It is a popular delusion that the government wastes vast amounts of money through inefficiency and sloth. Enormous effort and elaborate planning are required to waste this much money.”― P.J. O’Rourke.

Today, we put Construction Partners, Inc. (NASDAQ:ROAD) in the spotlight for the first time. The shares of this infrastructure play have performed well over the past year and have benefited from the massive amount of infrastructure spending Congress approved in 2022. The stock is up a bit over 15% here in 2023 to date. Will the rally continue? An analysis follows below.

Seeing Alpha

Company Overview:

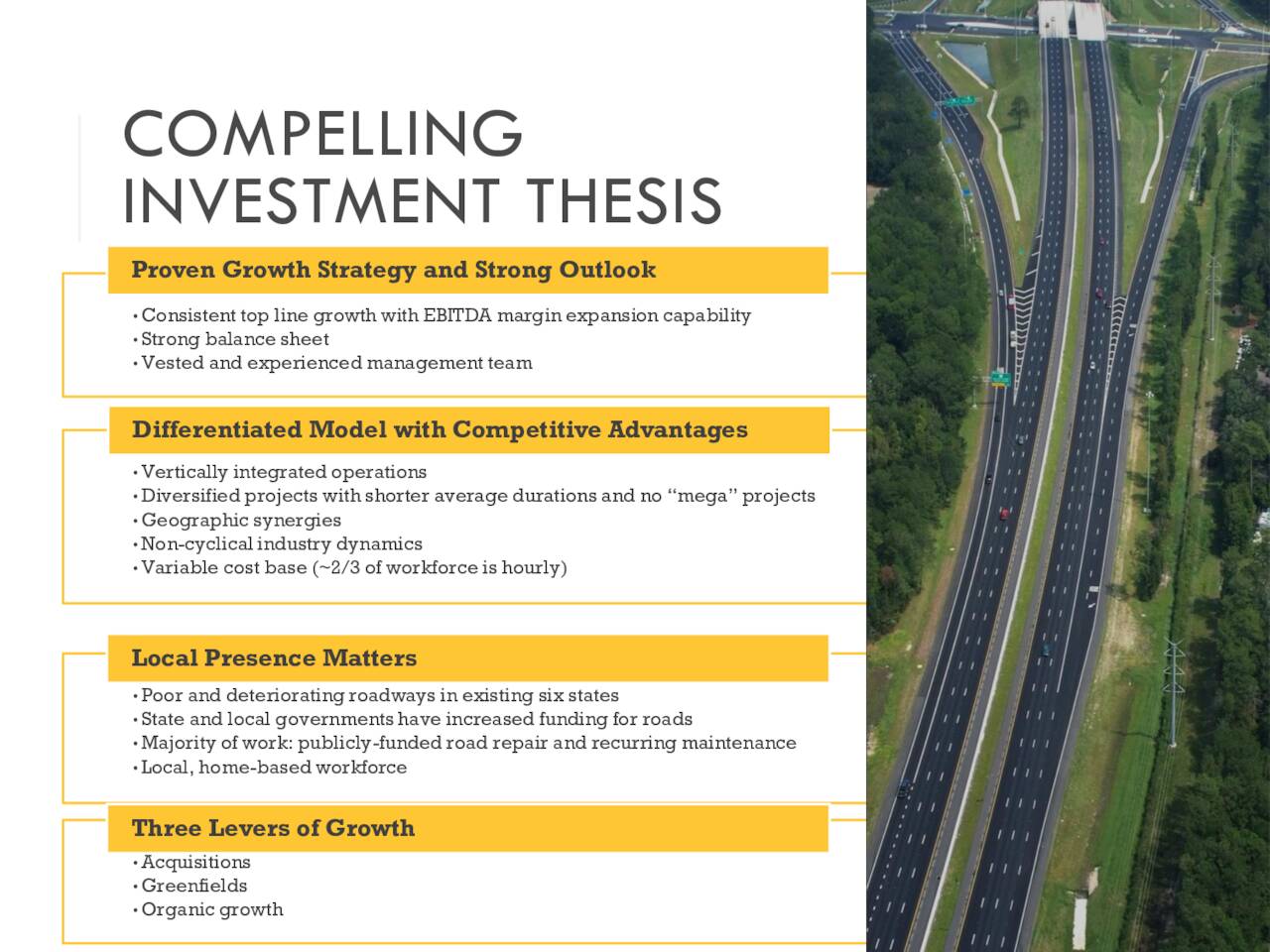

Civil infrastructure company Construction Partners, Inc. is based in Dothan, AL. The company engages in the construction and maintenance of roadways across Alabama, Florida, Georgia, North Carolina, and South Carolina. The type of projects Construction Partners takes on include highways, roads, bridges, airports, and commercial and residential developments. The stock trades just under $31.00 a share and sports an approximate market capitalization $1.6 billion. The company’s fiscal year begins on October 1st.

November Company Presentation

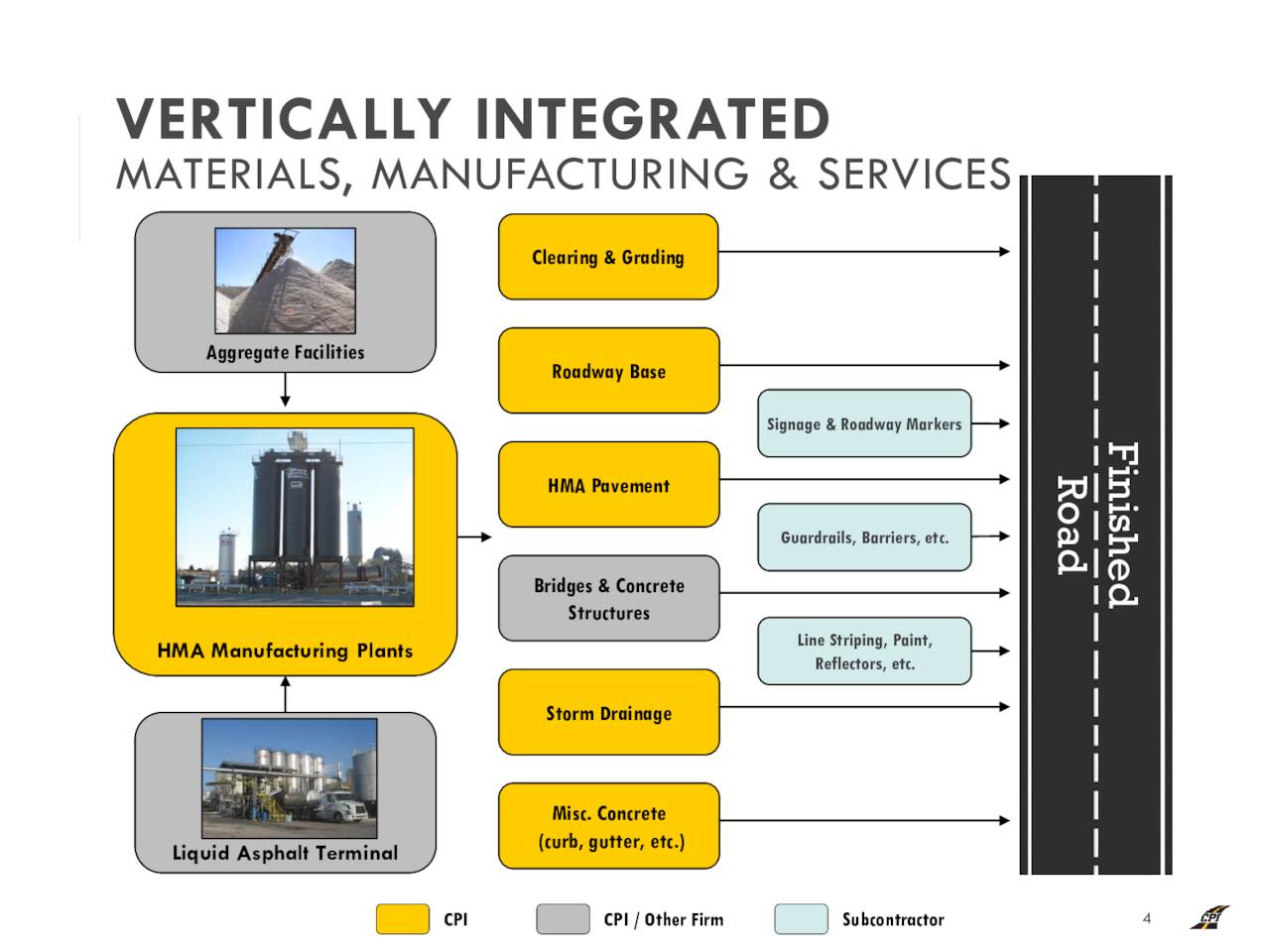

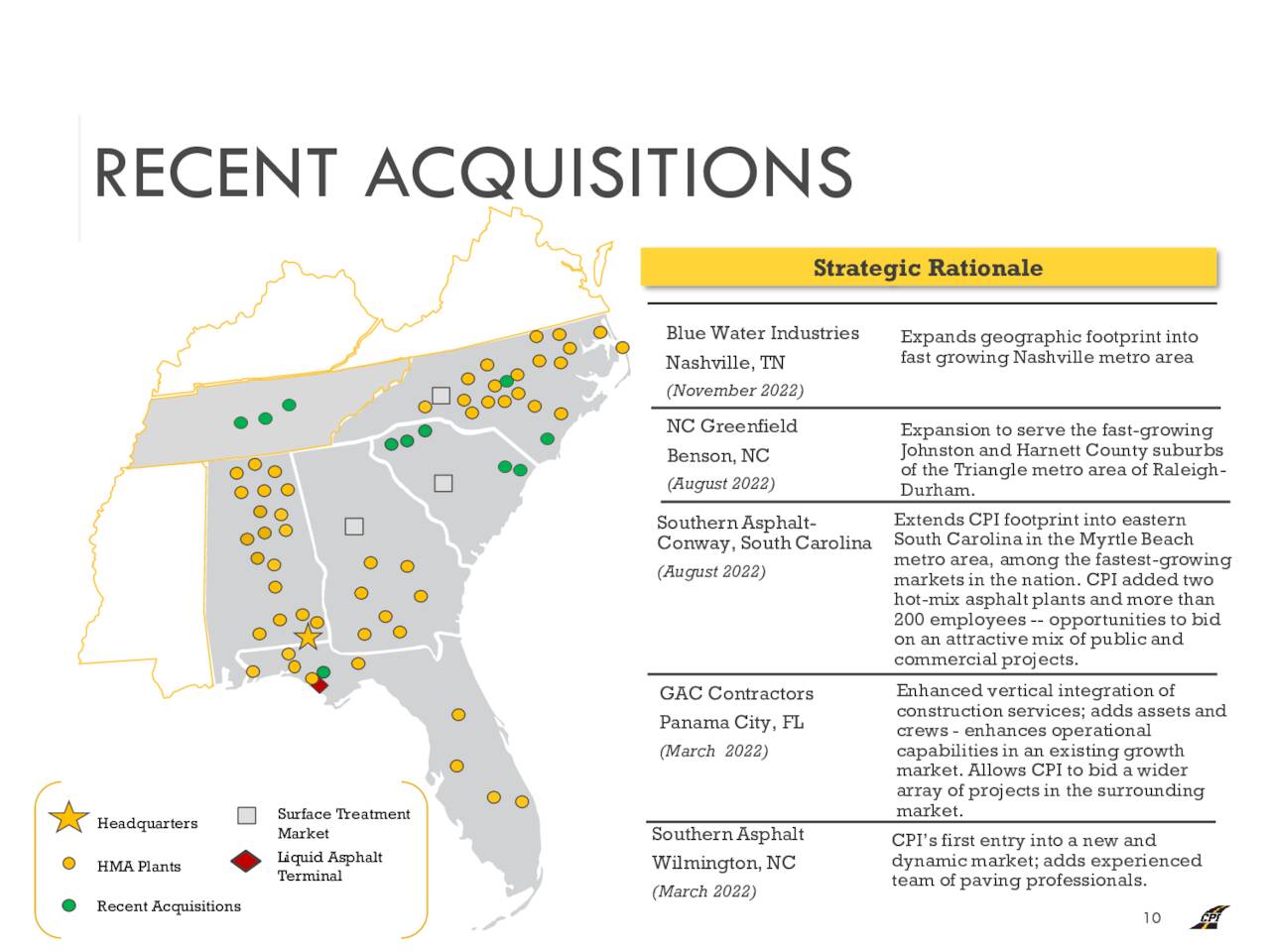

Vertically integrated Construction Partners has been active on the “bolt on” acquisition front, as a recent article on Seeking Alpha noted.

November Company Presentation

Second Quarter Results:

Construction Partners reported its second quarter earnings on May 5th. The company posted a GAAP loss of 11 cents a share in its second quarter, which was seven cents a share better than expectations. This amounted to a net loss of $5.5 million for the quarter, compared to a net loss of $9.4 million in the same period a year ago. Revenues rose an impressive 33% on a year-over-year basis to nearly $325 million, beating the consensus by just north of $40 million.

The company’s projected backlog grew $50 million sequentially, to $1.52 billion. This is up from $1.28 billion in 2Q2022. This is an all-time quarterly record for Construction Partners. Management gave full year guidance for FY2023 of between $1.53 billion and $1.58 billion in revenue, largely in line with the existing consensus. Leadership also expects positive net income of $34 million to $42 million for this fiscal year.

Analyst Commentary & Balance Sheet:

Since Construction Partners’ second quarter results were posted, Bank of America has reiterated its Buy rating and $33 price target on ROAD while D.A. Davidson has maintained its Hold rating and $29 price target. Raymond James ($36 price target) and Robert W. Baird ($32 price target) have also issued Buy ratings on the stock so far in 2023.

Just over two percent of the outstanding float in the shares are currently held short. Over the past six months, several insiders have sold shares worth approximately $3.5 million collectively. The company produced Adjusted EBITDA in the second quarter of $20.8 million. This was an increase of 165% compared to the same quarter last year.

This is how management described its balance sheet at the end of the second quarter on its conference call:

The company had $30.6 million of cash, $280.6 million of principal outstanding under the term loan and $143.1 million outstanding under the revolving credit facility. We have availability of $182 million under the credit facility, net of a reduction for outstanding letters of credit.“

Verdict:

The current analyst firm consensus has Construction Partners earning 71 cents a share in FY2023 as revenues rise 20% to $1.57 billion. Sales growth is projected to be cut in half in FY2024 even as profits rise to a buck a share.

November Company Presentation

Other than a growing project backlog and being in states seeing a surge of intrastate migration, it is hard to find much to recommend purchase of Construction Partners stock at these trading levels. ROAD shares trade north of 40 times earnings. Yes, spending on infrastructure provided a nice boost to revenue growth for a few years. However, insiders through their sales and analyst firms via their price targets seem right at that any upside from here seems very limited.

I would rather own construction giant Tutor Perini (TPC) in this space. Yes, the company has a history of being poorly run, and is projected to lose money this year. However, analyst firms expect the company to earn at least $1.20 a share in FY2024 and the stock is price at less than 10% of revenues compared to nearly 100% for ROAD. Tutor Perini is trading under seven bucks a share and also seems a good turnaround candidate, as a recent Seeking Alpha article noted.

The more corrupt the state, the more numerous the laws.”― Tacitus, The Annals of Imperial Rome.

Read the full article here