After a difficult two years for the stock, Zscaler (NASDAQ:ZS) is now trading at a more attractive valuation, while the opportunity for the company remains bright.

Company Profile

ZS is a cloud security provider. It has three main products: Zscaler for Users, Zscaler for Workloads and Zscaler for IoT/OT.

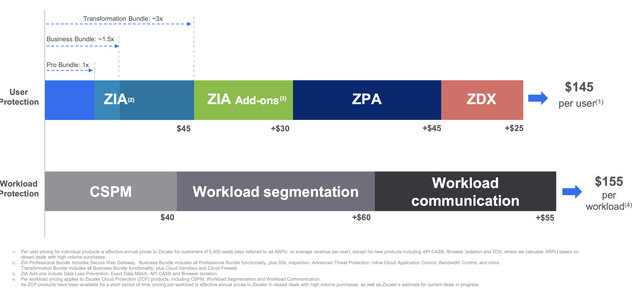

Zscaler for Users provides workers and other users secure access to the internet and apps through its Zscaler Internet Access, or ZIA, solution. The product can also provide Zero Trust Network Access (ZTNA) to internally managed applications, hosted internally or on the cloud, through its Zscaler Private Access (ZPA) solution. ZPA can grant access to an app without exposing its identity or location. Organizations can also optimize its users end to end experiences through its Zscaler Digital Experience, or ZDX. ZDX allows an organization to isolate where in the network path an issue is happening and whether it is caused by a user’s device, the internet or WiFi connection, or the service provider.

Zscaler for Workloads secures workloads using its ZIA and ZPA solutions to provide connectivity across multi-cloud and hybrid-cloud environments. Meanwhile, its Posture Control solution helps address public cloud security issues by automatically identifying and remediating cloud service, application, and identity misconfigurations for assets deployed in public cloud infrastructure. Finally, its Zscaler for IOT/OT leverages its platform to lower the risk of data loss and cyberattacks by providing zero trust security for connected IoT and OT devices.

ZS primarily generates revenue for the sale of subscription to access its cloud platform. Pricing is based on a per-user basis. ZIA, ZPA, and ZDX solutions as well as ZIA add-ons all increase the cost of a product per user.

Company Presentation

Opportunities and Risks

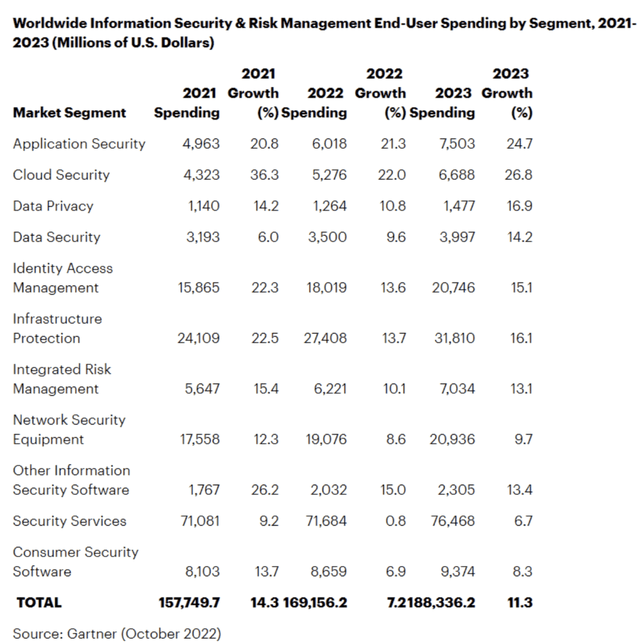

Cyberthreats continue to remain a huge problem with the number of cyber-attacks only growing. This year, the total cost of cybercrime is expected to reach an astounding $8 trillion. To keep up with the criminal threats, organizations of all types continue to pour money into protecting against these threats.

Gartner estimates that global cyber security and risk management spending be over $188 billion this year, an 11% increase versus a year ago. It predicts a similar 11% rise in spending each year through 2026 to over $267 billion.

Gartner

ZS is in one of the hottest areas of cybersecurity: zero trust network access (ZTNA). This segment is projected to grow 31% this year, according to Gartner. Meanwhile, ZTNA is expected to continue to replace VPN service, with over 70% of new remote access deployments being ZTNA by 2025, up from less than 10% in 2021.

ZIA is ZS’s biggest solution, and the company still has a lot of room to grow in this area. While it has the opportunity for greenfield expansion, there is also still a big replacement market out there. The company has said that about 80% of its ZIA deals are Blue Coat replacement deals, and that there are still a lot of large companies still using this older technology, including some very large banks. ZS notes that there are 20,000 companies with more than 2,000 employees, and that it’s currently only penetrated around 10% of this market.

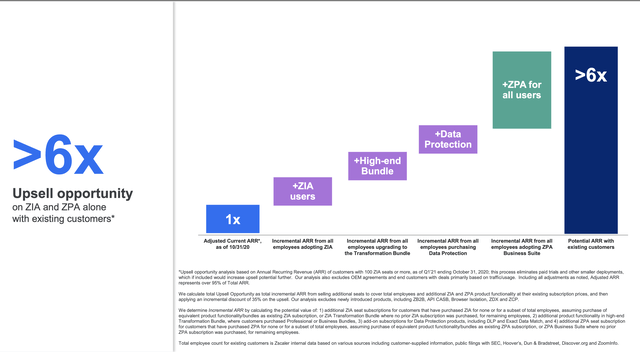

Upselling is also a big opportunity for ZS. Adding ZPA and ZDX solutions to a ZIA customer, for example, can nicely increase revenue at existing customers. ZS thinks it has a 6x upsell opportunity on ZIA and ZPA alone with existing customers.

Company Presentation

Adding Workload or IOT protection can be another upsell boost. Both of these products are newer, but Workloads solutions has been gaining some nice traction. ZS said on its fiscal Q2 call that Workload solutions has be roughly double year over year.

Adding additional users or departments in an organization is also another way to boost net dollar retention. Overall, ZS’s ability to upsell has shown through in its numbers, as it has consistently had over 125% net dollar retention.

When looking at risk, a slowdown in the economy is one potential risk. Organizations are becoming much more careful with their budgets and how they spend money. Cybersecurity is still a priority, but there is certainly more scrutiny across the board.

Discussing the impact of the macro environment on ZS at a Morgan Stanley conference earlier this year, CEO Jay Chaudhry said:

“Yes, macro is getting tighter. There’s more scrutiny. But overall, if you look at from revenue or sales point of view, you think of 2 things. Number one, due to tight environment, is there enough demand? Generally hard times make demand soft. We are seeing a very high degree engagement with our customers. Now why is that? That’s because, number one, all CIO, CISOs do care about cyber. Cyber interest is not going down. Number two, if CIOs understand that they can save money to reduce cost, they’re willing to engage. It’s because of these 2 reasons, we see good demand. We’ve seen a record pipeline.

“The second part is great, you got pipeline. Can you close the business? Because that’s where extra scrutiny comes in. Yes, 3, 4 quarters ago, a CIO could get the deal done, more and more deals do go to CFO for approval now. The 2 things we do in that area that help us. Number one, Zscaler has always been selling to C level because we are transformational. Traditional appliances, firewalls have been bought at the technical level, we started at a CIO level, not even CISO, CIO level. That helps us because there’s only one more level to go to. Number two, there’s a lot of push on business justification. About 6 years ago, we started a team for business value assessment. That team has grown. It does a good job. So being able to do these 2 things is helping us actually do good business”.

Competition and technology obsolesce remain another risk. Legacy companies are trying to win business with SASE solutions, which they market as more complete solutions. ZS would disagree with this assessment, but companies are having success in this area. Meanwhile, there are always new upstarts looking to disrupt current technology. So far, neither of these has been slowing down ZS’s growth, but it is a risk.

Valuation

SaaS companies are generally valued based on a sales multiple given their high gross margins and the companies wanting to pump money back into sales and marketing to grow.

ZS is projected to generate $2.02 billion in revenue in fiscal 2024 (ending July) and $2.57 billion in fiscal year 2025. It trades at EV/sub revenue multiple of 9.4x and 7.4x, respectively.

That’s a lower multiple than what Palo Alto (PANW) was selling at when I looked at it at the end of April. ZS is also growing its revenue at a faster in the mid to upper 20% range, versus low 20% for PANW. With no legacy business to be displaced, this discount seems unwarranted in my view.

Conclusion

ZS stock has seen a lot of pressure over the past two years despite a strong operational performance, as its valuation clearly got ahead of itself. While not exactly in the bargain bin, a sub-7.5x multiple on fiscal 2025 revenue is not an over-the-moon valuation for a company that is a leader in one of the hottest parts of the cybersecurity market. At the same time, I see no reason for it to trade at a similar valuation to more legacy players.

ZS still has plenty of room to grow, both adding new customers as well as through upselling to its existing customer base. While the macro environment could impact sales growth some, ZS is still in the right area and shouldn’t see a huge impact to its business, with ZTNA being one of the biggest cybersecurity priorities among organizations.

I think interested investors can take a starter position at current levels, and be more aggressive on any stock pullback.

Read the full article here