Markets were surprised by the hike and hawkish tilt on fears about inflation expectations and surging labor costs without productivity gains.

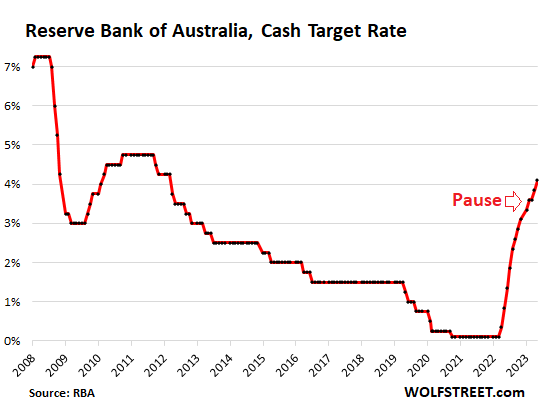

The Reserve Bank of Australia had become the first major central bank among developed economies to “pause” its rate hikes at the meeting in April. This was widely ballyhooed as a harbinger for the Great Pause that would spread among other central banks, to then be quickly followed by the Great Rate Cuts – in months, not years. Those hopes got crushed when the RBA became the first central bank to un-pause at the May meeting with a 25-basis point hike.

Tuesday, the RBA hiked its cash rate another 25 basis points to 4.1%, the highest since April 2012. It put more hikes on the table. It indicated that it is getting nervous about inflation expectations becoming unanchored. And it fretted about surging labor costs that weren’t matched by productivity gains. This hawkishness surprised a lot of observers who’d counted on a re-pause.

RBA

Puts additional rate hikes on the table: “Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe,” the RBA said in the statement.

Inflation – for Q1, at 7.0%, above the expectation of 6.9% – has become an intractable problem. The dynamics are practically everywhere the same, including in Australia: While energy prices plunged, and inflation in goods backed off, inflation has shifted to services, and services are the biggest part of the economy, and inflation has moved into wages that are surging to keep pace with rising consumer prices, but without matching productivity gains.

“Recent data indicate that the upside risks to the inflation outlook have increased and the Board has responded to this,” the RBA said.

Gets nervous about inflation expectations: Ominously, the statement omitted the language of prior statements, that “Medium-term inflation expectations remain well anchored.” In today’s statement, there was nothing about “well-anchored,” or anything “anchored.”

Instead, the RBA showed its nervousness about inflation expectations by adding a new phrase:

“The Board remains alert to the risk that expectations of ongoing high inflation contribute to larger increases in both prices and wages, especially given the limited spare capacity in the economy and the still very low rate of unemployment,” it said.

And it repeated its standard phrase on inflation expectations: “And if high inflation were to become entrenched in people’s expectations, it would be very costly to reduce later, involving even higher interest rates and a larger rise in unemployment.”

Frets about rising labor costs: The BAA “will continue to pay close attention to both the evolution of labour costs and the price-setting behaviour of firms.” And it added, “Unit labour costs are also rising briskly, with productivity growth remaining subdued.”

Markets reacted to the surprise hawkishness: The ASX 200 stock index dropped 1.2% in a mini rug-pull, and the Australian dollar rose by 0.7% against the USD. Since the first un-pause hike in May, the AUD has risen by 3.2% against the USD.

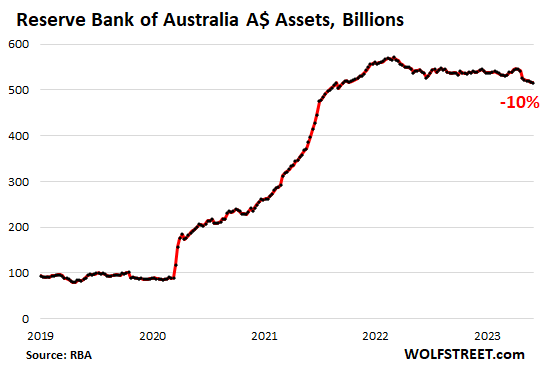

And QT continues. The RBA’s holdings of Australian-dollar-denominated securities (this excludes gold and foreign currency holdings) have dropped by nearly 10%, or by A$55 billion, from the peak in March 2022 to A$516 as of the last balance sheet on May 31.

RBA

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here