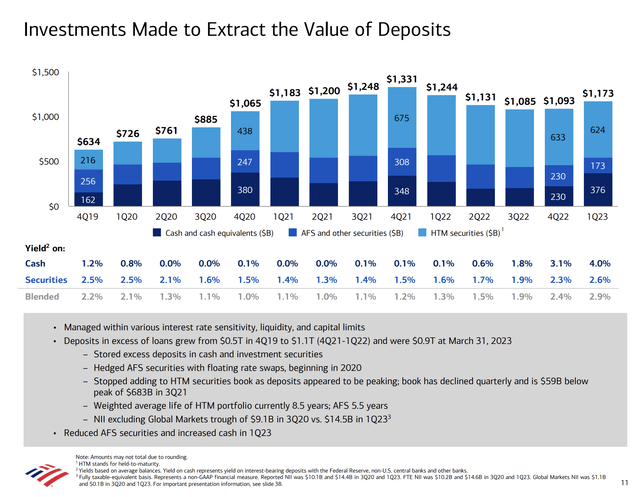

The large bank ended Q1’23 with excess deposits to the extreme. BoA has $0.9 trillion in excess deposits, requiring the money to be invested in order to extract value.

Source: BoA Q1’23 presentation

Said another way, BoA doesn’t need to chase these deposits at 4% costs. The bank currently earns a 2.9% blended yield on the investments on these excess deposits, so the bank has no need to chase those deposits.

The company has HTM securities only yielding 2.6%, but risks aren’t high here with BoA not needing to sell these securities. The Fed pausing on rate hikes and likely done provides more support for these securities to run off as they mature.

At the Bernstein conference, CEO Brian Moynihan again confirmed the company isn’t chasing despots with higher rates:

It really is mix in what you need it for. So, the idea of chasing balances with higher rates when you really don’t have anything to do with the money.

Cheap Again

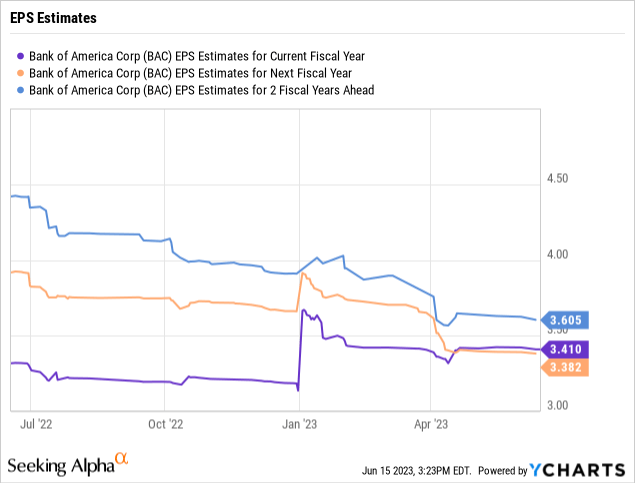

BoA definitely faces a tough economy ahead, with a potential recession and lower income. The company guided to a ~2% dip in net interest income for Q2.

The consensus analyst estimates appear very conservative at $3.39 for the year, after BoA earned $0.94 during Q1. The bank could face some steep profit dips the rest of the year, with consensus EPS targets dipping below $0.80 for Q4’23 and Q1’24.

The company regularly repurchases shares, with a reduction of nearly 100 million shares in the last year. The large bank faces a capital requirement of 10.9%, while BoA sits at 11.4% CET1 levels following Q1 providing plenty of excess capital going forward, especially on additional profits.

The large bank spent $2.2 billion on stock buybacks during Q1, and investors sure hope BoA is more aggressive during Q2, with the stock dipping below $30. The market cap is down to only $232 billion, so each $2.3 billion worth of buybacks here will cut share counts by 1% while the large bank already pays a solid dividend yield of 3%.

BoA shouldn’t trade below 9x forward EPS targets again, but investors should be rewarded with high capital returns compared to the market cap at these levels. A long-term investor can’t really complain about strong outstanding share reductions on dips in the stock price.

Takeaway

The key investor takeaway is that Bank of America Corporation stock is just too cheap here. The large bank faces a tough economic climate, but the market is far off base, fearing the deposit position here.

Investors should use the recent weakness with BAC stock trading near yearly lows, while the bank should ultimately benefit from higher interest rate levels going forward.

Read the full article here