A deal to suspend the U.S. debt limit has finally been agreed, putting an end to a months-long distraction for investors. Now, the U.S. Treasury is scrambling to replenish its cash balance, and market expectations for the rate outlook are seeing significant revisions.

With inflation remaining sticky and the labor market proving extremely resilient, a further policy rate hike is likely from here, while a rate cut this year is almost certainly not in the cards.

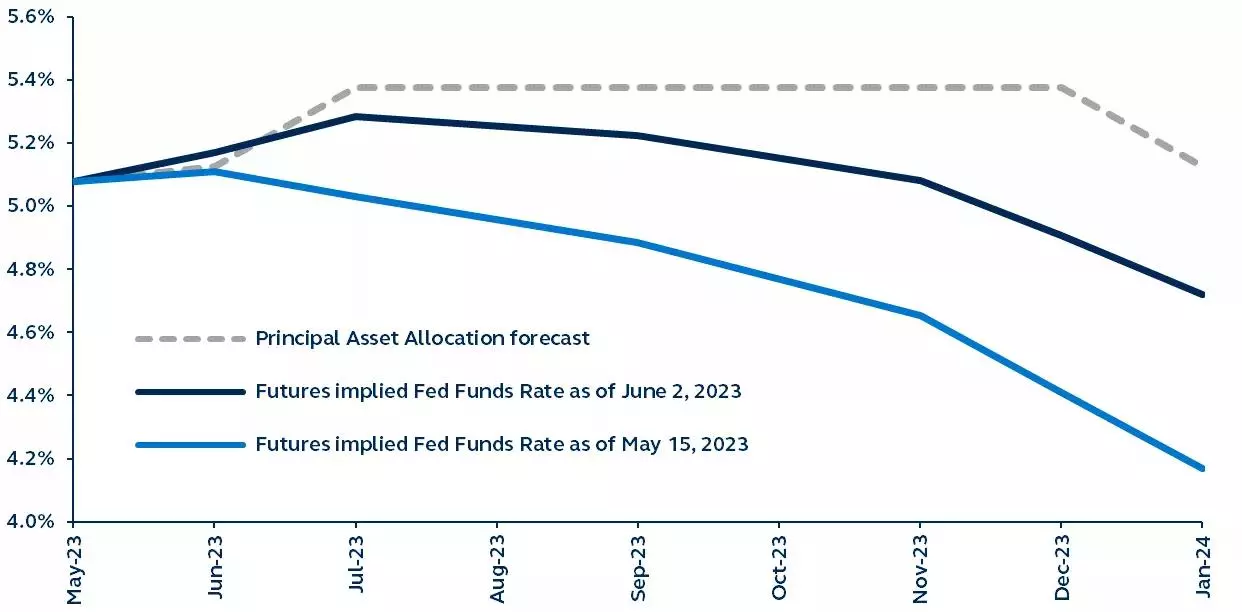

Market expectations for U.S. Fed Funds Rate

Present–January 2024

Source: Bloomberg, Principal Asset Management. Data as of June 2, 2023.

Policymaker agreement to suspend the debt ceiling until January 1, 2025, has brought only a small sigh of market relief, as equity markets had priced in a negligible probability of default. The aftermath, however, leaves a few key factors investors should note while positioning for the period ahead.

- Spending cuts: The fiscal impact of the deal is small and, therefore, inconsequential from an economic standpoint. The bill lowers federal spending over the next fiscal year by 0.25% of GDP. As a comparison, the debt ceiling agreement in 2011 reduced spending by 0.7% of GDP.

- Liquidity drain: Since hitting the debt limit in January, the Treasury has run down its cash balance to keep making payments. Now, it must replenish it. Doing so will involve significant Treasury issuance, effectively draining liquidity from the financial system and raising short-term borrowing costs—potentially further challenging already beleaguered banks.

- Fed policy: Investors are now re-focusing on sticky inflation and the extremely tight labor market, prompting a repricing of the market’s rate outlook. Not only is a further policy rate hike likely, but rate cuts this year are being steadily priced out.

Now that the debt ceiling noise has faded, investors can see that the fundamental picture is unchanged. Quality defensive equities and core fixed income will likely remain attractive during the tight liquidity, high-rate environment ahead.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here