Investment Summary

California Resources Corporation (NYSE:CRC) is an energy company that specializes in the exploration, production, and development of oil and natural gas. With a strong presence in the energy sector, the company plays a significant role in meeting the growing demand for energy resources. With its operations in California, the company does face some challenges given the push for renewables the state incentivizes.

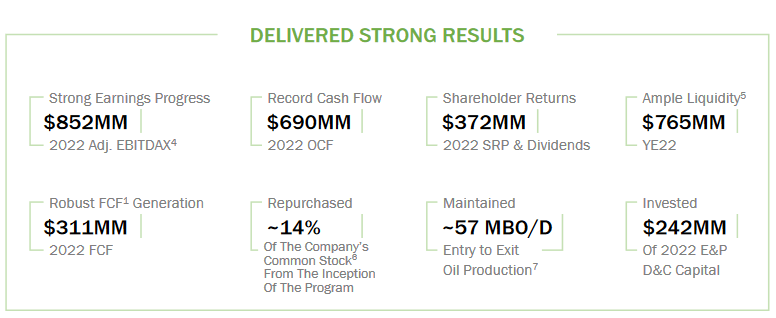

Earnings Results (Earnings Presentation)

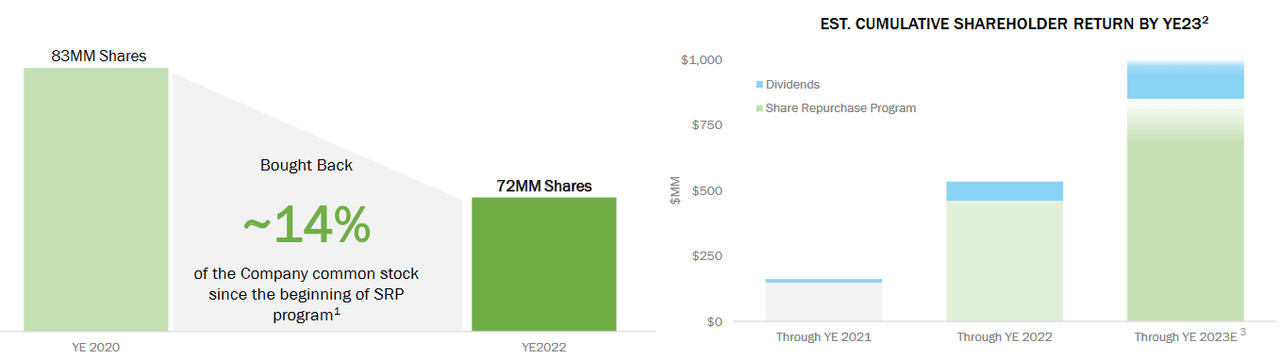

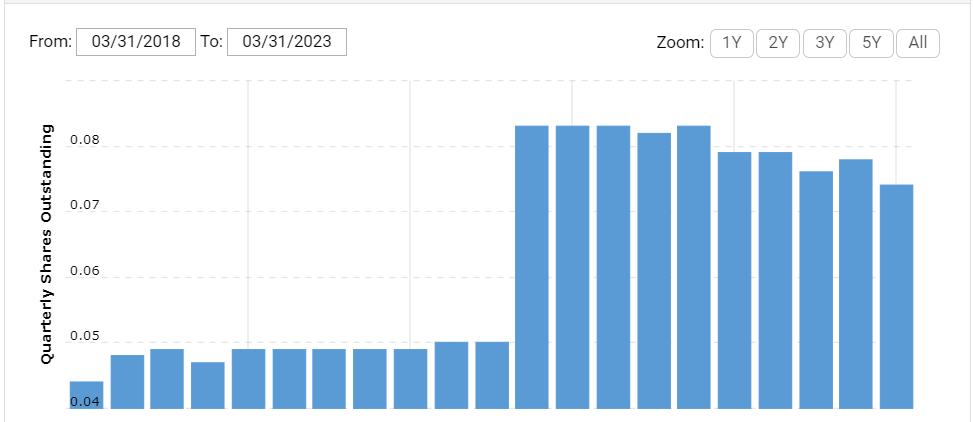

This hasn’t stopped the company from generating record cash flows in 2022 for example, which helped return plenty of value to shareholders through buybacks. In just 2022 CRC repurchased 14% of the outstanding shares, but it hasn’t really been reflected in the share price, from the beginning of 2022 the price is down around 7 – 8%. I think that despite the challenges the company is facing in the state, the long-term demand and necessity that is the oil and gas industry helps trump the sell case here. The company clearly has the shareholders in mind when spending cash flows. I think CRC is a buy at these levels, and the value to be had here is still very intriguing.

The Necessity Of Oil And Gas

The complete transition away from oil and natural gas is unlikely to occur in the near future, as it depends on significant shifts in major trends. However, it is worth noting that renewable energy sources are gaining traction and playing an increasingly important role in the global energy mix. While natural gas continues to show growth in the US, there is also a growing focus on the development and adoption of cleaner and more sustainable energy solutions to address environmental concerns and promote a greener society. But demand for oil for example is still very much strong and the likelihood of needing to increase production to help supply demand is very high in my opinion.

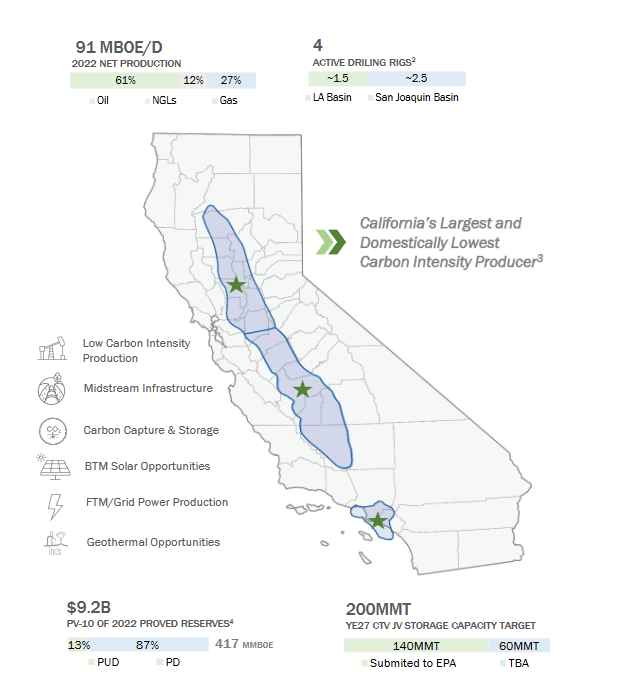

Market Position (Investor Presentation)

Even though CRC generates nearly 50% of its revenues through oil, they are increasingly pushing for other sources too. The company has been investing in increasing its capabilities within other parts of energy generation. But a notable partnership that happened last year with Brookfield Renewable (BEP) is investing $500 million into CCS projects that are related to some of the areas that CRC has, like Elk Hills Field. If successful, BEP could invest another $1 billion and help CRC become a leader in carbon capture in the region. With CCS projects becoming increasingly more and more popular, the incentives for companies to become established in the space already now is very high. Within California, there is a tax credit of $50 per ton of CO2 captured and permanently stored. In the meantime, however, I think CRC will be able to generate strong revenues and cash flows for many years to come.

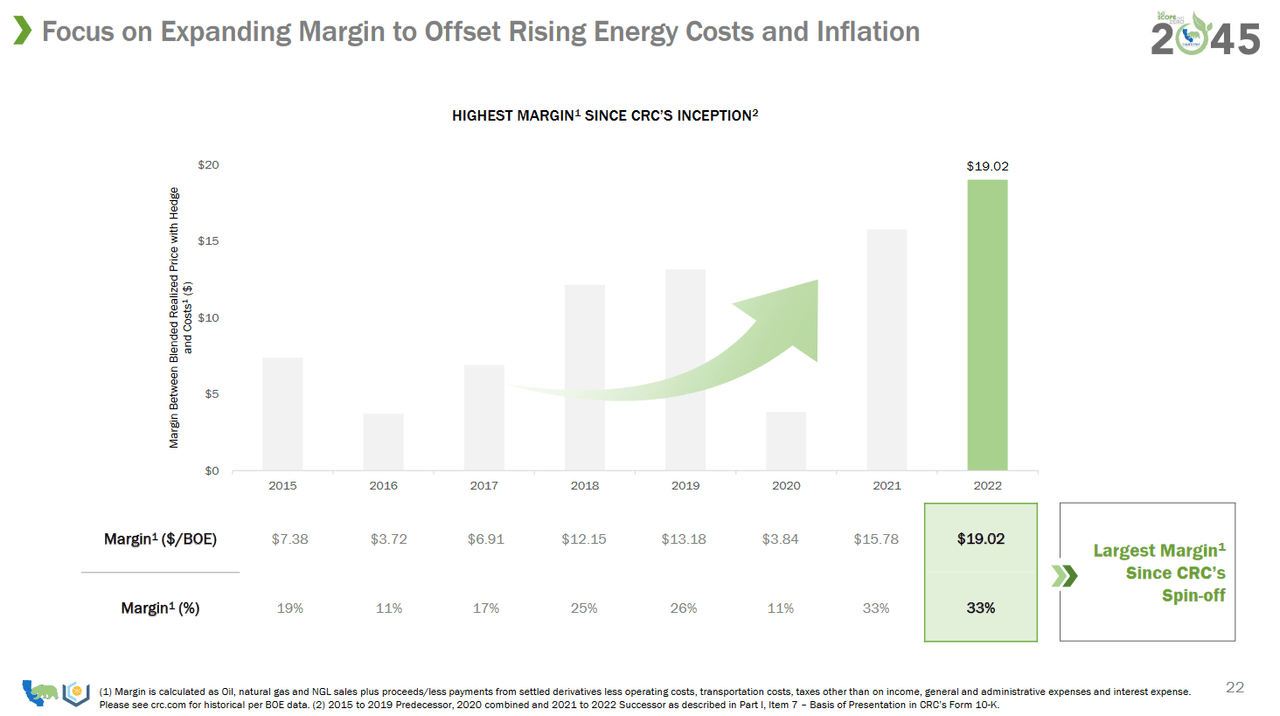

Margin Expansion (Investor Presentation)

The focus on increasing the margins will benefit the company greatly as cash flows will stay relevant, and the buybacks can continue and raising the dividend might be possible too. The company even raised the guidance for 2023 with cash flows as a result of the solid start they had to the year. For 2023, FCF is expected to come in between $360 – $470 million. Above the 2022 levels of $311 million. Oil prices seem to remain on an uptrend, which will of course benefit CRC.

Shareholder Return (Investor Presentation)

Much of the value I think we will have going forward is benefiting from the company’s ability to still buy back shares and distribute the dividend. The likelihood of a vast jump up in revenues I don’t think will come until the CCS projects mentioned earlier start to come online, which is still a few years out it seems. With a market cap of around $2.8 billion currently, the company has the ability to keep buying back around 12% of the shares outstanding if they used all of their low-end estimated FCF for 2023. I don’t think that would be wise, keeping some for investments is wise too, but it highlights the value that can still be extracted here as an investor.

Risks

The primary risks facing the company I think are the regulations that are in place in California. CRC has noted they need to improve margins to help battle the taxes and costs that are added on when operating in California to help keep FCF robust.

Shares Outstanding (Macrotrends)

The buy case for me here is that I think the company still has the potential of generating strong cash flows, especially when they are investing in CCS projects now to get ahead of the curve. But if there is a clear sign margin are slipping for the company, the buy case here will quite quickly disappear. With CRC also investing in solar, they are trying to offset some of the risks that are associated with being an otherwise pure oil or natural gas company. They have 39 MW of BTM projects in development currently and if these prove successful the risks with the company are lessened as it presents them with a different opportunity to generate revenues, and in a more state-friendly way too.

Financials

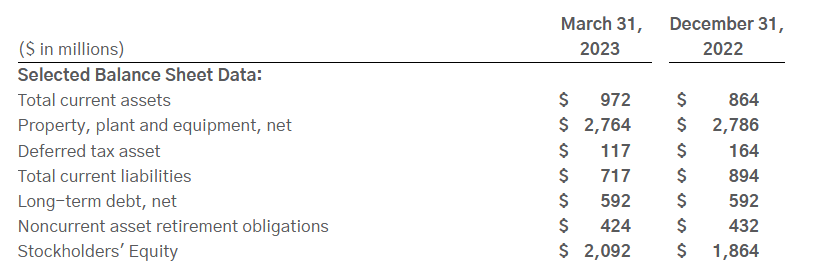

Right now, I think the financials of CRC remain very solid. With a cash position nearing $500 million, they can pay off a significant portion of their long-term debts of $592 million. What is very reassuring is the company has over the last few years placed a very big focus on growing its cash position. Going back to 2019 the company had only $17 million in cash, whilst still generating $290 million in levered FCF. This shift is great to see, and it will help cushion the company if they are faced with unexpected expenses. But also leaves them able to invest in projects like solar, which I mentioned before.

Balance Sheet (Earnings Report)

Besides the growing cash position, the company hasn’t increased its long-term debts on a QoQ basis. Looking back, CRC had large amounts of debts in 2018, nearing $3 billion, but the management has taken big steps to help pay back a lot of this to bring more stability to the balance sheet. In my opinion, I wouldn’t view it as necessary that bad if the debts increased further from here, in the spirit of using it to invest further into CCS projects.

With a net debt/EBITDA ratio of just 0.12, they have a lot of room to play with and can be more aggressive in their investments and ventures of taking on further debt. All in all, though, I think the numbers I have highlighted and the tone I have had regarding the financials says I believe them to be very strong currently. I don’t see CRC facing any difficulties in this way that would impact the buybacks or the dividends. The long-term debt seems very manageable and leaves the company in a flexible financial position.

Valuation & Wrap Up

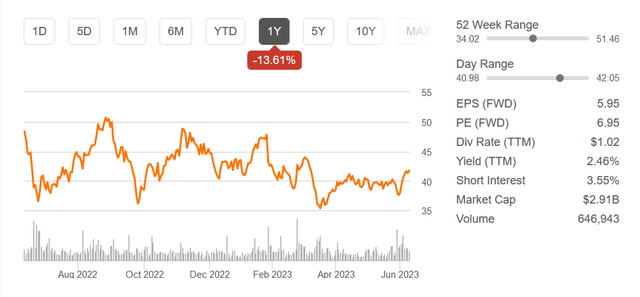

To conclude the article a little, I think that CRC right now is a buy. Paying around 6x forward earnings seems very fair to me, given they are buying back shares at a very strong rate and still are able to maintain a decent dividend yield of 2.59%. The balance sheet that the company has is solid, and I see them able to even raise the dividend whilst taking on more debts to finance CCS projects or solar installations.

Stock Chart (Seeking Alpha)

The most prominent benefit I see with CRC compared to other larger or more established energy companies niched towards oil and gas is the market position that CRC has in California. The state is a major spot for energy opportunities and the push towards renewables can, instead of being a hurdle, be a tailwind for CRC if they play it right. The current share prices offer an upside of around 20% as I think worthy earnings multiple for CRC would be around 8, the same as the sector, and using the 2023 EPS estimate of $5.95. But the regulations facing the company and the state they are in could be the reason for the lower valuation. Despite that, I view them as a solid investment and will be rating them a buy.

Read the full article here