Psychologically, emotionally, and fundamentally, we are at an important inflection point for 2023. June will mark the 12-month stretch of when the energy “bear” market started. After hitting $125/bbl, oil has been in a non-stop downtrend since last June. The drawdown has been so horrific, we apparently broke an all-time record for the most down months ever in a year. According to Gurgen Ayvazyan, the end of May marks the first time oil was down 10 out of the last 12 months. It’s no wonder everyone’s feeling resentful toward their energy portfolio.

Fun fact: In 2008-2009, oil was down 7 out of 12 months. In 2014-2015, oil was down 9 out of 12 months.

stockchart.com

So yes, this oil selloff is one for the history books, and not in a good way either.

But fortunately, I am here to tell you that we are at a rather important inflection point in the oil market. No, I am not speaking about technicals or sentiment, but rather from a fundamental perspective.

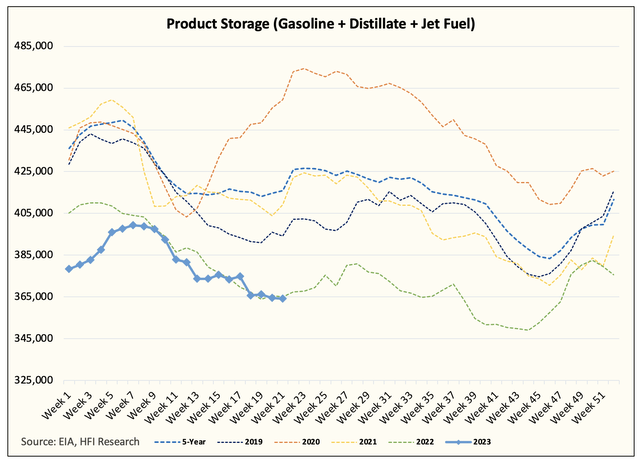

EIA, HFIR

First, I want you to look at the product storage chart above. Despite lower implied oil demand on a week-to-week basis, product storage for the U.S. is slightly below that of 2022. Refinery throughput is at ~16.16 million b/d today, so it has room to increase to ~16.8 million b/d.

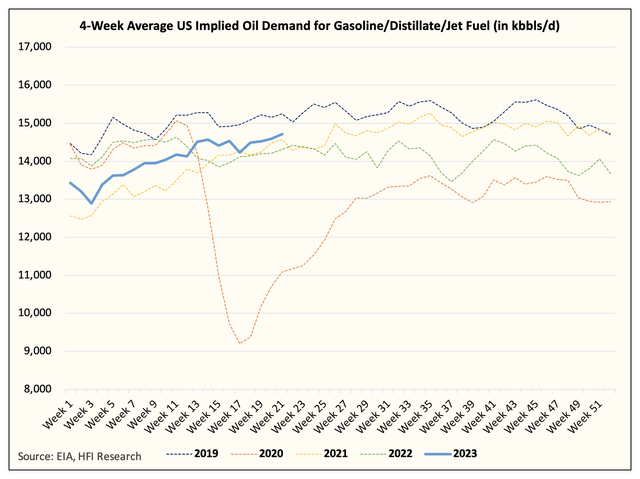

But what separates this year from 2022 is that implied oil demand is actually trending higher vs. the weakness we saw heading into June last year.

EIA, HFIR

This is important because by this point last year, the weakness in the big 3 was noticeably bad, and we repeatedly pointed that out in articles from last year. And by the end of June and into July, we started seeing a material drop y-o-y.

But last year’s product storage was saved by very elevated product exports, so we didn’t see very meaningful builds despite the drop in demand. This year, however, with implied demand on pace to well surpass last year’s levels, we could see a counter-seasonal move.

Even with elevated refinery throughput on the horizon, if US oil demand continues to trend in the right direction, we should see inventory draws accelerate.

Note: Keep in mind that next week’s EIA oil storage report is likely to include a large crude build. This is primarily because of the timing of exports and imports. U.S. crude imports remain very elevated, while U.S. crude exports show a material drop w-o-w. The following week’s data looks to correct that.

Inflection Point

If you have the time to revisit some of the articles from June last year, you will find a certain irony to all of this. Last year’s June saw oil prices average above $100, while there were talks of OPEC suspending Russia from the oil production deal due to its inability to pump more thanks to sanctions. Fast forwarding to today, OPEC+ is set to meet this weekend to “potentially” make the voluntary cuts into mandatory cuts clarifying to the market that an additional ~1 million b/d will be removed from the market.

Last year saw demand visibly surprise to the downside due to very elevated prices. This year is showing demand strength despite the macro headwinds and weak manufacturing data. The irony is that if people really did pay attention to the data, the time to get more bearish was June last year, not today. But that’s how markets work, price determines narratives, and narratives determine emotions.

But I am here to tell you that if U.S. oil demand coupled with the OPEC+ cut follows through, global oil inventories will draw, and this will eventually push prices higher.

The road ahead may not be that smooth, but that’s the path we are on. Macro headwinds will continue, so demand and inventory draws will have to be the driving force to push oil prices higher.

It’s just that simple.

Read the full article here