It’s always nice to see validation from the market with a higher price on a stock that you own. However, a more expensive stock price usually doesn’t benefit a traditional corporation unless if it has plans to raise capital, which is generally not the case for most established companies.

On the other hand, higher stock prices can be great for REITs, since there are almost always good opportunities to put freshly raised capital to work through property acquisitions. That’s because a decent valuation results in a low cost of equity, which can be used to fund accretive growth.

This brings me to Getty Realty (NYSE:GTY), which I last covered here back in January, highlighting its strong acquisition strategy. In this article, I discuss recent developments and provide an updated recommendation on the stock, so let’s get started.

Why GTY?

Getty Realty is a self-managed net lease REIT that’s focused on owning and acquiring automotive service-related properties. It has a $2.3 billion enterprise value and at present has 1,047 properties spread across the 39 U.S. states and Washington D.C. 70% of its properties are located in higher foot traffic corner locations and 64% are in the top 50 MSAs in the U.S. Moreover,

What gives GTY a competitive edge is its size as the largest institutional player in a fragmented space that’s comprised primarily of mom-and-pop and small private owners. This means that GTY faces low competition for deals and can leverage its low cost of capital to fund deals.

Over the years, GTY has put together a solid portfolio that barely blinked in 2020 during the pandemic, when retail real estate fell on hard times. Its portfolio is 99.7% occupied with full rent collection, and tenants on average have strong 2.7x rent coverage. This combined with strategic and accretive acquisitions have enabled GTY to deliver 5.2% AFFO/share CAGR since 2015.

Meanwhile, GTY continues to grow by adding higher growth potential property types. This includes the acquisition of eight car washes and one convenience store during the first quarter for $48 million. Furthermore, it acquired four under-construction car washes and advanced construction loans totaling $8.5 million for 13 new car washes and conveniences stores.

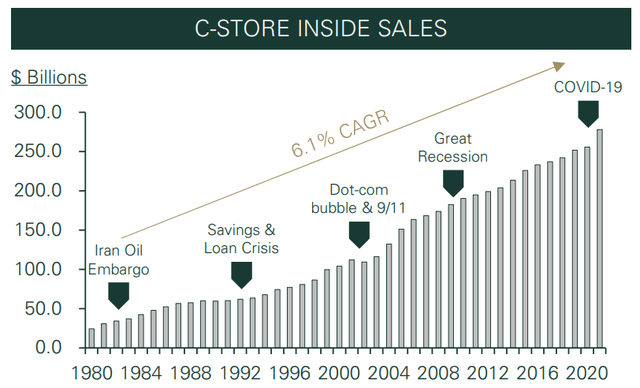

In total gas/convenience store and car washes now make up 85% of GTY’s portfolio, while legacy gas and repair shops have now declined to 10% of the portfolio. This bodes well for GTY’s future, as convenience store sales have demonstrated their “all-weather” characteristics, rising nearly every year since 1980 through a number of economic shocks, as shown below.

Investor Presentation

Meanwhile, GTY has continued to demonstrate strong growth characteristics, with 7.7% AFFO per share growth during the first quarter, driven by rents on newly acquired properties and contractual rent increases on existing properties.

GTY’s elevated share price compared to where it was a year ago is also a strong benefit. That’s because at its current price of $34.61, it carries a forward P/FFO of 16.4, which translates to a 6.1% cost of equity. This combined with its 3.9% weighted average interest rate results in a materially lower weighted average cost of capital compared to the 7.2% initial cash yield on newly acquired properties during Q1.

Looking ahead, GTY should be able to continue to drive accretive growth, as it had $145 million of unsettled forward equity directly after the close of Q1. It also maintains plenty of balance sheet capacity, as it carries a low net debt to EBITDA ratio of 3.8x and a BBB- investment grade credit rating from Fitch. This lends support to the 5% dividend yield, which is well protected by a 77% payout ratio based on the midpoint of management’s AFFO/share guidance of $2.23.

Admittedly, GTY isn’t as cheap as it was last year. At its current price of $34.61, it carries a forward P/AFFO of 15.5 which is not cheap, but not expensive either. With its cost of equity sitting comfortably below initial cash yields on acquisitions, GTY could reasonably have mid-single digit annual AFFO/share growth, which combined with the 5% dividend yield could result in ~10% annual returns.

Investor Takeaway

Overall, Getty Realty looks poised to continue to drive accretive growth, while providing investors with a solid and well-covered 5% dividend yield. While the stock is not cheap, it’s reasonably priced given its low cost of equity and strong balance sheet capacity to fund its investment pipeline. As such, GTY investors could see a long-term total return that closely aligns with that of the historical S&P 500 (SPY), with a far higher dividend yield to boot.

Read the full article here